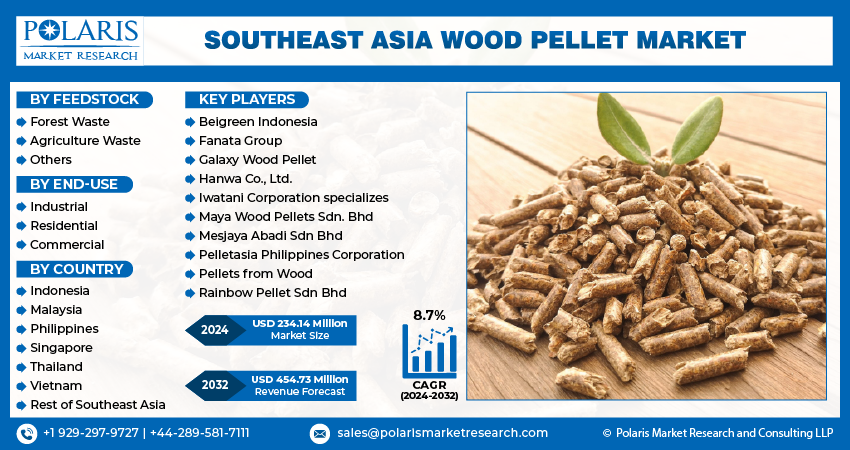

Southeast Asia Wood Pellet Market Share, Size, Trends, Industry Analysis Report

By Feedstock (Forest Waste, Agriculture Waste, Others); By End-Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4948

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Southeast Asia wood pellet market size was valued at USD 217.30 million in 2023. The market is anticipated to grow from USD 234.14 million in 2024 to USD 454.73 million by 2032, exhibiting the CAGR of 8.7% during the forecast period.

Industry Trends

Wood pellet is form of dried biomass mainly constituting of wood as a raw material. The finely powdered form of wood is treated with high temperature and pressure under a pellet dye to produce wood pellets. During the process of compression, the lignin content in the wood fuses with the particles to re-form as a solid pellet. The wood pellet market has gained significant popularity in the recent years due to its sustainability and as an alternative to traditional fossil fuels. Moreover, the growing interest of sectors such as industrial, residential, and commercial to employ better alternative of fossil fuels to generate electricity and for other industrial applications is driving the demand for wood pellets.

To Understand More About this Research:Request a Free Sample Report

Additionally, wood pellets are in greater demand among the power generation plants owing to its direct utilization in co-firing plants. Since, most of the energy generating plants are still running on coal as a raw material, utilization of wood pellet helps in reducing the emission of greenhouse gases and minimizes the environmental impact. Moreover, owing to its high calorific value and heat efficiency, wood pellets play an import role as a fuel in combination with coal, thus providing a better heat energy for applications including heat and power generation.

In addition, wood pellets contain naturally occurring self-bonding adhesive, known as lignin. The lignin content in the wood helps it to bind the particles and provide additional strength coupled with waterproofing properties. Owing to the properties such as low moisture content, which ranges from 3.5%-5.5%, coupled with other values such as lower ash content of 0.2%-0.5%, the calorific value of 8800 Btu/lb, and bulk density of 600-750kg/m promotes it as a better renewable source of energy in comparison to wood chip and varies other types of biomass pellets.

Key Takeaways

- Malaysia dominated the market and contributed over 22% of the market share in 2023

- By feedstock category, the forest waste segment accounted for the largest Southeast Asia wood pellet market share in 2023

- By end-use category, the residential segment is anticipated to grow with a lucrative CAGR over the Southeast Asia wood pellet market forecast period

What are the Market Drivers Driving the Demand for the Market?

Increase in the Popularity of Wood Pellets as an Energy Carrier

Wood pellet is considered an important renewable energy biomass energy carrier owing to their higher efficiency and calorific values. The key attributing factors promoting the growth of wood pellets include rising environmental concerns and efforts being taken by countries to proceed with decarbonization. Owing to the rising greenhouse gas (GHG) emissions from burning fossil fuels such as coal, natural gas, and petroleum products has become an important concern for the countries contributing to global warming.

Moreover, biomass-based fuels such as wood pellets, palm kernel shells, and wood chips, among others, are increasingly gaining popularity in developed and developing nations due to their energy efficiency and as the best source of renewable energy. Wood as biomass, thus can directly contribute to the decreased emission of carbon from power and heat sectors. Moreover, owing to its advantages such as high energy density, low moisture content, easy handling, and durability is promoting its market growth in the region of Southeast Asia. Further, biomass fuels such as wood pellets are more social and economic in nature, thus benefiting environmental protection and financial savings. In addition, the growing motive to decrease the rate of greenhouse gases such as CO2 and NOx is further boosting the demand for wood pellets.

Which Factor is Restraining the Demand for Market?

High Cost Involved in the Production of Wood Pellet

The cost of production of wood pellets varies depending on varied factors such as raw material cost, operational cost, cost of transportation, and warehousing cost, among others. Considering the external costs such as extraction of raw material, cultivation, and operational costs involved tends to raise the cost of wood pellets. In addition, most of the production mills and plants producing wood pellets operate on electricity, which is generated by the combustion of fossil fuels. Moreover, the cost of production also involves transportation costs that include agricultural product transportation and raw material transportation, among others.

Furthermore, fluctuating raw material prices of wood and wood residues in different regions also influence the pricing of the final product. Further, the costs associated with setting up infrastructure such as mills, conveyor belts, and silos, among others, greatly influence the price of wood pellets.

