Sulfuric Acid Market Share, Size, Trends, Industry Analysis Report

By Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM2713

- Base Year: 2024

- Historical Data: 2020-2023

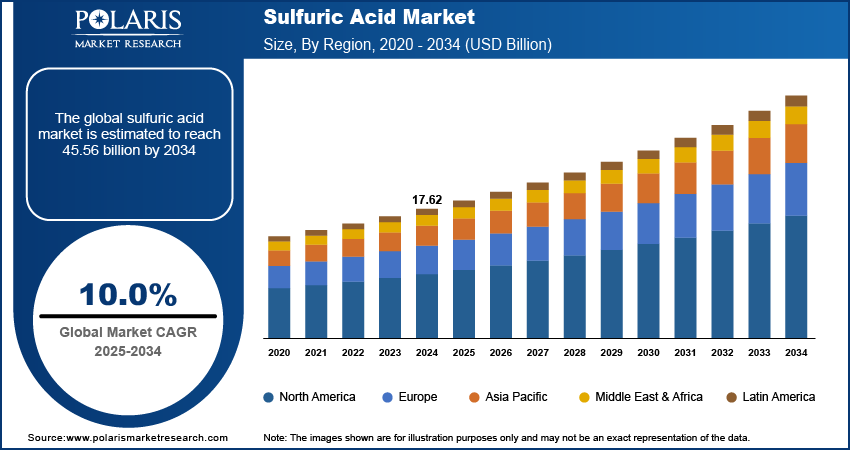

The sulfuric acid market was valued at USD 17.62 billion in 2024 and is expected to grow at a CAGR of 10.0% during the forecast period. The growing demand for sulfuric acid is due to its increased utilization in the agriculture and automotive sectors and its direct and indirect applications in manufacturing many chemicals, including fertilizers.

Key Insights

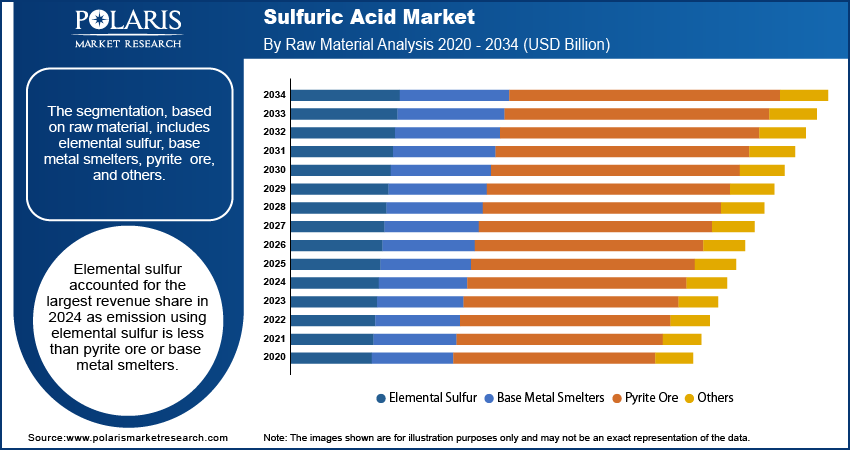

- Elemental sulfur accounted for the largest revenue share in 2024, as the emissions using elemental sulfur are less than those from pyrite ore or base metal smelters.

- The chemical manufacturing segment is expected to witness rapid growth during the forecast period. This is due to the chemical refineries, which involve the production of contaminated sulfuric acid.

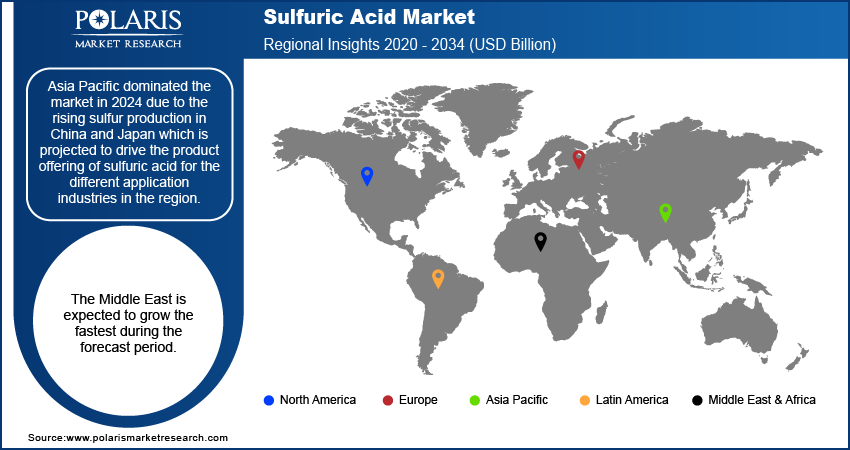

- Asia Pacific dominated the market in 2024. This is due to the rise in sulfur production, which boosts the product offering of sulfuric acid for the different application industries in the region.

