Space Propulsion Market Share, Size, Trends, Industry Analysis Report

By Type (Chemical Propulsion, Non-Chemical); By System Component; By Platform; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM2924

- Base Year: 2024

- Historical Data: 2020-2023

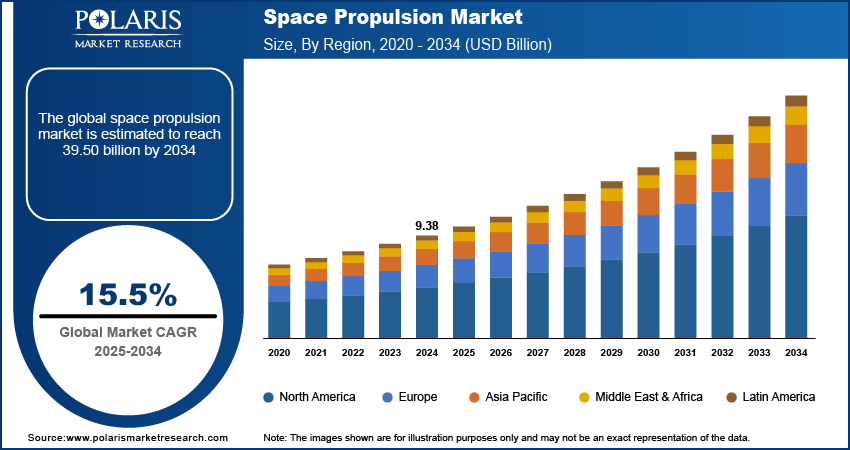

The global space propulsion market was valued at USD 9.38 billion in 2024 and is expected to grow at a CAGR of 15.5% during the forecast period. Key factors driving the demand includes increasing demand for LEO-based services, technological advancement in space propulsion, rise in conflicts on borders, keeping track of weather forecasting and natural calamities, and growth in space missions for exploring.

Key Insights

- Non-chemical propulsion segment dominated the market in 2024. Solar propulsion is an advanced propulsion technology that is cost-saving and provides safety and superior propulsive power to support a variety of space exploration missions.

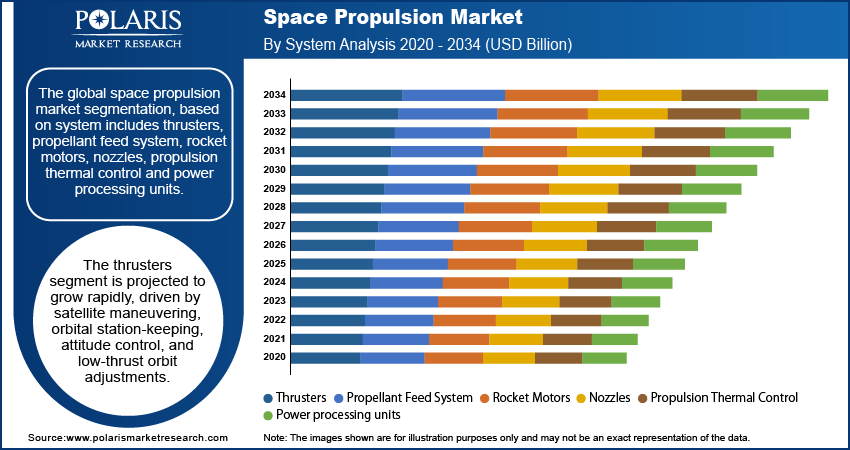

- The thrusters segment is expected to witness rapid growth during the forecast period. This is due to their use for maneuvering, orbital station-keeping, attitude control, or long-duration, low-thrust acceleration orbit control of satellites.

