U.S. Plastic Welding Equipment Market Size, Share, Trends, Industry Analysis Report

By Type (Automatic, Semi-automatic, Manual), By Technology, By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5880

- Base Year: 2024

- Historical Data: 2020-2023

Overview

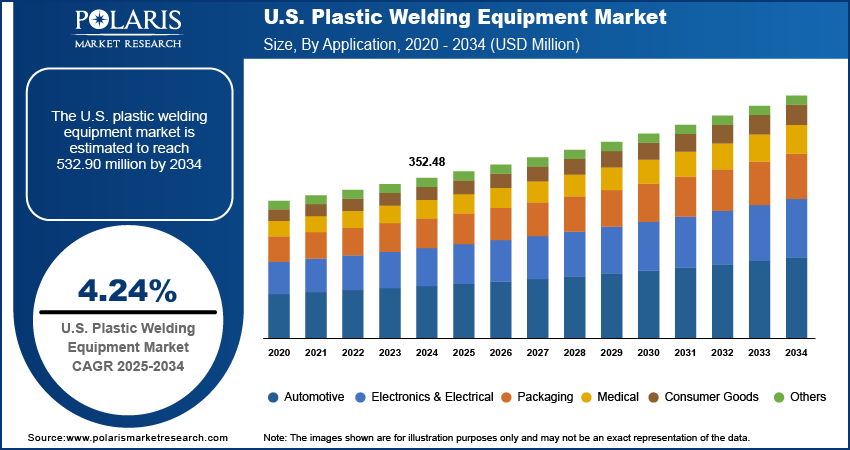

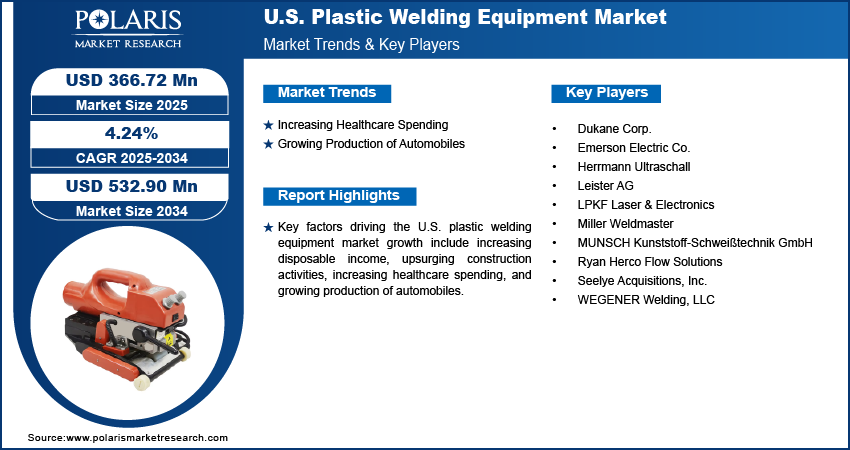

The U.S. plastic welding equipment market size was valued at USD 352.48 million in 2024, growing at a CAGR of 4.24 % from 2025 to 2034. A few key factors driving demand for plastic welding equipment include increasing disposable income, rising construction activity, increasing healthcare spending, and growing production of automobiles.

Plastic welding equipment refers to a range of specialized tools and machines designed to join or repair plastic materials by melting and fusing them together, creating a permanent and strong bond. Plastic welding is widely used across industries, including automotive, construction, packaging, medical, and electronics, enabling the fabrication and repair of products ranging from car bumpers and water tanks to medical devices and electronic housings.

The increasing disposable income is driving the U.S. plastic welding equipment market growth. Bureau of Economic Analysis, in its report, stated that disposable personal income in the U.S. increased by 0.7% in April 2025 from March 2025. This increase in disposable income is driving demand for plastic products such as food storage containers, beverage bottles, buckets, storage bins, and others, prompting manufacturers to buy more welding equipment to meet rising orders. Additionally, increasing disposable income is fueling the adoption of advanced 5G smartphones, which is propelling the need for plastic-wielding equipment, as it plays a critical role in the manufacturing of 5G smartphones, particularly in assembling and joining the various plastic components that make up the device’s internal structures.

