Metal Screw Fasteners Market Size, Share, Trends, Industry Analysis Report

By Material (Stainless Steel, Carbon Steel, Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6097

- Base Year: 2024

- Historical Data: 2020-2023

Overview

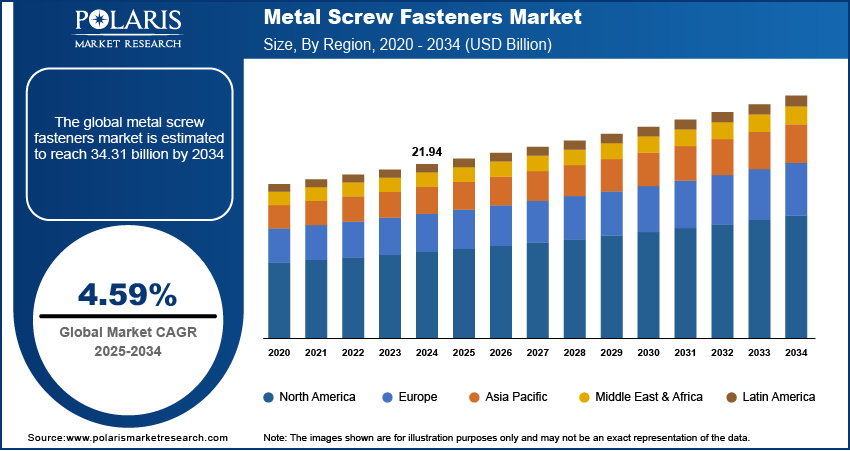

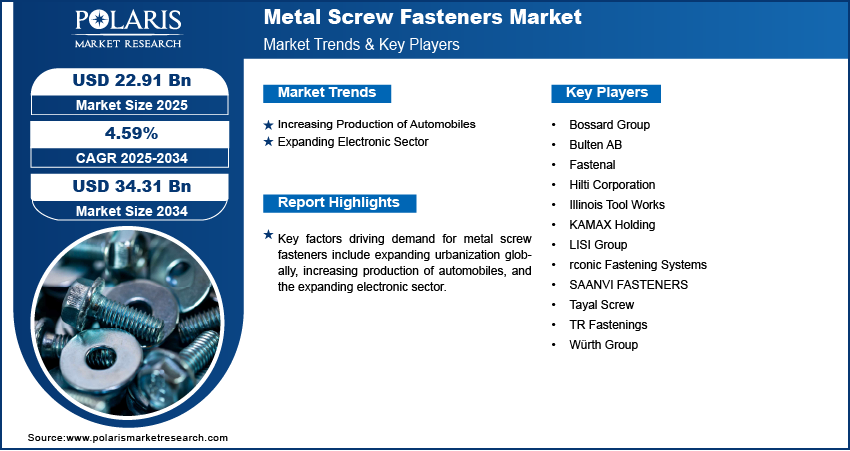

The global metal screw fasteners market size was valued at USD 21.94 billion in 2024, growing at a CAGR of 4.59% from 2025 to 2034. Key factors driving demand for metal screw fasteners include expanding urbanization globally, increasing production of automobiles, and the growing electronic sector.

Key Insights

- The stainless steel segment dominated the revenue share in 2024.

- The automotive segment held 28.85% revenue share in 2024.

- Asia Pacific accounted for a 38.15% share of the global metal screw fasteners market revenue in 2024.

- China held the largest revenue share in Asia Pacific in 2024 due to booming automotive, electronics, and machinery sectors.

- The market in North America is projected to hold a substantial share by 2034 due to the growing construction, aerospace, and automotive industries.

- The markets in the U.S. and Canada are witnessing an increase in infrastructure spending, including residential and commercial construction, which drives fastener demand.

Industry Dynamics

- The increasing production of automobiles is driving market growth, as automakers utilize metal screw fasteners extensively in engines, chassis, and electronic systems to ensure structural strength, safety, and optimal performance.

- The expanding electronic sector is propelling the demand as electronic manufacturers rely on metal screw fasteners to assemble smartphones, laptops, televisions, servers, and other electronic equipment with accuracy and stability.

- The expanding construction sector in emerging nations is expected to create a lucrative opportunity for the market during the forecast period.

- Volatility in raw material costs hampers the market revenue.

