Sun Care Cosmetics Market Size, Share, Trends, Industry Analysis Report

By Product (Tinted Moisturizers, SPF Foundation, SPF BB Creams), By Type, By Distribution Channel, By Form, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM3234

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

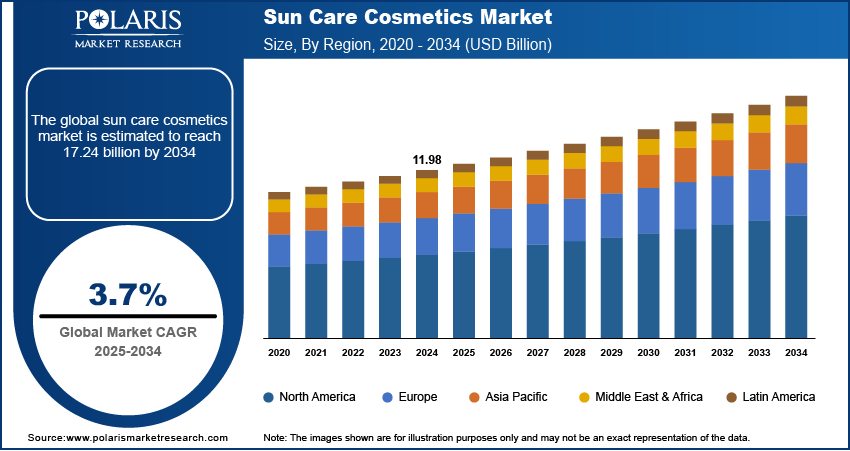

The global sun care cosmetics market size was valued at USD 11.98 billion in 2024 and is expected to register a CAGR of 3.7% from 2025 to 2034. Growing consumer awareness regarding the long-term effects of sun exposure drives the adoption of sun care solutions. The expanding tourism industry, due to rising disposable income, reinforces the demand for sun care cosmetics as travelers prioritize skin protection during leisure and business trips.

Key Insights

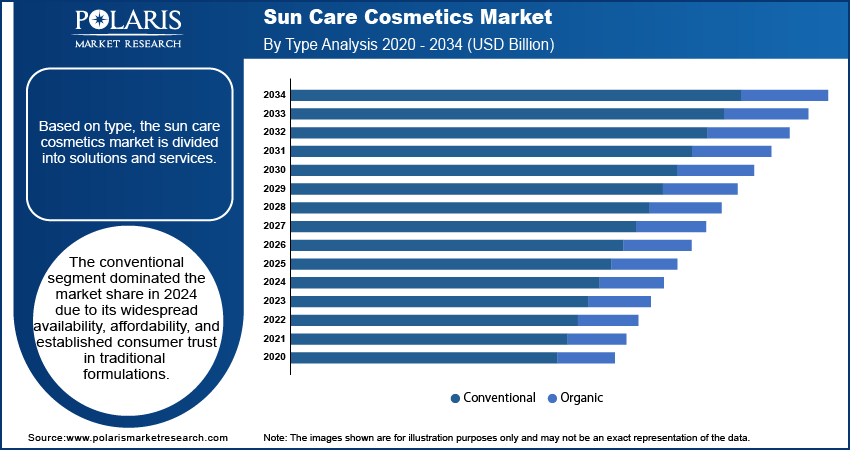

- The conventional segment dominated the sun care cosmetics market share in 2024. It is due to its affordability and established consumer trust in traditional formulations.

- The SPF sunscreen segment is expected to witness the fastest growth during the forecast period. The growth is driven by increasing consumer awareness regarding the harmful effects of UV radiation.