Report Segmentation

The market is primarily segmented based on feedstock, end-use, and country.

|

By Feedstock |

By End-Use |

By Country |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Feedstock Insights

Based on feedstock category analysis, the market has been segmented on the basis of forest waste, agriculture waste, and others. The forest waste segment dominated Southeast Asia's wood pellet market in 2023. Forest waste, commonly known as forest biomass, consists of residues generated from organic materials such as bark, twigs, branches, and wood chips, among others. The Southeast Asian region is mainly consisting of trees such as teak, maples, oak, and magnolias. Forests within the region are mainly generating a wide range of forest wastes due to traditional and modern activities that include thinning, logging, tree trimming, and composting, among others.

Moreover, residues generated from forest wastes also include woodworking processes that include sawdust, and wood chips, among others. In addition, activities such as tree trimmings and pruning also generate residues that are collectively known as forest waste. Owing to the growing requirement for renewable sources of energy to lower the carbon footprint is driving the demand for forest waste in the manufacturing of wood pellets.

By End-Use Insights

Based on end-use category analysis, the market has been segmented on the basis of industrial, residential, and commercial. The residential segment is poised for significant growth over the forecast period in Southeast Asia's wood pellet market since appliances such as boilers, stoves, and furnaces are largely in use by residents for applications such as cooking and heating solutions, among others. Houses placed in low-temperature environments are dependent on heating systems to keep the homes and spaces heated for survival. Therefore, heating appliances such as boilers and stoves provide convenient and efficient heating solutions to the home.

Moreover, for cooking applications such as grills and barbeques, wood pellets have gained popularity among the population due to their affordability and generation of less heat and smoke. Further, appliances such as pellet fireplaces have replaced traditional wood-burning fireplaces to offer clean combustion and convenient operations in modern homes.

Country-wise Insights

Malaysia

Malaysia led the wood pellet market in Southeast Asia owing to the several factors, including the establishment of wood pellet plant production facilities by companies from various countries. With growing concerns about climate change and environmental sustainability, there is a rising demand for renewable energy sources worldwide. Wood pellets are recognized as a clean and sustainable alternative to fossil fuels for power generation and heating. As a result, the demand for wood pellets in Malaysia is on the rise, driving the need for increased production capacity.

One of the Malaysia customers enlisted ABC Machinery to establish their first pilot wood pellet plant, utilizing 100% sawdust as raw feed. Its comprehensive solutions and expertise in successful wood pellet plant projects in Malaysia contribute to driving the market forward, further bolstering Malaysia's position as a key player in the global wood pellet industry.

Indonesia

Indonesia is rich in forestry resources, with vast areas of forested land. This provides ample raw materials for wood pellet production, including wood residues, sawdust, and biomass from forestry and agricultural activities. With increasing awareness of environmental issues and the need to reduce reliance on fossil fuels, there is a rising demand for renewable energy sources worldwide. Wood pellets are considered a sustainable alternative to coal and other fossil fuels for power generation and heating purposes.

Competitive Landscape

The Southeast Asia (SEA) wood pellet market is highly competitive, with key players such as Pellets from Wood, Galaxy Wood Pellet, Hanwa Co., Ltd., Beigreen Indonesia, Fanata Group, and Mesjaya Abadi Sdn Bhd dominating the industry. These companies have substantial customer bases and robust distribution networks, giving them a competitive edge in terms of market reach and penetration. Intense competition drives players to vie for market share through continuous technological advancements, strategic partnerships, and a focus on innovation. To meet industry demands and maintain high-quality standards, companies are actively investing in research and development.

Some of the major players operating in the Southeast Asian market include:

- Beigreen Indonesia

- Fanata Group

- Galaxy Wood Pellet

- Hanwa Co., Ltd.

- Iwatani Corporation specializes

- Maya Wood Pellets Sdn. Bhd

- Mesjaya Abadi Sdn Bhd

- Pelletasia Philippines Corporation

- Pellets from Wood

- Rainbow Pellet Sdn Bhd

Recent Developments

- In December 2023, PT Malinau Hijau Nusantara, secured a USD 51.2 million loan from PT Bank OCBC NISP Tbk to fund the construction of a wood pellet production facility in Malinau, North Kalimantan, aligning with MBAP's diversification plan into new and renewable energy.

- In March 2023, Blackwood Technology B.V. was selected as a torrefaction technology partner for the first commercial black pellet plant in Thailand. Blackwood has signed a contract with TTCL Public Company Ltd for the supply of a 10-ton-per-hour FlashTor torrefaction system for this new torrefaction plant in the Thai province of Lampang.

- In September 2020, Ratch Group Public Co., Ltd. initiated the development of a wood pellet production and distribution project in Lao PDR with the goal of achieving an annual capacity of 60,000 tons per year.

Report Coverage

The Southeast Asia wood pellet market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, feedstock, end-use, and their futuristic growth opportunities.

Southeast Asia Wood Pellet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 234.14 million |

|

Revenue forecast in 2032 |

USD 454.73 million |

|

CAGR |

8.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2024 to 2032 |

|

Segments covered |

By Feedstock, By End-Use, By Country |

|

Country scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Southeast Asia |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Southeast Asia Wood Pellet Market report covering key segments are feedstock, end-use, and country

Southeast Asia Wood Pellet Market Size Worth USD 454.73 Million by 2032.

Southeast Asia wood pellet market exhibiting the CAGR of 8.7% during the forecast period.

The key driving factors in Southeast Asia Wood Pellet Market are Increase in the popularity of wood pellets as an energy carrier