Undercarriage Components Market Size, Share, Trends, & Industry Analysis Report

By Component Type (Track and Carrier Rollers, Track Chains), By Equipment Type, By Sales Channel, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5874

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

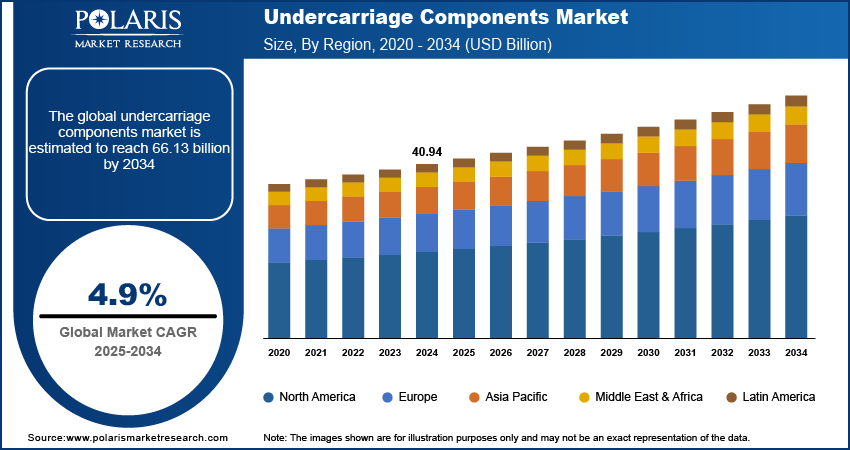

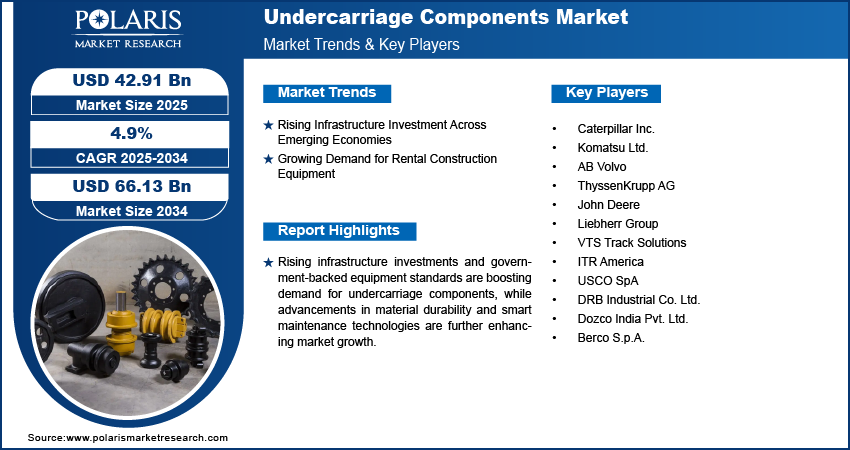

The global undercarriage components market size was valued at USD 40.94 billion in 2024, growing at a CAGR of 4.9% during 2025–2034. Rising construction and mining activities worldwide, coupled with increasing demand for heavy-duty machinery are key factors driving industry growth. Continuous infrastructure development across emerging economies is further accelerating the demand for reliable and durable undercarriage components.

Undercarriage components are essential structural elements that support tracked equipment, enabling efficient movement and weight distribution over diverse terrain. These components include track chains, rollers, idlers, sprockets, and track shoes that collectively bear the load and provide mobility for construction and earthmoving machinery. High-quality undercarriage systems improve machine performance, reduce downtime, and extend equipment lifespan, thereby lowering operational costs.

Undercarriage components are critical in sectors such as construction, mining, agriculture, and forestry, where machines operate under extreme conditions. Their performance directly impacts productivity and fuel efficiency, making timely maintenance and replacement vital. Modern advancements in material strength, wear resistance, and component design are enhancing the durability and service life of undercarriage parts, ensuring improved lifecycle value for equipment owners.

The market witnesses a strong aftermarket demand driven by regular wear and tear in high-usage applications. OEMs and aftermarket players are increasingly offering customized solutions and predictive maintenance services to meet end-user requirements. Furthermore, digital integration through telematics is enabling real-time monitoring of component wear, supporting proactive decision-making in equipment management.

Undercarriage components are essential for heavy machinery performance in harsh conditions due to their durability and efficiency impact equipment uptime, fuel usage, and overall project costs, making them critical for operational success. Urban expansion and industrial growth in emerging economies is increasing the demand for earthmoving machinery. According to the United Nations, 55% of the global population currently lives in urban areas, a figure projected to rise to 68% by 2050, with Asia and Africa accounting for nearly 90% of the expected 2.5 billion increase in urban residents. This leads to higher wear-and-tear rates, creating a steady aftermarket for replacement components.