- The Middle East is expected to witness the fastest growth during the forecast period. This is due to the boost in supply of H2SO4 products from Saudi Arabia.

Industry Dynamics

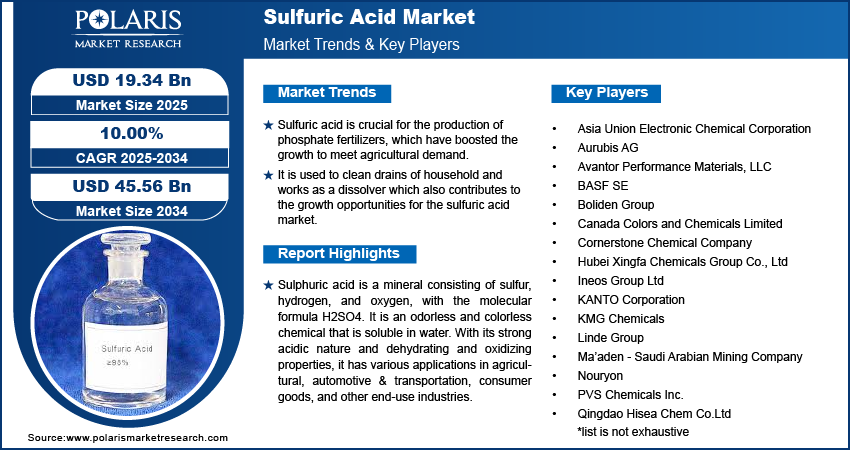

- Sulfuric acid is crucial for the production of phosphate fertilizers, which have boosted the growth to meet agricultural demand.

- It is used to clean drains of household and works as a dissolver which also contributes to the growth opportunities for the sulfuric acid market.

- Environmental regulations by the government on waste disposal and emmissions from production facilities boost operational costs and complicate expansion plans for manufacturers.

- Demand for Li-Ion batteries in the EV and energy storage sector creates expansion opportunities for the high-purity sulphuric acid for processing cathode materials.

Market Statistics

- 2024 Market Size: USD 17.62 billion

- 2034 Projected Market Size: USD 45.56 billion

- CAGR (2025-2034): 10.0%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Sulphuric acid is a mineral consisting of sulfur, hydrogen, and oxygen, with the molecular formula H2SO4. It is an odorless and colorless chemical that is soluble in water. With its strong acidic nature and dehydrating and oxidizing properties, it has various applications in agricultural, automotive & transportation, consumer goods, and other end-use industries. It is obtained from sulfur-di-oxide, and some are made of ferrous sulfate waste solutions and is produced by two major processes called lean chamber and contact process. The rise in stringent government rules and regulations for controlling emissions has increased the utilization of smelters to capture sulfur dioxide products, which has driven the market. Growing product demand as a catalyst, dehydrating agent and reactant in fertilizers, paper & pulp, chemical manufacturing, metal processing, petroleum refinery, and others is expected to propel the market’s growth over the forecast period.

Additionally, higher requirements for sulfate salts, nitric acid, hydrochloric acid, synthetic detergents, dyes & pigments, explosives, and other drugs have augmented the market growth. The Covid-19 pandemic has negatively impacted the market, and the demand for the product decreased tremendously due to the disruption of supply chains and restrictions on transportation worldwide. Several companies operating in the automotive, paper & pulp, metal, petroleum, and other industries have incurred enormous losses, which led to a decline in the demand for the products manufactured using sulphuric acid.

