CBD Pouches Market Size, Share, Trends, Industry Analysis Report

By Content (up to 10 mg, 10 mg–20 mg), By Type (Flavored, Unflavored), By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6091

- Base Year: 2024

- Historical Data: 2020-2023

Overview

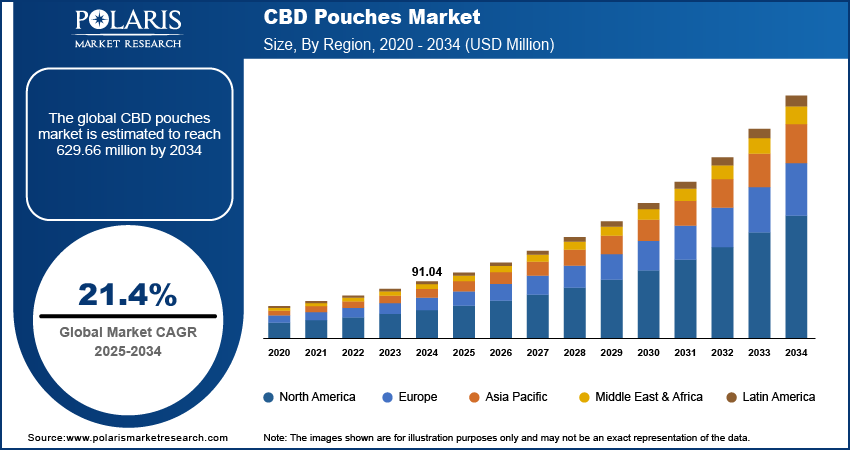

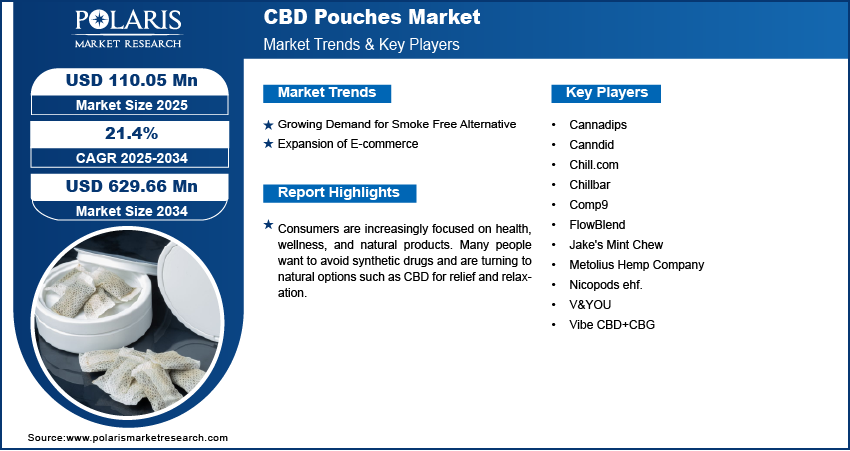

The global CBD pouches market size was valued at USD 91.04 million in 2024, growing at a CAGR of 21.4% from 2025 to 2034. The market growth is driven by growing demand for smoke-free alternatives and the rising penetration of e-commerce platforms.

Key Insights

- In 2024, the 10 mg–20 mg segment dominated with the largest share as this strength level offers a balanced experience, which is strong enough for noticeable effects but not overwhelming for everyday use.

