Sustainable Refrigeration Technology Market Size, Share, Trends, & Industry Analysis Report

By Type of Component, By Technology (Chemotherapy, Targeted Therapy, Immunotherapy, and Others), By Type of Equipment, Application, End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6102

- Base Year: 2024

- Historical Data: 2020-2023

Overview

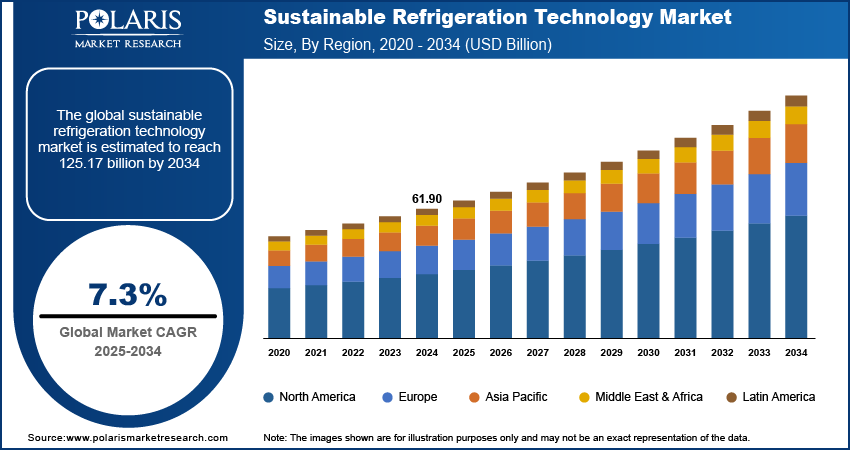

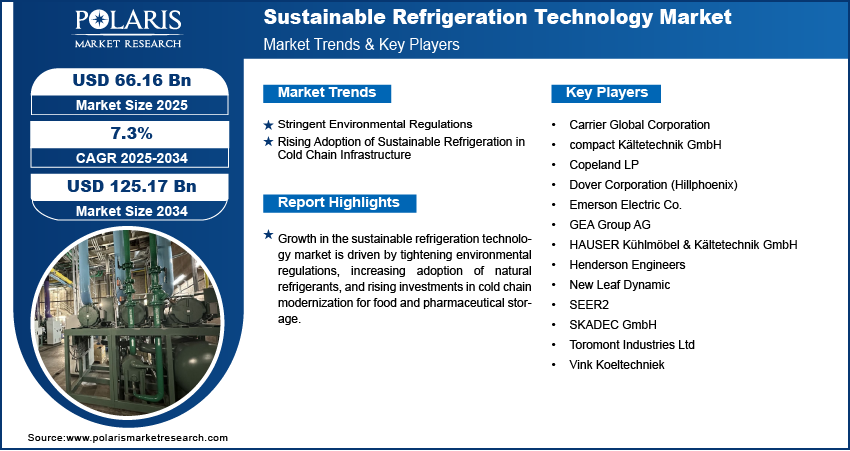

The global sustainable refrigeration technology market size was valued at USD 61.90 billion in 2024, growing at a CAGR of 7.3% from 2025–2034. Stringent environmental regulations and the rising adoption of sustainable refrigeration in cold chain infrastructure are driving the shift toward low-emission and energy-efficient cooling technologies.

