Electrical Sectionalizer Market Size, Share, Trends, & Industry Analysis Report

: By Product (Resettable Electronic Sectionalizers, Programmable Sectionalizers, and Others), By Voltage, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5733

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

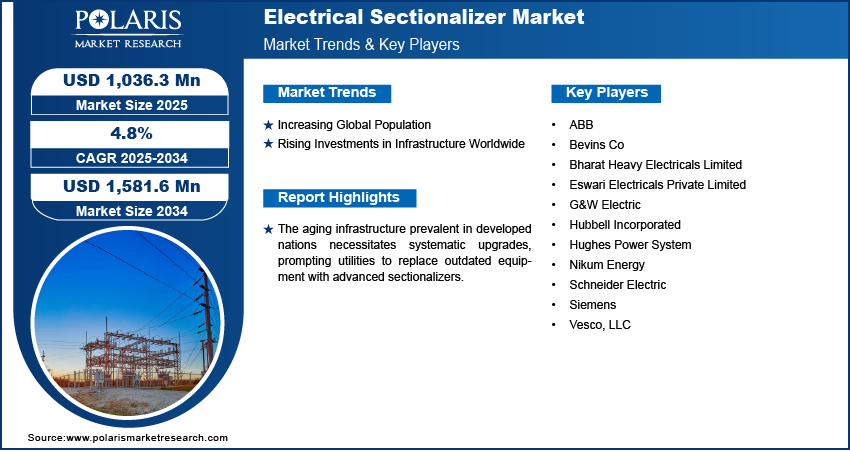

The global electrical sectionalizer market was valued at USD 993.0 million in 2024 and is expected to register a CAGR of 4.8% during the forecast period. The aging infrastructure prevalent in developed nations necessitates systematic upgrades, prompting utilities to replace outdated equipment with advanced sectionalizers. These modern devices enhance operational efficiency and lower maintenance expenses, thereby facilitating significant growth.

An electrical sectionalizer, also known as a disconnect switch or sectionalizing switch, is a protective device used in power distribution systems to isolate faulted sections of a distribution line automatically. It is usually located near the distribution circuit and load side of the electrical transmission. Sectionalizer works alongside reclosers and circuit breakers to improve system reliability and minimize power outages. Electrical sectionalizers are used for both AC and DC electrical systems. The increasing development of mobile-operated sectionalizers is driving the electrical sectionalizer market growth. In March 2023, Goa Engineering College (GEC) students, in association with the Electricity Department, Govt of Goa, developed a sectionalizer operated from a mobile phone for feeder control. These mobile-operated sectionalizers allow engineers to remotely open or close the sectionalizer, adjust settings, and receive fault alerts instantly, reducing interruption time, improving reliability, and stability. Moreover, mobile connectivity eliminates the need for expensive SCADA systems or dedicated communication lines, encouraging utilities to adopt these mobile-operated sectionalizers.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for electricity, coupled with upgrades to existing infrastructure and enhancements in system reliability, is advancing the importance of electrical sectionalizers as essential elements within power distribution networks.

Market Dynamics

Increasing Global Population

The rapid growth of the global population is creating the need for reliable, efficient, and resilient electrical distribution systems. Electrical sectionalizers help achieve this need by isolating faulty sections of the power distribution unit without interrupting service to unaffected areas, which is crucial in regions with rising populations such as Asia. The Population Reference Bureau stated that the population in Asia is projected to increase by 10% by 2050 to 5.3 billion, up from 4.8 billion in 2024. Moreover, countries in Asia such as India and Indonesia, are actively investing in modernizing their electrical infrastructure to meet the high energy consumption driven by rising population and industrial growth. Modern electrical infrastructures such as smart grids and renewable energy integration demand advanced fault management solutions, increasing the need for sectionalizers. The growing global population is further fueling industrial growth, creating energy needs. Factories and manufacturing plants rely on stable power to avoid costly downtime. Sectionalizers help maintain uninterrupted operations and provide stable power by isolating faults without disrupting the entire supply chain. Furthermore, the increasing population worldwide is also encouraging governments to make investments in industrial smart cities, which is fueling the demand for electrical sectionalizers. In August 2024, the Government of India approved 12 new industrial smart city projects with a total project cost of USD 3,382.19 million. Industrial smart cities require smart grid solutions that minimize outages, optimize energy flow, and enhance resilience. Electrical sectionalizers fulfill these requirements by isolating faults and preventing widespread blackouts. Hence, the rising global population is fueling the demand for the electrical sectionalizer.

