Stone Paper Market Share, Size, Trends, Industry Analysis Report

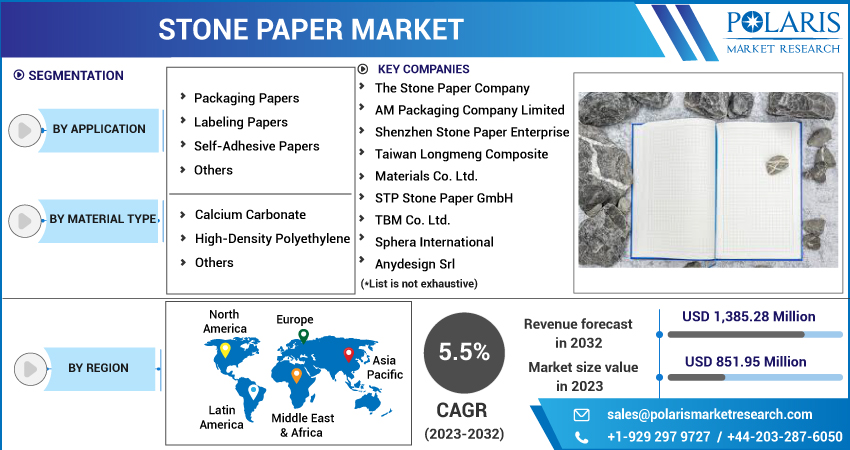

By Application (Packaging Papers, Labeling Papers, Self-Adhesive Papers, and Others); By Material Type; By Distribution Channel; By Region; Segment Forecast, 2023-2032

- Published Date:May-2023

- Pages: 118

- Format: PDF

- Report ID: PM3273

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global stone paper market was valued at USD 808.68 million in 2022 and is expected to grow at a CAGR of 5.5% during the forecast period. Growing demand and prevalence of the product owing to its eco-friendly, recycling, and waterproof properties, along with the increasing environmental concern towards deforestation to synthesize wood pulp effectively, are key factors expected to fuel the global market growth and demand in the forecast period. Additionally, the rapid increase in international trade due to extensively emerging e-commerce platforms fueling the demand for sustainable packaging products such as cardboard boxes and bags. The high focus of market players on developing products with more advanced features is also creating lucrative growth opportunities for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in December 2021, Pebble Printing unveiled its first stone paper compatible with inkjet, manufactured using about 80% calcium carbonate and 20% high-density polyethylene. The new product is being developed with no trees or water, eliminating all poisonous chemicals and less energy consumed.

Stone paper is rapidly gaining momentum and traction in paper and packaging applications due to its unique composition that offers excellent water, oil, and tear resistance. Stone paper box pouches with attractive digital printing are also widely used to increase market awareness. Moreover, these products are largely preferred by various food companies due to their aesthetic and sustainable qualities and have found vast applications in the FMCG sector, stimulating the demand and pushing the market forward. Despite the growing demand for stone paper-based products globally, they are comparatively more expensive than other traditional papers available in the market, leading consumers to opt for other cheaper alternatives and hampering the market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the stone paper market. The emergence of the lethal coronavirus across the globe has forced countries to impose several restrictions, including lockdowns, trade barriers, and regulations on mass movements, that resulted in the temporary closure of manufacturing facilities and high disruptions in the global supply chain. Due to this, stone paper production was negatively affected, and the market has seen a significant decline in demand and sales worldwide.

For Specific Research Requirements, Request For Customized Report

Industry Dynamics

Growth Drivers

The growing adoption of stone paper as an alternative to conventional form contributes to overcoming problems, including deforestation worldwide, due to its energy-saving and eco-friendly nature. Along with this, it further helps reduce carbon emissions more than traditional manufacturing processes, which are the major factors driving the global stone paper market growth over the study period. Furthermore, the increasing government support coupled with the economies of density and implementation of various types of stringent regulations of the emission of different kinds of greenhouse gases and the introduction of various innovative sources or materials is a few other factors likely to fuel the demand and growth of the market at a significant pace.

