Underwater Warfare Market Share, Size, Trends, Industry Analysis Report

By System (Unmanned Systems, Electronic Warfare Systems, Sonar Systems, Weapons Systems); By Capability; By Platform; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 114

- Format: PDF

- Report ID: PM4759

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

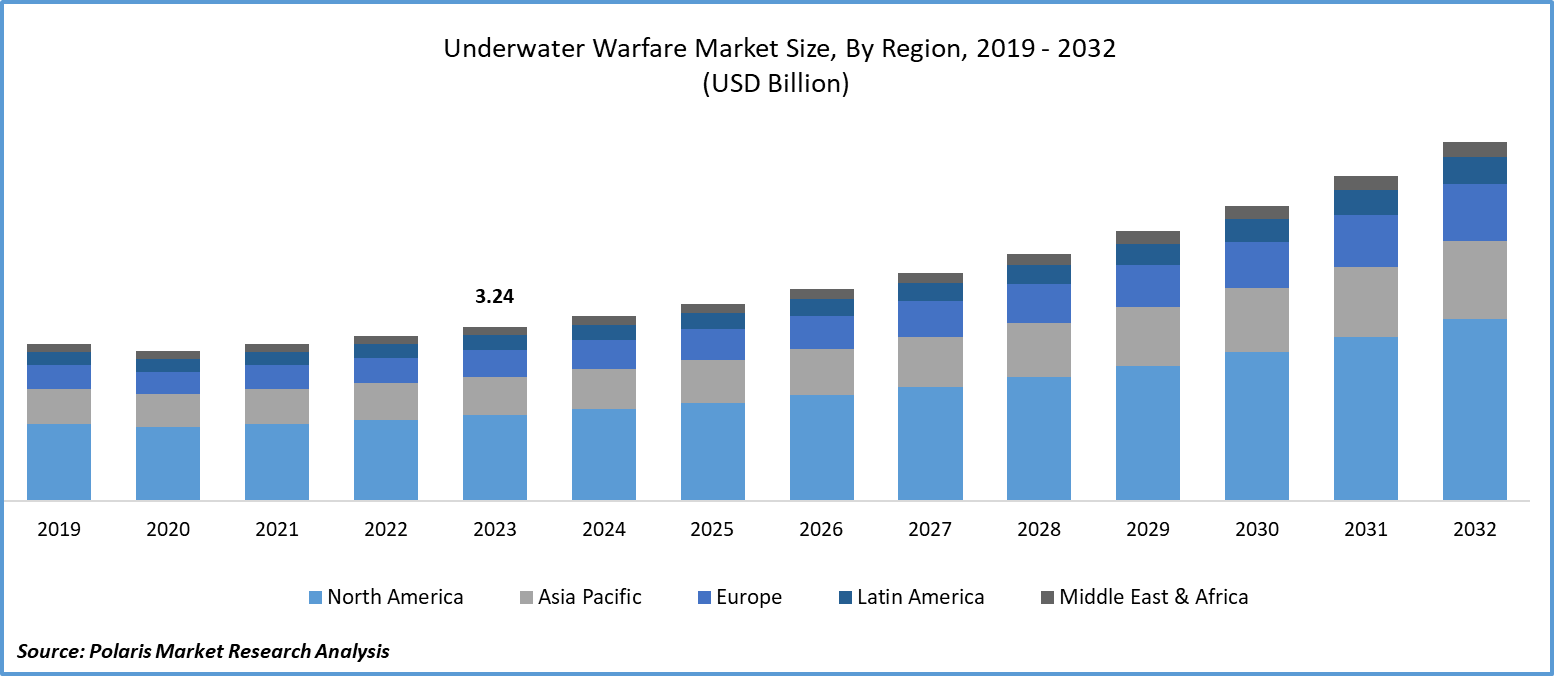

Global underwater warfare market size was valued at USD 3.24 billion in 2023. The market is anticipated to grow from USD 3.45 billion in 2024 to USD 6.70 billion by 2032, exhibiting the CAGR of 8.7% during the forecast period

Underwater Warfare Market Overview

The increasing need for advanced technology-based underwater warfare systems stems from a growing demand for modernizing existing platforms to counter evolving underwater threats. Governments worldwide are investing in the development of solutions within the Underwater Warfare Industry to modernize their navies. This trend reflects a strategic shift towards enhancing maritime security through the deployment of more sophisticated and capable underwater warfare systems.

- For instance, in January 2024, Australia and Japan reached a deal to improve the strategic capabilities of robotic and autonomous systems for underwater warfare.

To Understand More About this Research: Request a Free Sample Report

The use of underwater warfare is restricted by various environmental and regulatory laws, which can pose significant challenges. The US Navy is committed to operating in an environmentally compatible way and complying with all environmental laws and regulations. They have put specific programs and instructions in place to ensure environmental readiness and adherence. However, adhering to these regulations can be difficult due to legal challenges that have arisen under US and global environmental law. These legal hurdles have impacted the use of certain sonar systems and have led to adjustments in training schedules to address environmental concerns. As a result, these regulations and legal challenges can limit the ability of naval forces to train effectively and conduct operations in underwater warfare.

Furthermore, the United Nations Convention on the Law of the Sea (UNCLOS 1982) requires all countries to safeguard and maintain the health of the ocean environment. Regulatory limitations, such as the Law of Armed Conflict (LOAC), oversee the interactions between nations and the behavior of military actions within a country. Submarines, just like any other naval vessels, are obligated to adhere to the LOAC.

