South East Asia Medical Gas Application & Equipment Market Size, Share, Trends, Industry Analysis Report

By Gas Type (Medical Oxygen, Helium), By Equipment Type, By Application, By End User, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6387

- Base Year: 2024

- Historical Data: 2020-2023

Overview

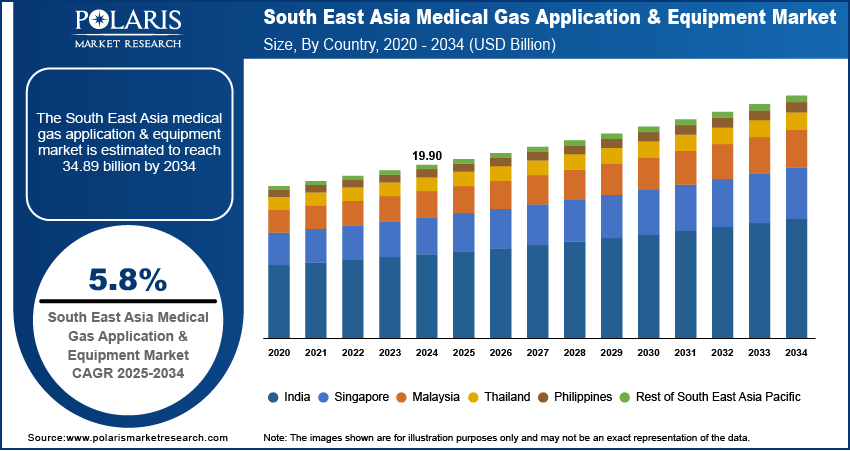

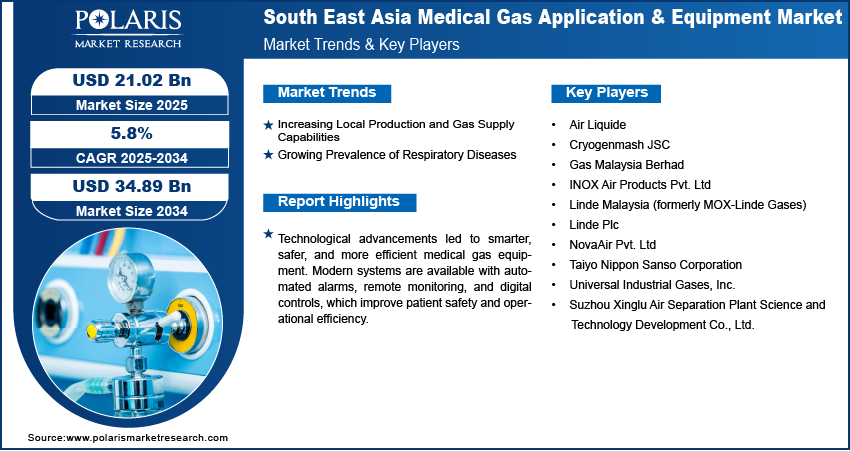

The South East Asia medical gas application & equipment market size was valued at USD 19.90 billion in 2024, growing at a CAGR of 5.8% from 2025 to 2034. The market growth is driven by increasing local production and gas supply capabilities, and growing prevalence of respiratory diseases.

Key Insights

- In 2024, the medical oxygen segment dominated with the largest share due to a high number of respiratory illness cases and rising hospital admissions.

- The pharmaceutical manufacturing & research segment is expected to experience significant growth driven by expanding drug production in countries such as Malaysia, Singapore, and Thailand.

- India dominated with the largest share in 2024, driven by its large healthcare infrastructure, rising patient volumes, and increasing awareness of critical care needs.

- The industry in the Philippines is expected to witness significant growth during the forecast period, due to increasing investments in public and private healthcare infrastructure.

Industry Dynamics

- Increasing local production and gas supply capabilities drives the demand for medical gases.

- The growing prevalence of respiratory diseases is fueling the industry growth.

- Technological advancement has led to smarter, safer, and more efficient medical gas equipment.