Contractors and equipment rental firms are focusing on reducing maintenance downtime and improving fleet efficiency. As a result, there is a growing shift towards advanced undercarriage solutions offering longer service life, easier installation, and better wear monitoring. The competitive nature of the heavy equipment industry is also encouraging manufacturers to offer value-added services such as predictive maintenance and digital tracking, making undercarriage performance a key differentiator in machinery selection.

Industry Dynamics

Rising Infrastructure Investment Across Emerging Economies

Rising infrastructure investments across emerging economies is boosting the global undercarriage components sector. According to a Morgan Stanley report, India's infrastructure investment is expected to rise gradually from 5.3% of GDP in FY24 to 6.5% of GDP by FY29. Large-scale construction and mining projects in regions such as Asia Pacific, Latin America, and Africa are driving demand for heavy-duty tracked machinery that relies on durable undercarriage systems. Governments are prioritizing road development, urban expansion, and energy projects, all of which require reliable equipment that operates in challenging environments. This growing deployment of excavators, bulldozers, and track loaders directly fuels the need for high-performance components such as rollers, idlers, track chains, and sprockets.

In response to the increasing operational demands, OEMs and aftermarket suppliers are introducing advanced undercarriage solutions with improved wear resistance, easier maintenance, and digital tracking capabilities. Contractors are also shifting toward predictive maintenance and lifecycle cost optimization to ensure maximum uptime and equipment efficiency. As projects become more complex and time-sensitive, the role of undercarriage systems in supporting machine productivity and reducing operational delays becomes even more critical, positioning them as a core element in global infrastructure growth.

Growing Demand for Rental Construction Equipment

The rising preference for rental construction equipment is emerging as a major driver for the global undercarriage components industry. According to the American Rental Association, the North America construction and general tool rental industry reached USD 83.7 billion in 2024 and is projected to grow by 5.2% in 2025 to USD 87.5 billion, with the US contributing USD 7XYZ billion and Canada USD 5.73 billion. Cost-conscious contractors and small to mid-sized firms are increasingly opting for rented machinery to reduce capital expenditure for short-term or project-specific needs. This trend is particularly strong in developing regions where access to financing is limited, making equipment rental a more viable option. As a result, rental companies are expanding their fleets with a wide range of tracked machines, driving consistent demand for replacement undercarriage parts due to frequent use and high wear rates.

Rental fleets generally experience higher machine turnover and usage intensity, leading to accelerated wear of critical undercarriage components. This helps to maintain reliability and minimize downtime, rental firms invest heavily in preventive maintenance and timely part replacements. This operational model ensures a stable aftermarket for undercarriage components and incentivizes suppliers to offer cost-effective, high-durability solutions. Furthermore, rental providers are adopting advanced monitoring tools to track component health, encouraging the use of premium-grade undercarriage systems that offer better performance and longer service life.

Segmental Insights

Component Type Analysis

The global segmentation, based on component type includes, track and carrier rollers, track chains, idlers & sprocket, equalizer bars, track shoe/rubber tracks, track adjuster & recoil, link assemblies, and others. The track chains segment is projected to reach substantial CAGR by 2034. This growth is attributed to their indispensable role in maintaining traction and supporting the heavy weight of tracked machinery. These components are constantly exposed to friction, debris, and heavy loads, leading to frequent wear and tear in intensive operations such as mining, roadwork, and excavation. Their high replacement frequency and impact on machine performance make them critical for both equipment manufacturers and aftermarket suppliers. Moreover, ongoing advancements in heat treatment and metallurgy are further enhancing the strength and longevity of track chains, driving their continued dominance across end-use sectors.

The track shoe/rubber tracks segment is projected to grow at a robust pace in the coming years, fueled by the rising demand for compact tracked equipment in urban construction, landscaping, and agricultural applications. According to the USDA, agricultural output increased nearly fourfold, while the global population grown by 2.6 times, resulting in a 53% rise in per capita agricultural production. Rubber tracks are favored for their reduced vibration, lower noise levels, and ability to minimize ground damage, making them ideal for operations in sensitive environments. Additionally, technological improvements in rubber composition and tread patterns improved traction and durability, encouraging broader adoption. As lightweight machinery becomes more prevalent in residential and infrastructure projects, the demand for advanced track shoes and rubber track systems is set to increase significantly.