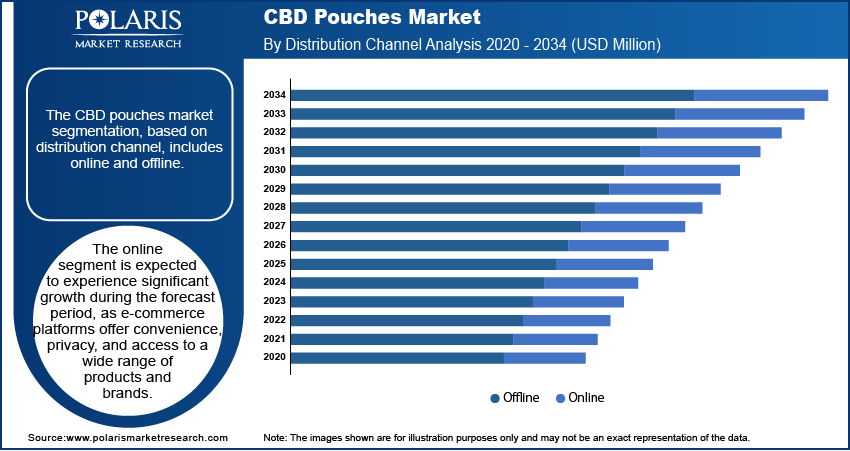

- The online segment is expected to experience significant growth during the forecast period, as e-commerce platforms offer convenience, privacy, and access to a wide range of products and brands.

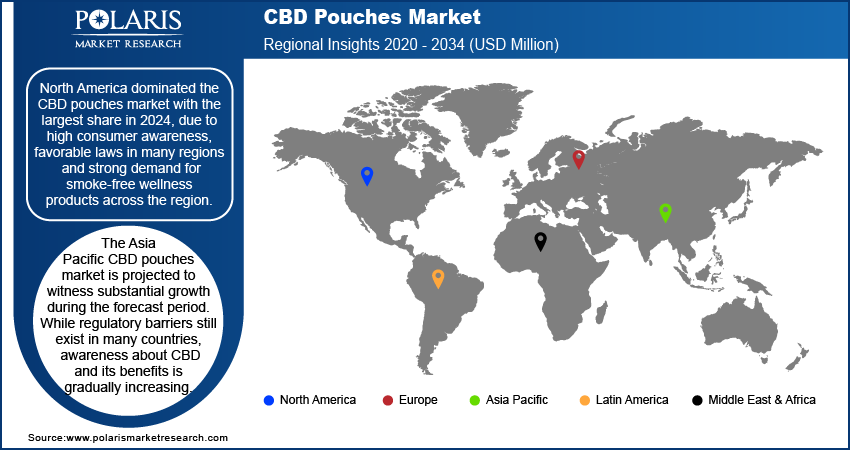

- The market in North America dominated with the largest share in 2024. High consumer awareness, favorable laws in many regions, and strong demand for smoke-free wellness products have driven growth.

- The industry in the U.S. is expected to witness significant growth during the forecast period, due to its early legalization trends, advanced product development, and strong consumer demand.

- The Asia Pacific industry is projected to witness substantial growth during the forecast period. While regulatory barriers still exist in many countries, awareness about CBD and its benefits is gradually increasing.

Industry Dynamics

- Growing demand for smoke-free alternatives drives the adoption of CBD pouches.

- Expansion of e-commerce platforms is fueling the industry growth by boosting product accessibility.

- The rising focus on health, wellness, and natural products is fueling the demand.

- Regulatory barrier in some countries restrains the growth in emerging regions.

Market Statistics

- 2024 Market Size: USD 91.04 million

- 2034 Projected Market Size: USD 629.66 million

- CAGR (2025–2034): 21.4%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

CBD pouches are small, smokeless, and tobacco-free sachets infused with cannabidiol (CBD), designed to be placed between the gum and lip for discreet oral absorption. They offer a convenient and mess-free way to consume CBD without vaping, smoking, or ingesting oils. Popular among wellness-focused consumers, CBD pouches are used for relaxation, focus, or stress relief.

CBD pouches are popular because they are easy to use and can be taken anywhere. There is no need to measure doses or carry bulky items. This makes them perfect for people with busy lifestyles or those who want to use CBD in public places without drawing attention. Unlike vaping or using oils, CBD pouches don’t produce odor or require any equipment. Their portability and discreet use make them highly attractive to both new and experienced users, helping to expand the customer base, thereby driving the growth.

Consumers are increasingly focused on health, wellness, and natural products. Many people want to avoid synthetic drugs and are turning to natural options such as CBD for relief and relaxation. CBD pouches fit into this lifestyle by offering a simple, plant-based way to support mental and physical wellness. They appeal to people looking for stress relief, better focus, or a sense of calm without harsh side effects. More individuals are including CBD pouches in their daily routines as the wellness trend grows globally, helping to drive steady demand in this segment of the CBD industry.