- High implementation costs restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 19.90 billion

- 2034 Projected Market Size: USD 34.89 billion

- CAGR (2025–2034): 5.8%

- India: Largest market in 2024

Medical gas equipment refers to the devices and systems used to store, regulate, and deliver medical gases such as oxygen, nitrous oxide, and medical air in healthcare settings. This includes cylinders, flowmeters, regulators, manifolds, gas pipelines, and alarm systems. These tools ensure the safe, precise, and continuous delivery of gases for patient care, surgeries, anesthesia, and respiratory therapy.

Southeast Asia is witnessing significant growth in healthcare infrastructure due to increasing government investments and public-private partnerships. According to the FREOOP, in 2022, Singapore invested 6% of its GDP in the healthcare sector. Countries such as Vietnam, Malaysia, Singapore, Indonesia, and the Philippines are actively expanding hospital networks and upgrading medical facilities. This infrastructure expansion drives the demand for essential medical utilities, including oxygen supply systems, gas delivery equipment, and pipeline networks. The growing need for modern healthcare services, with a rising middle-class population and urbanization, fuels the adoption of reliable medical gas systems, thereby driving the growth.

Governments in Southeast Asia are imposing stringent healthcare regulations to improve patient safety and facility standards. Countries such as Malaysia, Indonesia, and Vietnam have introduced policies to ensure proper storage, handling, and delivery of medical gases. These regulatory pressures compel hospitals and clinics to upgrade from manual gas handling systems to automated, monitored delivery solutions. Facilities are prioritizing the integration of certified equipment, gas alarms, and pipeline management tools as compliance becomes non-negotiable, thereby directly boosting the growth in medical gas applications and related devices.

Drivers & Opportunities

Increasing Local Production and Gas Supply Capabilities: Several Southeast Asian countries are promoting domestic production of medical gases to reduce dependency on imports and manage costs. Companies in Vietnam, Thailand, and the Philippines are expanding production of oxygen, nitrous oxide, and medical air to meet growing demand. This local availability ensures a stable supply and encourages more hospitals, especially in rural areas, to adopt medical gas systems. The growing presence of regional gas manufacturers makes equipment and refill services more accessible, which further supports widespread penetration across both urban and underserved areas.

Growing Prevalence of Respiratory Diseases: The incidence of respiratory diseases such as asthma, COPD, and pneumonia is on the rise in Southeast Asia due to factors such as air pollution, smoking, and urban congestion. According to the Chronic Obstructive Pulmonary Disease Association, in Singapore alone, approximately 340,000 people suffer from COPD each year. In response, demand for medical oxygen and related respiratory care equipment has increased significantly. Hospitals and emergency care centers across the region are investing in advanced oxygen therapy systems and gas supply units. Additionally, post-COVID awareness regarding respiratory health has led to stronger adoption of medical gas solutions, particularly in community health centers and rural clinics where oxygen access was previously limited, thereby driving the growth.

Segmental Insights

Gas Type Category Analysis

The segmentation, based on gas type, includes medical oxygen, helium, nitrous oxide, carbon dioxide, nitrogen, and others. In 2024, the medical oxygen segment dominated with the largest share due to a high number of respiratory illness cases and rising hospital admissions. Countries such as Indonesia, Vietnam, and the Philippines have seen increased demand for oxygen therapy, especially after the COVID-19 pandemic highlighted oxygen shortages. Government efforts to improve oxygen supply in rural and underdeveloped regions have led to a surge in installations of oxygen generation plants. Additionally, public and private hospitals are investing in centralized oxygen systems to ensure uninterrupted critical care, further driving the segment growth.

Equipment Type Analysis

The segmentation, based on equipment type, includes respiratory devices, gas delivery systems, gas storage and transport, gas monitoring systems, and others. The gas delivery systems segment accounted for significant growth due to the region’s growing number of hospitals and clinics aiming to modernize infrastructure. There is a strong focus on installing centralized gas pipelines, automated control systems, and alarm monitors for enhanced safety and efficiency as healthcare facilities expand. In urban areas such as Bangkok, Kuala Lumpur, and Jakarta, new hospitals are prioritizing advanced delivery solutions to reduce manual handling and improve patient outcomes. The increasing awareness of safety regulations and the push for international healthcare standards in the region are further encouraging the adoption of reliable gas distribution systems, thereby driving the segment growth.

