South Korea Anti-Aging Products Market Size, Share, Industry Analysis Report

By Product (Facial Cream & Lotion, Eye Cream & Lotion), By Distribution Channel, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6173

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

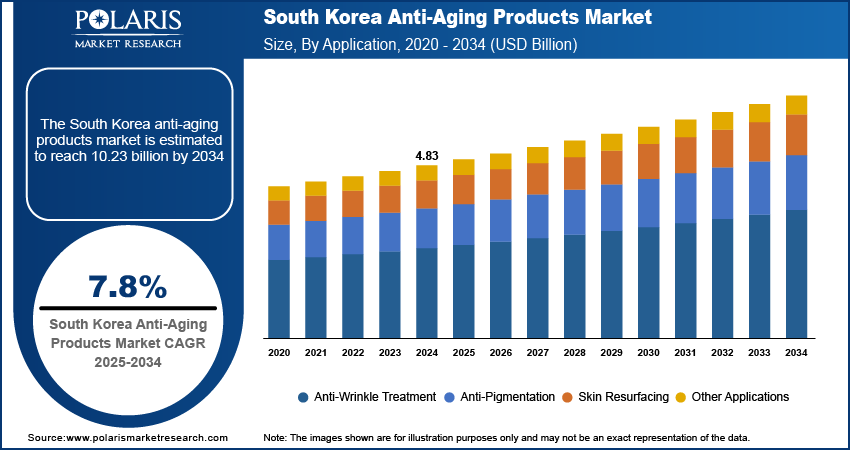

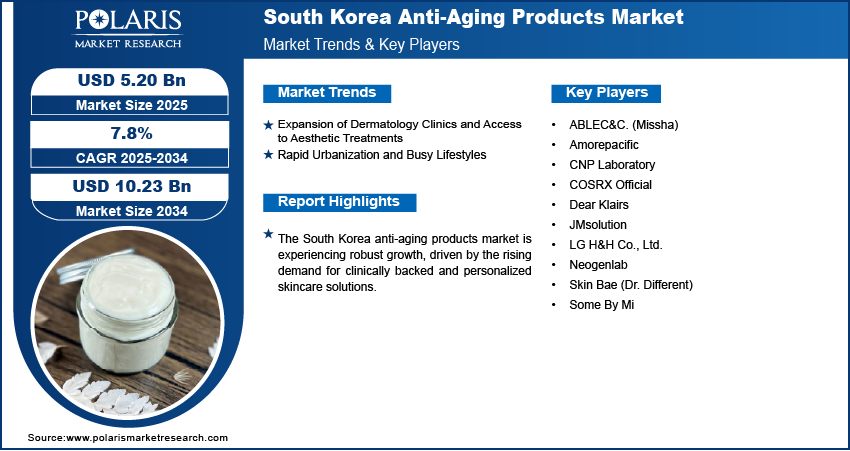

The South Korea anti-aging products market size was valued at USD 4.83 billion in 2024, growing at a CAGR of 7.8% from 2025 to 2034. The market is witnessing growth due to the country’s strong cultural focus on youthfulness and personal aesthetics, expansion of dermatology clinics, improved access to aesthetic treatments, and rapid urbanization and increasingly busy lifestyles.

Key Insights

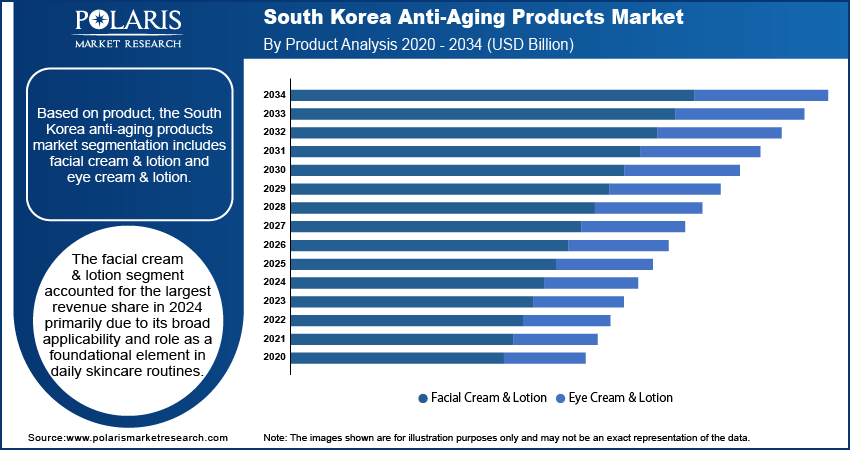

- The facial cream & lotion segment accounted for the largest revenue share in 2024, primarily due to its broad applicability and role as a foundational element in daily skincare routines.

