South America Carbon Dioxide Market Share, Size, Trends, Industry Analysis Report

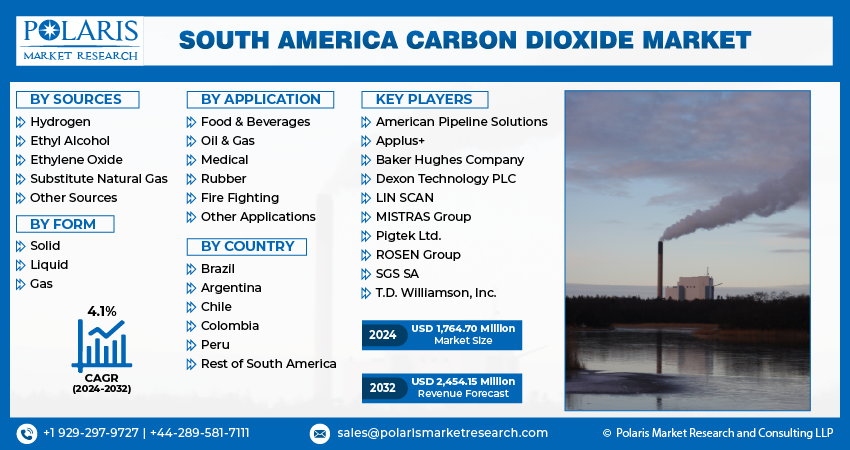

By Sources; By Form (Solid, Liquid, Gas); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 116

- Format: PDF

- Report ID: PM4923

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

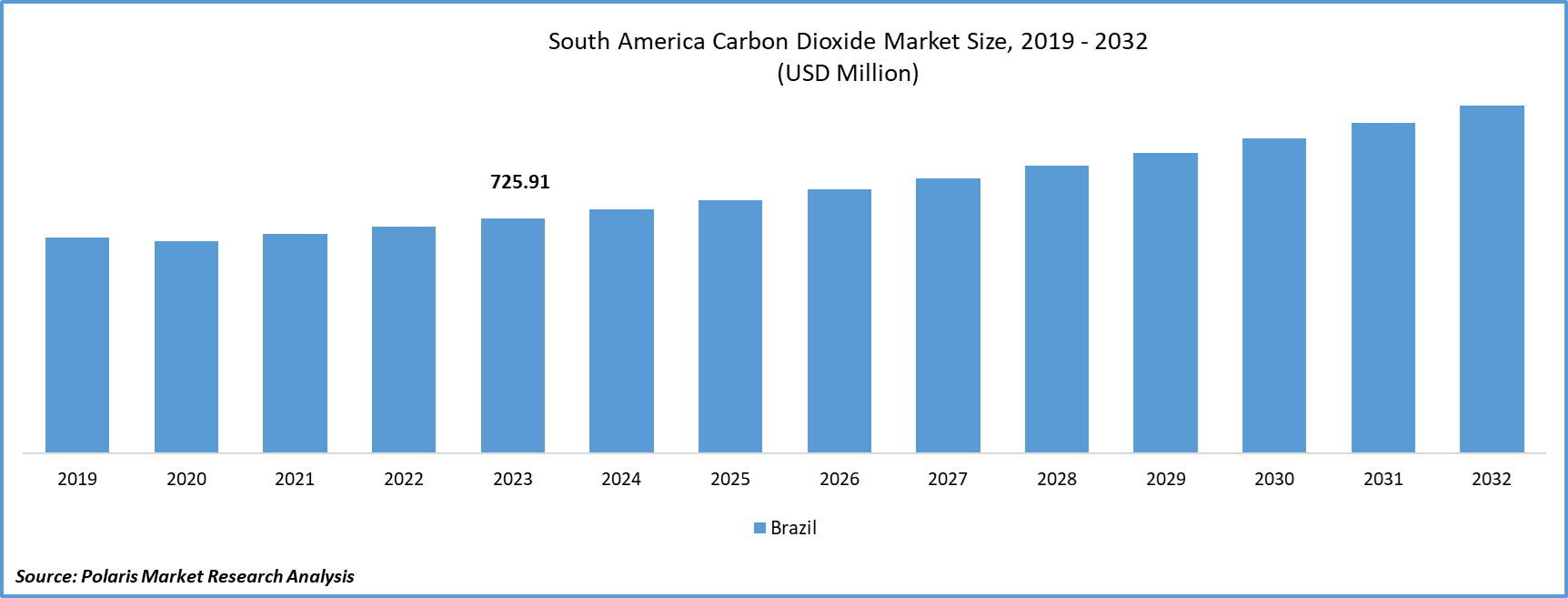

The South America carbon dioxide market was valued at USD 1,705.99 million in 2023 and is expected to grow at a CAGR of 4.1% during the forecast period.