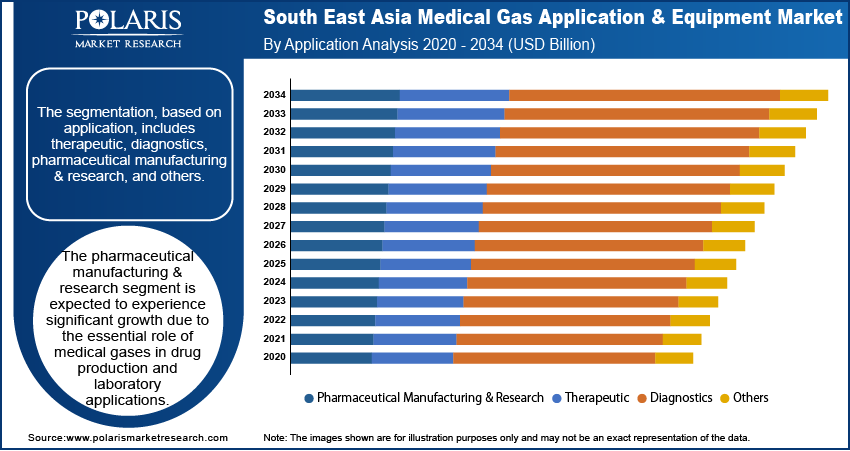

Application Analysis

The segmentation, based on application, includes therapeutic, diagnostics, pharmaceutical manufacturing & research, and others. The pharmaceutical manufacturing & research segment is expected to experience significant growth during 2025–2034. The growth is driven by expanding drug production in countries such as Malaysia, Singapore, and Thailand. Medical gases are essential in sterile manufacturing, drug preservation, and lab research, making them a vital part of the pharmaceutical supply chain. Governments are supporting local production of medicines and vaccines to reduce reliance on imports. This growth in pharma infrastructure boosts demand for high-purity gases such as nitrogen and carbon dioxide, along with specialized gas delivery equipment used in labs and cleanroom environments across the region.

End User Analysis

The segmentation, based on end user, includes hospitals, clinics, ambulatory surgical centers, home healthcare, academic & research institutions, pharmaceutical & biotechnology companies, and others. The hospitals segment dominated with the largest share driven by the rapid construction of new hospitals and the expansion of existing ones in countries such as Indonesia, Vietnam, and the Philippines. The rising number of hospitals has significantly increased the demand for centralized gas systems. These facilities rely heavily on medical oxygen, nitrous oxide, and vacuum systems for surgeries, intensive care, and emergency response. Hospitals are increasingly investing in automated gas control systems and safety-compliant infrastructure with a growing patient population and efforts to meet international accreditation standards, thereby fueling the segment growth.

Regional Analysis

India Medical Gas Application & Equipment Market Trends

India dominated the industry with the largest share in 2024, driven by its large healthcare infrastructure, rising patient volumes, and increasing awareness of critical care needs. The COVID-19 pandemic exposed gaps in oxygen supply, leading to major investments in oxygen plants, storage systems, and hospital pipeline upgrades across the country. Government initiatives such as PM-ABHIM and Ayushman Bharat are strengthening healthcare delivery in rural and semi-urban regions, boosting demand for reliable medical gas systems. Additionally, India’s growing pharmaceutical and biotechnology industries require high-purity gases for manufacturing and research. The rise in private hospitals and home healthcare is further fueling expansion.

Philippines Medical Gas Application & Equipment Market Insights

The industry in the Philippines is expected to witness significant growth during the forecast period, due to increasing investments in public and private healthcare infrastructure. The COVID-19 pandemic revealed gaps in oxygen supply, prompting government initiatives to expand oxygen production and distribution, especially in provincial hospitals. The rise in respiratory illnesses, coupled with growing awareness of the importance of safe gas delivery systems, has led to a surge in demand for medical oxygen and related equipment. Furthermore, the country’s shift toward universal healthcare is expanding access to treatment, driving demand for reliable gas systems across public hospitals and rural health units, thereby fueling the growth.