Key Insights

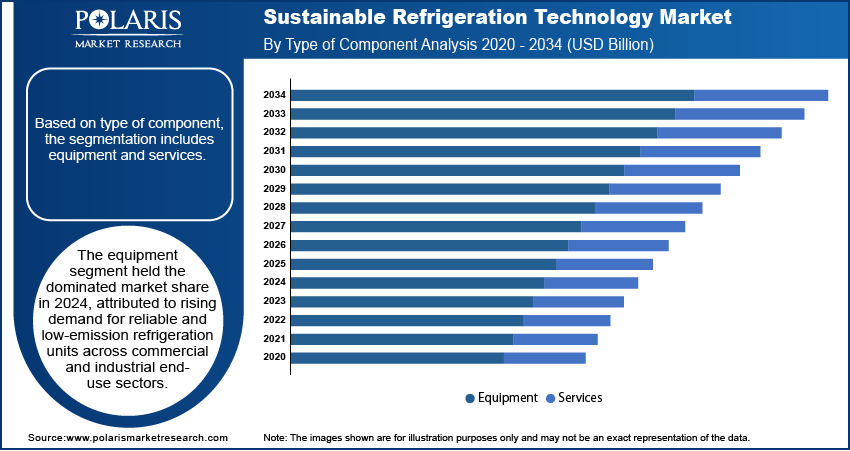

- The equipment segment dominated the sustainable refrigeration technology market share in 2024.

- The services segment is projected to grow at the fastest CAGR, driven by increasing demand for system maintenance, performance optimization, and regulatory compliance support.

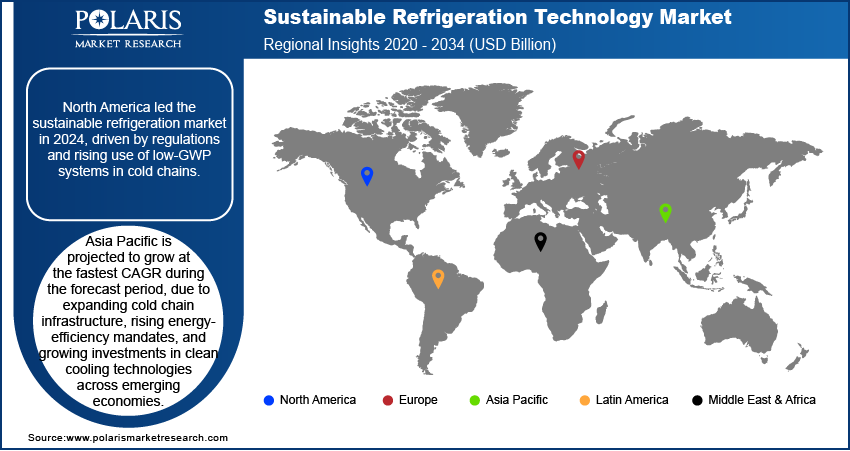

- The North America sustainable refrigeration technology market dominated the global market share in 2024.

- The U.S. sustainable refrigeration technology market held the largest regional share of the North America market in 2024, fueled by early adoption of energy-efficient buildings and strong enforcement of environmental regulations.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to rapid cold chain development and increasing investment in low-emission refrigeration technologies.

- The China market is expanding steadily, driven by government initiatives driving green infrastructure, domestic manufacturing of eco-friendly refrigeration systems, and rising demand in the food and pharmaceutical cold storage sectors.

Market Dynamics

- Stringent environmental regulations aimed at phasing down high-GWP refrigerants are driving the demand for sustainable refrigeration technologies across commercial, industrial, and residential areas.

- Expansion of cold chain infrastructure for food preservation, vaccine distribution, and pharmaceutical logistics is increasing the need for energy-efficient and low-emission refrigeration systems.

- The integration of IoT and smart monitoring systems is expected to create significant opportunities for the market by optimizing refrigeration system efficiency and reducing maintenance costs in the coming years.

- High capital costs for natural refrigerant-based and energy-efficient systems are hindering the adoption of sustainable refrigeration technology for small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 61.90 billion

- 2034 Projected Market Size: USD 125.17 billion

- CAGR (2025-2034): 7.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Sustainable refrigeration technology is witnessing rapid adoption across food retail, healthcare, and logistics sectors due to stricter emission regulations and rising electricity costs. Governments and industry bodies are introducing phase-down programs for high-GWP refrigerants under the Kigali Amendment to reduce climate impact. In December 2024, the U.S. Environmental Protection Agency (EPA) expanded regulatory guidance under the SNAP program, pushing the use of natural refrigerants such as CO₂, ammonia, and hydrocarbons in commercial applications.