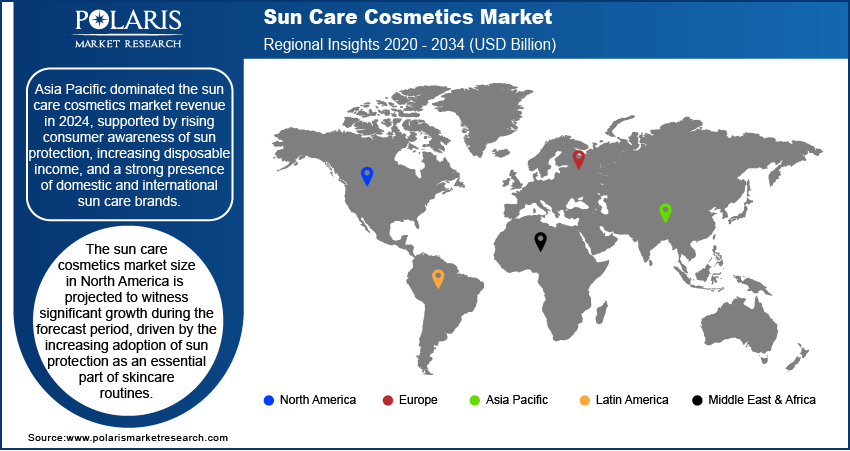

- Asia Pacific dominated the global revenue share in 2024. The growth is supported by rising consumer awareness of sun protection and a strong presence of domestic and international sun care brands.

- The North America sun care cosmetics industry is projected to witness significant growth during the forecast period. The expanding availability of sun care cosmetics through online and offline retail channels is expected to propel industry growth across North America.

Industry Dynamics

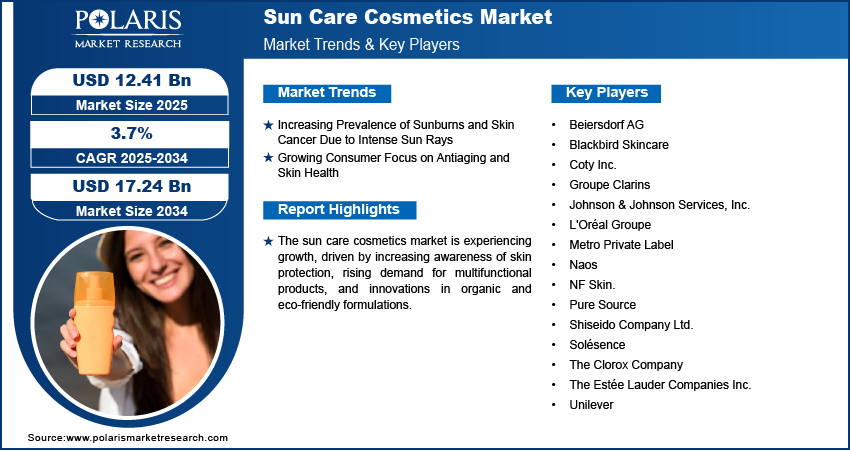

- Increasing prevalence of sunburns, skin cancer, and other skin conditions, due to intense sun rays, drives the demand for sun care cosmetics.

- Growing consumer focus on antiaging and skin health propels the demand for cosmetics, including sun care cosmetic products.

- Seasonal product requirements act as a restraint for the sun care cosmetics market expansion.

- The rising focus on developing mineral-based and biodegradable formulations is expected to offer opportunities in the coming years.

Market Statistics

2024 Market Size: USD 11.98 billion

2034 Projected Market Size: USD 17.24 billion

CAGR (2025–2034): 3.7%

Asia Pacific: Largest market in 2024

AI Impact on Sun Care Cosmetics Market

- Artificial intelligence is used in the development of sun care products to customize SPF levels, ingredients, and textures according to environmental factors and individual skin needs.

- AI tools recommend or formulate optimal sun protection products by analyzing skin sensitivity, tone, and UV exposure.

- AI-enabled skin diagnostics tools use computer vision to assess skin conditions and recommend sun care practices.

- Chatbots and virtual assistants help consumers select suitable products based on skin type, location, and lifestyle.