The U.S. plastic welding equipment demand is driven by the rising construction activity. Construction projects heavily use plastic welding equipment to join pipes, tanks, and insulation materials. Governments and private firms in the country are investing heavily in modernizing utilities, leading to higher orders for plastic welding machines to fabricate and repair utility components, such as electrical sectionalizers, LBS switches, and others. Therefore, the rising construction activity in the US is fueling the demand for plastic products, which is increasing the adoption of plastic welding equipment.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Healthcare Spending

Increasing healthcare spending is expanding the production of medical products such as IV bags, catheters, blood filters, and surgical instruments that rely heavily on precise, contamination-free plastic welding. The American Medical Association, in its article, stated that health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion or $14,570 per capita. Additionally, increasing healthcare spending is pushing healthcare providers to achieve higher quality standards in products, which is encouraging the adoption of automated and high-performance plastic welding equipment.

Growing Production of Automobiles

Automakers in the US continuously replace metal parts with high-strength plastics to reduce vehicle weight and improve fuel efficiency, which is raising the requirement for strong and precise plastic joints or assemblies. Manufacturers rely on plastic welding equipment to assemble dashboards, bumpers, fuel tanks, door panels, and under-the-hood components. Therefore, as vehicle output rises in the country, automakers expand their manufacturing capacity and invest in advanced welding solutions to meet production targets, driving demand for plastic welding equipment.

Segmental Insights

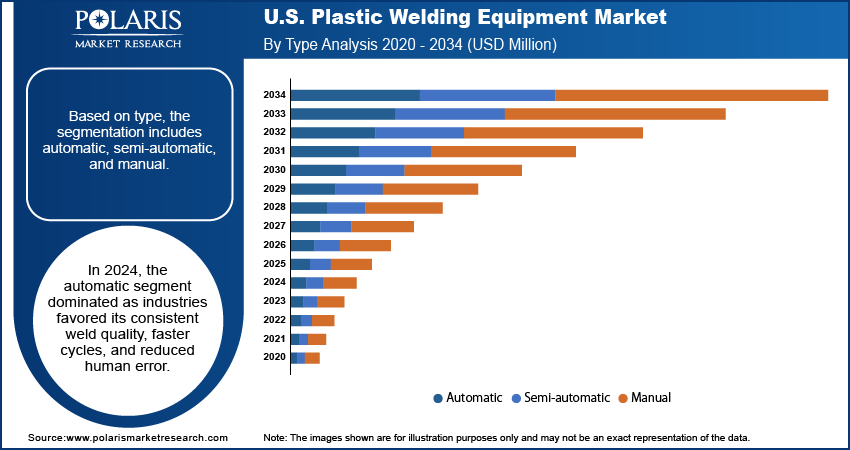

Type Analysis

Based on type, the segmentation includes automatic, semi-automatic, and manual. The automatic segment accounted for a major market share in 2024. Manufacturers across key industries, including automotive, electronics, and medical devices, increasingly favored automatic systems due to their ability to deliver consistent weld quality, faster cycle times, and reduced human error. The growing need for precision and productivity in high-volume manufacturing operations further drove the demand for fully automated equipment. Additionally, automation reduced long-term labor costs and ensured compliance with stringent safety and quality standards, especially in sectors governed by tight regulatory frameworks. This propelled the segment’s dominance.

The semi-automatic segment is projected to grow at a robust pace in the coming years. Mid-sized manufacturers and contract fabricators are adopting semi-automatic systems to keep a balance between operational flexibility and cost-efficiency. These systems provide more user control than fully automatic machines while still improving production efficiency compared to manual alternatives. Moreover, the versatility of semi-automatic machines supports a wider range of plastic types and component geometries, making them increasingly attractive across diverse industries, such as electronics, automotive, and others.

Technology Analysis

In terms of technology, the segmentation includes ultrasonic welding, vibration welding, laser welding, infrared welding, spin welding, hot plate welding, and others. The ultrasonic welding segment held the largest market share in 2024 due to its widespread adoption across industries that demand precision, speed, and strong weld quality. Manufacturers in sectors such as automotive, electronics, and medical devices increasingly preferred ultrasonic welding for its ability to deliver high-throughput production with minimal material degradation. The technology’s noninvasive nature and capability to weld complex and delicate plastic parts without requiring adhesives or solvents significantly contributed to its dominance. Additionally, advancements in microprocessor-controlled systems and real-time monitoring enhanced its weld reliability and operational efficiency, leading to its dominance.

