Soil Treatment Market Size, Share, Trends, Industry Analysis Report

: By Type, Technology, End User (Agriculture and Construction), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3388

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

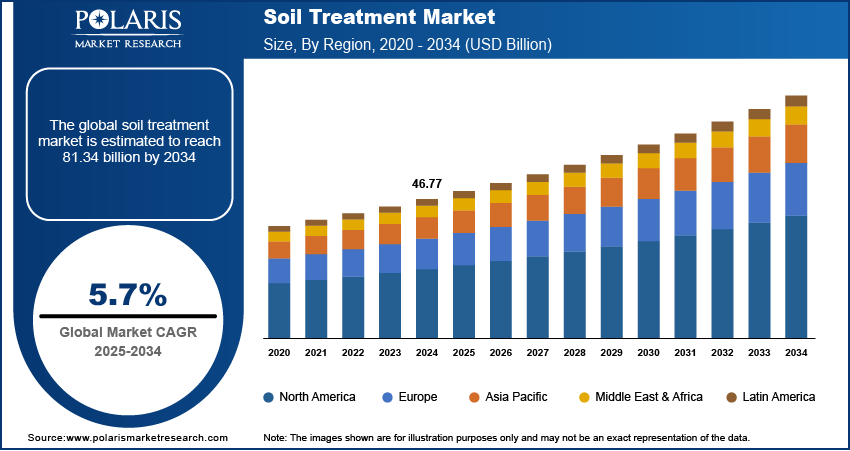

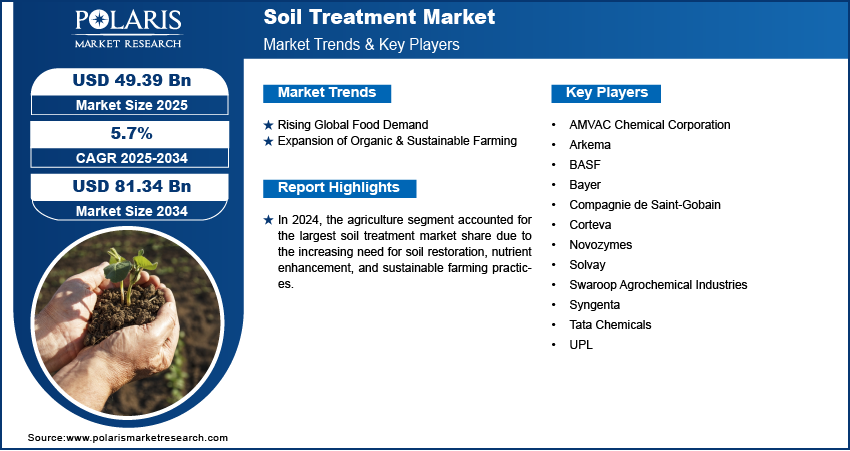

The global soil treatment market size was valued at USD 46.77 billion in 2024, growing at a CAGR of 5.7% during 2025–2034. The market growth is primarily fueled by rising soil contamination and nutrient depletion, and growing farmer education and incentives promoting soil conservation practices.

Key Insights

The biological treatment segment led the market in 2024, owing to the rising preference for organic farming solutions.

The agriculture segment accounted for the largest market revenue share in 2024, primarily due to the growing need for soil restoration and sustainable farming practices.