Market Statistics

- 2024 Market Size: USD 21.94 Billion

- 2034 Projected Market Size: USD 34.31 Billion

- CAGR (2025–2034): 4.59%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Metal screw fasteners serve as crucial components in various applications across industries due to their ability to join two or more objects with precision and durability. These fasteners feature a helical ridge, known as the thread, that wraps around a cylindrical shaft, enabling them to grip objects or products when rotated. Manufacturers produce them using metals such as stainless steel, carbon steel, brass, and aluminum to ensure strength, corrosion resistance, and long-lasting performance. Screw fasteners can easily be removed and reused without damaging the product or object, making them ideal for applications requiring disassembly or maintenance.

Engineers and designers prefer metal screw fasteners as they provide a strong clamping force and resist loosening under vibration. Various types of screw fasteners exist to suit specific needs, including machine screws, self-tapping screws, wood screws, sheet metal screws, and socket head cap screws. Each type features different head designs, such as flat, pan, hex, or round.

Manufacturers of machinery and equipment use screw fasteners extensively to assemble components such as gearboxes, motors, pumps, and control panels. These fasteners allow easy disassembly during repair, reducing downtime and improving serviceability. The furniture industry benefits from the use of wood screws and confirmat screws as users can assemble or reassemble products with minimal effort.

The global metal screw fastener demand is driven by expanding urbanization globally. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. This increase in urbanization is driving developers and contractors to build more residential complexes, commercial buildings, and transportation networks, all of which require durable fastening solutions for structural integrity. Manufacturers also ramp up production of appliances, vehicles, and machinery to meet the rising needs of urban populations, further increasing the consumption of metal screw fasteners. Additionally, urban infrastructure projects such as bridges, rail systems, and energy grids rely on metal fasteners to ensure safety and long-term stability. Therefore, the expanding urbanization is fueling the need for metal screw fasteners.

Drivers and Opportunities

Increasing Production of Automobiles: Automobile manufacturers are expanding the production lines of automobiles to meet the rising global demand. This is leading to higher consumption of metal screw fasteners across various stages of manufacturing as automakers use these fasteners extensively in engines, chassis, interiors, and electronic systems to ensure structural strength, safety, and performance. European Automobile Manufacturers' Association stated that in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Additionally, the shift toward electric vehicles is adding complexity to vehicle designs, which is creating need for more specialized metal screw fasteners for battery packs and electronic modules.

Expanding Electronic Sector: Electronic manufacturers rely on metal screw fasteners to assemble smartphones, laptops, televisions, servers, and other electronic equipment with accuracy and stability. The miniaturization of electronics is further boosting the demand for tiny, high-quality screws to secure compact components, while the growing production of servers and data centers is increasing the adoption of screw fasteners in rack mounting and hardware installations. Additionally, frequent product upgrades and shorter device lifecycles ensure continuous demand, as electronics manufacturers constantly source metal screw fasteners for new models and repairs. As the electronics sector is growing across the world, the market under study is expected to grow during the forecast period.

Segmental Insights

Material Analysis

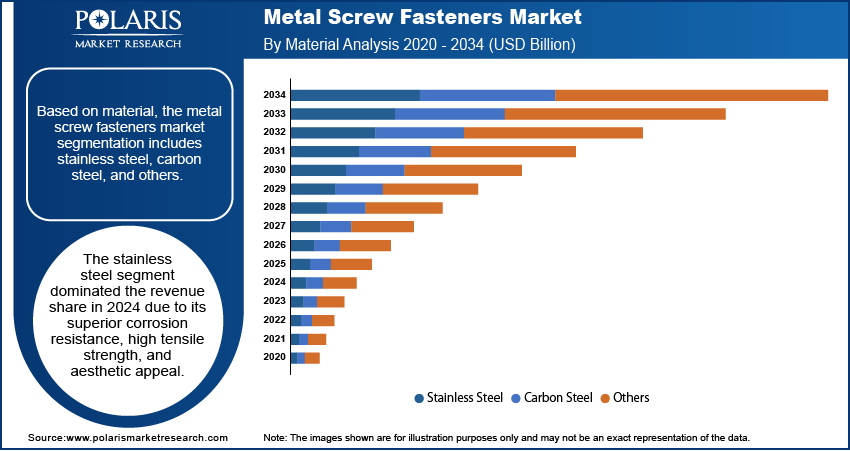

Based on material, the segmentation includes stainless steel, carbon steel, and others. The stainless steel segment dominated the revenue share in 2024 due to its superior corrosion resistance, high tensile strength, and aesthetic appeal. Manufacturers across the automotive, construction, and marine sectors preferred stainless steel for its durability and ability to withstand harsh environmental conditions. The rapid expansion of infrastructure projects and the surge in demand for long-lasting fastening solutions in coastal and high-humidity regions drove significant adoption. Moreover, the rising implementation of stainless steel in medical devices and food processing equipment further boosted its market share. OEMs and industrial assemblers consistently selected stainless steel fasteners to meet stringent regulatory and quality standards, especially in developed economies with mature industrial bases.

