Surgical Planning Software Market Size, Share, Trends, Industry Analysis Report

: By Delivery (Cloud-based and On-premises), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5057

- Base Year: 2024

- Historical Data: 2020-2023

Surgical Planning Software Market Overview

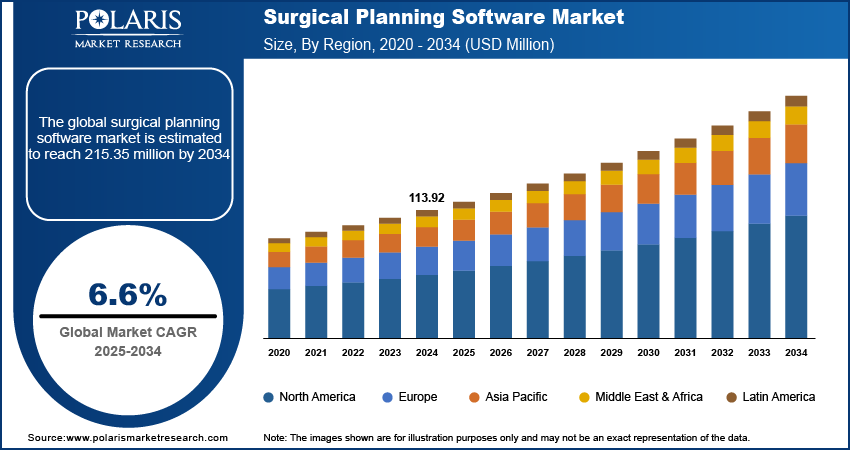

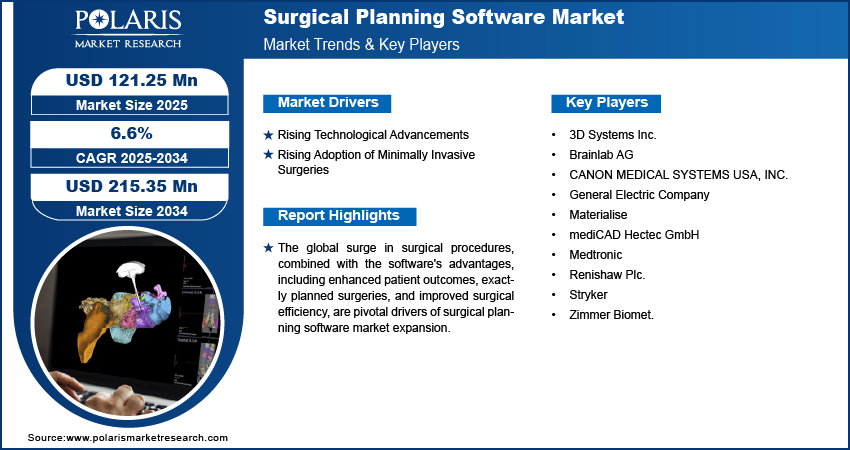

The global surgical planning software market size was valued at USD 113.92 million in 2024. The market is projected to grow from USD 121.25 million in 2025 to USD 215.35 million by 2034, exhibiting a CAGR of 6.6% during the forecast period.

Surgical planning software is a specialized tool that helps surgeons in preoperative planning by simulating procedures, visualizing anatomy, and optimizing strategies to enhance surgical outcomes and patient safety. The surgical planning software market is experiencing robust growth driven by the rising prevalence of chronic diseases such as cardiovascular diseases, cancer, and orthopedic disorders, which has significantly increased the demand for surgical interventions. These conditions often require complex surgical procedures that demand precise planning and execution to ensure optimal outcomes and reduce post-operative complications.

These software solutions allow surgeons to preoperatively assess the patient's anatomy, identify potential challenges, and strategize the surgical approach by utilizing advanced imaging technologies such as MRI, CT scans, and 3D modeling. For instance, in April 2024, Materialise introduced Mimics Enlight CMF, a 3D surgical planning software that automates and improves cranio-maxillofacial surgical preparation, enhancing efficiency and precision for healthcare providers.