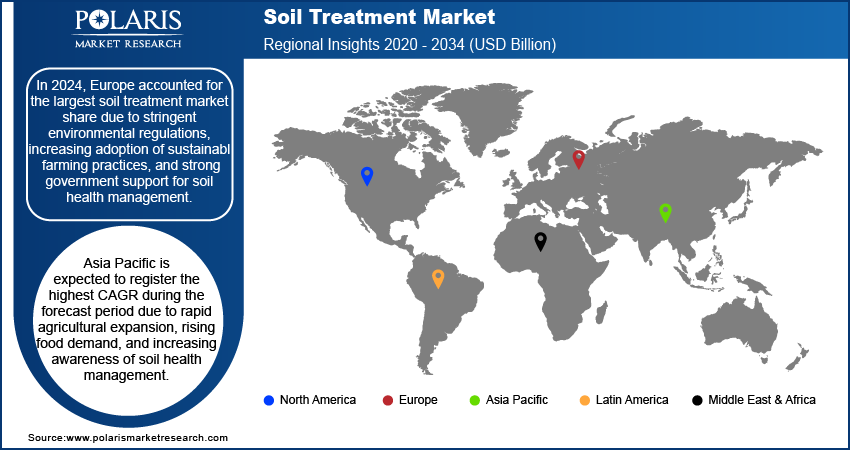

Europe dominated the market in 2024. The regional market dominance is fueled by its stringent environmental regulations and robust government support for soil health management.

Asia Pacific is projected to register the highest CAGR during the projection period. Rising food demand and rapid agricultural expansion are driving market growth in the region.

Industry Dynamics

The need for effective soil management solutions has increased due to the rising population and increased demand for food.

The rising emphasis on eco-friendly farming practices has boosted the adoption of biological soil enhancers and organic amendments, fueling market growth.

Innovations in soil treatment technologies are expected to provide several market opportunities in the coming years.

Lack of awareness about soil treatment may present market challenges.

Market Statistics

2024 Market Size: USD 46.77 billion

2034 Projected Market Size: USD 81.34 billion

CAGR (2025-2034): 5.7%

Europe: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The soil treatment market refers to the industry focused on enhancing soil quality through biological, chemical, and physical treatments to improve fertility, structure, and contamination levels. Treatment includes solutions such as pH adjusters, organic amendments, soil conditioners, and bioremediation techniques, driving market demand by supporting sustainable agriculture, land reclamation, and environmental restoration.

Increasing soil contamination, erosion, and nutrient depletion drive soil treatment market demand for restoration solutions to enhance soil productivity. Additionally, innovations in soil bioremediation, nanotechnology, and precision agriculture enhance treatment efficiency and effectiveness, which is stimulating soil treatment market development.

Increasing farmer education and initiatives promoting soil conservation practices support market adoption and long-term agricultural sustainability. Additionally, stringent regulations on soil health, pollution control, and sustainable land use drive investments in soil treatment solutions, which is contributing to soil treatment market growth.

Market Dynamics

Rising Global Food Demand

The rising global population and increasing food demand have intensified agricultural activities, leading to a greater need for effective soil management solutions. According to the US Department of Agriculture, increasing population growth and rising incomes are expected to increase the global food demand by 70 to 100% by 2050. The United Nations projects that agricultural production in developing countries must nearly double to meet this demand. Intensive farming practices deplete essential nutrients, degrade soil structure, and increase contamination risks. Thus, farmers and agribusinesses are increasingly adopting soil treatment products to restore fertility and enhance crop yields. Additionally, climate change-related challenges, such as soil salinity and water retention issues, drive the need for innovative treatment solutions. Government initiatives promoting sustainable farming practices, along with stringent soil health regulations, contribute to the widespread adoption of soil enhancement technologies. The expansion of precision agriculture and biotechnology-based treatments also supports efficiency in soil rehabilitation. As a result, the increasing reliance on soil treatment solutions is significantly fueling soil treatment market growth, enhancing productivity, and ensuring food security worldwide.

Expansion of Organic & Sustainable Farming

The growing emphasis on eco-friendly farming practices has significantly increased the adoption of biological soil enhancers and organic amendments, driving soil treatment market expansion. Farmers and agricultural enterprises are shifting away from chemical-based solutions toward sustainable alternatives that improve soil fertility while minimizing environmental impact. Innovations in biofertilizers, compost, and microbial treatments enhance soil health, leading to higher crop yields and long-term sustainability. Additionally, government incentives and regulatory support for organic farming and reducing greenhouse gas emissions further accelerate market growth. In May 2020, the California Department of Food and Agriculture (CDFA) allocated around USD 22.06 million in grants to 316 projects under the Healthy Soils Program (HSP) Incentives Program. This initiative aims to encourage farmers and ranchers to adopt practices that improve soil health, reduce greenhouse gas emissions, and enhance carbon sequestration.