- The anti-pigmentation segment is expected to witness the fastest growth during the forecast period, driven by rising concerns over uneven skin tone, sunspots, and post-inflammatory hyperpigmentation among South Korean consumers.

Industry Dynamics

- Rising dermatology clinic access boosts South Korea's anti-aging demand, as professional treatments and homecare recommendations fuel product adoption.

- Pollution and hectic urban living accelerate skin aging, driving demand for protective, time-efficient anti-aging solutions.

- Growing demand for K-beauty’s science-backed anti-aging solutions, such as fermented skincare and bio-retinol, creates export potential, especially in Western markets seeking proven efficacy.

- The rising imposition of stringent local regulations slows down approval for innovative anti-aging ingredients, limiting product differentiation and delaying launches compared to competitors.

Market Statistics

- 2024 Market Size: USD 4.83 billion

- 2034 Projected Market Size: USD 10.23 billion

- CAGR (2025–2034): 7.8%

To Understand More About this Research: Request a Free Sample Report

Anti-aging products are formulations designed to reduce or delay visible signs of aging, such as wrinkles, fine lines, and skin sagging, through preventive or corrective skincare. In South Korea, the market for anti-aging products is expanding, driven by the country’s strong cultural focus on youthfulness and personal aesthetics. This rising growth is attributed to the seamless integration of medical ingredients into everyday skincare routines. In June 2025, Innisfree introduced its Green Tea PDRN Serum, a vegan, noninvasive alternative to PDRN micro needling. The serum harnesses the regenerative properties of polydeoxyribonucleotide to combat wrinkles, uneven texture, and loss of elasticity, making collagen-boosting technology accessible to all. The integration of dermatological science with cosmetic innovation has led to the development of highly effective, clinically backed products, thereby boosting consumer trust and encouraging consistent use across all age groups.

Drivers & Opportunities

Expansion of Dermatology Clinics and Access to Aesthetic Treatments: The expansion of dermatology clinics and improved access to aesthetic treatments are driving the growth of the South Korean market. Consumers are increasingly exposed to professional skincare guidance and treatments that highlight the importance of routine maintenance using anti-aging products, with dermatological services becoming more widely available and affordable. In April 2025, Korea's Ministry of Health reported 1.17 million foreign medical tourists in 2024, a 93.2% surge from 610,000 tourists in 2023. This record growth highlights Korea's booming medical/aesthetic appeal. Clinics often recommend complementary home care regimens, leading to a higher adoption of advanced skin care products. This clinical endorsement enhances consumer confidence in product efficacy, encouraging consistent use and driving demand for targeted solutions that align with in-office treatments.

Rapid Urbanization and Busy Lifestyles: Rapid urbanization and increasingly busy lifestyles are also influencing consumer behavior toward anti-aging skincare in South Korea. Urban citizens face increased exposure to pollution, stress, and irregular schedules, all of which can accelerate skin aging. According to the 2024 Environmental Performance Index report, South Korea ranked 36th in air pollution, with a score of 87.3. These factors have created a strong demand for convenient, multi-functional anti-aging products that address multiple concerns efficiently. Brands are responding with innovative formulations that combine hydration, protection, and rejuvenation as consumers aim for quick and effective skincare routines to combat environmental pollution. This alignment with the fast-paced urban lifestyle continues to support the growth trajectory.