To Understand More About this Research: Request a Free Sample Report

The global surge in surgical procedures, combined with the software's advantages, including enhanced patient outcomes, exactly planned surgeries, and improved surgical efficiency, are pivotal drivers of surgical planning software market expansion. Moreover, elderly individuals often develop conditions such as osteoporosis, leading to surgeries, including knee and hip replacements. According to the American Joint Replacement Registry's 2020 annual report, approximately 2 million hip and knee procedures were conducted in the U.S. in 2020, marking a 24.4% increase from the previous year. Thus, such rising knee replacement surgeries are expected to dominate the surgical planning software market outlook. Additionally, the rising incidence of sports-related and accident-related injuries further contributes to the escalating demand for surgical interventions.

Surgical Planning Software Market Drivers Analysis

Rising Technological Advancements

The market CAGR for surgical planning software is being driven by recent advancements in medical imaging, artificial intelligence (AI), and virtual reality (VR), increasing its precision and usefulness. Innovations in medical imaging modalities, such as MRI and CT scans, provide detailed anatomical insights, enabling surgeons to create accurate 3D models of patient anatomy. AI algorithms integrated into surgical planning software enhance decision-making by analyzing vast datasets and predicting surgical outcomes based on historical data and patient-specific factors. This capability not only improves preoperative assessments but also aids in personalized treatment planning, optimizing surgical strategies for individual patient needs.

The integration of VR technology enhances the visualization and simulation capabilities of surgical planning software. Many key players are introducing products to help anticipate challenges, reduce operative time, and minimize risks during real surgeries. For instance, in January 2024, Realize Medical's Elucis, a VR surgical planning software, received FDA 510(k) clearance, facilitating immersive 3D pre-operative planning and collaborative medical consultations.

The adoption of advanced surgical planning software is increasing due to the impact of AI, VR, and advanced medical imaging technologies, meeting the growing demand for more precise and personalized healthcare solutions.

Rising Adoption of Minimally Invasive Surgeries

The demand for minimally invasive surgeries (MIS) continues to rise significantly as patients and healthcare providers prioritize faster recovery, shorter hospital stays, and reduced healthcare expenditures. Minimally invasive procedures offer distinct advantages over traditional surgeries by using smaller incisions, which typically result in less trauma to surrounding tissues and reduced post-operative pain. This approach not only accelerates recovery times but also lowers the risk of complications and infections, ultimately enhancing patient satisfaction.

Healthcare providers are also increasingly adopting surgical planning software to optimize the planning and execution of MIS. These software solutions utilize advanced imaging technologies and simulation capabilities to plan procedures meticulously, visualize patient anatomy in 3D, and simulate surgical maneuvers with precision. By enabling surgeons to accurately navigate complex anatomical structures and anticipate potential challenges before surgery, these tools contribute to improved surgical outcomes and patient safety in MIS drives the surgical planning software market revenue.

Surgical Planning Software Market Segment Analysis

Surgical Planning Software Market Assessment by Delivery

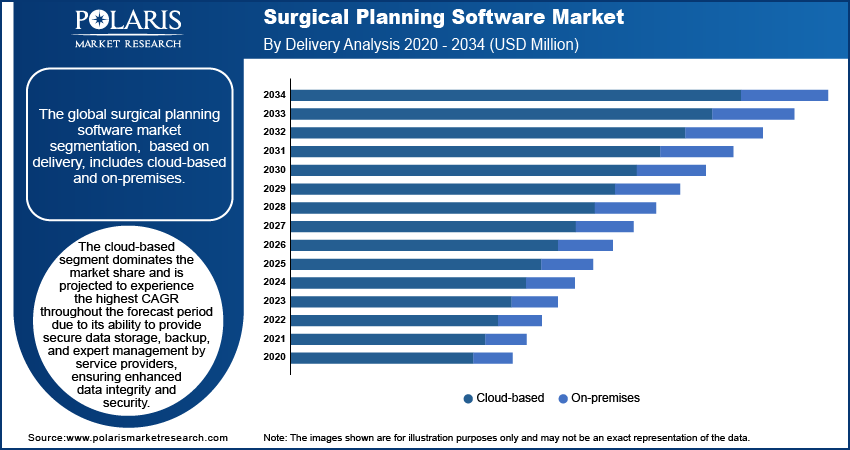

The global surgical planning software market segmentation, based on delivery, includes cloud-based and on-premises. The cloud-based segment dominates the market share and is projected to experience the highest CAGR throughout the forecast period. Cloud-based solutions provide secure data storage, backup, and expert management by service providers, ensuring enhanced data integrity and security. These advantages have significantly boosted the popularity of cloud-based surgical planning software. Additionally, the shortage of skilled professionals capable of operating and maintaining such software in healthcare settings further propels the preference for cloud-based options.

