Soy Grits Market Share, Size, Trends, Industry Analysis Report

By Type (Roasted, Non-roasted); By Grain Size; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4165

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

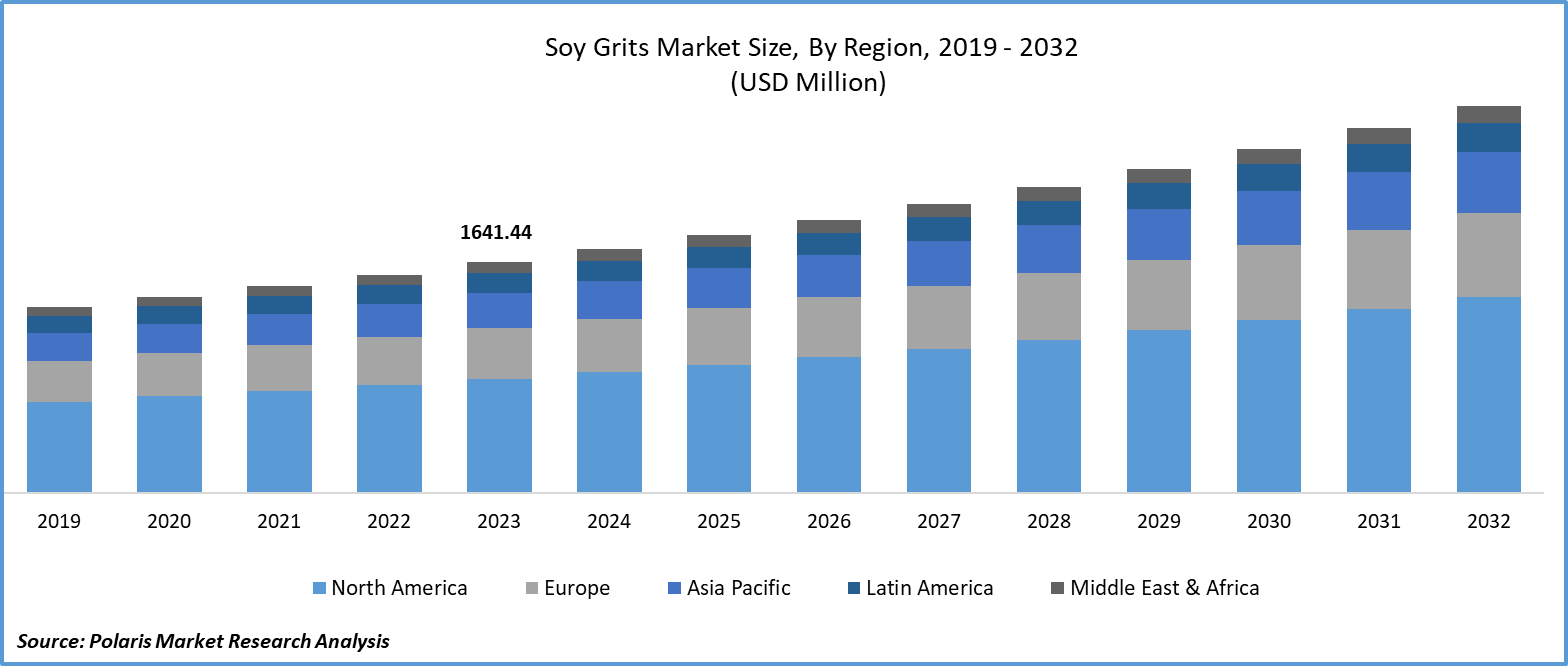

The global soy grits market was valued at USD 1641.44 million in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period.

Soy grits are widely used in the making of pasta, soups, bakery products, gravies, and the fortification of cereals and sweet products. Furthermore, it is highly incorporated in the production of soy products, such as soy nuggets, tofu, soybean powder, soy milk, and more. Moreover, the rising cases of malnutrition among people in some regions are increasing the production and sales of soy-based proteins, including soy grits. According to a study, 43% of the children in Nepal are facing health issues due to protein and energy malnutrition. This is enforcing government agencies to formulate suitable food reforms to address rising health problems. The growing emphasis on innovation and effective technology to extract soy protein is positively affecting the growth of soy grits, as it will likely enhance the supply of soy protein products, including soy grits, in the coming years.

To Understand More About this Research: Request a Free Sample Report

- For instance, in June 2022, a study published in Authorea focused on reviewing the advancements in the extraction of soy protein technology, such as reverse micellar, enzyme-assisted, and membrane ultrafiltration.

Moreover, soy grits are used in the formulations of baby foods and drink mixes. Meanwhile, it is incorporated into diabetic foods, driven by its higher nutritional profile and cost-effectiveness compared to the other alternatives. These factors are likely to impact the growth of the global market in the next few years.

However, lower awareness about soy grits, the presence of larger substitutes, including wheat and rice protein, and unstable soybean prices are influencing the global market, which is likely to hinder the adoption of soy grits among consumers and food manufacturers.