Report Segmentation

The market is primarily segmented based on application, material type, and region.

|

By Application |

By Material Type |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

Labeling papers segment accounted for the largest market share during the forecast period

The labeling papers segment accounted for the largest market share and will likely retain its position throughout the forecast period. The growth of the segment market can be mainly attributed to its widespread use in various applications, including wrappers, colored notes, shelf tags, shelf signage, and sticky notes, because of its cost-effectiveness and better flexibility. Labeling paper includes product tags and labeling, multi-purpose notes, wine bottles, office uses, air-line luggage, door hangs, and identity hands, resulting in higher product demand worldwide.

Moreover, the growing penetration for labeling in the food & beverage packaging applications, as it provides complete information regarding the ingredients used and also offers a visual appeal to the product, to achieve product differentiation and gain consumer attention, many manufacturers across the globe are being implemented on labeling their brands, which in turn have paved the way for higher product demand and adoption in the forecast period.

However, the packaging papers segment is expected to grow fastest during the anticipated period, mainly driven by the rising need and prevalence to replace plastic with traditional packaging material. In addition, the rapidly surging use of recyclable stone paper containers across several industrial sectors will likely impact the segment market growth and demand positively.

High-density polyethylene segment is expected to grow fastest in upcoming years

The high-density polyethylene segment is expected to grow fastest over the projected period. The growing use of HDPE as a binder that provides the stone paper with a better foldable quality, which is similar to another traditional form, and increasing awareness regarding its ability to help in retaining the shape of stone paper because of the high density are among the major factors driving the growth of the segment market. Additionally, the wide range of benefits of using HDPE packaging, such as enhanced protection, highly adaptable, lightweight, excellent rigidity, and easily recyclable, further increase product application across several industries.

The calcium carbonate segment held the largest market share in 2022, which was highly accelerated by the abundant availability of the resource and the adoption of calcium carbonate as a key ingredient in stone paper production. It helps increase the brightness and opacity of stone paper and does not have any gain that allows for smoother writing, propelling the segment's demand and growth over the coming years.

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with a healthy market share and is expected to maintain its dominance over the study period. The regional market growth can be largely attributed to rapid urbanization and continuously growing awareness regarding the regulation of the use of plastic and the implementation of sustainability. For example, the ban on plastic imports in China is creating significant growth opportunities for stone paper manufacturers and suppliers in the region.

In addition, the extensive rise in the demand for advanced packaging applications and the increase in the market and penetration of a variety of packaged food products in countries like India, China, South Korea, and Indonesia is further anticipated to boost the growth of the market.

The North American region is projected to emerge as the fastest growing region with a significant growth rate over the coming years on account of increasing research & development-related activities aimed at innovating sustainable products with several new and more advanced features and the robust presence of major manufacturers in the region.

Competitive Insight

Some of the major players operating in the global stone paper market include Stone Paper Company, AM Packaging Company, Shenzhen Stone Paper, Taiwan Longmeng Composite, STP Stone Paper, TBM Co., Sphera International, Anydesign, Guangzhou Myhome Wallpaper, Agood Company, Karst Stone Paper, WestRock Company, Parax Paper, & Stone Paper Italia.

Recent Developments

- In February 2021, Siakal Enterprise announced the inauguration of its new production facility of unique stone paper. The total capacity of the new manufacturing facility is estimated at 9,000 tonnes, mainly based on Chinese Henan GX-Mach technology. The new stone paper is characterized by higher strength and better durability and is highly resistant to dirt and moisture.

- In November 2021, Naya introduced new mushroom packaging for better sustainability; the kit is completely biodegradable, recyclable, and compostable & it uses 100% recycled glass & labels made from stone paper. The new packaging product is developed with Mycelium Technology.

Stone Paper Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 851.95 million |

|

Revenue Forecast in 2032 |

USD 1,385.28 million |

|

CAGR |

5.5% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Application, By Material Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

The Stone Paper Company, AM Packaging Company Limited, Shenzhen Stone Paper Enterprise, Taiwan Longmeng Composite Materials Co. Ltd., STP Stone Paper GmbH, TBM Co. Ltd., Sphera International, Anydesign Srl, Guangzhou Myhome Wallpaper Co. Ltd., Agood Company, Karst Stone Paper, WestRock Company, Parax Paper, and Stone Paper Italia. |

FAQ's

The stone paper market report covering key segments are application, material type, and region.

Stone Paper Market Size Worth $1,385.28 Million By 2032.

The global stone paper market expected to grow at a CAGR of 5.5% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in stone paper market are growing application in paper packaging.