Manufacturers are advancing next-generation systems to improve energy efficiency and reduce environmental footprint. CO₂ transcritical systems, inverter-driven compressors, and magnetocaloric refrigeration are integrated across cold storage, supermarkets and last-mile delivery units. These innovations are helping reduce lifecycle emissions and improve operational cost savings. Key companies are investing in modular refrigeration units that support temperature stability and durability in extreme climates. Rapid adoption of sustainable solutions in vaccine storage, perishable goods transport and food processing is further increasing the deployment of eco-friendly cooling systems globally. The shift toward compliant and energy-optimized technologies is transforming industry standards across developed and emerging countries.

The growing focus on improving refrigerant safety, lifecycle efficiency and digital integration is transforming product development in sustainable refrigeration systems. Manufacturers are incorporating smart controllers, health sensors and remote monitoring to enhance system performance and predictive maintenance. These technologies are enabling real-time fault detection, reducing downtime, and accelerating long-term operational efficiency in food retail and logistics. In addition, the introduction of AI-integrated refrigeration platforms is driving the market by enabling energy-efficient and adaptive cooling aligned with sustainable refrigeration practices. For instance, in May 2025, MITAC introduced a sustainable server cooling solution that leverages direct-to-chip and immersion liquid cooling technologies to reduce energy consumption and improve thermal efficiency in AI data centers. This innovation meets the principles of sustainable refrigeration technology by minimizing reliance on traditional refrigerants and enabling low-carbon cooling infrastructure for high-performance computing environments.

Drivers & Opportunities

Stringent Environmental Regulations: Strict environmental regulations are pushing industries to reduce the use of high-GWP refrigerants in commercial and industrial refrigeration systems. According to the Consumer Goods Forum, Refrigeration is a major source of greenhouse gases, with HFCs 1,400 times more potent than CO₂ and projected to contribute up to 9% of global emissions by 2050. Thus, developed and developing countries are rapidly implementing policies under international agreements such as the Kigali Amendment to reduce greenhouse gas emissions. These rules are boosting the adoption of natural and low-impact refrigerants including CO₂, ammonia, and hydrocarbons. In addition, the growing focus on updated safety codes, refrigerant quotas, and mandatory reporting requirements is driving the transition from conventional to sustainable refrigeration systems to ensure regulatory compliance. Regulatory shifts aimed at reducing environmental impact are accelerating the demand for refrigeration technologies that comply with long-term sustainability and emissions reduction goals.

Rising Adoption of Sustainable Refrigeration in Cold Chain Infrastructure: The rising adoption of sustainable refrigeration systems in cold chain infrastructure is driving market growth, as companies seek to enhance energy efficiency and minimize environmental impact. Key sectors such as food storage, pharmaceuticals and vaccine transportation are upgrading their refrigeration networks to meet regulatory standards and reduce carbon emissions. Sustainable technologies are deployed across cold rooms, transport vehicles, and distribution centers to ensure temperature stability, reduce product loss and improve overall system reliability. Additionally, increasing investments by governments and private stakeholders in cold chain development across emerging markets are accelerating the demand for sustainable refrigeration systems for low-emission and energy-efficiency.

Segmental Insights

Type of Component Analysis

Based on type, the segmentation includes equipment and services. The equipment segment dominated the market in 2024, due to the widespread installation of sustainable refrigeration systems across retail, cold storage, and logistics facilities. Increasing demand for natural refrigerant-based units such as CO₂ and ammonia systems is driving equipment replacement in compliance with evolving environmental regulations. High installation rates of display cabinets, chillers, and condensing units in food retail and healthcare storage applications are also contributing to segment growth. Rising adoption across new cold chain infrastructure projects in Asia Pacific and the Middle East is further boosting equipment sales, driven by efficiency mandates and decarbonization initiatives.