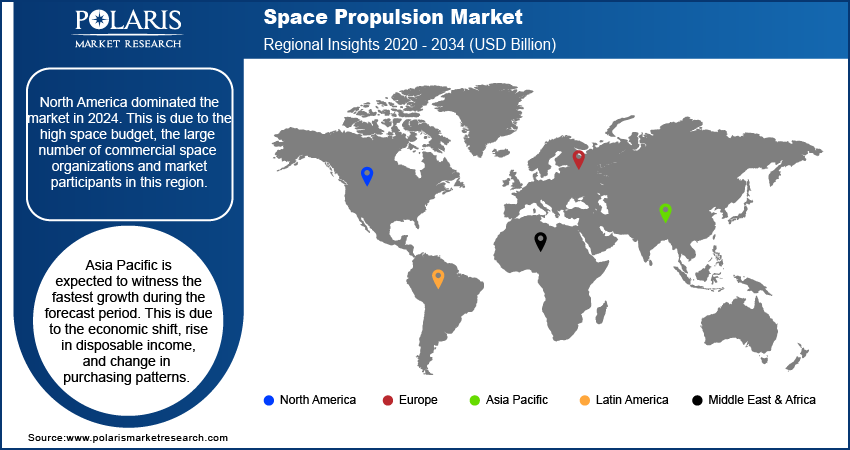

- North America dominated the market in 2024. This is due to the high space budget, the large number of commercial space organizations and market participants in this region.

- Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the economic shift, rise in disposable income, and change in purchasing patterns.

Industry Dynamics

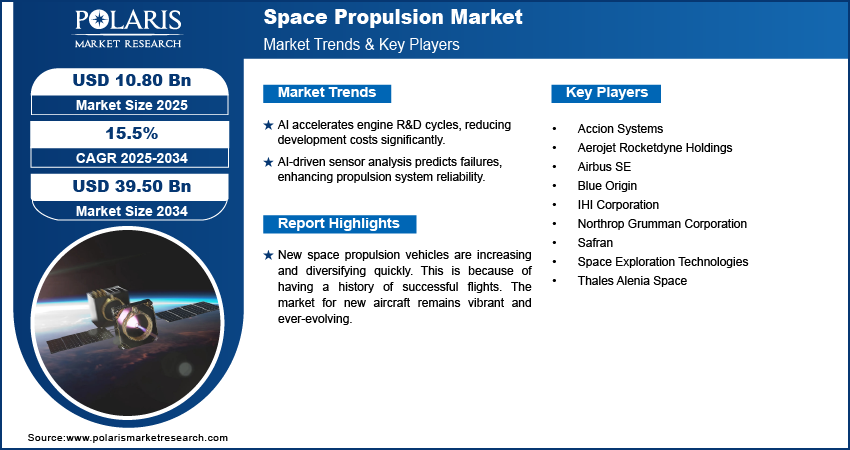

- AI algorithms enhance performance and optimize the design of engines while circumstances change, which accelerates R&D cycles, and decreases development costs.

- With the analysis of sensors, AI also predicts failures prior to their occurrence, improving mission safety, and reliability through maintenance of propulsion systems.

- Machine learning maximizes fuel efficiency, and mission performance by optimizing real-time control and mixture ratios during cruise flight.

- It analyzes vast amounts of data from tests to determine issues and adjust parameters, which increases test efficiency and robustness.

Market Statistics

- 2024 Market Size: USD 9.38 billion

- 2034 Projected Market Size: USD 39.50 billion

- CAGR (2025-2034): 15.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Space Propulsion Market

- AI algorithms enhance performance and optimize the design of engines while circumstances change, which accelerates R&D cycles, and decreases development costs.

- With the analysis of sensors, AI also predicts failures prior to their occurrence, improving mission safety, and reliability through maintenance of propulsion systems.

- Machine learning maximizes fuel efficiency, and mission performance by optimizing real-time control and mixture ratios during cruise flight.

- It analyzes vast amounts of data from tests to determine issues and adjust parameters, which increases test efficiency and robustness.

New space propulsion vehicles are increasing and diversifying quickly. This is because of having a history of successful flights. The market for new aircraft remains vibrant and ever-evolving. The latest aircraft is designed by keeping track of the history of space flights. This has increased safety and reduced the time and cost associated with new product development. Many advanced technologies and the use of composite materials in the manufacturing of components are driving the growth of the global market.

