Racquet Sports Court Rental Market Size, Share, Trends, & Industry Analysis Report

By Sport Type (Tennis, Pickleball), By Facility Type, By Booking Mode, By End‑User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5873

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

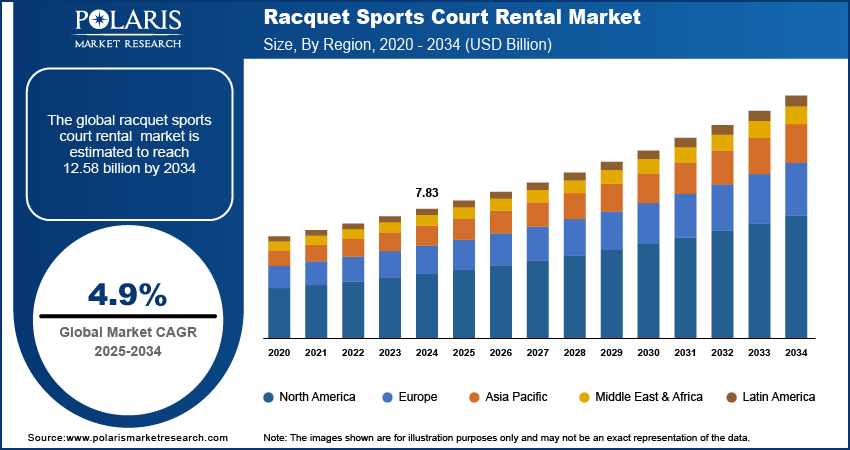

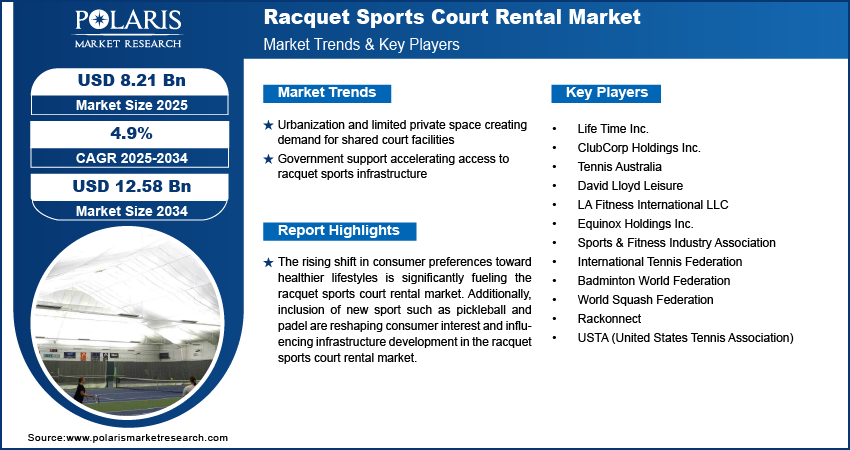

The global racquet sports court rental market size was valued at USD 7.83 billion in 2024, growing at a CAGR of 4.9% during 2025–2034. Urbanization and limited private space creating demand for shared court facilities. Government support accelerating the demand racquet sports court rental.

The racquet sports court rental market refers to the organized rental and reservation of playing courts for sports such as tennis, badminton, squash, and increasingly, pickleball. This market facilitates access to courts for individuals, clubs, tournaments, and fitness communities through scheduled bookings, either through physical centers or digital platforms. It involves the coordination of court availability, equipment, coaching services, and related amenities to support recreational and competitive play. Modern rental systems also integrate with online platforms and mobile applications, enabling users to check availability, make payments, and manage bookings with greater convenience. This digitization is improving user experience, reducing administrative overhead, and maximizing facility utilization.

Court rental services are mostly utilized in urban and suburban regions, where population density and limited access to personal playing spaces make shared facilities essential. The demand is particularly strong in multi-sport fitness centers, private sports clubs, school and university campuses, residential complexes, and public recreational facilities.