Equipment Type Analysis

The global segmentation, based on equipment type includes, excavator, track loader, dozers, multi terrain loaders, crawler cranes, asphalt pavers, and other equipment type. The excavator segment accounted for substantial market share in 2024, due to the machine’s widespread usage across construction, utility, and mining projects. As an example, in July 2024, Komatsu introduced its European-proven PC490HRD‑11, PC290LC‑11, PC360LC‑11, and PC490LC‑11 demolition excavators to the North American market to boost jobsite efficiency with enhanced reach, rapid boom changes, and heavy-duty protection. Excavators perform critical functions such as digging, trenching, and lifting, often on rough and uneven surfaces, placing high stress on undercarriage components such as rollers, idlers, and sprockets. Given their operational frequency and harsh working environments, crawlers & dozers machines require frequent inspection and replacement of parts to avoid downtime. This consistent demand drives substantial revenue for both OEM and aftermarket players. Furthermore, as infrastructure development accelerates globally, the role of excavators in project execution continues to boost undercarriage component consumption.

The multi-terrain loaders segment is projected to grow at a significant pace during the assessment phase, driven by increasing applications in residential construction, agriculture, and forestry. These machines are valued for their ability to maneuver on soft, uneven, or muddy surfaces, making them highly versatile across diverse terrain. Equipped with rubber tracks, multi-terrain loaders offer low ground pressure, minimizing surface disruption and enhancing operator comfort. Their compact size and operational flexibility make them ideal for projects in urban and semi-urban areas where space constraints exist. As mechanization expands in emerging markets and sustainability becomes a focus, demand for lightweight, efficient, and less invasive machinery such as multi-terrain loaders is expected to surge.

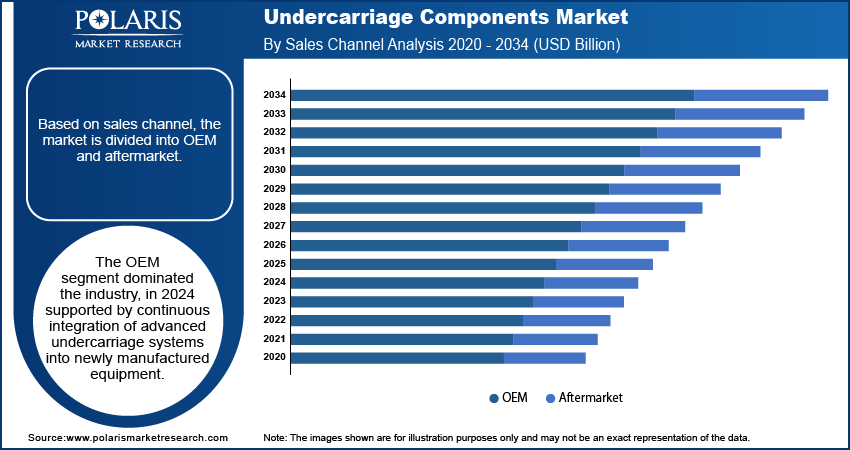

Sales Channel Analysis

The global segmentation, based on equipment type includes, OEM and aftermarket. The OEM segment dominated the industry, in 2024 supported by continuous integration of advanced undercarriage systems into newly manufactured equipment. Original equipment manufacturers focus on enhancing machine efficiency and minimizing operational costs by offering components with longer lifespans, better corrosion resistance, and low-maintenance features. As construction and mining companies increasingly prioritize performance and reliability, OEMs are responding with factory-fitted systems optimized for harsh environments. OEM partnerships with machinery brands also provide consistent quality and support, making them the preferred choice for large-scale equipment purchases. Additionally, innovations in component design and materials are helping OEMs solidify their position in the competitive landscape.

The aftermarket segment is estimated to hold a substantial market share in 2034, driven by the high wear rate of undercarriage parts and the need for periodic replacement. In industries such as construction and mining, equipment often operates under extreme conditions, accelerating component degradation and increasing reliance on the aftermarket for quick, cost-effective replacements. End-users are increasingly turning to aftermarket solutions due to flexible pricing, regional availability, and shorter lead times. Moreover, aftermarket suppliers are expanding service capabilities with predictive maintenance tools, installation support, and tailored kits to improve operational uptime. This adaptability and responsiveness are fueling the aftermarket’s rapid growth trajectory.

End User Analysis

The global segmentation, based on end user includes, construction, mining, agriculture & forestry, oil & gas. The construction segment is projected to grow at a significant CAGR during the forecast period. This is attributed to strong global infrastructure growth and consistent use of tracked equipment on construction sites. Activities such as land clearing, excavation, road building, and foundation work require machines that offer high stability, load-bearing capacity, and terrain adaptability functions that is directly supported by undercarriage systems. Frequent machine movement across abrasive surfaces leads to accelerated component wear, generating recurring demand for replacements. Additionally, the push for shorter project timelines and reduced downtime compels construction firms to maintain their fleets in top condition. As both public and private sector infrastructure projects rise globally, the construction segment remains a primary revenue contributor.