The increasing investment, rise in conflicts on borders, keeping track of weather forecasting and natural calamities, and growth in space missions for exploring are propelling the space propulsion market's revenue growth. Rockets are employed as low Earth orbit (LEO) elevators, continued development of reusable rockets could stimulate market revenue growth.

The space propulsion system includes valves, fuel tanks, pressure regulators, propellant assembly, thrusters, etc. Many space propulsion systems are used by aeronautics and space agencies because of the presence of a wide range of satellites and space crafts. All the above factors fueled the growth of the global space propulsion market.

Covid-19 has a negative effect on the global market. Due to the worldwide lockdown imposed by the governments to stop the spreading of the virus, all the manufacturing companies have shut down their manufacturing. This has led to a reduction in the space launch vehicle’s components and satellites. Due to delivery and production delays, many market players go through a significant decline in their revenue share during the time of the pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

LEO satellite has many advantages like lower launch cost, cost effectivity, and availability of satellite parts, the emphasis has been led on its construction by major players. LEO satellites have high-power signals which produce a signal that is 1,000 times (30 dB) stronger than any GNSS signal. LEO satellites can receive signals from anywhere in the sky. LEO constellations have multiple satellites therefore they can provide 3-D location information along with exact timings. Some examples are Communication, Scientific missions, Logistics and geo-location, Earth observation, Signal monitoring, etc. The many advantages and properties of LEO spacecraft, have created a demand for the space propulsion system.

In Oct 2022, OneWeb successfully launched 36 new LEO (Low Earth Orbit) satellites into its constellation from India. This launching mission from India enhances global coverage and forms connectivity in India and South Asia. The increase in space exploration missions and a rise in the collaboration between government and private companies have increased in recent years. For instance, the executive chairman of Amazon, Jeff Bezos wants to colonize the moon in 2019. And in Feb.

Military forces and defense use remote sensing technology, communication systems, and GPS with the help of satellites. Through satellites, they get more accurate and precise information about enemies and targets and thus, reduce collateral damage and casualties of both civilians and military. During war when the ground communication system is often unavailable or unsecured, military satellites can overcome such limitations. Thus, increasing demand for such satellites or spacecraft for military purposes increases space propulsion.

Report Segmentation

The market is primarily segmented based on type, system, platform, end-use, and region.

|

By Type |

By System |

By Platform |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Type Analysis

Non-chemical propulsion segment dominated the market in 2024. Solar propulsion is an advanced propulsion technology that is cost-saving and provides safety and superior propulsive power to support a variety of space exploration missions. This system uses solar cells to generate power. In a Laser propulsion system, a spaceship can get velocity using two ways. The first method, which is the basis for solar sails and laser sails, transfers momentum by the application of photon radiation pressure. The second technique makes use of the laser to assist in mass removal from the spaceship, much like a traditional rocket. The nuclear propulsion system is a system in which propulsion methods use some form of nuclear reaction as their primary power source.

System Analysis

Thrusters segment is expected to witness fastest growth during the forecast period as they are mainly used for maneuvering, orbital station-keeping, attitude control, or long-duration, low-thrust acceleration orbit control of satellites. Thus, it leads the space propulsion market during the forecast period. They can either be pressure supplied or pump-fed, in general. This pressure-supplied system is frequently employed in auxiliary propulsion and space propulsion applications that ask for low system pressures and sparse propellant supplies. In contrast, the high-pressure, high-performance application uses the pump-fed system.

Platform Analysis

The satellite segment accounted for largest market share in 2024 due to many applications such as the launching of satellites and spacecraft in orbit, probes and interplanetary spacecraft, controlling automobiles that re-enter, automated resupply missions for the International Space Station, controlling and stabilization of ascent roll for light to heavy launch vehicles, control of the attitude, orbit, and roll of the launch vehicle's upper stage.

The market for launch vehicles is expected to expand significantly due to the high demand for space propulsions for numerous planned satellite launches by commercial market players, while the market for rovers and landers is expected to expand slowly but steadily because of their complex systems, high space budgets, and scarcity of manufacturers.