Rising Investments in Infrastructure Worldwide

Global investments in infrastructure, particularly in power transmission, are rising rapidly. Governments and private sector players worldwide are funding heavily to expand and modernize energy grids, transportation networks, and urban infrastructure, creating demand for sectionalizers. These devices, which isolate faulted sections of power distribution lines and quickly restore service to unaffected areas, enhance grid reliability and minimize downtime, making them crucial in power transmission infrastructure projects. For instance, the Government of India announced its plans to invest USD 107.89 billion in power transmission infrastructure by 2032 to boost capacity and support growing electricity demand. Moreover, developed countries such as the US and those in Europe are investing in upgrading aging electrical infrastructure to improve efficiency, resilience, and safety. These upgrades often include replacing outdated manual switches with sectionalizers. For instance, according to financial reports to the Federal Energy Regulatory Commission (FERC), annual spending by major utilities in the US to produce and deliver electricity increased by 12% from USD 287 billion in 2003 to USD 320 billion in 2023.

The rising investments in power generation infrastructure are pushing the deployment of renewable energy sources, such as wind and solar power. Renewable energy deployments frequently involve complex, decentralized grids that need sophisticated protection and control equipment, including sectionalizers, to maintain stability and reliability. Therefore, as investment in power generation infrastructure and renewable energy sources increases, utilities increase the deployment of electrical sectionalizers to protect and balance the grid. Hence, the increasing investment in infrastructure worldwide is fueling the electrical sectionalizers demand.

Segment Insights

Market Assessment by Product

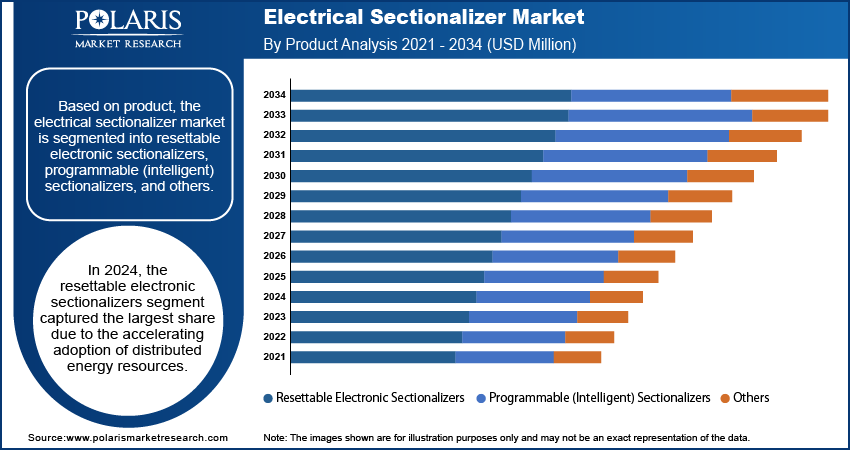

Based on product, the segmentation includes resettable electronic sectionalizers, programmable (intelligent) sectionalizers, and others. In 2024, the resettable electronic sectionalizers segment accounted for more than 51.0% of the share due to the accelerating adoption of distributed energy resources, which is driving critical innovations in grid protection technology, particularly in markets with high renewable penetration. According to a report by Hawaiian Electric, in March 2025, the utility's grid integrates nearly 114,000 private solar systems, representing a 7.5% annual increase, with 1,410 MW of solar capacity representing 13% growth since 2023, creating complex operational challenges where fault currents become increasingly variable and bidirectional. This environment demands advanced sectionalizing solutions that combine rapid fault isolation with intelligent reset capabilities, particularly valuable for Hawaii's unique grid architecture that combines urban-density solar adoption with extended rural-style branches. Modern resettable sectionalizers address these challenges through three innovations such as adjustable sensitivity settings that accommodate fluctuating fault current levels from distributed generation, automated restoration functionality that eliminates manual interventions for temporary faults (common in solar-rich networks), and improved coordination algorithms that maintain reliability, for instance, Hawaiian Electric's variable generation capacity grows 13% annually, managing 7,976 new solar connections and aiding digital transformation.