To Understand More About this Research: Request a Free Sample Report

Sun care cosmetics are skincare products designed to protect against harmful UV radiation, preventing sunburn, premature aging, and skin damage. The sun care cosmetics market demand is growing steadily, driven by the rising popularity of outdoor recreational activities and increasing global tourism. A report by the UNWTO in 2024 stated that approximately 1.4 billion international tourists (overnight visitors) were recorded globally in 2024, marking an 11% increase from 2023, which correlates to 140 million more visitors. This surge in global travel and outdoor engagement underscores the market expansion for innovative sun protection cosmetic products that combine aesthetic appeal with comprehensive skin health benefits.

Another major driver shaping the sun care cosmetics market growth is the innovation in natural and reef-safe formulations. Consumers are increasingly seeking sun protection solutions that align with environmental sustainability and skin-friendly ingredients, leading to the development of mineral-based and biodegradable formulations. Regulatory pressures and concerns over chemical sunscreen ingredients harming marine ecosystems have accelerated the shift toward reef-safe products, particularly in coastal tourism hotspots. Brands are responding to this demand by introducing formulations free from oxybenzone and octinoxate while incorporating antioxidants and plant-based ingredients for enhanced skin benefits. For instance, in March 2024, 4ocean collaborated with Stream2Sea to launch a Reef-Safe Sunscreen Balm, featuring EcoSafe Zinc that surpasses US and EU reef protection standards, ensuring safety for both humans and the environment. The convergence of sustainability, health consciousness, and product innovation is expected to further propel the sun care cosmetics market evolution, catering to both environmentally conscious consumers and regulatory compliance requirements.

Market Dynamics

Increasing Prevalence of Sunburns and Skin Cancer Due to Intense Sun Rays

Rising global temperatures and depletion of the ozone layer have intensified UV radiation, leading to a higher prevalence of sunburns and skin-related disorders. Consumers are increasingly prioritizing sun protection as part of their daily skincare routine with growing public awareness of the harmful effects of UV exposure, such as premature aging and skin cancer. A report by the WCRF in 2024 stated that there were 331,722 melanoma (type of cancer caused by the exposure to ultraviolet light from the sun and sunbeds) cases worldwide in 2022. Dermatologists and healthcare organizations are actively advocating the use of sunscreens, further driving the demand for advanced sun care formulations. This heightened awareness, combined with preventive healthcare initiatives, continues to boost sun care cosmetics market growth as consumers seek effective and broad-spectrum sun protection solutions.

Growing Consumer Focus on Antiaging and Skin Health

Long exposure to UV radiation accelerates antiaging, leading to wrinkles, fine lines, and hyperpigmentation, prompting consumers to integrate sun care products into their daily skincare routines. Dermatological research highlighting the link between sun damage and premature aging has further reinforced the demand for broad-spectrum sunscreens with added skincare benefits. Formulations enriched with antioxidants, hydration-boosting ingredients, and anti-inflammatory compounds are gaining popularity, catering to consumers seeking multi-functional sun care solutions. Additionally, the rising preference for preventive skincare rather than corrective treatments has driven product innovation, with brands developing lightweight, non-greasy formulations suitable for everyday use. For instance, in September 2023, BASF launched TinomaxTM CC, a new sunscreen ingredient offering enhanced UV protection, improved sensory experience, and sustainability benefits for cosmetic formulators. This growing emphasis on long-term skin health is expected to sustain sun care cosmetics market expansion, as consumers prioritize high-performance sun care products that offer both protection and skincare benefits.

Segment Insights

Market Assessment by Type Outlook

The global sun care cosmetics market segmentation, based on type, includes conventional and organic. The conventional segment dominated the sun care cosmetics market share in 2024 due to its widespread availability, affordability, and established consumer trust in traditional formulations. Conventional sun care products, such as chemical-based sunscreens and lotions, have long been the preferred choice due to their proven efficacy in providing broad-spectrum UV protection. These formulations often offer enhanced water resistance, lightweight textures, and superior absorption, catering to diverse consumer preferences. Additionally, the extensive presence of conventional sun care brands in retail and e-commerce channels has reinforced sun care cosmetics market economic landscape. The established market position, cost-effectiveness, and continued advancements in conventional sun care formulations have sustained their dominance while the demand for organic alternatives is rising.