End Use analysis

Over the projection period, the government and defense industry is anticipated to experience quicker revenue growth. A military satellite is a spacecraft that has been launched into orbit to perform activities for the military on the surface of the Earth, including communications, navigation, and reconnaissance. Early notice supplied by military satellites regarding military developments and enemy force deployments on the ground would be crucial for the Indian armed forces. The tasks that military satellites can be used for reporting to the relevant agency all the intelligence information collected on adversary troops through signal and electronic intelligence, in the country's most remote and inaccessible places, including Jammu and Kashmir and the North East.

Regional Analysis

North America Space Propulsion Market Assessment

North America region dominated the market in 2024 due to the high space budget, the large number of commercial space organizations and market participants in this region, and the sizeable space industry are all credited with the expansion. This is due to its developed and well-integrated private aerospace ecosystem. The region has an unmatched concentration of established spacecraft manufacturers, launch service providers, and propulsion technology companies, which allows for continuous innovation and development. Moreover, substantial government investment, steady private venture financing, and other funding sources provide the necessary fuel for advanced research and prototyping, as well as commercialization of next generation propulsion systems, from conventional chemical thrusters to new electric and nuclear thermal propulsion concepts.

Asia Pacific Space Propulsion Market Insights

Asia Pacific is expected to witness the fastest growth during the forecast period. This is due to the economic shift, rise in disposable income, and change in purchasing patterns. Value-added products in the food and beverage sector within the urban middle-class population are driving the demand for premium products. This growth is further boosted by the activities between both regional and international companies that are expanding their product portfolios and presence. The rapid growth in e-commerce platforms has also improved accessibility, which has boosted the demand from consumers.

The market will experience impressive expansion with increasing government and commercial satellite launches due to increased space budgets in China, India, and Japan. The market is driven by defense utilities, rising demand for satellites over Asia, and other factors. Market expansion is driven by rising space investments and expanding military satellite programs from various APAC nations.

Competitive Insight

Some of the major players operating in the global market include Accion Systems, Aerojet Rocketdyne Holdings, IHI Corporation, Blue Origin, Northrop Grumman Corporation, Space Exploration Technologies, Safran, Airbus Se, and Thales Alenia Space.

Recent Developments

July 2025: ThrustMe, Marble Imaging, and Reflex Aerospace collaborated for an in-orbit demonstration (IOD) of the JPT150, the world’s first low-power iodine Hall thruster system. The propulsion system will be integrated into MIRI, a high-performance Earth observation satellite.

September 2022: Contracts for satellite communications were signed by Airbus with the Dutch and Czech defense ministries. Airbus UHF (Ultra High Frequency) military communications hosted payload will be used by the armed services on 2 or 3 channels, and it will be launched as part of the EUTELSAT 36D communications satellite in 2024.

January 2022: before the launch of the 1st Galileo satellites, Safran aircraft engines will deliver the 1st PPF5000 thrusters to Alenia Space. These thrusters will be used for both commercial & military purposes and provide both defense & civil positioning services.

Space Propulsion Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.38 billion |

| Market size value in 2025 | USD 10.80 billion |

|

Revenue forecast in 2034 |

USD 39.50 billion |

|

CAGR |

15.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By System, By Platform, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Accion Systems, Aerojet Rocketdyne Holdings, IHI Corporation, Blue Origin, Northrop Grumman Corporation, Space Exploration Technologies, Safran, Airbus Se, Thales Alenia Space. |

FAQ's

• The global market size was valued at USD 9.38 billion in 2024 and is projected to grow to USD 39.50 billion by 2034.

• The global market is projected to register a CAGR of 15.5% during the forecast period.

• North America dominated the global market share in 2024.

• A few market players are Accion Systems, Aerojet Rocketdyne Holdings, IHI Corporation, Blue Origin, Northrop Grumman Corporation, Space Exploration Technologies, Safran, Airbus Se, and Thales Alenia Space.

• Non-chemical propulsion segment dominated the market in 2024.

• The thrusters segment is expected to witness rapid growth during the forecast period.