The programmable (intelligent) sectionalizers segment is projected to register a CAGR of 5.5% during the forecast period, due to the growing need for smarter grid control and enhanced fault management. According to the International Energy Agency, global grid investment rose 8% in 2022 as compared to the previous year. The EU's 2030 action plan allocated USD 633 billion for grid upgrades, with USD 434 billion for distribution networks. This investment supports the deployment of advanced technologies that enable system utilities to tailor fault response settings, thereby enhancing operational flexibility and reducing system downtime.. Their ability to differentiate between temporary and permanent faults ensures fewer unnecessary outages and more efficient power restoration. The demand for adaptable and responsive protection solutions is rising with the increasing complexity of modern grids and the integration of distributed energy resources. This shift toward intelligent automation is fueling the adoption of programmable sectionalizers.

Market Assessment by Voltage

Based on voltage, the segmentation includes medium-voltage (1 kV–36 kV) and high-voltage (>36 kV). In 2024, the medium-voltage (1 kV–36 kV) segment accounted for 59.0% of the share, largely due to its widespread adoption across distribution grids to improve system resilience and reduce outage durations. These devices are essential for separating faulted segments without affecting the rest of the network. Their compatibility with pole-mounted and underground systems makes them versatile for diverse infrastructure needs. Medium-voltage solutions offer a balance between performance and cost as utilities modernize their networks, especially in densely populated areas where power reliability is critical. The ongoing expansion and reinforcement of urban distribution networks are driving the growth of this segment. With increasing electricity demand from residential, commercial, and industrial users, utilities are investing in medium-voltage sectionalizers to ensure timely fault isolation and quick restoration.

The high-voltage (>36 kV) segment is expected to register a CAGR of 5.4% over the forecast period, due to its capability of operating in high-stress electrical environments. These devices ensure system stability by separating faults quickly to prevent failures across the grid. They are essential in infrastructure that supports high-capacity energy transfer, such as transmission lines and substations. Their design often incorporates remote control and monitoring capabilities to meet the operational demands of complex systems. The growing emphasis on grid reliability in high-load transmission environments boosts the growth of high-voltage sectionalizers due to the need for dependable high-voltage protection as countries invest in large-scale power projects and inter-regional grids. According to April 2025 report by the India Brand Equity Foundation, the Global Energy Alliance for People and Planet plans to invest USD 100 million in clean energy projects, focusing on AI-driven grid solutions. The country announced its plans to invest USD 107 billion in transmission infrastructure by 2032 to support its goal of nearly tripling renewable capacity. These sectionalizers play a crucial role in safeguarding critical infrastructure from disruptions, enabling better load management and grid balancing.

Market Evaluation by End Use

Based on end use, the segmentation includes power & utilities, mining & heavy manufacturing, railways & transportation, telecommunications, and others. In 2024, the power and utilities segment held over 53.0% of the share and is expected to register a CAGR of 5.3% during the forecast period. Power and utility companies use sectionalizers to automate fault isolation and improve operational efficiency across distribution and sub-transmission networks. Sectionalizers in power and utility applications maintain continuous electricity delivery to residential, commercial, and industrial consumers. They are typically used on feeders and substations to detect faults and isolate sections of the grid to prevent wider outages. The need for advanced fault management tools is growing with increasing focus on grid automation and the integration of renewable energy. This push toward smart grid development and modernization of legacy infrastructure further boosts the sectionalizers application. Utilities are seeking automated solutions that improve power quality, reduce operational losses, and provide real-time control. Sectionalizers offer these capabilities by ensuring selective coordination, improving fault location precision, and contributing to overall grid stability.

The mining & heavy manufacturing segment is projected to register a CAGR of 5.0% from 2025 to 2034. Sectionalizers protect critical machinery and electrical networks from damage, which can be due to overloads and short circuits in mining and heavy industrial operations. These environments are characterized by high power consumption and harsh operational conditions, making robust electrical protection essential. The increasing automation in heavy industries, which demands highly reliable and responsive protection systems, drives the demand for sectionalizers. For instance, Schneider Electric to invest USD 700 million in the US by 2027 to support energy infrastructure modernization, focusing on AI-driven data centers, manufacturing, and grid resilience amid growing regional demand, further boosting the sectionalizers expansion. Industries reduce the risk of extended downtimes and improve the safety of operations by integrating sectionalizers into the network. Their performance in high-load and hazardous settings makes them an essential part of the industrial electrical infrastructure.

