Acrylic and Polycarbonate Sheets Market Size, Share, Trend, Industry Analysis Report

By Material (Acrylic, Polycarbonate), By Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5875

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

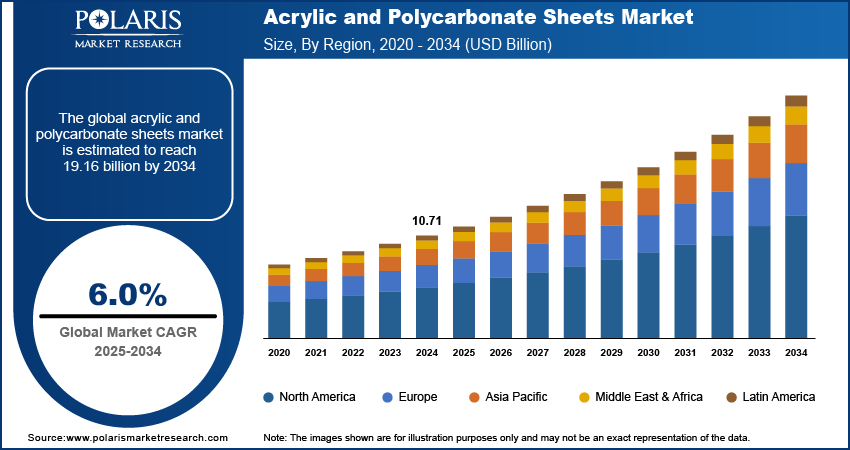

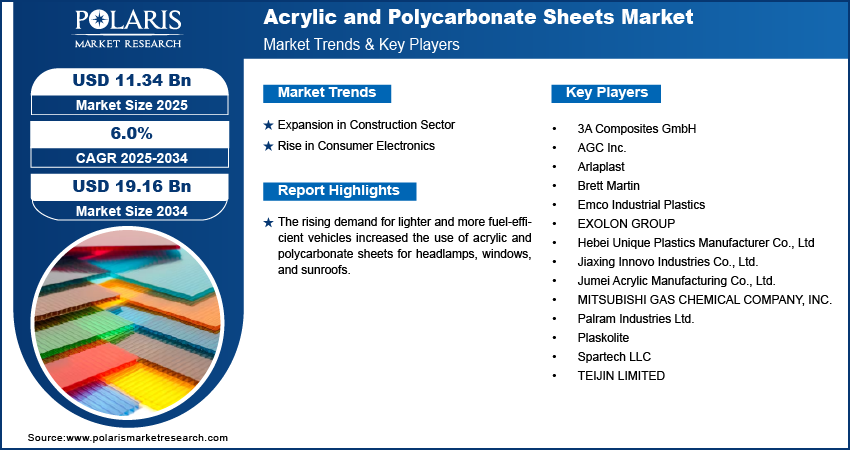

The global acrylic and polycarbonate sheets market size was valued at USD 10.71 billion in 2024 and is projected to register a CAGR of 6.0% from 2025 to 2034. The rising demand for lighter and more fuel-efficient vehicles has increased the use of acrylic and polycarbonate sheets for headlamps, windows, and sunroofs. Their high impact resistance and optical clarity make them ideal substitutes for glass, supporting design flexibility and improved performance in electric and conventional vehicles.

The market refers to the industry focused on the production and distribution of transparent, lightweight, and impact-resistant plastic films and sheets used in various applications such as construction, automotive, signage, electronics, and medical devices. These thermoplastic sheets offer superior clarity, UV resistance, and high strength-to-weight ratios, making them ideal alternatives to glass in both functional and aesthetic applications. Retail and outdoor advertising heavily rely on acrylic sheets for signage due to their high clarity, weather resistance, and ease of fabrication. Increasing demand for illuminated signs, digital displays, and decorative panels in shopping centers and public infrastructure is fueling the consumption of these materials.