Market Evaluation by Product Outlook

The global sun care cosmetics market segmentation, based on product, includes tinted moisturizers, SPF foundation, SPF BB creams, SPF primers, SPF spray, SPF lotion, SPF sunscreen, and others. The SPF sunscreen segment is expected to witness the fastest growth during the forecast period, driven by increasing consumer awareness regarding the harmful effects of UV radiation and the necessity of daily sun protection. SPF sunscreens offer a high degree of protection against UVA and UVB rays, making them a fundamental skincare product across all demographics. The rising preference for dermatologically tested, high-SPF formulations with additional skincare benefits, such as hydration and antioxidant protection, has further fueled their adoption. Moreover, the growing trend of multi-functional sunscreens, such as antiaging and skin-brightening properties, has strengthened the market expansion. Additionally, continuous product innovation, such as lightweight, non-greasy, and water-resistant formulations, is expected to sustain the strong demand for SPF sunscreens.

Regional Analysis

By region, the report provides the sun care cosmetics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the sun care cosmetics market revenue in 2024, supported by rising consumer awareness of sun protection, increasing disposable income, and a strong presence of domestic and international sun care brands. Countries such as China, Japan, South Korea, and India have witnessed a surge in demand for sun care products, driven by growing skincare consciousness and cultural preferences for maintaining bright and even-toned skin. The increasing emphasis on sustainable and eco-friendly sun care solutions has driven innovation in the region, with brands focusing on reef-safe and biodegradable formulations. For instance, in March 2024, BASF collaborated with Meifubao to launch China’s first ocean-friendly sunscreen, certified by BASF’s EcoSun Pass. The lotion uses eco-friendly UV filters, offering effective sun protection while reducing environmental impact, aligning with growing consumer demand for sustainable skincare solutions. Additionally, the region’s high UV index, coupled with the increasing influence of K-beauty and J-beauty skincare trends, has driven the adoption of advanced sun care formulations. The expanding e-commerce sector and strategic marketing efforts by leading brands have further accelerated market penetration, solidifying Asia Pacific’s dominant position in the global sun care cosmetics industry.

The North America sun care cosmetics market is projected to witness significant growth during the forecast period, driven by the increasing adoption of sun protection as an essential part of skincare routines. Rising awareness of the risks associated with prolonged sun exposure, such as skin cancer and premature aging, has led to higher consumer demand for high-SPF, broad-spectrum sun care products. The presence of major skincare and dermatology brands investing in innovative formulations, such as mineral-based, reef-safe, and tinted sunscreens, has further fueled the market expansion. Additionally, shifting consumer preferences toward clean beauty and dermatologist-recommended products have contributed to the demand for premium sun care products. The expanding availability of sun care cosmetics through online and offline retail channels is expected to sustain market growth across North America.

List of Key Companies

- Beiersdorf AG

- Blackbird Skincare

- Coty Inc.

- Groupe Clarins

- Johnson & Johnson Services, Inc.

- L'Oréal Groupe

- Metro Private Label

- Naos

- NF Skin.

- Pure Source

- Shiseido Company Ltd.

- Solésence

- The Clorox Company

- The Estée Lauder Companies Inc.

