Sonar Systems Market Size, Share, Trends, Industry Analysis Report

: By Product (Hull-Mounted, Stern Mounted, Sonobuoy, and DDS), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 289

- Format: PDF

- Report ID: PM2337

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

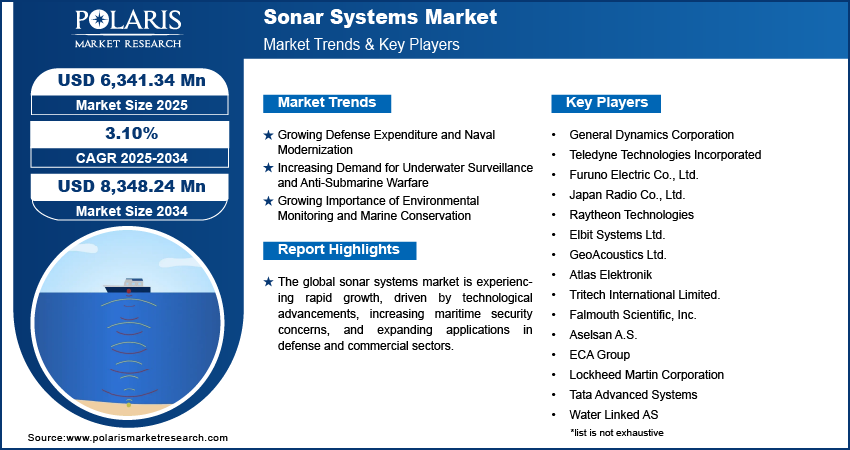

The sonar systems market size was valued at USD 6,186.71 million in 2024. The market is projected to grow from USD 6,341.34 million in 2025 to USD 8,348.24 million by 2034, exhibiting a CAGR of 3.10 % during 2025–2034.

The global sonar systems market growth is attributed to various factors such as rising technological advancements in sonar systems, increasing maritime security concerns, and expanding applications in defense and commercial sectors.

Sound Navigation and Ranging (Sonar) is a technology that uses sound propagation to navigate, detect, and communicate underwater. Originally developed for military applications, sonar technology has evolved significantly, finding utility in various fields such as fishing, marine research, and oil and gas exploration. The demand for advanced sonar systems is rising as nations prioritize underwater security and companies seek efficient tools for underwater mapping and resource discovery.

A key benefit of sonar systems lies in their ability to enhance situational awareness in underwater environments where traditional visual-based systems cannot operate. In military applications, sonar systems are essential for detecting submarines, underwater mines, and other potential threats, enabling nations to safeguard their territorial waters. In the commercial sector, sonar systems support the fishing industry by identifying fish populations and other marine life, allowing for more sustainable practices. The oil & gas industry also benefits from sonar technology, as it enables precise mapping of underwater terrain and identification of oil and gas deposits, reducing exploration costs and minimizing environmental impact.

The sonar systems market forecast predicts rapid market expansion with ongoing research focused on increasing the accuracy, range, and data-processing capabilities of these systems. Autonomous and remotely operated vehicles (AUVs and ROVs), commonly used in underwater exploration, rely heavily on sonar systems for navigation and data collection. Advances in artificial intelligence (AI) and machine learning (ML) are expected to further augment the capabilities of sonar systems, enabling faster and more precise data analysis. Such improvements are estimated to transform underwater exploration, making it safer, more efficient, and less reliant on human operators.

To Understand More About this Research: Request a Free Sample Report

Sonar systems offer substantial benefits for search and rescue operations, as they detect objects and persons underwater with great precision. In the aftermath of natural disasters, such as tsunamis and hurricanes, sonar technology is employed to locate sunken vessels and debris, expediting recovery efforts. Sonar technology's ability to operate in challenging underwater conditions makes it an invaluable asset for emergency responders, allowing them to operate in scenarios where traditional methods are insufficient. This functionality is crucial for nations facing increasing natural disasters due to climate change, positioning sonar as a critical technology for disaster response.

Driver Analysis

Growing Defense Expenditure and Naval Modernization

Nations are investing in advanced sonar technologies to enhance their anti-submarine warfare (ASW) capabilities, underwater surveillance, and security of maritime borders. As geopolitical tensions and concerns over underwater incursions grow, countries are prioritizing the modernization of their naval fleets, fueling demand for state-of-the-art sonar systems that offer better detection ranges, improved resolution, and the ability to operate in complex underwater environments. Therefore, the rise in defense budgets, particularly in regions such as North America, Asia Pacific, and Europe, boosts the sonar systems market expansion.