Underwater Warfare Market Dynamics

Market Drivers

Advanced sonar technology development and its application for underwater warfare

The surge in the underwater warfare market is driven by escalating technological advancements in underwater defense systems. Nations worldwide are acknowledging the strategic significance of safeguarding their maritime borders and interests, resulting in heightened development and deployment of specialized technologies for underwater defense. Autonomous Underwater Vehicles (AUVs) and Unmanned Underwater Vehicles (UUVs) equipped with advanced sensors and communication systems are bolstering surveillance and reconnaissance capabilities in underwater environments.

Enhancements in sonar technologies have elevated detection and tracking capabilities, facilitating more robust monitoring of submarine activities. Integration of artificial intelligence and machine learning algorithms has revolutionized the analysis of extensive underwater data, leading to swifter and more precise decision-making. Moreover, the evolution of stealth technologies, including advanced coatings and materials, has rendered underwater assets increasingly elusive and challenging to detect.

Market Restraints

Cost associated with the components of underwater warfare systems

Underwater warfare encompasses a range of systems and components, requiring the use of specialized materials and technologies to withstand harsh underwater conditions like high pressure and corrosive seawater. Manufacturing these systems is costly, and ongoing expenses for maintenance, personnel training, and technological upgrades further increase operational costs. Protecting underwater warfare systems from threats, including cyber threats, necessitates additional security expenses. The high cost of developing underwater warfare systems is a significant constraint, with platforms such as submarines, surface ships, and naval helicopters costing billions, making them unaffordable for many nations.

Report Segmentation

The market is primarily segmented based on system, capability, platform, and region.

|

By System |

By Capability |

By Platform |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Underwater Warfare Market Segmental Analysis

By Systems Analysis

- The unmanned segment is projected to grow at a CAGR during the projected period. Unmanned underwater vehicles (UUVs), which are used for underwater missions such as surveillance and mine countermeasures, are becoming more and more in demand. Autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) are the two broad categories under which UUVs fall. Without endangering human lives, autonomous underwater vehicles (AUVs) are used to map underwater topography, find and track mines and submarines, and acquire vital intelligence. High-resolution cameras, sonar, and other sensors are available on ROVs for thorough examinations of undersea structures and possible hazards. AUVs and ROVs significantly influence the demand for underwater warfare market development.

By Platform Analysis

- The surface ships segment accounted for the largest market share in 2023 and is likely to retain its position throughout the underwater warfare market forecast period. In submarine warfare, surface vessels like frigates and corvettes are frequently deployed. The use of surface vessels is common in anti-submarine warfare. To detect and track submarines, surface ships are outfitted with robust sonar systems and helicopters that can detect submerged objects using dipping sonar. In mine warfare, surface ships are also employed for mine searching and mine sweeping tasks. Armed with missiles, depth charges, and torpedoes, destroyers, and frigates can engage and neutralize hostile submarines head-on. The industry is growing because surface ships are essential to many types of underwater combat operations.

Underwater Warfare Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The region has a strong focus on defense spending, allowing for significant investment in underwater warfare technologies. Secondly, North America is home to several major defense contractors and technology companies that are at the forefront of developing advanced underwater warfare systems. Additionally, the region has a large and technologically advanced navy, which drives the demand for cutting-edge underwater warfare capabilities. Finally, North America's geopolitical position, with access to both the Atlantic and Pacific Oceans, further emphasizes the importance of underwater warfare capabilities, leading to continued dominance in this market.

The Europe region is expected to be the fastest growing region with a healthy CAGR during the projected period. The UK is expected to exhibit the highest growth rate in the European underwater warfare market development. This dominance is driven by the presence of key players and their increasing investments in developing and deploying various underwater warfare platforms. The Royal UK Navy is particularly focused on investing in advanced technologies such as Artificial Intelligence (AI) and Cyber Security to modernize its naval fleet through the development of various underwater warfare platforms.

Competitive Landscape

The underwater warfare market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Aish Technologies

- ASELSAN

- ATLAS ELEKTRONIK

- BAE Systems plc

- Elbit Systems Ltd

- General Dynamic Corporation

- Huntington Ingalls Industries

- L3Harris Technologies

- Naval Group

- Northrop Grumman Corporation

- Raytheon Technologies

- Saab AB

- Thales

- Thyssenkrupp AG

Recent Developments

- In February 2024, India is set to conduct tests of a 500 km range Submarine-Launched Cruise Missile (SLCM) against a backdrop of escalating tensions in underwater warfare.

- In January 2023, Raytheon Technologies began producing miniature torpedo prototypes that are intended to both strike and protect American Navy submarines from approaching torpedoes.

- In September 2020, Thales has completed a successful demonstration of the world's first fully integrated drone-based mine countermeasures system. This system is designed to locate, identify, and neutralize sea mines.

Report Coverage

The underwater warfare market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, system, capability, platform and their futuristic growth opportunities.

Underwater Warfare Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.45 billion |

|

Revenue forecast in 2032 |

USD 6.70 billion |

|

CAGR |

8.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By System, By Capability, By Platform, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Underwater Warfare Market report covering key segments are system, capability, platform, and region.

Underwater Warfare Market Size Worth $6.70 Billion By 2032

Underwater Warfare Market exhibiting the CAGR of 8.7% during the forecast period

North America is leading the global market

key driving factors in Underwater Warfare Market are Advanced sonar technology development and its application for underwater warfare