The services segment is projected to grow at the fastest CAGR during the forecast period, due to rising demand for maintenance, retrofitting, and performance monitoring of installed systems. Companies are focusing on long-term service contracts and predictive maintenance strategies to optimize energy efficiency and prevent leakage of natural refrigerants. Increased focus on system compliance, technician training, and periodic safety audits is further boosting service-based business models. The growing complexity of sustainable refrigeration technologies and the need for remote monitoring tools are also contributing to the rising demand for value-added services across commercial and industrial sectors.

Technology Analysis

By technology, the segment includes co₂ refrigeration technology, ammonia refrigeration technology, propane refrigeration technology, and other refrigeration technologies. The CO₂ refrigeration technology segment dominated the market in 2024, due to its growing adoption across supermarkets, cold storage warehouses, and food processing units. In July 2023, Advansor introduced two new CO₂-based refrigeration solutions designed to save energy and space in supermarket applications. These systems aim to support climate-friendly operations by enhancing efficiency and reducing the environmental footprint of commercial refrigeration. CO₂ systems offer high thermal performance, low GWP, and strong regulatory acceptance, which makes them suitable for retail chains across Europe and North America. Their proven efficiency in transcritical and subcritical applications is accelerating the replacement of synthetic refrigerants in commercial settings. Government support and technology maturity are enabling wider acceptance of CO₂-based systems in new installations and retrofit projects, driving their dominance in the sustainable refrigeration market.

The ammonia refrigeration technology segment is projected to grow at the fastest CAGR during the forecast period, due to its strong thermal efficiency and zero GWP profile. Industrial cold storage, dairy processing, and beverage manufacturing facilities are rapidly deploying ammonia-based systems to meet operational sustainability targets. Advancements in low-charge ammonia systems and safety-enhanced designs are allowing wider adoption in smaller and urban facilities. Continued innovation in modular system design and energy optimization is further expanding its use in emerging markets, where regulatory standards are met with climate-friendly refrigeration goals.

Type of Equipment Analysis

Based on type of equipment, the segmentation includes a display cabinet, cascades, condensing units, chillers, and other equipment. The display cabinets segment accounted for the highest market share in 2024. This is due to high usage in food retail, convenience stores, and supermarkets. These cabinets are rapidly integrated with CO₂ and hydrocarbon refrigerants to meet energy labeling and eco-design standards. Retailers are replacing conventional cabinets with energy-efficient models that feature natural refrigerants and digital temperature controls. Rising investments in sustainable retail infrastructure and the expansion of cold chains are fueling the demand for modern display equipment. This adoption is strong in Europe and the U.S., where policy mandates require the phase-out of high-GWP refrigerants in visible cooling applications.

The chillers segment is expected to grow at the fastest CAGR during the forecast period, driven by expanding usage in industrial refrigeration, HVAC applications, and healthcare storage. Natural refrigerant-based chillers are deployed in pharmaceutical production, hospitals, and vaccine storage facilities to maintain temperature reliability with low environmental impact. New-generation chillers are equipped with variable-speed compressors, smart controllers, and energy recovery features, making them suitable for high-performance applications. This trend is further fueled by government programs promoting clean cooling solutions and the rising need for scalable and durable systems in tropical climates.

Application Analysis

Based on application, the segmentation includes refrigerators & freezers, air conditioners & HVAC systems, cold chain logistics, chillers & cooling units, vaccine & medical storage, data center cooling, and other applications. The cold chain logistics segment dominated the market in 2024, due to growing investments in temperature-sensitive transportation and storage systems. Food, pharmaceutical, and agricultural supply chains are reliant on energy-efficient refrigeration to reduce spoilage and comply with global quality standards. Sustainable units are deployed in cold rooms, refrigerated trucks, and containers to support the growing volume of perishable goods in global trade. Strong policy support for cold chain expansion in Asia Pacific and Africa is further increasing the demand for reliable and eco-friendly refrigeration technologies in storage and transit applications.