Industry Trends

The demand for carbon dioxide (CO2) in South America is poised to experience significant growth driven by various factors. Firstly, upstream players in the region are increasingly investing in enhanced oil recovery operations to maintain production levels, thus boosting the demand for CO2. This demand surge is attributed to the use of CO2 in tertiary oil recovery methods, where it is injected into oil reservoirs to facilitate the extraction of remaining oil reserves.

Additionally, the increasing use of CO2 in various application industries such as refrigeration, food and beverages, chemical wholesaling, and pharmaceuticals further propels market growth. As these industries expand and evolve, the demand for CO2 as a crucial component in their processes rises accordingly.

Moreover, the consumption of carbonated drinks and soda water is a major contributing factor to the growing demand for CO2 in South America. As the region's population continues to embrace carbonated beverages, the need for CO2 for carbonation purposes escalates, thereby driving market growth. However, despite these favorable market dynamics, the high cost associated with the capture, liquefaction, and transportation of CO2 poses a significant challenge. This cost factor can potentially hinder the growth of the CO2 market in South America, as it affects the feasibility and profitability of utilizing CO2 across various industries.

To Understand More About this Research: Request a Free Sample Report

Furthermore, The COVID-19 pandemic significantly impacted the carbon dioxide market in South America, causing disruptions across various industries and altering demand dynamics. As countries implemented lockdown measures and restrictions to curb the spread of the virus, industrial activities slowed down, leading to reduced CO2 emissions and a decline in demand for CO2 in sectors such as manufacturing, transportation, and energy production.

The closure of businesses, suspension of construction projects, and decreased consumer spending resulted in a temporary downturn in industrial output, leading to lower CO2 emissions associated with industrial processes. Additionally, travel restrictions and reduced mobility led to decreased demand for transportation fuels, further contributing to the decline in CO2 emissions.

Key Takeaways

- Brazil dominated the market and contributing highest market share

- By sources category, the hydrogen segment accounted for the largest South America Carbon Dioxide market share

- By form category, the liquid segment is anticipated to grow with a lucrative CAGR over the South America Carbon Dioxide market forecast period

What are the market drivers driving the demand for market?

- Increasing application of enhanced oil recovery (EOR) technology

The increasing application of Enhanced Oil Recovery (EOR) technology is significantly driving the demand for carbon dioxide (CO2) in South America. EOR techniques involve injecting CO2 into oil reservoirs to enhance oil recovery rates, particularly in mature fields where conventional extraction methods have been exhausted. This method has gained traction due to its effectiveness in accessing previously unrecoverable oil reserves, thereby prolonging the economic lifespan of oil fields. The utilization of CO2 in EOR not only enhances oil recovery rates but also offers environmental benefits by sequestering CO2 underground, thereby mitigating greenhouse gas emissions. This dual benefit aligns with global efforts to address climate change, driving regulatory support and incentives for EOR projects across South America.

- Rising usage in medical and food & beverage sector to drive progression of market

The burgeoning utilization of carbon dioxide (CO2) in the medical and food and beverage industries is poised to propel the progression of the carbon dioxide market in South America. This trend stems from CO2's versatile properties, which find application in various sectors beyond its traditional uses. In the medical industry, CO2 is increasingly employed for its efficacy in minimally invasive surgical procedures such as laparoscopy and endoscopy. The inert nature of CO2 makes it ideal for insufflation during surgeries, facilitating improved visibility and patient outcomes. Additionally, CO2 is utilized in cryotherapy for its cooling properties, aiding in tissue ablation and treatments. As the demand for advanced medical procedures grows across South America, so does the requirement for medical-grade CO2, driving market expansion

Which factor is restraining the demand for market?

- High cost of carbon capture and storage (CCS) technology

The high cost of carbon capture and storage (CCS) technology presents a significant barrier hindering the carbon dioxide market in South America. CCS technology plays a crucial role in mitigating greenhouse gas emissions by capturing CO2 from industrial processes and power plants before it is released into the atmosphere and subsequently storing it underground to prevent its contribution to climate change. However, the substantial expenses associated with implementing CCS projects deter widespread adoption across the region.

One of the primary cost drivers of CCS technology is the initial investment required for infrastructure development. Establishing CCS facilities demands significant capital expenditure for constructing capture equipment, pipelines for transporting CO2, and storage sites compliant with safety and regulatory standards. These upfront costs pose a financial challenge for industries operating in South America, particularly in sectors with narrow profit margins or limited access to funding.