In 2024, the railways and transportation segment is expected to record a CAGR of 3.6% during the forecast period. Sectionalizers in railways and transportation are used to protect and manage electrical supply systems powering train lines, signaling equipment, and related infrastructure. In the transportation sector, especially in railways, ensuring uninterrupted power supply to signaling systems, communication networks, and traction units is critical for safety and efficiency. The complexity of power systems increases as railway networks modernize with electrification and automation, requiring responsive protection devices. According to the Ministry of Railways, Indian Railways commissioned 3,433 km of track from April to December 2024, including 1,158 km of new lines and 259 km of gauge conversion. The network achieved 97% electrification, with 3,210 route kilometers electrified in 2024. Sectionalizers help reduce downtime by isolating only the faulted section, ensuring the rest of the network continues operating. The rise in railway electrification projects and intelligent transportation infrastructure boosts the demand for sectionalizers as they improve reliability, reduce maintenance time, and enhance passenger safety.

Pricing Analysis

The pricing dynamics in the electrical sectionalizer market are influenced by factors such as raw material costs, manufacturing complexity, and regional demand-supply balances. Product differentiation, brand reputation, and after-sales services also play a crucial role in price determination. While competitive pricing strategies are adopted to gain market share, premium pricing is observed for advanced, technologically superior models.

|

Manufacturer |

Oil-immersed Sectionalizers (USD/unit) |

Vacuum-based Sectionalizers (USD/unit) |

Smart Digital Sectionalizers (USD/unit) |

|

ABB |

$5,000 |

$9,000 |

$16,000 |

|

Siemens |

xx |

xx |

xx |

|

Schneider Electric |

xx |

xx |

xx |

|

Eaton |

xx |

xx |

xx |

|

Mitsubishi Electric |

xx |

xx |

xx |

|

Toshiba |

xx |

xx |

xx |

|

Hyundai |

xx |

xx |

xx |

|

GE Grid Solutions |

xx |

xx |

xx |

Regional Analysis

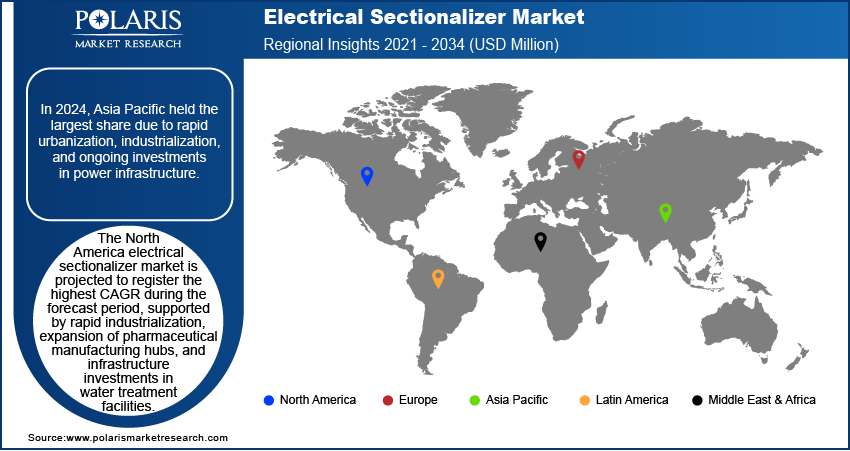

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for 46.0% of the share due to rapid urbanization, industrialization, and ongoing investments in power infrastructure. The growing government initiatives and investments in smart grid and automation technologies, particularly in developed countries such as Japan, South Korea, and China, boost the Asia Pacific electrical sectionalizer market expansion. According to the Global Smart Energy Federation, the South Korean government launched the Korea Smart Grid Association to develop projects and encourage the use of a smart grid electricity transmission system. Sectionalizers are essential components in smart grid systems, which are driving the demand for sectionalizers. The integration of renewable energy sources, such as solar and wind, is further boosting demand for sectionalizers. According to the Institute of Sustainable Energy Policies, in 2023, the share of renewable energy in Japan’s total electricity generation was estimated to be 25.7%, an increase from the 22.7% in 2022. These energy sources often connect to the grid in remote or rural areas and require intelligent grid equipment to handle fluctuations and maintain stability.

The China electrical sectionalizer market holds 31.45% share of the Asia Pacific market, driven by the rapid expansion of energy infrastructure to accommodate its growing population. According to the International Energy Agency projections, between 2019 and 2024, China will contribute approximately 40% to the global renewable capacity expansion. This escalating demand for sectionalizers and similar devices is closely linked to the ongoing enhancement of energy networks, which are critical for managing the integration of renewable energy sources and ensuring grid stability.