The agriculture and forestry segment is estimated to hold a significant market share in 2034. This is driven by rising mechanization trends and expanding cultivation and logging areas in developing regions. Tracked machines are increasingly used in tasks such as soil preparation, harvesting, and land clearing, where conventional wheeled equipment may struggle due to ground softness or uneven surfaces. Undercarriage components designed for these applications must ensure strong traction, durability, and minimal soil compaction. The shift toward high-efficiency farming and sustainable forestry practices is boosting demand for machinery that operates efficiently in diverse environmental conditions, thereby propelling the uptake of specialized undercarriage systems in this segment.

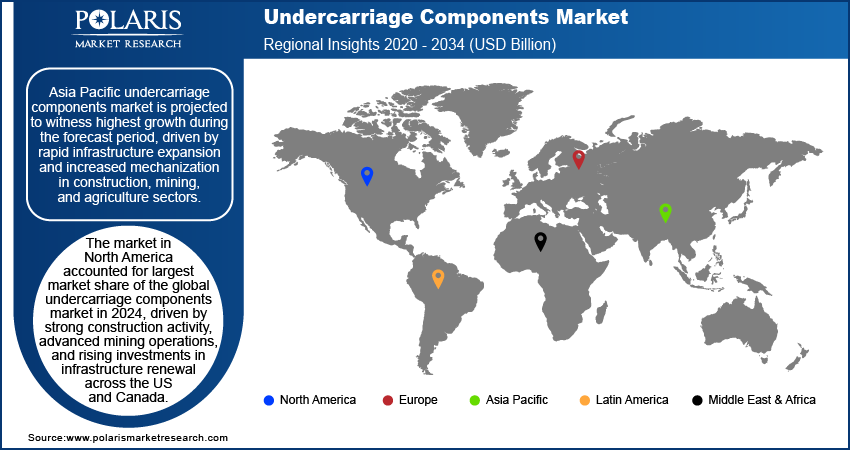

Regional Analysis

Asia Pacific undercarriage components market is projected to witness highest growth during the forecast period, driven by rapid infrastructure expansion and increased mechanization in construction, mining, and agriculture sectors. The region’s growing urban population and government-led development initiatives led to a surge in demand for heavy tracked equipment such as excavators, dozers, and loaders, thereby fueling the need for reliable undercarriage systems. Additionally, regional manufacturers are focusing on cost-effective production and localized supply chains, strengthening the availability of aftermarket components. Technological upgrades and rising adoption of performance-optimized machinery further support the growth trajectory of undercarriage component consumption in this region.

China Undercarriage Components Market Insight

The China undercarriage components market is driven by the country’s expansive infrastructure investments under initiatives including the Belt and Road Initiative (BRI), as well as strong domestic demand in construction and mining sectors. According to the American Enterprise Institute, the China Global Investment Tracker recorded USD 2.5 trillion in combined investment and construction by the end of 2024. This sustained surge in global infrastructure projects is driving significant demand for undercarriage components used in heavy construction equipment. Furthermore, the presence of large-scale OEMs and component manufacturers enabled fast production turnaround and cost-competitive solutions. Additionally, increasing mechanization in the country’s agriculture sector and rapid urbanization continue to boost demand for tracked equipment. The Chinese government’s emphasis on industrial automation and equipment localization also supports the ongoing growth and innovation in undercarriage component manufacturing.

Europe undercarriage components Market Trend

Europe undercarriage components market is projected to witness steady growth through 2034, supported by rising investments in infrastructure modernization, road expansion, and smart construction equipment. Countries such as Germany, France, and the United Kingdom are significantly increasing their construction machinery fleets to meet infrastructure targets and sustainability mandates. This uptick in heavy equipment utilization directly drives the demand for high-performance undercarriage components, particularly for excavators, dozers, and pavers used in complex terrain. Additionally, the growing demand for fuel-efficient and low-emission machinery is prompting OEMs to adopt lightweight and durable undercarriage systems, accelerating innovation and competition across the European market.

Germany leads the regional undercarriage components market due to its robust construction equipment manufacturing base and high standards for operational reliability and environmental compliance. The country’s strong emphasis on equipment quality, lifecycle efficiency, and reduced carbon output is influencing the development and adoption of advanced undercarriage systems. As per the European Parliament, Germany revised its Climate Change Act to target climate neutrality by 2045 and achieve negative emissions post-2050, with interim goals of reducing emissions by 65% from 1990 levels by 2030 and by 88% by 2040. Moreover, Germany’s ongoing road maintenance, infrastructure upgrades, and urban expansion projects are increasing the deployment of tracked machinery, generating consistent demand for replacement parts and aftermarket solutions. Local manufacturers and OEMs are focusing on technological upgrades such as wear-resistant alloys and track monitoring systems, further strengthening the country’s position in the European market.