Surgical Planning Software Market Evaluation by Application

The global surgical planning software market segmentation, based on application, includes orthopedic surgery, neurosurgery, dental and orthodontics, and others. In 2024, the orthopedic surgery segment garnered the largest share of the market. This dominance is attributed to a global increase in elderly populations and the rising incidence of bone and muscle injuries due to factors such as sports-related incidents and accidents.

Elderly individuals, in particular, are more prone to various injuries and conditions, such as osteoarthritis, necessitating orthopedic interventions. According to the World Health Organization (WHO), the number of people aged 60 years and older now exceeds the population of children under five years. Additionally, this demographic is projected to expand from 12% to 22% between 2015 and 2050. The aging population's susceptibility to orthopedic surgeries has, therefore, significantly bolstered growth within this segment.

Surgical Planning Software Regional Insights

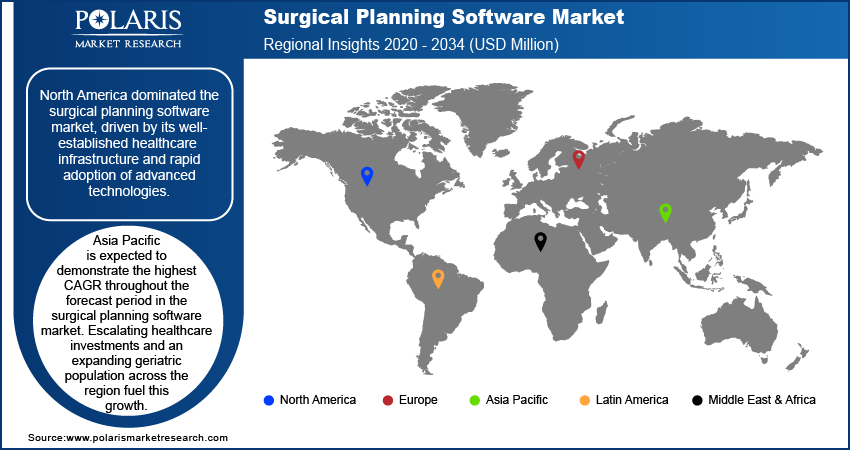

North America dominated the surgical planning software market, driven by its well-established healthcare infrastructure and rapid adoption of advanced technologies. The region's robust healthcare system attracts global market players who are keen on leveraging opportunities within its healthcare sector. For instance, in May 2023, Formus Labs, a New Zealand-based medical technology startup, secured FDA approval for its 3D software designed for hip replacement preoperative planning, marking its entry into the lucrative the US market.

The US is poised for significant growth in the surgical planning software market over the forecast period. This growth is fueled by escalating demand for advanced surgical technologies and a regulatory framework conducive to innovation. The country's sophisticated healthcare infrastructure supports the adoption of advanced surgical planning solutions. In June 2023, SMAIO announced FDA 510(k) clearance for its custom surgery planning software developed in partnership with NuVasive, aimed at enhancing spine surgery planning and patient outcomes. Moreover, Canada's surgical planning software market is also projected to experience notable growth, driven by the increasing adoption of advanced surgical technologies and a rising number of surgical procedures nationwide. For instance, the Government of Saskatchewan reported a record annual surgical volume exceeding 95,700 procedures between April 2023 and March 2024, underscoring the country's growing demand for surgical planning solutions.

Asia Pacific is expected to demonstrate the highest CAGR throughout the forecast period in the surgical planning software market. Escalating healthcare investments and an expanding geriatric population across the region fuel this growth. Furthermore, increasing awareness regarding the benefits of surgical planning software, including improved accuracy, enhanced patient outcomes, and reduced operating times, is anticipated to drive its adoption in the region.