Vietnam Medical Gas Application & Equipment Market Analysis

The Vietnam industry is projected to witness substantial growth during the forecast period, driven by government-backed healthcare reforms and rising public investment in hospitals and clinics. The country’s focus on upgrading provincial and district-level healthcare facilities has created strong demand for centralized oxygen supply systems and gas management equipment. A growing elderly population and increased incidence of chronic respiratory conditions such as COPD have further accelerated the use of medical oxygen. Moreover, Vietnam's domestic medical gas production is expanding, improving access and affordability across regions. The growing pharmaceutical and diagnostic sectors further contribute to rising demand for high-purity gases and research-based equipment, thereby fueling the growth.

Malaysia Medical Gas Application & Equipment Market Overview

The Malaysia industry is projected to witness substantial growth during the forecast period, driven by a robust private healthcare sector and ongoing modernization of public hospitals. The demand for oxygen therapy and anesthesia devices has increased steadily with chronic diseases such as diabetes and cardiovascular conditions on the rise. Malaysia is further a regional hub for medical tourism, prompting hospitals to maintain high standards of care—including advanced gas delivery and monitoring systems. The government’s emphasis on digitizing healthcare services and improving rural health access is further boosting demand for portable and centralized gas solutions, thereby fueling the growth.

Key Players and Competitive Analysis

The Southeast Asia medical gas application and equipment market features a competitive mix of global and regional players, driving growth through innovation and strong distribution networks. Air Liquide leads with comprehensive healthcare solutions and a robust presence across the region, while Linde Malaysia (formerly MOX-Linde Gases) plays a key role in supplying medical gases across Malaysia’s healthcare infrastructure. INOX Air Products Pvt. Ltd, originally from India, has expanded into Southeast Asia, offering a broad range of gases with a customer-focused approach. Gas Malaysia Berhad supports the market mainly through its natural gas distribution infrastructure, aiding medical gas supply. Taiyo Nippon Sanso Corporation from Japan and China-based Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd. further enhance the market with advanced medical gas equipment and air separation units. Together, these companies contribute to the region’s evolving healthcare landscape by addressing the rising demand for reliable medical gas solutions.

Key Players

- Air Liquide

- Cryogenmash JSC

- Gas Malaysia Berhad

- INOX Air Products Pvt. Ltd

- Linde Malaysia (formerly MOX-Linde Gases)

- Linde Plc

- NovaAir Pvt. Ltd

- Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd.

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

South East Asia Medical Gas Application & Equipment Industry Developments

In May 2023, Luxfer Gas Cylinders introduced the G-Stor Go H2 Type 4 hydrogen cylinder, designed for high-pressure storage up to 350 bar. The lightweight, low-permeation solution targeted fuel cell transit, heavy-duty transport, and bulk hydrogen applications across South East Asia markets.

South East Asia Medical Gas Application & Equipment Market Segmentation

By Gas Type Outlook (Revenue, USD Billion, 2020–2034)

- Medical Oxygen

- Helium

- Nitrous Oxide

- Carbon Dioxide

- Nitrogen

- Others

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory Devices

- Gas Delivery Systems

- Gas Storage and Transport

- Gas Monitoring Systems

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Therapeutic

- Diagnostics

- Pharmaceutical Manufacturing & Research

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Singapore

- India

- Malaysia

- Thailand

- Philippines

- Rest of South East Asia

South East Asia Medical Gas Application & Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 19.90 Billion |

|

Market Size in 2025 |

USD 21.02 Billion |

|

Revenue Forecast by 2034 |

USD 34.89 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 19.90 billion in 2024 and is projected to grow to USD 34.89 billion by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

India dominated the market share in 2024.

A few of the key players in the market are Air Liquide, Cryogenmash JSC, Gas Malaysia Berhad, INOX Air Products Pvt. Ltd, Linde Malaysia (formerly MOX-Linde Gases), Linde Plc, NovaAir Pvt. Ltd, Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd., Taiyo Nippon Sanso Corporation, and Universal Industrial Gases, Inc.

The medical oxygen segment dominated the market share in 2024.

The pharmaceutical manufacturing & research segment is expected to witness the significant growth during the forecast period.