The rising shift in consumer preferences toward healthier lifestyles is significantly fueling the racquet sports court rental market. Across urban and suburban areas, racquet sports such as tennis, badminton, and squash are gaining momentum due to the effective full-body workout. According to the latest report by the Association of Summer Olympic International Federations, global tennis participation reached an all-time high, surpassing 100 million players for the first time. These sports enhance cardiovascular endurance, agility, and hand-eye coordination, making them increasingly appealing for individuals seeking physical and mental well-being benefits. Also, public health campaigns and community initiatives are pushing citizens to adopt more active routines, particularly in response to rising cases of obesity and lifestyle-related diseases. This growing focus on wellness created consistent demand for accessible, high-quality court rental spaces that support year-round participation.

Additionally, the inclusion of new sport such as pickleball and padel are reshaping consumer interest and influencing infrastructure development in the racquet sports court rental market. Unlike traditional racquet sports, these newer formats are gaining popularity among a broader range of age groups and experience levels. Pickleball, in particular, is attracting older adults and recreational users who seek less physically demanding but socially engaging activities. Padel, with its fast-paced yet accessible gameplay, is seeing widespread uptake in Latin America, Europe, and parts of Asia. The growing inclusivity of these sports is expanding the renter demographic and driving investments in courts that can accommodate multiple formats.

Industry Dynamics

Urbanization and Limited Private Space Creating Demand for Shared Court Facilities

The increasing concentration of populations in urban centers is significantly influencing the demand for shared recreational amenities, including racquet sports courts. The United Nations estimates that by 2050, an additional 2.5 billion people will be living in urban areas due to the rising global trend of rural-to-urban migration. In cities with smaller living spaces, people are increasingly using rental court services from community clubs, private sports centers, and residential societies to access recreational areas. These facilities enable regular participation in activities such as tennis, squash, badminton, and pickleball without the need for permanent infrastructure. This trend is particularly prominent in densely populated areas of Asia Pacific, Europe, and North America, where rising real estate pressures limit access to private recreational space.

Rental models are addressing urban challenges by offering flexible access to sports infrastructure. Developers are increasingly incorporating rooftop or underground courts in mixed-use buildings, while municipalities are upgrading public parks and schools with reservable multi-sport courts. Educational institutions in countries such as the US, Japan, and South Korea are also adopting this model by opening their facilities for public use during non-school hours. These shifts are boosting the utilization of sports infrastructure while catering to a growing urban population that prioritizes convenience, affordability, and access to quality recreational amenities.

Government Support Accelerating Access to Racquet Sports Infrastructure

Public sector initiatives aimed at promoting physical activity and community well-being are boosting investments in racquet sports infrastructure. Governments in regions such as South Asia, Europe, and Oceania are implementing targeted programs to make sports more accessible and inclusive. For instance, India’s Khelo India mission and the Active Lives campaign in the UK are driving the development and modernization of sports facilities, with a portion of this funding allocated to building or refurbishing racquet courts. These policies encourage local authorities and private operators to introduce rental-based usage models to maximize access and affordability.

Financial support and policy direction are enabling public-private partnerships that lead to better facility management and faster infrastructure development. In several cities, sports agencies are working with real estate developers and recreational chains to deliver purpose-built racquet complexes supported by rental platforms. These collaborations are increasing the availability of courts in urban and semi-urban regions while enhancing inclusivity across income groups. Government initiatives that focus on providing well-maintained and rentable court facilities are expanding access to racquet sports, propelling sustainable user base and driving the market growth.

Segmental Insights

Sport Type Analysis

The global segmentation, based on sport type includes, tennis, pickleball, badminton, paddle tennis, squash. The tennis segment held the largest share of the market in 2024. This growth is due to its long-standing popularity, global presence, and well-established infrastructure across both public and private domains. Countries such as the US, France, and Australia invested heavily in building and maintaining tennis facilities at national, community, and school levels. For instance, in June 2025, the United States Tennis Association (USTA) introduced a new micro-grant program designed to support the growth of tennis at the community level. As part of this initiative, the USTA committed USD 5 million over the next five years to further reinforce its support for grassroots tennis development. Tennis appeals to a wide demographic, including youth participants, adult recreational players, and senior citizens, making it a significant offering at sports clubs and municipal complexes.