Increasing Demand for Underwater Surveillance and Anti-Submarine Warfare

There is an increasing emphasis on underwater surveillance to monitor potential threats, with rising concerns over maritime security and the strategic importance of underwater domains. Sonar systems are essential for detecting and tracking submarines, underwater mines, and other hazards. Many navies are expanding their sonar capabilities to strengthen their ASW defenses, using sonar-equipped ships, aircraft, and submarines to monitor ocean territories and safeguard against underwater threats. This heightened focus on defense preparedness propels the sonar systems market demand across the world.

Growing Importance of Environmental Monitoring and Marine Conservation

Sonar systems are being adopted for monitoring marine biodiversity and studying oceanographic changes with an increased global emphasis on environmental conservation and sustainable practices. Governments and NGOs are investing in sonar technology to assess the health of marine ecosystems and track environmental parameters, including pollution levels and the effects of climate change on aquatic life. Sonar’s ability to provide noninvasive underwater mapping and species tracking has made it a valuable tool for conservationists, promoting the adoption of sonar systems in environmental monitoring and research initiatives.

Segment Analysis

Sonar Systems Market Assessment by Product

Based on product, the sonar systems market is categorized into hull-mounted, stern mounted, sonobuoy, and DDS. The hull-mounted segment, valued at USD 2,723.10 million in 2024, held the largest market share. Hull-mounted sonar systems are an integral component of military and commercial maritime vessels. The systems are designed to detect and track underwater objects by transmitting sound waves from the hull of the ship. They are often favored in naval applications, where they provide robust capabilities for underwater warfare, underwater surveillance, and obstacle avoidance. In military settings, hull-mounted sonar systems are installed on destroyers, frigates, and submarines, where they serve as a crucial tool for detecting enemy submarines and safeguarding territorial waters. The mounting position on the hull allows for broad acoustic coverage and is ideal for deep-sea missions, enabling high-performance tracking and detection of underwater threats at extended ranges. For commercial vessels, hull-mounted sonar supports safer navigation, particularly in regions with dense marine traffic or challenging seabed topography, making it a popular choice for shipping companies and deep-sea exploration firms.

Sonar Systems Market Evaluation by Application

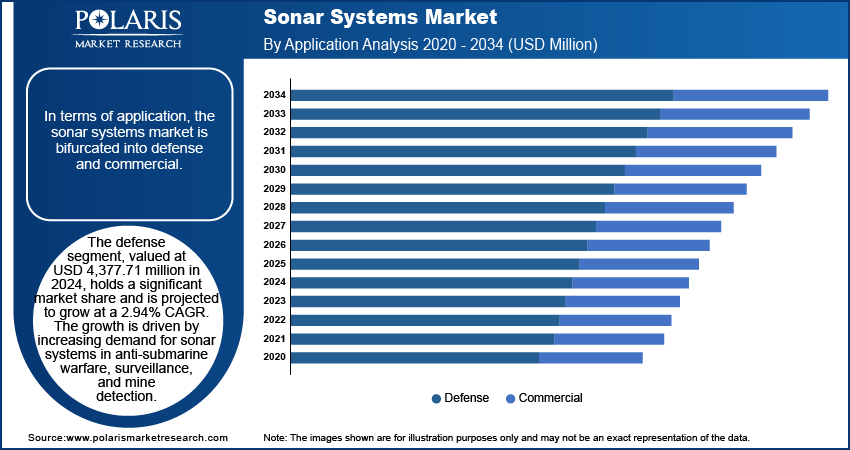

In terms of application, the sonar systems market is bifurcated into defense and commercial. The defense segment, valued at USD 4,377.71 million in 2024, accounted for a larger market share. The segment is expected to grow at a faster pace with a CAGR of 2.94% during the forecast period. In the defense sector, sonar systems are essential for a wide range of applications, particularly anti-submarine warfare (ASW), underwater surveillance, and mine detection. Militaries worldwide rely on advanced sonar technology to detect and track submarines, monitor underwater activities, and secure territorial waters from potential threats. Both active and passive sonar systems are employed on naval vessels, submarines, and aircraft, providing layered underwater defense and situational awareness across vast ocean areas. With rising geopolitical tensions and growing concerns over maritime security, nations are investing significantly in sonar systems to enhance their naval capabilities. Innovations in defense sonar, such as low-frequency sonar for long-range detection and AI-driven data processing for real-time threat analysis, are transforming underwater defense strategies, making sonar a strategic asset for military operations.