Segment Insights

Assessment by Technology Outlooks

The global soil treatment market segmentation, based on technology, includes biological treatment, thermal treatment, and physiochemical treatment. In 2024, the biological treatment segment accounted for the largest market share due to its environmentally sustainable approach and growing preference for organic farming solutions. Biological treatments, such as bioremediation, microbial soil amendments, and biofertilizers, improve soil fertility while decreasing reliance on chemical-based approaches. The rising adoption of microbial inoculants and organic conditioners to improve soil structure, nutrient availability, and contamination remediation has further fueled market growth. Additionally, stringent environmental regulations and government incentives promoting eco-friendly soil restoration methods have driven the demand for biological soil treatment solutions, contributing to soil treatment market expansion.

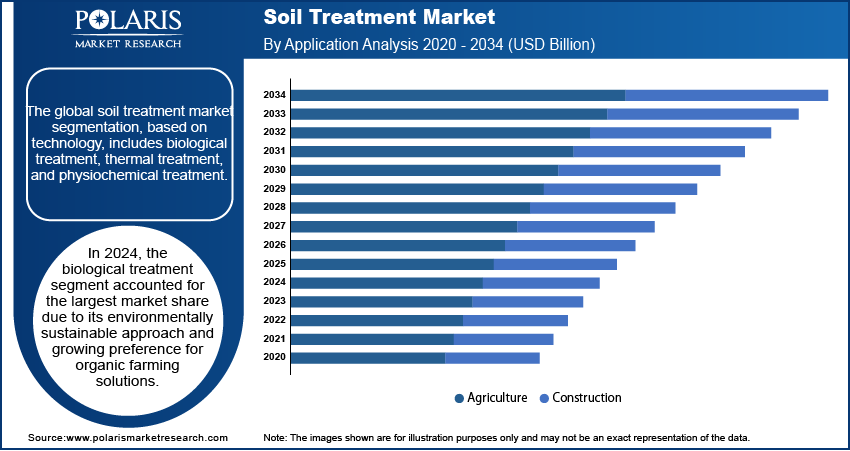

Evaluation by End User Outlook

The global soil treatment market segmentation, based on end user, includes agriculture and construction. In 2024, the agriculture segment accounted for a larger market share due to the increasing need for soil restoration, nutrient enhancement, and sustainable farming practices. The rising global population and food demand have intensified agricultural activities, leading to higher adoption of soil treatment solutions to improve crop yield and soil health. Additionally, concerns over soil degradation, salinity, and contamination have driven farmers to invest in biological, physiochemical, and organic soil treatments. Government initiatives promoting sustainable farming and organic farming further contribute to soil treatment market growth, supporting the expansion of advanced soil management technologies.

Regional Analysis

By region, the study provides soil treatment market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share due to stringent environmental regulations, increasing adoption of sustainable farming practices, and strong government support for soil health management. In July 2023, the European Union proposed a Soil Monitoring Law designed to protect and restore soil health while promoting sustainable management practices. The legislation establishes a framework for monitoring soil quality and addressing issues such as degradation and contamination to ensure the long-term viability of this vital resource. The region's focus on organic farming, precision agriculture, and soil remediation initiatives has driven demand for advanced soil treatment technologies. Additionally, the presence of leading agriculture technology providers and rising concerns over soil contamination and degradation have fueled market expansion.

The Asia Pacific soil treatment market is expected to witness the highest CAGR during the forecast period due to rapid agricultural expansion, rising food demand, and increasing awareness of soil health management. The adoption of biological soil treatments, government initiatives promoting sustainable farming, and advancements in precision agriculture are key factors driving soil treatment market growth in the region. The Republic of Korea is advancing toward sustainable agriculture through the Eco-friendly Agriculture Promotion Act (2021–2025), aiming to improve environmentally friendly land to 10% by 2025. Additionally, the country has updated its nationally determined contributions to achieve a 40% reduction in greenhouse gas emissions from 2018 levels by 2030. Additionally, soil degradation caused by intensive farming and industrial pollution has accelerated the need for effective soil remediation solutions, boosting market demand.