Countries such as China and Japan are also poised to witness increased demand for orthopedic surgeries and surgical planning software. Japan, in particular, is experiencing rapid growth in its elderly population and high adoption rates of advanced healthcare technologies. According to the Japan External Trade Organization, the number of people aged 65 and above in Japan is projected to rise from 35.89 million in 2019 to 37.16 million by 2030. This demographic shift is expected to lead to a surge in surgical procedures, thereby boosting the market for surgical planning software in the country and across Asia Pacific.

Surgical Planning Software Key Market Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their product lines, which will help the surgical planning software market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the surgical planning software market must offer cost-effective items.

Major players in the surgical planning software market include 3D Systems Inc.; Brainlab AG; CANON MEDICAL SYSTEMS USA, INC.; General Electric Company; Materialise; mediCAD Hectec GmbH; Medtronic; Renishaw Plc.; Stryker; and Zimmer Biomet.

Medtronic is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into cardiovascular portfolio, medical surgical portfolio, neuroscience portfolio, and diabetes operating unit. In April 2022, Medtronic and Cydar Medical collaborated to enhance endovascular aortic care through advanced AI technology, aiming to optimize surgical visualization and patient outcomes globally.

Zimmer Biomet is a global medical device company specializing in healthcare, orthopedics, medical instruments, surgical instruments, medical technology, medical supplies, innovation, medical devices, signature solutions, patient care, dental, spine, robotics, and joint reconstruction. The company’s innovations help to treat disorders or injuries of the joints, bones, and supporting soft tissues. In March 2023, Zimmer Biomet unveiled advancements to ZBEdge Dynamic Intelligence at AAOS 2023, integrating digital, robotic, and implant technologies to enhance surgical precision and patient care in orthopedics.

Key Companies in the Surgical Planning Software Market

- 3D Systems Inc.

- Brainlab AG

- CANON MEDICAL SYSTEMS USA, INC.

- General Electric Company

- Materialise

- mediCAD Hectec GmbH

- Medtronic

- Renishaw Plc.

- Stryker

- Zimmer Biomet.

Surgical Planning Software Market Developments

March 2024: Siemens Healthineers launched the Cinematic Reality app on Apple Vision Pro, which offers immersive holographic views of human anatomy for surgical planning and medical education.

February 2024: Sira Medical achieved FDA 510(k) approval for its AR surgical planning software, which aims to enhance surgical precision and patient outcomes through holographic anatomical models derived from CT and MRI data.

October 2023: Bausch + Lomb unveiled new surgical planning software for the Eyetelligence platform, enhancing surgical efficiency and data integration for ophthalmic procedures.

June 2023: SMAIO obtained FDA 510(k) clearance for its customized surgery planning software developed in collaboration with NuVasive, advancing spine surgery planning capabilities.

Surgical Planning Software Market Segmentation

By Delivery Outlook (Revenue - USD Million, 2020-2034)

- Cloud-based

- On-premises

By Application Outlook (Revenue - USD Million, 2020-2034)

- Orthopedic Surgery

- Neurosurgery

- Dental and Orthodontics

- Others

By End Use Outlook (Revenue - USD Million, 2020-2034)

- Hospitals

- Specialty Clinics

By Regional Outlook (Revenue - USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Planning Software Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 113.92 million |

|

Market Size Value in 2025 |

USD 121.25 million |

|

Revenue Forecast in 2034 |

USD 215.35 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global surgical planning software market size was valued at USD 113.92 million in 2024.

The global market is projected to grow at a CAGR of 6.6% during the forecast period 2025-2034.

North America had the largest share of the global market.

The key players in the market are 3D Systems Inc.; Brainlab AG; CANON MEDICAL SYSTEMS USA, INC.; General Electric Company; Materialise; mediCAD Hectec GmbH; Medtronic; Renishaw Plc.; and Stryker, Zimmer Biomet.

The cloud-based category dominated the market in 2023.

The orthopedic surgery had the largest share of the global market.