Drivers and Opportunities

Growing Demand for Smoke-Free Alternatives: Many consumers are seeking alternatives to smoking or vaping due to health concerns. CBD pouches offer a clean and smokeless way to enjoy the benefits of CBD without inhaling anything. Unlike traditional products such as cigarettes or vapes, these pouches are used by simply placing them in the mouth, making them more appealing to health-conscious users. The convenience and discreet nature of CBD pouches have further made them popular among working professionals and travelers. More consumers are turning to CBD pouches as a healthier and safer choice as awareness of smoke-free products grows, thereby fueling the demand for CBD pouches.

Expansion of E-commerce: The growth of online shopping has made it easier than ever for people to buy CBD pouches from the comfort of their homes. According to Eurostat, in 2023, B2C e-commerce turnover was USD 1,036.65 billion (EUR 887 billion). Online retail platforms allow consumers to explore different brands, compare prices, read reviews, and have products delivered directly to their door. This convenience is especially important in regions where local retail stores do not carry a wide selection of CBD products. Additionally, online shopping further helps brands reach a larger audience without the high cost of physical stores. The availability and visibility of CBD pouches are growing as more people shop online for wellness products, supporting the expansion.

Segmental Insights

Content Analysis

The segmentation, based on content, includes up to 10 mg, 10 mg–20 mg, and others. In 2024, the 10 mg–20 mg segment dominated with the largest share as this strength level offers a balanced experience that is strong enough for noticeable effects but not overwhelming for everyday use. It appeals to both regular users and those managing stress or mild discomfort. The 10–20 mg range is widely seen as effective for daily wellness routines, which has made it the most preferred option among consumers. Many popular brands focus on this content level to meet broad customer demand, thereby boosting the segment growth.

The up to 10 mg segment is expected to experience significant growth during the forecast period as these lower-dose pouches are ideal for beginners, casual users, or those who prefer lighter effects during the day. The demand for mild, entry-level products is increasing as more people become open to trying CBD. They allow users to test CBD’s effects without committing to a higher dosage. Additionally, many wellness-focused consumers choose smaller doses for microdosing throughout the day, thereby driving the segment growth.

Type Analysis

The segmentation, based on type, includes flavored, unflavored. The unflavored segment is expected to experience significant growth during the forecast period as health-conscious consumers seek clean and simple products. Without added flavors or sweeteners, unflavored pouches appeal to users looking for a natural experience. They are further preferred by people who may be sensitive to artificial ingredients or who simply don’t like strong flavors. More customers are focusing on product transparency and ingredient quality as the market matures. This trend is expected to push demand for unflavored CBD pouches, especially among experienced users and those using CBD as part of a wellness or health regimen.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online and offline. The online segment is expected to experience significant growth during the forecast period, as e-commerce platforms offer convenience, privacy, and access to a wide range of products and brands. Consumers easily read reviews, compare prices, and receive products at home making online shopping the preferred choice for many. This is especially important in areas where CBD products are not widely available in stores. The digital space further allows brands to market directly to customers, offer subscriptions, and build loyal communities. This channel continues to expand rapidly as internet usage grows and consumers become more comfortable buying wellness products online.

Regional Analysis

North America CBD Pouches Market Trends

The market in North America dominated with the largest share in 2024, due to high consumer awareness, favorable laws in many regions, and strong demand for smoke-free wellness products. Many well-established CBD brands are based in North America, offering a wide variety of pouch options to health-conscious users. The presence of a mature cannabis industry has further supported CBD products gain mainstream acceptance. CBD pouches are becoming a popular daily-use item with increasing interest in natural stress relief and convenient formats, thereby driving the growth.

U.S. CBD Pouches Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, due to its early legalization trends, advanced product development, and strong consumer demand. Americans are increasingly choosing CBD pouches as a convenient, discreet, and tobacco-free alternative to smoking and vaping. The variety of flavors, strengths, and clean-label products appeal to a broad audience. Many local brands are expanding their online presence, making CBD pouches widely accessible. Additionally, regulatory clarity around hemp-derived CBD has encouraged market entry.