Key Players & Competitive Analysis Report

The competitive landscape of the soil treatment market is characterized by the presence of key industry players focusing on innovation, strategic partnerships, and sustainable product development. Leading companies are investing in research and development (R&D) to introduce advanced biological, physiochemical, and thermal soil treatment solutions that enhance soil fertility, nutrient retention, and contamination remediation. The market is also witnessing mergers and acquisitions, and collaborations to expand product portfolios and geographic reach. Additionally, stringent environmental regulations and government initiatives promoting eco-friendly soil treatment solutions are encouraging companies to develop organic and bio-based products. Increasing investments in precision agriculture technologies, microbial soil enhancers, and smart soil monitoring solutions further drive market expansion. The competition is intensified by the rising demand for sustainable farming practices and soil health improvement, prompting players to focus on cost-effective and scalable soil treatment methods.

Arkema is engaged in the production of specialty chemicals and advanced materials, specializing in innovative solutions for various industries. The company was founded in 2004 and is headquartered in Colombes, France. Arkema's product portfolio includes adhesives, coatings, and advanced materials such as specialty polyamides and fluoropolymers. The services provided by Arkema encompass technical support, customized solutions, and research and development to meet specific customer needs. Arkema operates in over 55 countries, employing approximately 21,100 people worldwide. Moreover, Arkema offers products that enhance soil health and fertility in the soil treatment segment. Their solutions focus on improving agricultural productivity through sustainable practices, addressing challenges related to soil degradation and nutrient management.

BASF is engaged in the production of chemicals and performance products, specializing in a wide range of sectors including agriculture, automotive, and construction. The company was founded in 1865, and headquartered in Ludwigshafen, Germany. BASF's product portfolio includes crop protection products, fertilizers, plastics, and performance chemicals. The services provided by BASF encompass research and development, technical support, and customized solutions tailored to various industries. BASF has a significant global presence with operations in more than 80 countries and over 110,000 employees. Furthermore, in the soil treatment, BASF provides innovative solutions that promote soil health and enhance agricultural productivity. Their products are designed to improve nutrient availability and support sustainable farming practices.

List of Key Companies

- AMVAC Chemical Corporation

- Arkema

- BASF

- Bayer

- Compagnie de Saint-Gobain

- Corteva

- Novozymes

- Solvay

- Swaroop Agrochemical Industries

- Syngenta

- Tata Chemicals

- UPL

Soil Treatment Industry Developments

In November 2024, BioSafe Systems and LIVENTIA partnered to Enhance Soil Health. This collaboration integrates LIVENTIA’s advanced microbial inoculants, including hyper-vigorous bacteria strains, into BioSafe Systems’ Restorative Soils Program.

In August 2024, SoilSteam AS announced that it is set to deploy three new SoilSaver 20 units for advanced soil remediation. These units are key to a circular economy and the sustainable management of soil, an essential resource for global food security.

In November 2023, The Air Force Installation and Mission Support Center launched its first large-scale soil washing project to remediate PFAS contamination at Eielson Air Force Base, Alaska.

Soil Treatment Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Organic Amendments

- pH Adjusters

- Soil Protection

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Biological Treatment

- Thermal Treatment

- Physiochemical Treatment

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Agriculture

- Construction

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.77 billion |

|

Market Size Value in 2025 |

USD 49.39 billion |

|

Revenue Forecast in 2034 |

USD 81.34 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 46.77 billion in 2024 and is projected to grow to USD 81.34 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

In 2024, Europe accounted for the largest market share due to stringent environmental regulations, increasing adoption of sustainable farming practices, and strong government support for soil health management.

A few of the key players in the market are AMVAC Chemical, Arkema, BASF, Bayer, Compagnie de Saint-Gobain, Corteva, Novozymes, Solvay, Swaroop Agrochemical Industries, Syngenta, and Tata Chemicals & UPL

In 2024, the biological treatment segment accounted for the largest market share due to its environmentally sustainable approach and growing preference for organic farming solutions.

In 2024, the agriculture segment accounted for the largest market share due to the increasing need for soil restoration, nutrient enhancement, and sustainable farming practices.