The carbon steel segment is projected to grow at a robust pace in the coming years, owing to its cost-effectiveness, mechanical versatility, and increasing use in mass-produced machinery and equipment. The ongoing growth of the heavy machinery, transportation, and industrial equipment sectors is expected to further propel demand in the coming years. Additionally, advancements in coatings and surface treatment technologies are improving the corrosion resistance of carbon steel, allowing it to compete with more expensive materials in demanding environments.

End Use Analysis

In terms of end use, the segmentation includes automotive, construction, machinery & equipment, electrical & electronics, and others. The automotive segment held 28.85% revenue share in 2024, due to rising vehicle production and the increasing integration of lightweight components in modern vehicle designs. Automakers relied heavily on high-performance fasteners to ensure the structural integrity, safety, and durability of critical systems, including engines, transmissions, chassis, and interior assemblies. The surge in electric vehicle (EV) manufacturing further boosted demand, as EVs require specialized fasteners with high precision and conductivity.

The construction segment is estimated to grow at the fastest pace in the coming years, owing to the rising infrastructure development and urbanization. Rapid growth in residential and commercial building projects, particularly in Asia Pacific and the Middle East, continues to fuel demand for reliable fastening solutions that support heavy loads and resist environmental stress. Government investments in smart cities and transportation infrastructure, along with rising high-rise construction activity, are creating opportunities for fasteners with enhanced corrosion resistance and mechanical strength. Furthermore, the increased adoption of prefabricated building components and modular construction methods demands metal screw fasteners for faster assembly and long-term stability.

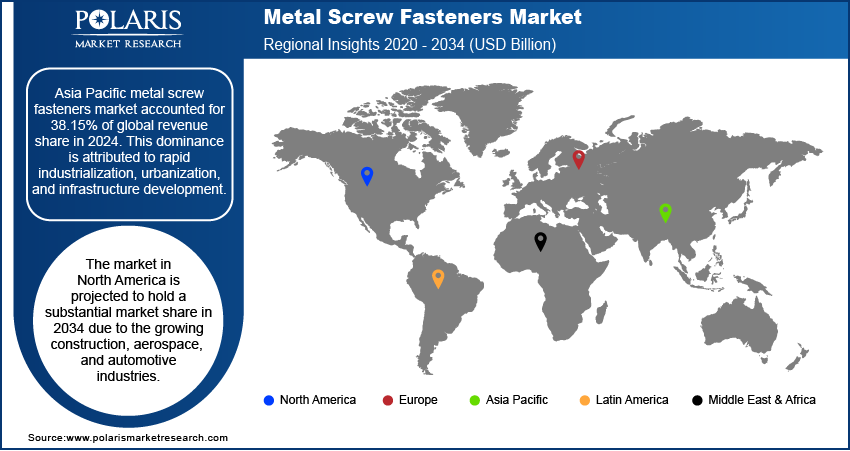

Regional Analysis

The Asia Pacific metal screw fasteners market accounted for 38.15% of global revenue share in 2024. This dominance is attributed to rapid industrialization, urbanization, and infrastructure development. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. Countries such as India, Japan, and Southeast Asian nations witnessed growth in construction, automotive, and electronics manufacturing, which rely heavily on metal screw fasteners. Additionally, the expansion of renewable energy projects, such as wind and solar power installations, and increasing investments in transportation infrastructure further propelled metal screw fasteners. The region’s cost-competitive manufacturing capabilities also make it a key supplier for global markets.

China Metal Screw Fasteners Market Insights

China held the largest revenue share in the Asia Pacific metal screw fasteners landscape in 2024 due to booming automotive, electronics, and machinery sectors. Government initiatives, such as Made in China 2025, and investments in high-speed rail, smart cities, and 5G infrastructure, fueled fastener consumption. Additionally, China’s export-oriented manufacturing sector ensures steady demand, as it supplies metal screw fasteners to North America, Europe, and other regions.