The India electrical sectionalizer market is expected to register the highest CAGR with over 6.0% from 2025 to 2034, due to increasing electricity consumption and a greater demand for uninterrupted power. According to the Indian Ministry of Power, per capita electricity consumption in India has surged to 1,395 kWh in 2023–2024, marking a 45.8% increase (438 kWh) from 957 kWh in 2013–2014. This is especially important in densely populated cities, where even short outages affect thousands of people and critical infrastructure.

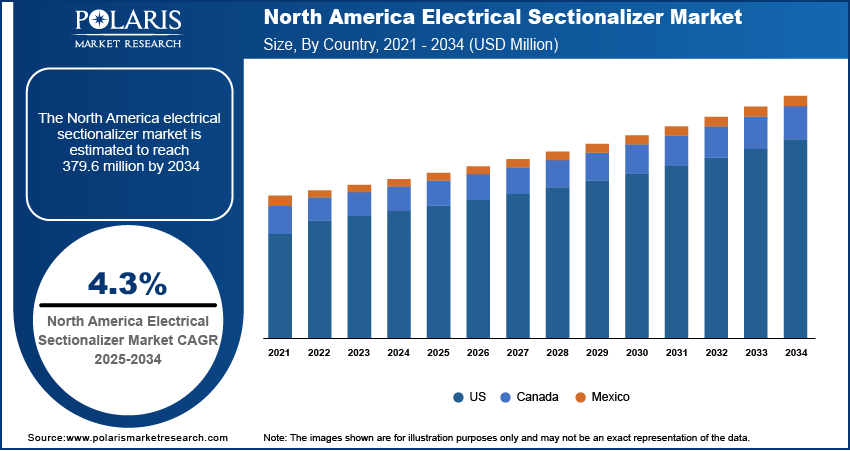

The North America electrical sectionalizer market is projected to grow at a CAGR of 4.3% over the forecast period, supported by the push toward improving the reliability and resilience of the power grid. The aging power infrastructure, especially in the US, is driving the demand for sectionalizers to enable faster fault detection and isolation, preventing widespread outages. According to the US Department of Energy Report, as of 2023, 70% of transmission lines were over 25 years old and approaching the end of their 50 to 80-year lifecycle. Many electrical grids were built decades ago and are now being upgraded or replaced. Utility companies are spending on substation equipment and automated devices such as sectionalizers as part of this modernization to help reduce the impact of outages and manage faults more efficiently. According to the US Energy Information Administration, utilities spent USD 6.1 billion on distribution substation equipment in 2023, an 184% increase from 2003 and a 15% increase from 2022.

The US electrical sectionalizer market accounted for 80% of the share in North America, due to a significant increase in renewable energy integration, including solar and wind power. These distributed energy sources require flexible and responsive grid management, which sectionalizes support by helping control load flow.

The Europe electrical sectionalizer market is expected to register a CAGR of 4.9% during the forecast period, driven by the region’s strong focus on sustainability, energy efficiency, and grid modernization. One of the main factors pushing this growth is the transition toward cleaner energy systems. Many European countries are phasing out fossil fuels and increasing their reliance on renewable energy sources such as wind, solar, and hydro. According to the Fraunhofer Institute for Solar Energy Systems ISE, in Germany, renewables produced around 260 TWh in 2023, around 7.2% more than in 2022, which was 242 TWh. The share of renewable energy generated in Germany in the load was 57.1%, compared to 50.2% in 2022. These sources often introduce variability into the grid, which requires flexible and responsive switching devices such as sectionalizers to maintain grid stability.

The Germany electrical sectionalizer market holds a 27.4% share in Europe, due to rising demand for reliable power distribution, increasing renewable energy integration, and grid modernization efforts. The country’s strong industrial base and focus on smart grid technologies further support overall expansion. Additionally, government initiatives promoting energy efficiency and infrastructure upgrades are driving adoption, ensuring sustained growth in the sector during the forecast period.

Key Players and Competitive Analysis Report

The competitive landscape of the electrical sectionalizers market is characterized by a mix of established global players and regional companies, all vying for share by offering a variety of advanced solutions. Major players include Schneider Electric, ABB, Siemens, and G&W Electric, who dominate the landscape due to strong brand recognition and global presence. These companies provide advanced sectionalizers designed to improve grid reliability and fault isolation.

Major companies are at the forefront of innovation in the market, particularly with the development of smart sectionalizers that integrate with advanced grid automation systems. Additionally, major players focus on delivering high-quality, durable sectionalizers suitable for large-scale applications, often catering to industrial and utility sectors. These players invest heavily in R&D to improve their products’ performance and expand their offerings.