The laser welding segment is estimated to grow at a rapid pace during the forecast period, owing to its ability to support seamless integration with automated production lines and ensure minimal thermal distortion. Furthermore, rising investments in electric vehicles (EVs) and battery manufacturing are accelerating the adoption of laser-based plastic welding equipment due to their ability to create clean, precise welds in compact assemblies.

Application Analysis

In terms of application, the segmentation includes automotive, electronics & electrical, packaging, medical, consumer goods, and others. The automotive segment held 35.65% market share in 2024, due to the rising need to produce lightweight and durable vehicle components such as fuel tanks, bumpers, instrument panels, and under-the-hood parts. The growing emphasis on fuel efficiency and emission reduction prompted manufacturers to replace metal components with engineered plastics, which significantly boosted demand for reliable and high-speed welding equipment. Additionally, the rapid expansion of EV production strengthened the segment's dominance, as EVs incorporate a higher volume of plastic parts that require precision welding to meet performance and safety standards.

The medical segment is projected to hold a substantial market share by 2034. The increasing production of disposable medical products such as IV catheters, blood filters, fluid reservoirs, and diagnostic cartridges is driving demand for welding equipment that offers clean joints without the use of adhesives or contaminants. Regulatory focus on sterility and traceability in healthcare manufacturing is fueling the adoption of advanced plastic welding systems, particularly ultrasonic and laser-based technologies. Furthermore, ongoing innovations in point-of-care diagnostics, wearable health devices, and drug delivery systems are elevating the importance of precise plastic joining methods.

Key Players and Competitive Analysis

The U.S. plastic welding equipment market is highly competitive, characterized by the presence of established multinational corporations, specialized manufacturers, and niche players offering a range of welding technologies, including hot gas, ultrasonic, laser, and vibration welding. Key competitors such as Emerson Electric Co. and Leister AG dominate with advanced, high-precision welding systems, catering to industries such as automotive, packaging, and medical devices. Emerson, through its Branson Ultrasonics division, is a leader in ultrasonic welding. Leister specializes in hot air and laser plastic welding solutions, serving both industrial and repair applications. Innovation remains a critical differentiator, with companies investing in automation, IoT-enabled welding systems, and eco-friendly technologies to meet sustainability demands. Price competition is intense, particularly in the low-to-mid-range segment, while premium manufacturers differentiate through after-sales support, precision, and integration with Industry 4.0 systems.

A few major companies operating in the U.S. plastic welding equipment market include Dukane Corp.; Emerson Electric Co.; Herrmann Ultraschall; Leister AG; LPKF Laser & Electronics; Miller Weldmaster; MUNSCH Kunststoff-Schweißtechnik GmbH; Ryan Herco Flow Solutions; Seelye Acquisitions, Inc.; and WEGENER Welding, LLC.

Key Players

- Dukane Corp.

- Emerson Electric Co.

- Herrmann Ultraschall

- Leister AG

- LPKF Laser & Electronics

- Miller Weldmaster

- MUNSCH Kunststoff-Schweißtechnik GmbH

- Ryan Herco Flow Solutions

- Seelye Acquisitions, Inc.

- WEGENER Welding, LLC

Industry Development

May 2024: Emerson announced the launch of the Branson GLX-1 laser welder for medical devices, electronics, and automotive sensors. It also promotes recyclable and sustainable manufacturing practices by supporting non-destructive “un-welding,”.

U.S. Plastic Welding Equipment Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Automatic

- Semi-automatic

- Manual

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Ultrasonic Welding

- Vibration Welding

- Laser Welding

- Infrared Welding

- Spin Welding

- Hot Plate Welding

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Electronics & Electrical

- Packaging

- Medical

- Consumer Goods

- Others

U.S. Plastic Welding Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 352.48 Million |

|

Market Size in 2025 |

USD 366.72 Million |

|

Revenue Forecast by 2034 |

USD 532.90 Million |

|

CAGR |

4.24% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 352.48 million in 2024 and is projected to grow to USD 532.90 million by 2034.

The market is projected to register a CAGR of 4.24% during the forecast period.

A few of the key players in the market are Dukane Corp.; Emerson Electric Co.; Herrmann Ultraschall; Leister AG; LPKF Laser & Electronics; Miller Weldmaster; MUNSCH Kunststoff-Schweißtechnik GmbH; Ryan Herco Flow Solutions; Seelye Acquisitions, Inc.; and WEGENER Welding, LLC.

The automatic segment dominated the market share in 2024.

The medical segment is expected to witness the fastest growth during the forecast period.