The vaccine and medical storage segment is projected to grow at the fastest CAGR during the forecast period, due to expanding global vaccination programs and healthcare infrastructure upgrades. Sustainable refrigeration systems are installed in clinics, hospitals, and diagnostic labs to store vaccines and biologicals under precise temperature conditions. These systems offer stable cooling performance while using low-GWP refrigerants that meet pharmaceutical safety standards. Growth is further propelled by international health initiatives, including the WHO’s push for green cold chains and increasing funding for reliable refrigeration in underserved regions.

End User Analysis

By end user, this segment includes residential, commercial, and industrial. The commercial segment dominated the market in 2024, due to strong adoption in supermarkets, food service outlets, and retail chains. Businesses are investing in sustainable refrigeration systems to meet corporate sustainability targets and reduce operating costs. CO₂ and hydrocarbon systems are widely deployed in display cabinets, walk-in coolers, and storage rooms. The segment is also benefiting from government regulations that mandate the transition away from high-GWP refrigerants in commercial buildings. Retail expansions across urban centers and increasing demand for energy-labeled cooling systems are further driving adoption in this segment.

The industrial segment is projected to grow at the fastest CAGR during the forecast period due to rising demand from cold storage, food processing, and pharmaceutical manufacturing facilities. Large-scale refrigeration systems using ammonia and CO₂ are adopted to enhance cooling efficiency while maintaining regulatory compliance. Industries are focusing on long-term energy savings, reduced emissions, and automated monitoring to improve system performance. The growth of food exports, industrial cold chain projects, and clean energy initiatives is accelerating the shift toward advanced sustainable systems in large industrial applications.

Regional Analysis

North America sustainable refrigeration technology market dominated the global market in 2024. This is driven by the implementation of low-GWP refrigerant regulations under the U.S. Environmental Protection Agency (EPA) SNAP program is driving the adoption of sustainable refrigeration systems across commercial and industrial facilities. Moreover, rising investments in upgrading cold storage infrastructure for pharmaceutical and food logistics are further fueling the demand for energy-efficient and environmentally compliant technologies.

The US Sustainable Refrigeration Technology Market Insight

The US held dominating market share in North America sustainable refrigeration technology landscape in 2024, driven by the regulatory actions under the EPA’s SNAP program are driving the phase-down of high-GWP refrigerants across refrigeration systems in food retail, cold storage, and healthcare applications. Moreover, strong public and private investment in energy-efficient refrigeration technologies is accelerating system upgrades across supermarkets and logistics centers to reduce operating costs and comply with climate policies. For instance, in October 2024, Hillphoenix introduced a new sustainable refrigeration solution designed to lower greenhouse gas emissions and improve energy efficiency in commercial refrigeration. The system features advanced technologies that align with evolving environmental regulations and sustainability goals across the retail sector.

Asia Pacific Sustainable Refrigeration Technology Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is witnessed due to the rapid development of food and pharmaceutical cold chain infrastructure in countries such as China, India and others. In addition, growing government initiatives focusing on energy-efficient systems and emission control are boosting local manufacturers and logistics providers to adopt natural refrigerant-based systems. Furthermore, the establishment of a CO₂ training centre to support the adoption of sustainable refrigeration systems is driving market growth in the region. In November 2024, Epta opened a CO₂ training centre in the Philippines to promote the adoption of natural refrigeration technologies across the Asia Pacific region. This initiative aims to build local expertise and accelerate the transition to environmentally sustainable cooling solutions.

China Sustainable Refrigeration Technology Market Overview

The market in China is expanding due to the large-scale investments in cold chain logistics for food preservation and vaccine distribution are increasing the demand for sustainable refrigeration technologies. In addition, government programs such as the National Green Cooling Action Plan are promoting the use of natural refrigerants and energy-efficient systems across industrial and commercial applications, driving market expansion.