Growth Drivers

- Rising demand for plant-based proteins is driving demand for soy grits

There is a growing awareness about the importance of consuming healthy snacks and food, which is leading to an increased demand for soy grits. This demand is driven by the availability of information, which is made possible by the growing access to the internet across the globe. Additionally, the popularity of flexitarian and vegetarian diets is resulting in a greater demand for plant-based proteins, which is further fueling the growth of the soy grits market. Research has shown that sales of alternative meat and dairy products are projected to increase by 14% every year, reaching $125 billion by 2030. This trend is expected to contribute to the growth of the global market for soy grits in the near future. This indicates a continued need for plant-based proteins, including soy grits, during the study period.

Report Segmentation

The market is primarily segmented based on type, grain size, distribution channel and region.

|

By Type |

By Grain Size |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Roasted segment is expected to witness the highest growth during the forecast period

The roasted segment will grow rapidly due to the growing demand for savory & nutty tastes, which is fueling the expansion of the soy grits in the study period. The changing consumer preferences towards roasted flavor are influencing the growth and demand for soy grits. Furthermore, roasted soy grits are likely to retain their nutritional value, catering to consumers' need for protein-rich foods. These factors, together, are expected to contribute to the expansion of the market during the study period.

The non-roasted segment led the industry market with a substantial revenue share in 2023, largely attributable to its ability to offer neutral flavor. It is highly incorporated in food applications where soybean flavor is preferred. Furthermore, non-roasted soy grits are allergen-free compared to roasted soy grits, driving the demand for soy grits among people with allergies in the near future.

By Grain Size Analysis

- Coarse soy grits segment accounted for the largest market share in 2023

The coarse soy grits segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. These coarse soy grits are used in plant-based meat alternatives due to the similar texture of the meat, contributing to segmental growth.

The medium-sized segment is expected to grow at the fastest rate over the next few years on account of the appealing look of the baked food products. Medium-sized soy grits are used in the manufacturing of cookies, breads, crackers, and other baked goods due to their higher protein value and ability to improve taste and texture. This application is likely to enhance the demand for soy grits in snacks in the coming years.

By Distribution Channel Analysis

- Online retail stores segment held the significant market revenue share in 2022

The online retail stores segment held the largest share, due to the increased availability of products such as soy grits to the larger consumer base attributable to the establishment of e-commerce platforms. Furthermore, the growing adoption of smartphones is increasing access to the Internet, contributing to the rising use of online retailers. The increasing discounts offered by e-commerce portals will further boost the sales of healthy foods like soy grits in the coming years.

Regional Insights

- North America region registered the largest share in global market in 2022

The North American region held the global market with the largest market share in 2023 and is expected to continue its dominance over the study period. The growing demand for healthy food with a higher nutritional profile in the region is facilitating new growth opportunities for the market. According to the survey findings on U.S. soy, 70% of U.S. consumers prefer an intake of sufficient proteins, vitamins, minerals, and healthy fats as a top priority. Compared to the previous year, four-in-one consumers increased their consumption of soy-based protein.

Furthermore, food manufacturers are showing interest in incorporating these plant-based proteins into their offerings, driven by growing popularity and rising concerns about sustainable and healthy foods. This trend is expected to continue in the coming years, contributing to the growth of the global market soon. Moreover, the cost-effectiveness of soy protein in line with dairy products is boosting its demand in the marketplace.

The Asia Pacific region will grow at a rapid pace, owing to the presence of larger soy grit producers in the market, which is likely to continue its growth trajectory in the coming years. According to Volza, the top three exporters of soy grits are India, with 5,097 shipments, followed by Chile and South Africa, with 7 and 3 shipments, respectively. The existence of larger producers may further assist countries in this region in meeting their population's soy grit demand and also stabilize price levels, leading to increased access for small and medium consumers.

Key Market Players & Competitive Insights

The soy grits market is highly fragmented and anticipated to register rapid expansion driven by growing demand for plant-based proteins and rising demand for healthy diets among the consumer base, which is stimulating market players to expand their production of soy grits and step forward with partnerships and acquisitions to gain a competitive edge over the other companies and to gain global market share.

Some of the major players operating in the global market include:

- Associated British Foods

- Batory Foods

- Bob's Red Mill Natural Foods

- CerealVeneta S.r.l.

- CHS

- Do It Organic

- Emsland Group

- International Flavors & Fragrances

- Linyi Shansong Biological Products

- NOW Health

- Nutri-Pea

- Puris Proteins

- Sotexpro

- SunOpta

Recent Developments

- In March 2022, a study published in Science Direct conducted a review on addressing plant-based proteins from soybeans. It also revealed the processing technologies for a wide range of byproducts and the health benefits associated with them, along with the development of soy products.

Soy Grits Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,734.68 million |

|

Revenue forecast in 2032 |

USD 2,754.38 million |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Grain Size, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The soy grits market report covering key segments are type, grain size, distribution channel and region.

Soy Grits Market Size Worth $2,754.38 Million By 2032

The global soy grits market is expected to grow at a CAGR of 5.9% during the forecast period.

North American is leading the global market

key driving factors in soy grits market are rising demand for plant-based proteins is driving demand for soy grits