The pickleball segment is projected to grow at a robust pace in the coming years, driven by its simple rules, low equipment costs, and suitability for a wide range of age groups. This sport is experiencing exponential adoption in regions such as North America and parts of Europe, particularly among older adults and new recreational players. Its rise is fueled by communities repurposing underutilized tennis and basketball courts into pickleball facilities, offering a cost-effective way to expand court availability. Sports organizations and developers are responding to this surge by creating dedicated pickleball complexes and incorporating the sport into multi-use recreational spaces. The rapid growth in participation and facility development is significantly increasing rental volumes, making pickleball a key contributor to the market expansion.

Facility Type Analysis

The global segmentation, based on facility type includes, indoor courts, outdoor courts. The outdoor courts segment accounted for significant market share in 2024. These courts are more cost-effective to construct and maintain compared to indoor alternatives and are widely available in parks, schools, residential complexes, and recreational facilities. In regions such as the US, Spain, Australia, and parts of the Middle East, favorable weather conditions throughout the year make outdoor courts highly accessible and frequently used. Local governments and municipalities are also investing in refurbishing public outdoor courts as part of wellness and sports promotion campaigns. The lower operational costs and widespread distribution contribute to higher rental volume, makes outdoor courts the leading segment in the market.

The indoor courts segment is projected to witness fastest growth during the forecast period, particularly in regions with harsh weather conditions or seasonal climate variation. Countries such as Canada, Germany, Japan, and South Korea are seeing rising demand for all-season sports access, pushing developers to invest in indoor infrastructure. These facilities offer climate-controlled environments, extended operating hours, and better playing conditions, attracting both recreational and competitive users. Indoor courts are also becoming more popular for multi-purpose use, including coaching programs, leagues, and community events. The rising preference for reliable, year-round play and improved player experience is fueling rapid growth in this segment.

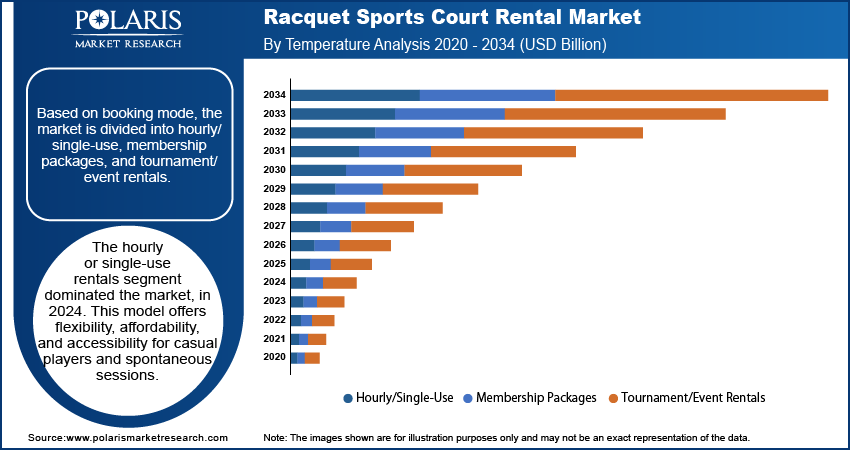

Booking Mode Analysis

The global segmentation, based on booking mode includes, hourly/single-use, membership packages, and tournament/event rentals. The hourly or single-use rentals segment dominated the market, in 2024. This model offers flexibility, affordability, and accessibility for casual players and spontaneous sessions. It is widely adopted in urban centers where players seek flexible access without long-term commitments or consistent availability. Sports facilities and app-based rental platforms commonly offer per-hour bookings with real-time availability and digital payment options. These services appeal to a large user base, including working professionals, families, and tourists, helping hourly rentals maintain a dominant position in terms of volume and revenue contribution.

The membership packages segment is estimated to hold a substantial market share in 2034 due to the increasing user engagement and loyalty programs. Sports clubs, residential facilities, and dedicated racquet centers are offers monthly and annual memberships that provide unlimited or discounted access to courts, coaching, and amenities. This model supports revenue predictability for facility operators while offering cost savings and convenience for frequent users. In regions such as the UK, Japan, and the US, clubs are expanding tiered membership plans that cater to different user profiles, including families, youth, and professionals. The focus on community-building and regular participation is accelerating growth of the market.