Europe Sustainable Refrigeration Technology Market

The sustainable refrigeration technology landscape in Europe is projected to hold a substantial share in 2034. This is owing to the implementation of the F-Gas Regulation, and carbon reduction targets is accelerating the replacement of high-GWP refrigerants with CO₂ and hydrocarbon-based refrigeration systems. As per the European Commission, the LIFE programme is promoting sustainable refrigeration by funding projects that develop energy-efficient cooling solutions using natural refrigerants, helping reduce emissions and support EU climate goals. Furthermore, increasing large-scale investments in supermarket and retail upgrades are driving the adoption of sustainable equipment that meets EU energy efficiency and environmental compliance standards.

Key Players & Competitive Analysis Report

The sustainable refrigeration technology is moderately competitive, with key players focusing on expanding their product portfolios through natural refrigerant systems, smart controls and energy-efficient components. The prominent companies are engaged in partnerships, regulatory compliance and innovation in low-GWP technologies to strengthen their market position. In addition, rising investments in cold chain infrastructure and growing demand from food retail and pharmaceutical sectors are boosting collaborations across equipment manufacturers and service providers, fueling long-term growth and competitiveness in the global sustainable refrigeration landscape.

Major companies operating in the sustainable refrigeration technology industry include Carrier Global Corporation, SEER2, Copeland LP, Dover Corporation (Hillphoenix), Henderson Engineers, New Leaf Dynamic, Toromont Industries Ltd, GEA Group AG, Emerson Electric Co., compact Kältetechnik GmbH, HAUSER Kühlmöbel & Kältetechnik GmbH, Vink Koeltechniek, and SKADEC GmbH.

Key Players

- Carrier Global Corporation

- compact Kältetechnik GmbH

- Copeland LP

- Dover Corporation (Hillphoenix)

- Emerson Electric Co.

- GEA Group AG

- HAUSER Kühlmöbel & Kältetechnik GmbH

- Henderson Engineers

- New Leaf Dynamic

- SEER2

- SKADEC GmbH

- Toromont Industries Ltd

- Vink Koeltechniek

Industry Developments

- July 2025: Pro Refrigeration launched the PROGreen50 system, a sustainable cooling solution designed to significantly reduce greenhouse gas emissions by replacing synthetic refrigerants with natural alternatives. This system incorporates IoT-enabled monitoring for improved energy efficiency and real-time performance optimization.

Sustainable Refrigeration Technology Market Segmentation

By Type of Component Outlook (Revenue, USD Billion, 2020–2034)

- Equipment

- Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- CO₂ Refrigeration Technology

- Ammonia Refrigeration Technology

- Propane Refrigeration Technology

- Other Refrigeration Technologies

By Type of Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Display Cabinets

- Cascades

- Condensing Units

- Chillers

- Other Equipment

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Refrigerators & freezers

- Air conditioners & HVAC systems

- Cold chain logistics

- Chillers & cooling units

- Vaccine & medical storage

- Data center cooling

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sustainable Refrigeration Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 61.90 Billion |

|

Market Size in 2025 |

USD 66.16 Billion |

|

Revenue Forecast by 2034 |

USD 125.17 Billion |

|

CAGR |

7.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 61.90 billion in 2024 and is projected to grow to USD 125.17 billion by 2034.

The global market is projected to register a CAGR of 7.3% during the forecast period.

North America dominated the market in 2024, driven by strict refrigerant regulations and increasing deployment of energy-efficient systems across commercial and industrial refrigeration applications.

A few of the key players in the market are Carrier Global Corporation, SEER2, Copeland LP, Dover Corporation (Hillphoenix), Henderson Engineers, New Leaf Dynamic, Toromont Industries Ltd, GEA Group AG, Emerson Electric Co., compact Kältetechnik GmbH, HAUSER Kühlmöbel & Kältetechnik GmbH, Vink Koeltechniek, and SKADEC GmbH.

The equipment segment dominated the market in 2024, driven by widespread adoption of sustainable systems across supermarkets, cold chain logistics, and healthcare storage infrastructure.

The industrial segment is projected to grow at the fastest CAGR, due to increasing demand for high-performance refrigeration in food processing, pharmaceutical manufacturing, and large-scale cold storage facilities.