The growing trend toward autonomous and remotely operated underwater vehicles (AUVs and ROVs) in defense applications is boosting demand for sonar technology in the defense sector. AUVs equipped with sonar systems are increasingly used in surveillance and reconnaissance missions, offering a stealthy and efficient solution for monitoring hostile underwater activities.

Regional Analysis

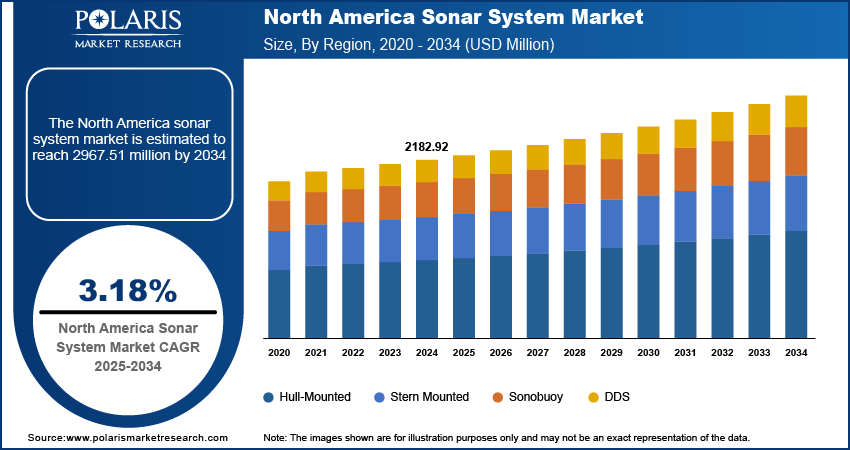

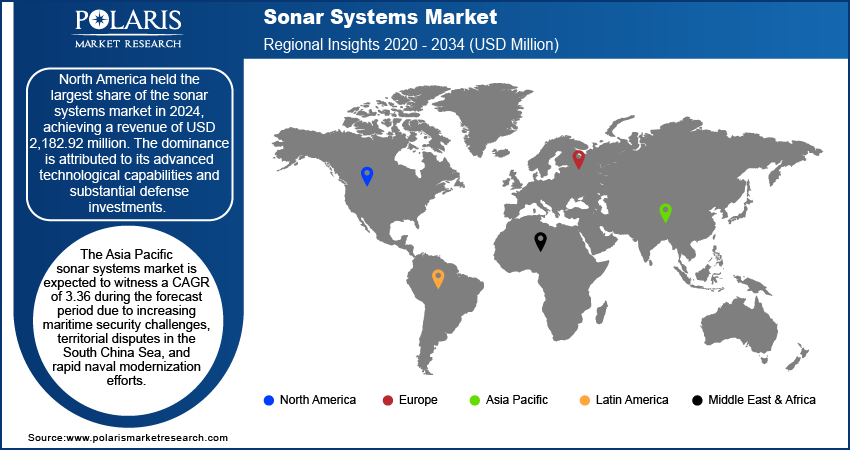

By region, the study provides the sonar systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024, achieving a revenue of USD 2,182.92 million. The dominance is attributed to its advanced technological capabilities and substantial defense investments. The region's market growth is propelled by continuous research and development in acoustic detection technologies, strategic military modernization efforts, and significant funding from government and private sector entities. Key defense contractors and technology firms in the US have been instrumental in developing advanced underwater detection and tracking systems, contributing to the North America sonar systems market expansion.

The Asia Pacific sonar systems market is expected to witness a CAGR of 3.36 during the forecast period due to increasing maritime security challenges, territorial disputes in the South China Sea, and rapid naval modernization efforts. Countries such as China, India, and Japan are making substantial investments in advanced underwater detection technologies, creating a competitive landscape that fuels technological innovation and market growth. The commercial marine exploration sector in this region is making significant investments in offshore resource exploration and marine scientific research, which is expected to drive the growth of the sonar system market in the coming years.

Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will boost the sonar systems market growth in the future. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The sonar systems market is fragmented, with the presence of numerous global and regional market players. A few major players in the sonar systems market are General Dynamics Corporation; Teledyne Technologies Incorporated; Furuno Electric Co., Ltd.; Japan Radio Co., Ltd.; Raytheon Technologies; Elbit Systems Ltd.; GeoAcoustics Ltd.; Atlas Elektronik; Tritech International Limited.; Falmouth Scientific, Inc.; Aselsan A.S.; ECA Group; Lockheed Martin Corporation; Tata Advanced Systems; Water Linked AS; Cerulean Sonar; EdgeTech Marine; R2Sonic; Thales Group; and L3Harris Technologies, Inc.

General Dynamics Corp is a global defense contractor. The company supplies battle tanks, armaments, business jets, propellants, and wheeled combat and tactical vehicles. Additional services offered by General Dynamics include command and commercial and logistic ships, control systems, and nuclear-powered submarines. The company's goods and services include weapons and munitions, shipbuilding and marine systems, business aviation, land and expeditionary combat vehicles and systems, mission-critical information systems, and technological solutions. It provides services to business enterprises, defense agencies, and the US government. In November 2024, General Dynamics announced that it was awarded a USD 15.9 million contract by the US Navy to design, test, and deliver the Mining Expendable Delivery Unmanned Submarine Asset (MEDUSA) system.

Thales Group designs, develops, manufactures, and supports electronic equipment. The company offers flight avionics, in-flight entertainment and connectivity systems, air traffic management solutions, radar and sensors, navigation and surveillance systems, electric systems, military avionics, microwave and imaging subsystems, telecommunication satellites, training and simulation systems, cybersecurity systems, networks and infrastructure systems, train control systems, and rail signaling systems. Thales also provides aerospace support and service, cybersecurity services, air traffic control, smart cards and digital services, simulation, and training services. In July 2024, Naval Group awarded Thales a contract to test a passive, autonomous sonar system placed on the hull. The contract is part of a project to construct an autonomous combat underwater vehicle demonstrator for testing, which is being led by the French Defense Procurement Agency (DGA).

Key Companies in Sonar Systems Market

- General Dynamics Corporation

- Teledyne Technologies Incorporated

- Furuno Electric Co., Ltd.

- Japan Radio Co., Ltd.

- Raytheon Technologies

- Elbit Systems Ltd.

- GeoAcoustics Ltd.

- Atlas Elektronik

- Tritech International Limited.

- Falmouth Scientific, Inc.

- Aselsan A.S.

- ECA Group

- Lockheed Martin Corporation

- Tata Advanced Systems

- Water Linked AS

- Cerulean Sonar

- EdgeTech Marine

- R2Sonic

- Thales Group

- L3Harris Technologies, Inc.

Sonar Systems Market Developments

June 2024: L3Harris Technologies, a company that offers products and solutions for the marine, sea, space, air, land, and cyber domains, inaugurated a new facility in Italy, marking a significant step forward in the company's European expansion.

October 2022: General Oceans acquired Tritech International, a global leader in imaging sonars and equipment used in low-visibility marine construction and subsea applications.

Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Hull-Mounted

- Stern Mounted

- Sonobuoy

- DDS

By Application Outlook (Revenue, USD Million, 2020–2034)

- Defense

- Commercial

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6,186.71 million |

|

Market Size Value in 2025 |

USD 6,341.34 million |

|

Revenue Forecast by 2034 |

USD 8,348.24 million |

|

CAGR |

3.10% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global sonar systems market size was valued at USD 6,186.71 million in 2024 and is projected to grow to USD 8,348.24 million by 2034.

The global market is projected to register a CAGR of 3.10% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are General Dynamics Corporation; Teledyne Technologies Incorporated; Furuno Electric Co., Ltd.; Japan Radio Co., Ltd.; Raytheon Technologies; Elbit Systems Ltd.; GeoAcoustics Ltd.; Atlas Elektronik; Tritech International Limited.; Falmouth Scientific, Inc.; Aselsan A.S.; ECA Group; Lockheed Martin Corporation; Tata Advanced Systems; Water Linked AS; Cerulean Sonar; EdgeTech Marine; R2Sonic; Thales Group; and L3Harris Technologies, Inc.

The hull-mounted segment held the largest share of the global market in 2024.

The defense segment dominated the market in 2024.