Segmental Insights

Product Analysis

Based on product, the South Korea anti-aging market segmentation includes facial cream & lotion and eye cream & lotion. The facial cream & lotion segment accounted for a larger revenue share in 2024, primarily due to its broad applicability and role as a foundational element in daily skincare routines. Consumers widely adopt these products for their ability to deliver hydration, improve skin texture, and support a youthful appearance across all age groups. Facial creams and lotions offer multifunctional benefits that serve to both preventive and corrective care, with enhanced formulations now incorporating anti-aging actives such as collagen peptides, retinoids, and antioxidants. Their versatility in addressing multiple skin concerns, ranging from dryness and dullness to early signs of aging, makes them an essential product category. Moreover, their compatibility with diverse skin types and seamless integration into morning and evening skincare regimens contribute to sustained consumer demand and category dominance.

Application Outlook

The segmentation, based on application, includes anti-wrinkle treatment, anti-pigmentation, skin resurfacing, UV protection & repair, hydration & barrier repair, collagen stimulation, elasticity improvement, and dark circle reduction (Under-Eye Treatments). The anti-pigmentation segment is expected to witness the fastest growth during the forecast period, driven by rising concerns over uneven skin tone, sunspots, and post-inflammatory hyperpigmentation among South Korean consumers. Consumers are actively seeking solutions that deliver visible results in correcting discoloration and enhancing skin radiance, as skin clarity and brightness are major aspects of aesthetic ideals in South Korea. The increasing awareness of pigmentation as both an age-related and environmental skin concern is driving a shift toward targeted treatments and using sun care cosmetics that offer precision and efficacy. Additionally, advanced ingredients, such as niacinamide, tranexamic acid, and alpha-arbutin, are gaining traction in product formulations aimed at reducing melanin production and enhancing overall complexion.

Key Players & Competitive Analysis

South Korea’s anti-aging industry thrives on revenue growth opportunities fueled by emerging market segments such as bio-fermented ingredients and personalized skincare. Leaders such as Amorepacific and LG Household & Health Care leverage competitive intelligence and strategy, blending advanced biotech with K-beauty’s signature innovation. Strategic investments in vegan collagen highlight a shift toward sustainable value chains, while small and medium-sized businesses such as COSRX disrupt with affordable, science-backed serums. Economic and geopolitical shifts, such as China’s tightening import regulations, push brands to adopt future development strategies focused on clinical validation. Expansion opportunities lie in Western markets, where latent demand and opportunities for K-beauty’s “pre-aging” solutions remain high.

A few major companies operating in the South Korea anti-aging products market include ABLEC&C. (Missha); Amorepacific; CNP Laboratory; COSRX Official; Dear Klairs; JMsolution; LG H&H Co., Ltd.; Neogenlab; Skin Bae (Dr. Different); and Some By Mi.

Key Players

- ABLEC&C. (Missha)

- Amorepacific

- CNP Laboratory

- COSRX Official

- Dear Klairs

- JMsolution

- LG H&H Co., Ltd.

- Neogenlab

- Skin Bae (Dr. Different)

- Some By Mi

South Korea Anti-Aging Products Industry Developments

- April 2025, Bertis (proteomics experts) partnered with COSMAX to co-develop precision skincare. The collaboration focuses on skin biomarker research, ingredient innovation, and commercializing proteomics-based anti-aging solutions through joint R&D and production.

South Korea Anti-Aging Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Facial Cream & Lotion

- Eye Cream & Lotion

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hypermarket & Supermarket

- Specialty Store

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Anti-Wrinkle Treatment

- Anti-Pigmentation

- Skin Resurfacing

- Other Applications

South Korea Anti-Aging Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.83 Billion |

|

Market Size in 2025 |

USD 5.20 Billion |

|

Revenue Forecast by 2034 |

USD 10.23 Billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.83 billion in 2024 and is projected to grow to USD 10.23 billion by 2034.

The market is projected to register a CAGR of 7.8% during the forecast period.

A few of the key players in the market are ABLEC&C. (Missha); Amorepacific; CNP Laboratory; COSRX Official; Dear Klairs; JMsolution; LG H&H Co., Ltd.; Neogenlab; Skin Bae (Dr. Different); and Some By Mi.

The facial cream & lotion segment accounted for the largest revenue share in 2024.

The anti-pigmentation segment is expected to witness fastest growth during the forecast period.