Asia Pacific CBD Pouches Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period. While regulatory barriers still exist in many countries, awareness about CBD and its benefits is gradually increasing. Young consumers and health-conscious individuals are showing interest in alternative wellness products such as CBD pouches. Countries such as Japan, South Korea, and Thailand are taking steps toward loosening CBD regulations, which could create new opportunities in the coming years. Moreover, online platforms and international brands are helping introduce CBD products to new users. As laws evolve and awareness spreads, Asia Pacific is expected to become a key growth region.

Europe CBD Pouches Market Insights

The industry in Europe is expected to experience rapid growth in the future, driven by increasing consumer interest in natural wellness products and gradual regulatory acceptance across many countries. Countries such as the UK, Sweden, and the Netherlands are more open to CBD usage, helping to drive regional demand. European consumers value high-quality, safe, and plant-based alternatives to tobacco and nicotine, making CBD pouches a strong fit. While rules on CBD still vary by country, the overall trend is moving toward wider acceptance, thereby fueling market growth in the region.

Germany CBD Pouches Market Outlook

The market in Germany is expected to experience significant growth due to its strong economy, health-focused population, and growing interest in non-traditional wellness products. While the country maintains strict regulations on CBD, hemp-derived, THC-free products such as pouches are gaining attention. German consumers prefer products that are safe, lab-tested, and free from nicotine or additives. The rise of e-commerce and specialty wellness retailers is making it easier for people to explore CBD options, including pouches.

Key Players and Competitive Analysis

The industry is growing rapidly, with several brands competing to offer smokeless, discreet, and convenient alternatives to traditional tobacco products. Cannadips remains a pioneer and leader, known for its wide flavor range and strong brand presence. Canndid, Vibe CBD+CBG, and FlowBlend offer pouches with varying cannabinoid profiles, targeting wellness-oriented users. Jake's Mint Chew and Metolius Hemp Company emphasize natural ingredients and are favored by consumers seeking tobacco-free, plant-based options. Chill.com and Chillbar leverage lifestyle branding to appeal to younger, trend-conscious users, while Comp9 focuses on premium CBD extraction methods for enhanced efficacy. V&YOU and Nicopods ehf., with roots in nicotine pouch innovation, are diversifying into CBD products to tap into a broader market. Overall, the competitive landscape is characterized by innovation in flavor, cannabinoid content, and form factor, with players aiming to differentiate through quality, branding, and health-conscious positioning in an evolving regulatory environment.

Key Players

- Cannadips

- Canndid

- Chill.com

- Chillbar

- Comp9

- FlowBlend

- Jake's Mint Chew

- Metolius Hemp Company

- Nicopods ehf.

- V&YOU

- Vibe CBD+CBG

CBD Pouches Industry Development

In February 2023, Cannadips Europe partnered with Haypp Group to launch its Terpene Pouch Collection. The product became available on snusbolaget.se from February 13, 2023, targeting users seeking healthier, cannabis-free pouch options.

CBD Pouches Market Segmentation

By Content Outlook (Revenue, USD Million, 2020–2034)

- Up to 10 mg

- 10 mg–20 mg

- Others

By Type Outlook (Revenue, USD Million, 2020–2034)

- Flavored

- Unflavored

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Offline

- Online

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

CBD Pouches Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 91.04 Million |

|

Market Size in 2025 |

USD 110.05 Million |

|

Revenue Forecast by 2034 |

USD 629.66 Million |

|

CAGR |

21.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 91.04 million in 2024 and is projected to grow to USD 629.66 million by 2034.

The global market is projected to register a CAGR of 21.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Cannadips, Canndid, Chill.com, Chillbar, Comp9, FlowBlend, Jake's Mint Chew, Metolius Hemp Company, Nicopods ehf., V&YOU, and Vibe CBD+CBG.

The 10 mg–20 mg segment dominated the market share in 2024.

The online segment is expected to witness the significant growth during the forecast period.