Moreover, the governments are taking steps to relax taxes and fiscal deficits to minimize the impact that can stabilize the market situation and assist growth.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

In agriculture, sulfuric acid creates inorganic phosphate fertilizers such as ammonium sulfate and superphosphate of lime. It is also used in the production of mono ammonium phosphate (MAP) and diammonium phosphate (DAP), which is used in the tilling process to increase the yield of crops. So, the growing demand for fertilizers in agriculture is boosting the market’s growth. Increased use of sulfuric acid in the automotive sector for vehicle battery is anticipated to boost market growth. Car batteries consist of up to 28-32% of sulfuric acid, which generates an electrical current capable of reacting with lead. In households, it is used as a liquid-form drain cleaner that unclogs drains. In lesser concentrations, it occurs in glass-cleaning etching compounds, rust and corrosion dissolvers, and some fabric cleaners. These daily applications of sulfuric acid are expected to propel the market.

Sulfuric acid is used to manufacture chemotherapy drugs as it damages the cancerous cell DNA. Various skin infections, such as canker sores triggered by stress, acidic foods, or minor trauma, can be treated with sulfuric acid as it is used as an ingredient in skin ointments. Such beneficial applications of sulfuric acid in the healthcare sector are supposed to influence the market’s growth. In modern industry, sulfuric acid is a necessary commodity chemical used primarily for producing phosphoric acid. It is also suitable for removing oxidation from iron and steel, so metal manufacturers use it in large quantities. Additionally, it is vital in treating wastewater, manufacturing lead acid batteries, manufacturing rayon, and harvesting potatoes as a desiccant. All these uses and factors are driving the market growth.

Report Segmentation

The market is primarily segmented based on raw material, application, and region.

|

By Raw Material |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Raw Material Analysis

The segmentation, based on raw material, includes elemental sulfur, base metal smelters, pyrite ore, and others. Elemental sulfur accounted for the largest revenue share in 2024 as emission using elemental sulfur is less than pyrite ore or base metal smelters. Raw materials are readily available. The generation of sulphuric acid through sulfur is less polluting than base metal smelting and roasting pyrite ore, which require businesses/factories to undertake rigorous methods to clean the generated sulfur oxide gas before releasing them into the atmosphere.

Increasing developmental activities, such as enhancing companies' production capacities to propel the manufacturing of sulphuric acid products from elemental sulfur, are expected to trigger market growth. Additionally, elemental sulfur is used as an insecticide, rodenticide, repellent, and soil amendment to lower soil pH, which has led to the segment's growth.

Application Analysis

Based on applications, the segmentation includes, fertilizers, chemical manufacturing, metal processing, petroleum refining, textile industry, automotive, paper & pulp, and others. The fertilizer segment dominated the market share in 2024 as the increased population has led to a demand for superior-quality food crops. There is a reduction of arable land, leading farmers to use fertilizers to increase crop yield due to rapid industrialization and urbanization. The rise in sulfuric acid utilization for producing quality fertilizers for agriculture is anticipated to augment fertilizer production, thereby complementing market’s growth.

Chemical manufacturing segment is expected to witness the fastest growth during the forecast period. The chemical refineries primarily involve contaminated sulfuric acid production, resulting in the regeneration of pure and concentrated H2SO4 products. The regenerated acids emit low emissions leading to reduced production costs, which makes them sustainable and environmentally friendly. Moreover, growing investment in developmental activities related to chemical synthesis in China is anticipated to fuel the market growth over the forecast period. The rising production of industrial cleaning agents is expected to spur industry growth.

Regional Analysis

Asia Pacific Sulfuric Acid Market Assessment

Asia Pacific dominated the market in 2024 due to the rising sulfur production in China and Japan which is projected to drive the product offering of sulfuric acid for the different application industries in the region. Increasing demand for H2SO4 in the Philippines and Indonesia has also surged the exports from China, which is expected to boost the market growth. Thus, Asia Pacific accounts for the highest growth rate.

Increase in the cultivation of crops and higher crop yields due to rising demand from industrial and phosphoric acid sectors has triggered growth in China. Sulfuric acid prices are rising due to the growing demand for the product in the Asia Pacific. The increasing need to expand the production of phosphate fertilizer due to the high demand in the agriculture sector and stringent environmental regulations concerning the manufacturing of environment-friendly products is likely to propel the market over the coming years.

Middle East Sulfuric Acid Market Insights

The Middle East is expected to grow the fastest during the forecast period. The increasing supply of H2SO4 products from Saudi Arabia is expected to spur the market over the forecast period. The growing number of acid plants to meet growing consumer demand and the increasing supply of sulfur-burnt acids in the Middle East are anticipated to drive the market’s growth. The growth is further driven by the rise in demand from fretilizer and chemical manufacturing industry, which are the major consumers of this acid. Moreover, government investment in industrial sector has also boosted the expansion opportunities for these products.