Hospitals and diagnostic centers are increasingly using polycarbonate sheets in medical equipment housings, protective barriers, and cleanroom partitions. Their nontoxic properties, chemical resistance, and ability to withstand sterilization processes make them suitable for environments requiring high hygiene and safety standards. Additionally, government and industrial facilities are investing in impact-resistant glazing materials. Polycarbonate sheets provide ballistic and blast resistance, making them suitable for security windows, ATM enclosures, and protective barriers. Growing safety awareness across public infrastructure is propelling demand for acrylic and polycarbonate sheets.

Market Dynamics

Expansion in Construction Sector

Modern construction practices focus on materials that offer visual appeal, durability, and environmental efficiency, which has significantly increased the demand for acrylic and polycarbonate sheets. These materials are being widely used in architectural applications such as skylights, cladding, partitions, and signage, where both strength and design flexibility are essential. Their ability to resist UV radiation, withstand harsh weather conditions, and reduce structural load makes them ideal for high-rise buildings and modern infrastructure. For instance, Zhejiang Leasinder Technology Co., Ltd. delivers acrylic and polycarbonate sheets for outdoor applications that effectively resist UV radiation. These materials are engineered with advanced UV-stabilized formulations that prevent yellowing, brittleness, and degradation caused by prolonged sun exposure. As a result, they maintain their clarity, color, and structural integrity over time, even in harsh environmental conditions. In green buildings, they enable better natural light penetration while minimizing energy consumption. Transparent roofing and daylighting panels made from these sheets are also gaining popularity for their role in enhancing indoor environments. Their recyclability and low maintenance needs further add to their appeal, making them a preferred choice for architects and builders aiming to meet both design and sustainability goals.

Rise in Consumer Electronics

The demand for lightweight, durable, and aesthetically appealing materials in electronics is driving the use of both polycarbonate and acrylic sheets. Polycarbonate sheets offer high impact resistance, heat distortion resistance, and flame-retardant properties, making them ideal for smartphone casings, optical discs, and display panels. Their moldability and strength support compact, high-performance devices. Acrylic sheets, known for optical clarity and UV resistance, are used in LED displays, light guides, and protective screens. Though less impact-resistant than polycarbonate, they offer excellent surface finish and transparency.

Segment Insights

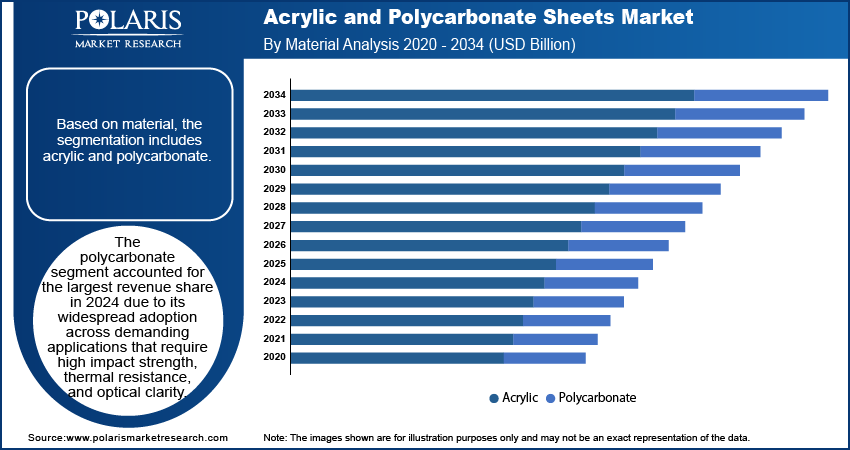

Material Analysis

Based on material, the segmentation includes acrylic and polycarbonate. The polycarbonate segment accounted for a larger revenue share in 2024 due to its widespread adoption across demanding applications that require high impact strength, thermal resistance, and optical clarity. It is extensively used in various sectors such as automotive, electronics, and security glazing, where material reliability under stress is critical. Its lightweight nature compared to glass, combined with resistance to flame and breakage, makes it suitable for protective covers, machine guards, and high-performance housings. Demand is further supported by growing use in sustainable building solutions, where polycarbonate sheets contribute to energy efficiency and design flexibility, reinforcing their commercial viability across multiple industrial verticals.