End-User Analysis

The global segmentation, based on end-user includes, recreational players, competitive athletes, tourists & travelers, and schools. The recreational players segment growth is driven due to their range from occasional hobbyists to regular fitness seekers who engage in racquet sports for leisure, health, and social interaction. The increasing health consciousness across urban populations and the low barrier to entry for sports such as pickleball and badminton led to widespread participation. Recreational players rely heavily on hourly rentals and community-based facilities, making them the primary contributors to overall court rental demand. Their presence is strong in suburban and urban settings where time-constrained individuals seek convenient sporting options.

The tourists and travelers’ segment are estimated to hold a significant market share in 2034, particularly in regions with well-developed sports tourism infrastructure. Hotels, resorts, and vacation rentals are increasingly including court access as part of their guest offerings. Destination-specific interest in racquet sports in places such as Florida, Dubai, the Mediterranean, and Southeast Asia, further fueling the demand for racquet sports court rental. Travel-focused booking platforms are also offering integrated packages with sports access, accelerating short-term rentals.

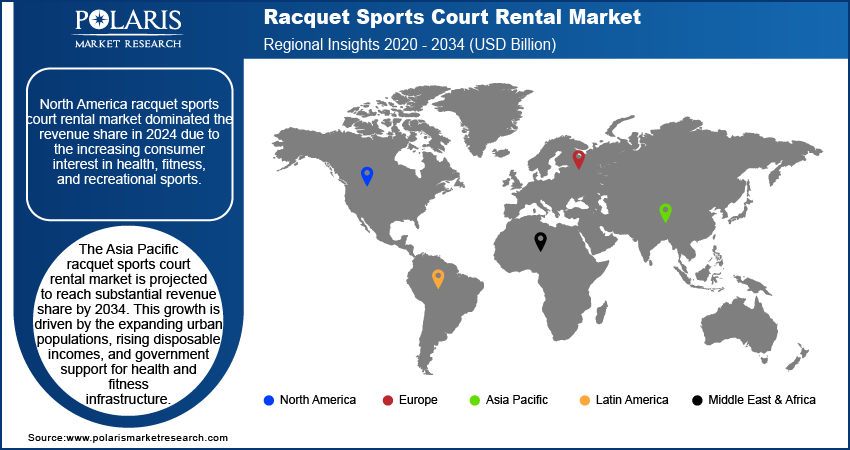

Regional Analysis

North America racquet sports court rental market dominated the revenue share in 2024 due to the increasing consumer interest in health, fitness, and recreational sports. A surge in participation across racquet disciplines such as tennis, pickleball, and squash led to strong demand for accessible court rental options. The popularity of community-based sporting culture, coupled with the rising influence of fitness-focused lifestyles, is significantly boosting the need for flexible, pay-per-use sports infrastructure. Moreover, real estate developers and municipalities are investing in court-based recreational facilities to enhance community engagement and attract high-amenity tenants, further boosting rental demand.

US Racquet Sports Court Rental Market Insight

The US, in particular, dominated the regional market, in 2024 due to the increasing adoption of pickleball sports in the country. Several cities and private operators are converting underused tennis or basketball courts into dedicated pickleball courts to meet growing demand. According to SFIA’s Topline Participation Report, pickleball remained the fastest-growing sport in US for the third consecutive year. Participation surged by 51.8% between 2022 and 2023, marking a remarkable 223.5% growth over the past three years, with increases seen across all age groups. Additionally, sports-focused real estate development coupled with integration of online court reservation systems, and community wellness programs continue to fuel the demand in the urban and suburban parts of the country.

Asia Pacific Racquet Sports Court Rental Market Trend

The Asia Pacific racquet sports court rental market is projected to reach substantial revenue share by 2034. This growth is driven by the expanding urban populations, rising disposable incomes, and government support for health and fitness infrastructure. Demographic and economic transformations in countries such as India, China, Japan, and Australia are fueling increased demand for recreational infrastructure across urban areas. New residential townships, commercial real estate projects, and municipal sports centers are including racquet courts to promote active lifestyles. For instance, in May 2025, Haridwar Sports Complex in Uttarakhand, India, was upgraded with new tennis and squash courts to support regional athlete development and community engagement. Also, in September 2024, Bay Pickle in Hong Kong launched a visionary development plan to expand pickleball courts across Hong Kong and the Greater Bay Area.