- Unilever

Key Players & Competitive Analysis Report

The competitive landscape comprises global leaders and regional players aiming to capture sun care cosmetics market share through innovation, strategic partnerships, and regional expansion. Global brands such as L’Oréal, Beiersdorf, Shiseido, and Johnson & Johnson leverage strong R&D capabilities and extensive distribution networks to introduce advanced sun protection formulations, such as mineral-based sunscreens, hybrid skincare-sun care solutions, and eco-friendly UV filters. Sun care cosmetics market trends highlight a rising demand for reef-safe, organic, and multi-functional sun care products, reflecting growing consumer awareness of skin health and environmental sustainability. The sun care cosmetics market is projected to grow significantly, fueled by increasing concerns over UV exposure, skin aging, and regulatory support for safer formulations. Regional players capitalize on localized consumer preferences by offering affordable, dermatologist-recommended, and region-specific products, particularly in Asia Pacific, which is expected to witness the fastest growth. Sun care cosmetics market competitive strategies include mergers and acquisitions, collaborations with dermatologists and skincare experts, and the development of innovative sun care solutions that align with evolving beauty and skincare trends. These factors emphasize the role of technological advancements, sustainability-driven innovations, and targeted marketing strategies in driving the expansion of the sun care cosmetics industry. A few key major players are Beiersdorf AG; Blackbird Skincare; Coty Inc.; Groupe Clarins; Johnson & Johnson Services, Inc.; L'Oréal Groupe; Metro Private Label; Naos; NF Skin; Pure Source; Shiseido Company Ltd.; Solésence; The Clorox Company; The Estée Lauder Companies Inc.; and Unilever.

Unilever PLC is a British multinational fast-moving consumer goods (FMCG) company established on September 2, 1929, through the merger of British soap maker Lever Brothers and Dutch margarine producer Margarine Unie. Unilever has a global presence, selling its products in over 190 countries with headquarters in London, England. The company owns more than 400 brands, including food, personal care, and cleaning products. Unilever is a manufacturer and supplier of fast-moving consumer goods. Its products include baby food, beauty products, bottled water, cleaning agents, and personal care items. The company is organized into five business groups: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. Unilever has been a pioneer, innovator, and future-maker for over 130 years. The company has a global purpose and aims to enhance people’s lives with its products. Unilever PLC offers a diverse range of sun care cosmetics, including sunscreen lotions, sprays, and after-sun products for skin protection.

Johnson & Johnson (J&J) is an American multinational corporation focused on pharmaceuticals, biotechnology, and medical technologies. Headquartered in New Brunswick, New Jersey, the company researches, develops, manufactures, and sells a broad range of healthcare products. J&J was founded in 1886. The company's business is divided into two sectors: Innovative Medicine and MedTech. Innovative Medicine focuses on immunology, infectious diseases, neuroscience, oncology, and cardiovascular and metabolic diseases. MedTech provides solutions to doctors, patients, and nurses with its high-technology medical and surgical equipment, devices, and services. Johnson & Johnson Services Inc. offers consumer healthcare products, including those in the areas of baby care, beauty, and facial skincare. Johnson & Johnson Vision Care is committed to transforming the world's vision. The company distributes its pharmaceutical and medical products to retailers, wholesalers, healthcare professionals, and hospitals across the US, Europe, Asia Pacific, Africa, and the Western Hemisphere. Johnson & Johnson (J&J) offers sun care cosmetics, including sunscreens and UV protection products, ensuring skin safety and enhanced skincare benefits.

Sun Care Cosmetics Industry Developments

December 2024: Kao Corporation developed a new sunscreen formulation technology that provides strong UV protection without UV absorbers, white cast, or heavy texture. This innovation utilizes a unique capsule-stabilized dispersion of UV-scattering agents like titanium oxide.

Sun Care Cosmetics Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Tinted Moisturizers

- SPF Foundation

- SPF BB Creams

- SPF Primers

- SPF Spray

- SPF Lotion

- SPF Sunscreen

- Others

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Conventional

- Organic

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets/Hypermarkets

- Online

- Specialty Stores

- Others

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Lotion

- Spray

- Stick

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sun Care Cosmetics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.98 billion |

|

Market Size Value in 2025 |

USD 12.41 billion |

|

Revenue Forecast by 2034 |

USD 17.24 billion |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.98 billion in 2024 and is projected to grow to USD 17.24 billion by 2034.

The global market is projected to register a CAGR of 3.7% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Beiersdorf AG; Blackbird Skincare; Coty Inc.; Groupe Clarins; Johnson & Johnson Services, Inc.; L'Oréal Groupe; Metro Private Label; Naos; NF Skin; Pure Source; Shiseido Company Ltd.; Solésence; The Clorox Company; The Estée Lauder Companies Inc.; and Unilever.

The conventional segment dominated the market share in 2024.