The acrylic segment is gaining traction due to its superior clarity, weather resistance, and excellent surface finish that make it suitable for aesthetic applications such as signage, retail displays, and lighting fixtures. Its ease of fabrication, lower cost compared to polycarbonate, and availability in a variety of colors and textures support its rising use in interior design and decorative construction. Acrylic sheets are also being adopted in point-of-purchase displays and sneeze guards, particularly in commercial environments where transparency and visual appeal are essential. Improvements in scratch resistance and UV protection technologies are further enhancing the adoption of acrylic sheets across end-use applications such as retail, healthcare, hospitality, and transportation.

Type Analysis

Based on type, the segmentation includes cast, extruded, solid, polycarbonate, multiwall, and others. In 2024, the solid sheets segment accounted for the largest revenue share, driven by its structural stability, optical clarity, and versatility across demanding environments. These sheets are commonly used in architectural glazing, machine covers, vehicle components, and transparent barriers where both strength and visibility are essential. Their ability to resist high impact, weathering, and chemical exposure makes them a reliable alternative to traditional materials such as glass. Solid sheets also offer better thermal insulation and reduced maintenance, which is critical for long-term use in both indoor and outdoor settings. Their wide availability in various options based on thicknesses and finishes further boosts their adoption across key industrial sectors such as construction, automotive, electrical and electronics, signage and advertising, agriculture, and transportation. These sectors benefit from the material’s durability, versatility, and performance in demanding environments.

The multiwall sheets segment is projected to register the highest CAGR over the forecast period due to the growing demand in energy-efficient construction and greenhouse applications. These sheets offer excellent thermal insulation, lightweight handling, and impact resistance, making them ideal for skylights, roofing systems, and partitions. The hollow structure of multiwall sheets reduces heat transfer, helping to lower energy costs in buildings. In agriculture, they provide optimal light diffusion and protection for crops. Their ability to meet sustainability goals, along with their durability and low maintenance needs, is encouraging increased usage across both commercial and residential projects that focused on performance and environmental impact.

Application Analysis

Based on application, the segmentation includes electronic, building and construction, automotive, medical, packaging, and others. In 2024, the automotive segment accounted for the largest revenue share, driven by rising demand for lightweight and impact-resistant materials to improve vehicle performance and fuel efficiency. Polycarbonate sheets are used in headlamp lenses, sunroofs, rear windows, and interior components where weight reduction is critical without compromising strength. The shift toward electric vehicles (EVs) and the adoption of aerodynamic designs are further expanding the use of advanced plastic sheets. These materials also support better thermal insulation and safety features, contributing to their integration in new-generation vehicles. Design flexibility, reduced tooling costs, and recyclability further support their use across automotive OEMs and aftermarket solutions.

The medical segment is projected to register the highest CAGR during the forecast period due to increased investments in medical infrastructure and the growing need for hygienic, transparent, and chemically resistant materials. Polycarbonate and acrylic sheets are used in equipment enclosures, isolation barriers, and diagnostic devices that require regular sterilization and high durability. Demand is also growing for portable medical units, patient monitoring systems, and cleanroom panels, where these materials offer both functional and safety advantages. The expanding role of plastic sheets in personal protective equipment and hospital interiors is reinforcing their critical role in modern healthcare environments.