The growing popularity of emerging sports such as padel and badminton among younger demographics is increasing facility requirements and pushing facility operators to adopt hybrid court models. Growing reliance on digital booking tools is making racquet sports more accessible to middle-income demographics. The growing investments in multipurpose indoor stadiums and community centers are further accelerating the market growth.

Europe Racquet Sports Court Rental Market Overview

Europe racquet sports court rental market is witnessing growth, owing to the strong government policies around sports participation, increased investment in local facilities, and a culture of active lifestyles. Countries such as Germany, France, Italy, and the UK are emphasizing community sport development through public-private partnerships, leading to better access to high-quality court facilities. Local governments are prioritizing accessible sports infrastructure, particularly in urban regeneration projects and community sports hubs. These initiatives are expanding the court rental base across both recreational and organized sporting levels. Pickleball and padel are emerging rapidly in Western Europe, reshaping demand patterns in a market traditionally dominated by tennis and squash. The entry of new demographic groups such as older adults and female participants is driving the demand for accessible and inclusive court rental options.

Key Players & Competitive Analysis Report

The racquet sports court rental market is marked by growing competition, driven by the increasing popularity of tennis, pickleball, badminton, and squash across both recreational and professional segments. Market players are focused on expanding their facility networks, enhancing booking technologies, and offering value-added services such as coaching programs, tournaments, and wellness amenities. In addition to traditional health and sports clubs, digital platforms and mobile apps are reshaping how courts are rented, allowing users to locate, reserve, and pay for courts in real time. This shift is propelling the competitive landscape and boosting investments in smart infrastructure and digital integration.

Prominent organizations shaping the racquet sports court rental market include Life Time Inc., ClubCorp Holdings Inc., Tennis Australia, David Lloyd Leisure, LA Fitness International LLC, Equinox Holdings Inc., Sports & Fitness Industry Association, International Tennis Federation, Badminton World Federation, World Squash Federation, Rackonnect, and the US Tennis Association (USTA).

Key Players

- Life Time Inc.

- ClubCorp Holdings Inc.

- Tennis Australia

- David Lloyd Leisure

- LA Fitness International LLC

- Equinox Holdings Inc.

- Sports & Fitness Industry Association

- International Tennis Federation

- Badminton World Federation

- World Squash Federation

- Rackonnect

- USTA (United States Tennis Association)

Industry Developments

August 2024: Swing Racquet + Paddle initiated construction of a USD 100 million racquet sports complex in Raleigh’s Brier Creek area. The 44-acre facility included 80 indoor and outdoor courts for tennis, pickleball, padel, and beach tennis, alongside a ping-pong lounge, and aimed to attract over one million annual visitors.

June 2024: Rackonnect expanded its sports venue listings across North Indian cities such as Gurugram, Noida, Faridabad, Jaipur, and Amritsar by adding new badminton and pickleball courts.

Racquet Sports Court Rental Market Segmentation

By Sports Type Outlook (Revenue, USD Billion, 2020–2034)

- Tennis

- Pickleball

- Badminton

- Paddle Tennis

- Squash

By Facility Type Outlook (Revenue, USD Billion, 2020–2034)

- Indoor Courts

- Outdoor Courts

By Booking Mode Outlook (Revenue, USD Billion, 2020–2034)

- Hourly/Single-Use

- Membership Packages

- Tournament/Event Rentals

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Recreational Players

- Competitive Athletes

- Tourists & Travelers

- Schools

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Racquet Sports Court Rental Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.83 Billion |

|

Market Size in 2025 |

USD 8.21 Billion |

|

Revenue Forecast by 2034 |

USD 12.58 Billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.83 billion in 2024 and is projected to grow to USD 12.58 billion by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Life Time Inc., ClubCorp Holdings Inc., Tennis Australia, David Lloyd Leisure, LA Fitness International LLC, Equinox Holdings Inc., Sports & Fitness Industry Association, International Tennis Federation, Badminton World Federation, World Squash Federation, Rackonnect, and the United States Tennis Association (USTA).

The hourly or single-use rentals segment dominated the market, in 2024.

The indoor courts segment is projected to witness fastest growth during the forecast period.