Key Players & Competitive Analysis Report

The market for sulfuric acid is characterized by the strategic investment in developing markets, notably in the Middle East, which have access to raw sulfur through sustainable value chains that presents the lowest costs. Most key vendor strategies involve a combination of backward integration and expansion opportunities close to fertilizer and metal processing centers to control costs and secure growth of raw acid. Competitive intelligence shows that the growth potential for the sulfuric acid market is due to the macroeconomic and geopolitical shifts impacting both phosphate fertilizer demand and raw sulfur supply chain logistics. Moreover, strategic considerations for new entrants into this market account for high capital intensity and leverage established industrial players with long-term contracts with purchasers. The future revenue growth is dependent on innovation of the technological space of acid recycling and addressing supply disruptions for raw chemical supplies.

Some of the major players operating in the global market include Asia Union Electronic Chemical Corporation (AUECC), Aurubis AG, Avantor Performance Materials, LLC, BASF SE,

Boliden Group, Canada Colors and Chemicals Limited, Cornerstone Chemical Company, Hubei Xingfa Chemicals Group Co., Ltd, Ineos Group Ltd, KANTO Corporation, KMG Chemicals, Linde Group, Ma’aden - Saudi Arabian Mining Company, Nouryon, PVS Chemicals Inc., Qingdao Hisea Chem Co.Ltd, Seastar Chemicals, Tata Chemicals, Trident Group, UBE INDUSTRIES, LTD., and Zhejiang Jiahua Energy Chemical Industry Co. Ltd.

Industry Developments

May 2025: Sumitomo Corporation collaborated with Thailand's tank terminal operator for a sulfuric acid tank terminal business. Sumitomo Corporation aims to enhance operational safety and logistics service reliability by acquiring a strategically located terminal and leveraging its expertise in sulfuric acid terminal operations.

April 2025: BASF expanded its production capacity for semiconductor-grade sulfuric acid (H2SO4). The new production facility will feature cutting-edge purity capabilities to serve growing demand for advanced semiconductor chip manufacturing across Europe.

July 2021: BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd., and Zhejiang Jiafu New Material Technology Co. Ltd., collaborated to expand the electronic-grade sulfuric acid production capacity in China.

Sulfuric Acid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.62 billion |

| Market size value in 2025 | USD 19.34 billion |

|

Revenue forecast in 2034 |

USD 45.56 billion |

|

CAGR |

10.0 % from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Raw Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Asia Union Electronic Chemical Corporation (AUECC), Aurubis AG, Avantor Performance Materials, LLC, BASF SE, Boliden Group, Canada Colors and Chemicals Limited, Cornerstone Chemical Company, Hubei Xingfa Chemicals Group Co., Ltd, Ineos Group Ltd, KANTO Corporation, KMG Chemicals, Linde Group, Ma’aden - Saudi Arabian Mining Company, Nouryon, PVS Chemicals Inc., Qingdao Hisea Chem Co.Ltd, Seastar Chemicals, Tata Chemicals, Trident Group, UBE INDUSTRIES, LTD., Zhejiang Jiahua Energy Chemical Industry Co. Ltd. |

FAQ's

• The global market size was valued at USD 17.62 billion in 2024 and is projected to grow to USD 45.56 billion by 2034.

• The global market is projected to register a CAGR of 10.0% during the forecast period.

• Asia Pacific dominated the global market share in 2024.

• A few of the key players in the market are Asia Union Electronic Chemical Corporation (AUECC), Aurubis AG, Avantor Performance Materials, LLC, BASF SE, Boliden Group, Canada Colors and Chemicals Limited, Cornerstone Chemical Company, Hubei Xingfa Chemicals Group Co., Ltd, Ineos Group Ltd, KANTO Corporation, KMG Chemicals, Linde Group, Ma’aden - Saudi Arabian Mining Company, Nouryon, PVS Chemicals Inc., Qingdao Hisea Chem Co.Ltd, Seastar Chemicals, Tata Chemicals, Trident Group, UBE INDUSTRIES, LTD., and Zhejiang Jiahua Energy Chemical Industry Co. Ltd.

• Elemental sulfur accounted for the largest revenue share in 2024.

• The chemical manufacturing segment is expected to witness rapid growth during the forecast period.