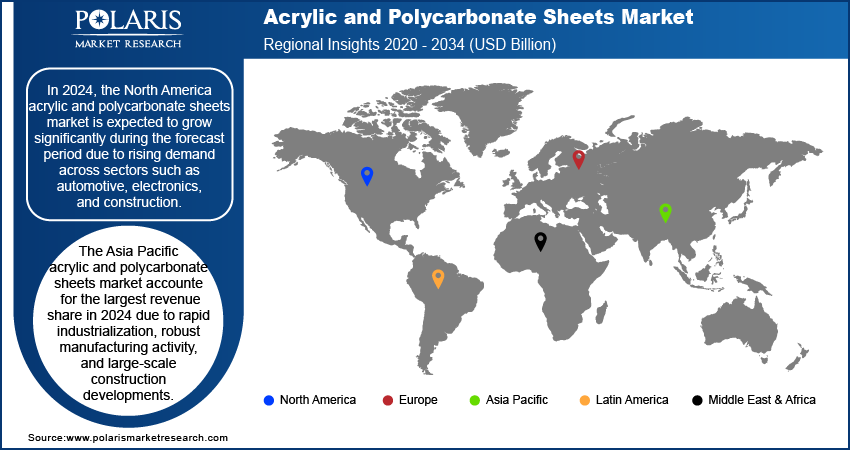

Regional Analysis

The North America acrylic and polycarbonate sheets market is expected to grow significantly during the forecast period due to rising demand across sectors such as automotive, electronics, and construction. The region’s focus on lightweight, impact-resistant materials in energy-efficient applications is expanding the use of advanced thermoplastics. Strict regulations promoting safety and material performance are pushing industries to shift from glass to more durable sheet alternatives. Continuous innovation in high-performance coatings and UV-resistant sheets is further strengthening adoption in outdoor and industrial environments. Growing investments in infrastructure modernization and smart building projects are expected to sustain the upward momentum in sheet demand. For instance, in January 2025, according to the US Department of Transportation, the Harris Administration announced a USD 1.32 billion funding initiative for infrastructure projects of local and regional importance. It will support various projects, including transportation networks, water systems, and energy infrastructure, to strengthen the nation's foundational assets and support regional growth.

U.S. Acrylic and Polycarbonate Sheets Market Trends

The U.S. acrylic and polycarbonate sheets market is expected to grow significantly over the forecast period, supported by increased usage in EV manufacturing, healthcare facilities, and commercial construction. Demand for transparent barriers and safety enclosures remains high in medical and retail spaces. Automotive OEMs are integrating lightweight materials for enhanced fuel economy and crash performance, boosting demand for polycarbonate applications. Additionally, the strong presence of local manufacturers, combined with expanding research in engineered plastics, is improving access to customized solutions. Ongoing upgrades in public transport infrastructure and energy-efficient architectural designs are contributing to sustained market growth across key urban centers.

Asia Pacific Acrylic and Polycarbonate Sheets Market Outlook

The Asia Pacific acrylic and polycarbonate sheets market accounted for the largest revenue share in 2024, due to rapid industrialization, robust manufacturing activity, and large-scale construction developments. Demand is rising across the automotive, consumer electronics, and infrastructure sectors, where lightweight and durable materials are essential. In 2024, retail sales of consumer goods in urban areas of China reached approximately USD 6,050 billion, reflecting a year-over-year growth of 3.2%. High production capacity, cost-effective labor, and growing investments in urban development have supported the region’s dominance. Manufacturers are also scaling operations to meet international quality standards, enabling increased exports. The shift toward smart cities, along with adoption of energy-efficient materials in residential and commercial projects, continues to fuel consumption of acrylic and polycarbonate sheets in the region.

China Acrylic and Polycarbonate Sheets Market Assessment

The market in China accounted for the largest revenue share in Asia Pacific in 2024, fueled by extensive infrastructure projects, strong automotive output, and demand from electronics manufacturing. Growth in the construction of high-speed railways, airports, and commercial buildings is driving the adoption of transparent, UV-resistant sheets. Domestic suppliers have expanded production capacity to meet rising internal demand while also competing in export markets. High investments in EV production and integration of lightweight components has further strengthened the market. Continuous innovation in material processing and the growing use of engineered plastic solutions in consumer goods are enhancing the country’s leadership in this sector.