North America Metal Screw Fasteners Market Trends

The market in North America is projected to hold a substantial market share in 2034 due to the growing construction, aerospace, and automotive industries. The U.S. and Canada are witnessing an increase in infrastructure spending, including residential and commercial construction, which drives fastener demand. The giant aerospace sector, particularly in the U.S., requires metal screw fasteners for aircraft manufacturing. Additionally, the shift toward electric vehicles (EVs) and automation in manufacturing is creating new demand for specialized metal screw fasteners in North America. Based on Transport Canada’s analysis of data acquired from S&P Global Mobility, zero-emission vehicles (ZEVs) reached 11.7% market share of light-duty vehicle sales in Canada in 2023, up from 8.9% in 2022.

U.S. Metal Screw Fasteners Market Overview

The U.S., as the largest economy in North America, is a key region for metal screw fasteners due to its advanced manufacturing, automotive, and construction sectors. The Biden administration’s infrastructure bill has spurred demand for fasteners in road, bridge, and energy projects. The automotive industry’s transition to EVs and lightweight materials also requires innovative fastening solutions. Furthermore, the presence of giant defense and aerospace industries, supported by companies such as Boeing and Lockheed Martin, is contributing to the demand for metal screw fasteners.

Europe Metal Screw Fasteners Market Outlook

In Europe, stringent regulations on sustainability and energy efficiency are driving demand for high-quality metal screw fasteners. The region’s strong automotive industry, particularly in Germany and France, relies on precision fasteners for both traditional and electric vehicles. The construction sector is also propelling the demand for metal screw fasteners, with green building initiatives and renovation projects under the EU’s Green Deal. Additionally, Europe’s aerospace and machinery manufacturing sectors are contributing to demand for specialized fasteners, supported by companies such as Airbus and Siemens.

Key Players and Competitive Analysis Report

The global metal screw fasteners market is highly competitive, characterized by the presence of established multinational corporations, regional players, and niche manufacturers. Major companies such as Würth Group, Fastenal, and Bossard Group dominate the market with extensive distribution networks, strong brand recognition, and diversified product portfolios catering to industries such as automotive, aerospace, construction, and industrial machinery. These players focus on innovation, offering high-performance fasteners with advanced materials and coatings to enhance durability and corrosion resistance. Illinois Tool Works (ITW) and Hilti Corporation leverage their engineering expertise to provide specialized fastening solutions, gaining a competitive edge in high-demand sectors. Meanwhile, Bulten AB and KAMAX Holding emphasize precision manufacturing, particularly for automotive applications, where lightweight and high-strength fasteners are critical.

A few major companies operating in the metal screw fasteners industry include Bossard Group, Bulten AB, Fastenal, Hilti Corporation, Illinois Tool Works, KAMAX Holding, LISI Group, TR Fastenings, and Würth Group.

Key Players

- Bossard Group

- Bulten AB

- Fastenal

- Hilti Corporation

- Illinois Tool Works

- KAMAX Holding

- LISI Group

- SAANVI FASTENERS

- Tayal Screw

- TR Fastenings

- Würth Group

Industry Developments

January 2025, Bossard Group completed the acquisition of the German Ferdinand Gross Group, a distributor of fastening technology in Germany.

December 2024, Bulten AB, a global manufacturer and supplier of fasteners, and ZJK Vietnam Precision Components Co., Ltd, signed a letter of intent to establish operations in Vietnam through a joint venture.

Metal Screw Fasteners Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Stainless Steel

- Carbon Steel

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Construction

- Machinery & Equipment

- Electrical & Electronics

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Metal Screw Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.94 Billion |

|

Market Size in 2025 |

USD 22.91 Billion |

|

Revenue Forecast by 2034 |

USD 34.31 Billion |

|

CAGR |

4.59% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.94 billion in 2024 and is projected to grow to USD 34.31 billion by 2034.

The global market is projected to register a CAGR of 4.59% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Bossard Group, Bulten AB, Fastenal, Hilti Corporation, Illinois Tool Works, KAMAX Holding, LISI Group, TR Fastenings, and Würth Group.

The stainless steel segment dominated the market revenue share in 2024.

The construction segment is projected to witness the fastest growth during the forecast period.