North America Undercarriage Components Market Overview

The market in North America accounted for largest market share of the global undercarriage components market in 2024, driven by strong construction activity, advanced mining operations, and rising investments in infrastructure renewal across the US and Canada. According to Trading Economics, the US GDP from mining rose to USD 343.60 billion in the fourth quarter of 2024, up from USD 337.60 billion in the third quarter of 2024. The region benefits from high adoption of heavy-duty tracked equipment such as excavators, dozers, and crawler cranes in both public and private sector projects. Additionally, aging infrastructure and increased federal funding for transportation and energy developments are generating consistent demand for undercarriage replacements and performance upgrades. OEMs and aftermarket suppliers in the region are also integrating advanced materials and telematics-enabled components to improve equipment longevity, efficiency, and real-time maintenance tracking, further propelling market growth.

Key Players & Competitive Analysis Report

The undercarriage components industry is moderately consolidated, with key players competing on durability, cost-efficiency, and product lifespan. Manufacturers are expanding their global presence and strengthening ties with OEMs and distributors. There is rising demand for customized, terrain-specific solutions in construction, mining, and agriculture. Technological innovations such as smart wear monitoring and reinforced materials are shaping product development. R&D investments focus on lightweight, fuel-efficient, and long-lasting components to improve machine uptime.

Key companies operating in the global undercarriage components market include Caterpillar Inc., Komatsu Ltd., AB Volvo, ThyssenKrupp AG, John Deere, Liebherr Group, VTS Track Solutions, ITR America, USCO SpA, DRB Industrial Co. Ltd., Berco S.p.A., and Dozco India Pvt. Ltd.

Key Players

- Caterpillar Inc.

- Komatsu Ltd.

- AB Volvo

- ThyssenKrupp AG

- John Deere

- Liebherr Group

- VTS Track Solutions

- ITR America

- USCO SpA

- DRB Industrial Co. Ltd.

- Dozco India Pvt. Ltd.

- Berco S.p.A.

Industry Developments

January 2025: Dozco India Pvt. Ltd., acquired 100% stake in ITM Dozco (India) Pvt. Ltd. and renamed it as Dozco Tracks Pvt. Ltd. to strengthen its manufacturing base. The Visakhapatnam-based unit will continue producing undercarriage components for construction and mining equipment, supporting Dozco's expansion in domestic and international markets.

July 2024: Volvo Construction Equipment India facilitated the entry of two Korean undercarriage parts manufacturers to establish operations in India and bolster localization efforts. These suppliers will serve Volvo as well as other OEMs, leveraging India’s strengthened supply chain that supports high local-content products.

August 2023: CASE Construction Equipment launched the All Makes Undercarriage Program through an expanded partnership with Berco to distribute high-quality, competitively priced undercarriage parts across North America. The initiative also includes the CASE TrackCare monitoring service, enabling proactive undercarriage maintenance for steel‑tracked equipment of any brand and helping to control lifecycle costs.

Undercarriage Components Market Segmentation

By Component Type Outlook (Revenue, USD Billion, 2020–2034)

- Track and Carrier Rollers

- Track Chains

- Idlers & Sprocket

- Equalizer Bars

- Track Shoe/Rubber Tracks

- Track Adjuster & Recoil

- Link Assemblies

- Others

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Excavator

- Track Loader

- Dozers

- Multi Terrain Loaders

- Crawler Cranes

- Asphalt Pavers

- Other Equipment Type

By Sales Channel Outlook (Revenue, USD Billion, 2020–2034)

- OEM

- Aftermarket

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Construction

- Mining

- Agriculture & Forestry

- Oil & Gas

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Undercarriage Components Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 40.94 Billion |

|

Market Size in 2025 |

USD 42.91 Billion |

|

Revenue Forecast by 2034 |

USD 66.13 Billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 40.94 billion in 2024 and is projected to grow to USD 66.13 billion by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Caterpillar Inc., Komatsu Ltd., AB Volvo, ThyssenKrupp AG, John Deere, Liebherr Group, VTS Track Solutions, ITR America, USCO SpA, DRB Industrial Co. Ltd., Berco S.p.A., and Dozco India Pvt. Ltd.

The OEM segment dominated the industry, in 2024.

The agriculture and forestry segment is estimated to hold a significant market share by 2034.