Europe Acrylic and Polycarbonate Sheets Market Insights

The market in Europe is expected to grow significantly during the forecast period, driven by the imposition of stringent sustainability regulations and increased adoption of energy-efficient construction materials. Growth in renovation projects across commercial and institutional buildings is fueling the need for durable, lightweight glazing solutions. European industries are prioritizing recyclable materials and reducing carbon footprints, which favors the use of high-performance plastic sheets over traditional alternatives. Rising demand in sectors such as pharmaceuticals, electric vehicles, and advanced manufacturing is supporting the use of acrylic and polycarbonate sheets in the region. In addition, technological innovation in coating and extrusion techniques is enabling more versatile and durable sheet products across the region.

Key Players and Competitive Analysis

The competitive landscape of the acrylic and polycarbonate sheets market is shaped by aggressive market expansion strategies, ongoing product innovation, and rising emphasis on sustainable manufacturing. Industry analysis shows that key players are prioritizing mergers and acquisitions to strengthen distribution networks and diversify product portfolios, especially in high-demand applications such as automotive glazing, architectural facades, and medical equipment. Joint ventures and strategic alliances are being leveraged to access new markets and localize production capabilities. Post-merger integration efforts focus on optimizing production efficiency and enhancing supply chain resilience. Advancements in extrusion, UV coating, and anti-scratch surface treatments are enhancing the performance of these sheets across demanding use cases. Market participants are investing in lightweight, impact-resistant, and energy-efficient materials aligned with environmental regulations and green building trends. Customization, regulatory compliance, and high optical clarity remain key competitive differentiators, while digital platforms and design tools support tailored solutions for end users across diverse industries.

List of Key Companies

- 3A Composites GmbH

- AGC Inc.

- Arlaplast

- Brett Martin

- Emco Industrial Plastics

- EXOLON GROUP

- Hebei Unique Plastics Manufacturer Co., Ltd

- Jiaxing Innovo Industries Co., Ltd.

- Jumei Acrylic Manufacturing Co., Ltd.

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Palram Industries Ltd.

- Plaskolite

- Spartech LLC

- TEIJIN LIMITED

Acrylic and Polycarbonate Sheets Industry Developments

In April 2025, PLASKOLITE introduced its latest product, CELTEC White, an expanded PVC sheet designed for the sign and graphics industry, at the ISA International Sign Expo 2025 in Las Vegas. The new offering was developed to meet the growing demand for high-quality, durable materials in signage and visual communication applications.

In February 2024, VULCAN Plastics launched advanced polycarbonate sheet solutions, tailored to meet a variety of applications and specific market requirements.

Acrylic and Polycarbonate Sheets Market Segmentation

By Material Outlook (Revenue USD Billion, 2020–2034)

- Acrylic

- Polycarbonate

By Type Outlook (Revenue USD Billion, 2020–2034)

- Cast

- Extruded

- Solid

- Polycarbonate

- Multiwall

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Electronic

- Building and Construction

- Automotive

- Medical

- Packaging

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Acrylic and Polycarbonate Sheets Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.71 billion |

|

Market Size in 2025 |

USD 11.34 billion |

|

Revenue Forecast by 2034 |

USD 19.16 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.71 billion in 2024 and is projected to grow to USD 19.16 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

The Asia Pacific acrylic and polycarbonate sheets market dominated with a revenue share of approximately 39% in 2024 due to rapid industrialization, expansion of manufacturing hubs, and rising infrastructure projects across key economies.

A few of the key players are 3A Composites GmbH; AGC Inc.; Arlaplast; Brett Martin; Emco Industrial Plastics; EXOLON GROUP; Hebei Unique Plastics Manufacturer Co., Ltd; Jiaxing Innovo Industries Co., Ltd.; Jumei Acrylic Manufacturing Co., Ltd.; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Palram Industries Ltd.; Plaskolite; Spartech LLC; and TEIJIN LIMITED.

The polycarbonate segment accounted for the largest revenue share in 2024 due to its widespread adoption across demanding applications that require high impact strength, thermal resistance, and optical clarity.

The automotive segment accounted for the largest revenue share in 2024, driven by rising demand for lightweight and impact-resistant materials to improve vehicle performance and fuel efficiency.