Several smaller regional players contribute to the competitive dynamics by offering cost-effective solutions and specializing in specific geographical markets or niche applications. These include companies such as Nikum Energy; Eswari Electricals Private Limited; Vesco, LLC; and Bharat Heavy Electricals Limited, which focus on providing reliable, user-friendly solutions tailored to the needs of specific regions or utilities. Strategic partnerships and acquisitions are common strategies for expanding market share. For example, Bevins Co and Hubbell Incorporated have been involved in partnerships to strengthen their product portfolios and enhance their competitive position.

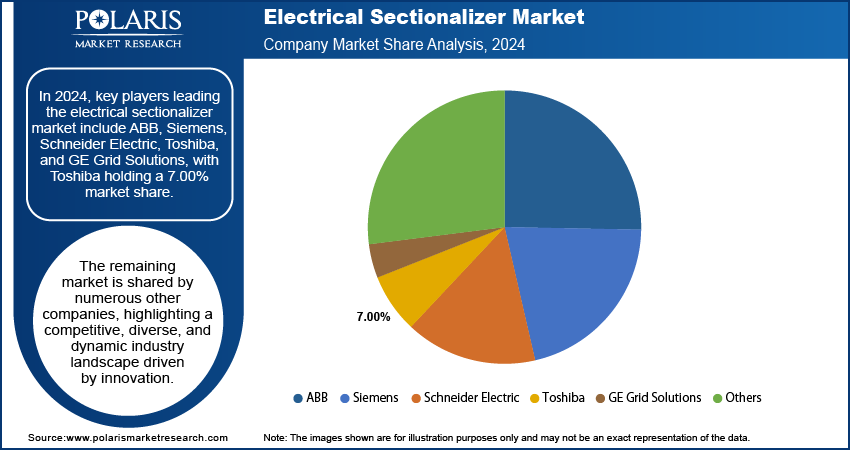

Company Share Analysis

Several key players in the electrical sectionalizer market hold significant positions, reflecting a competitive yet consolidated industry landscape. Companies are increasingly focusing on innovation, product reliability, and strategic partnerships to strengthen their market presence. The competition is driven by technological advancements, regional expansion, and customer-centric solutions. Market participants differ from global conglomerates to regional specialists, each leveraging their expertise to capture demand across industrial, commercial, and utility sectors, supporting continuous growth and differentiation.

List of Key Companies

- ABB

- Bevins Co

- Bharat Heavy Electricals Limited

- Eswari Electricals Private Limited

- G&W Electric

- Hubbell Incorporated

- Hughes Power System

- Nikum Energy

- Schneider Electric

- Siemens

- Vesco, LLC

Electrical Sectionalizer Industry Developments

In May 2024, ABB inaugurated a switchgear factory in Evergem, Belgium, where USD 22.5972 million was invested to enhance sustainable manufacturing and support Europe’s growing electrification demands.

Electrical Sectionalizer Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Resettable Electronic Sectionalizers

- Programmable (Intelligent) Sectionalizers

- Others

By Voltage Outlook (Revenue, USD Million, 2020–2034)

- Medium-Voltage (1 kV–36 kV)

- High-Voltage (>36 kV)

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Power & Utilities

- Mining & Heavy Manufacturing

- Railways & Transportation

- Telecommunications

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Electrical Sectionalizer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 993.0 million |

|

Market Size Value in 2025 |

USD 1,036.3 million |

|

Revenue Forecast by 2034 |

USD 1,581.6 million |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 993.0 million in 2024 and is projected to grow to USD 1,581.6 million by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

In 2024, Asia Pacific accounted for the largest share due to rapid urbanization, industrialization, and ongoing investments in power infrastructure.

A few of the key players are ABB; Bevins Co; Bharat Heavy Electricals Limited; Eswari Electricals Private Limited; G&W Electric; Hubbell Incorporated; Hughes Power System; Nikum Energy; Schneider Electric; Siemens; and Vesco, LLC.

In 2024, the resettable electronic sectionalizers segment captured the largest share, primarily driven by its superior compatibility with low- to medium-pressure applications in pharmaceutical, food, and laboratory settings.

In 2024, the mining & heavy manufacturing segment dominated the market. It protects critical machinery and electrical networks from damage due to overloads and short circuits in mining and heavy industrial operations.