Report Segmentation

The market is primarily segmented based on source, form, application and country.

|

By Sources |

By Form |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Sources Insights

On the basis of source, the South America Carbon Dioxide market has been segmented hydrogen, ethyl alcohol, ethylene oxide, substitute natural gas, and other sources. The dominance of hydrogen segment is due to its clean and versatile energy carrying capacity, its production processes can indirectly contribute to carbon dioxide emissions. One common method is steam methane reforming, where natural gas reacts with steam to produce hydrogen and carbon dioxide as a byproduct. hydrogen production from renewable sources like biomass offers a more sustainable alternative. While biomass can consume carbon dioxide during its growth phase, the conversion process to extract hydrogen may still release some carbon dioxide. However, the overall carbon footprint of renewable hydrogen production is significantly lower compared to fossil fuel-based methods.

The ethanol segment is anticipated to grow at the fastest CAGR owing to its fermentation process which produces carbon dioxide as a byproduct. The carbon dioxide produced during ethanol fermentation is of high purity and could potentially be captured and utilized. This captured carbon dioxide can be purified and sold for various industrial applications, including carbonation of beverages, food processing, pharmaceuticals, and manufacturing processes where carbon dioxide is utilized as a raw material or for inerting purposes.

By Form Insights

On the basis of form, the South America carbon dioxide market has been segmented solid, liquid, and gas. The solid state also known as dry ice dominated the market owing to its demand that has been steadily increasing, primarily driven by the growing demand for frozen foods. As more consumers opt for convenience and seek out quick and easy meal solutions, the frozen food market has experienced significant growth. This surge in demand for frozen foods directly correlates with the increased need for dry ice as a reliable freezing agent during transportation and storage. Consequently, industries involved in the production, distribution, and storage of frozen goods are driving the demand for dry ice in South America.

The Liquid CO2 segment is anticipated to grow at the fastest CAGR owing to its role in the food and beverage industry, particularly in carbonated soft drinks, beer, and water. It also serves as a preservative in food packaging. With the escalating consumption of carbonated beverages in South America, the food and beverage sectors are poised to remain the largest end-users of liquid CO2. The burgeoning population further solidifies this sector's dominance in the market in the years to come. Additionally, liquid CO2's application in the healthcare industry contributes to market growth.

Country-wise Insights

Brazil

The Brazil leads the South America carbon dioxide market in South America as companies in Brazil expand their CO₂ supply capacity to meet the needs of the country. CO₂ is utilized in various industrial applications, including food and beverage production, oil and gas extraction, pharmaceuticals, and manufacturing. As Brazil's industrial sector continues to grow, there is an increasing demand for CO₂ for use in processes such as carbonation, pH control, and inert gas shielding. For instance, in March 2021, Messer revealed plans to enhance its carbon dioxide (CO2) supply capabilities for clients in Brazil's South, Southeast, and Midwest regions. The company will implement sustainable CO2 production in Jandaia do Sul, situated in the Paraná countryside of Brazil.

Competitive Landscape

In the South America carbon dioxide market, Linde Plc, Messer SE & Co. KGaA, Air Products Inc., White Martins, Zephyr Solutions, LLC, Air Liquide, Oxigas Gases, SOL Group, and Praxair, Inc. (Linde plc.) stand out as key competitors. These companies compete fiercely, leveraging their technological capabilities, distribution networks, and diverse product portfolios to capture market share. Established players leverage their technological expertise and economies of scale to maintain significant market share while emerging companies often focus on niche segments or innovative solutions to gain a foothold. Additionally, partnerships, mergers, and acquisitions are prevalent strategies to enhance market presence and expand geographical reach.

Some of the major players operating in the European market include:

- American Pipeline Solutions

- Applus+

- Baker Hughes Company

- Dexon Technology PLC

- LIN SCAN

- MISTRAS Group

- Pigtek Ltd.

- ROSEN Group

- SGS SA

- T.D. Williamson, Inc.

Recent Developments

- In April 2024, Orizon, a Brazilian waste management firm, is set to sell carbon offsets from landfill projects, expecting to finalize the sale of 1-2mn tCO2e in Q2 at $6-7/tCO2e.

- In December 2023, Brazil plans to establish a regulated carbon market through a cap-and-trade system, aiming to reduce emissions and attract foreign investment. President Lula's green agenda includes this initiative, although it exempts agriculture, a major emission source. Critics argue this omission may limit the market's environmental impact and effectiveness.

Report Coverage

The South America Carbon Dioxide market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, application, organization size, vertical, and their futuristic growth opportunities.

South America Carbon Dioxide Market

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,764.70 million |

|

Revenue forecast in 2032 |

USD 2,454.15 million |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Sources, By Form, By Application, By Country |

|

Regional scope |

Brazil, Argentina, Chile, Colombia, Peru, Rest of South America |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The South America Carbon Dioxide Market report covering key segments are source, form, application and country.

The South America Carbon Dioxide market size is expected to reach USD 2,454.15 Million by 2032

The South America carbon dioxide market is expected to grow at a CAGR of 4.1% during the forecast period.

key driving factors in South America Carbon Dioxide Market are increasing application of enhanced oil recovery (EOR) technology