Recycled Polyolefin Market Size, Share, Trends, Industry Analysis Report

By Product Type [Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE)], By Source, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6095

- Base Year: 2024

- Historical Data: 2020-2023

Overview

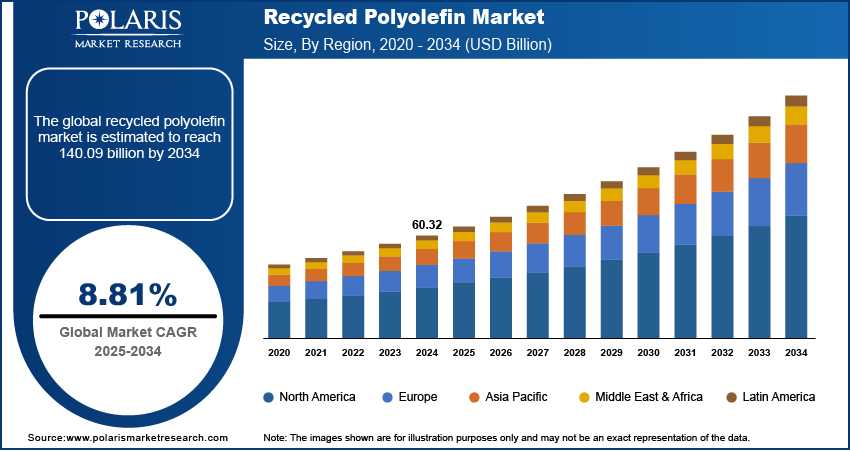

The global recycled polyolefin market size was valued at USD 60.32 billion in 2024, growing at a CAGR of 8.81% from 2025 to 2034. The growing demand for recycled polyolefin is fueled by the rapid expansion of end-use industries such as packaging and automotive, continuous advancements in recycling technologies that enhance material quality and process efficiency, and increasing consumer preference for sustainable and eco-friendly products.

Key Insights

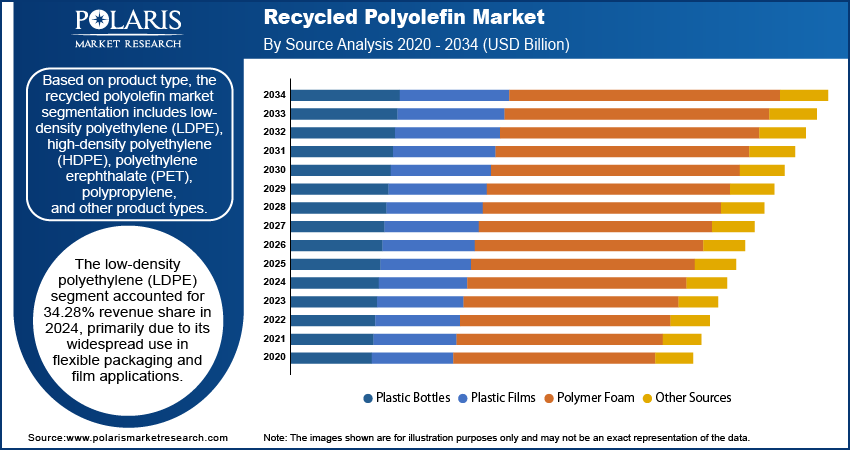

- The low-density polyethylene (LDPE) segment accounted for 34.28% revenue share in 2024, primarily due to its widespread use in flexible packaging and film applications.

- The plastic bottles segment dominated the revenue share with 41.37% in 2024, owing to their wide availability and relatively straightforward recycling process.

- The automotive segment is expected to register a CAGR of 9.2% during the forecast period, driven by increasing demand for lightweight, durable, and cost-effective materials across the industry.

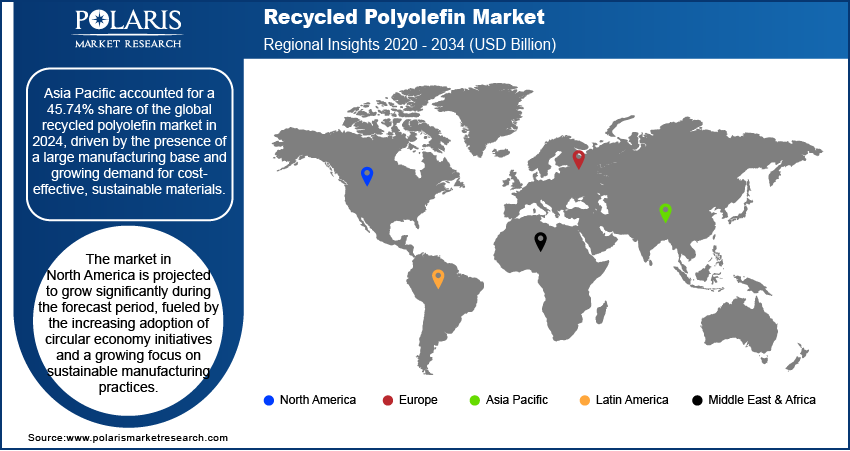

- Asia Pacific accounted for 45.74% of global share in 2024, fueled by the presence of a large manufacturing base and growing demand for cost-effective, sustainable materials.

- China held the largest share in Asia Pacific in 2024 due to its extensive manufacturing sector and high plastic consumption across industrial and consumer sectors.

- The market in North America is projected to grow significantly during the forecast period, driven by the increasing adoption of circular economy initiatives and a growing focus on sustainable manufacturing practices.

- The industry in the U.S. is expanding due to a growing focus on sustainability across major industries and increasing consumer demand for eco-conscious products.

Industry Dynamics

- Innovations such as chemical recycling, AI sorting, and enhanced purification are improving the quality and scalability to achieve near-virgin-grade output.

- Growing eco-consciousness is accelerating the adoption of recycled materials, compelling brands to use them to meet regulatory standards and consumer preferences.

- Rising demand for recycled plastics in the packaging and automotive sectors offers expansion opportunities for companies in advanced recycling technology.

- High recycling costs and regulations restrict competition with low-cost virgin plastics.

Market Statistics

- 2024 Market Size: USD 60.32 billion

- 2034 Projected Market Size: USD 140.09 billion

- CAGR (2025–2034): 8.81%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Recycled polyolefin refers to plastic materials such as polyethylene (PE) and polypropylene (PP) that have been recovered and reprocessed from post-consumer or post-industrial waste streams for reuse in manufacturing. The market for recycled polyolefin is witnessing steady growth, primarily driven by the expansion of end-use industries, such as automotive, construction, packaging, and consumer goods. These sectors are increasingly integrating recycled materials into their production processes to reduce costs, enhance sustainability credentials, and meet evolving consumer preferences for eco-friendly products. Thus, as demand for durable yet cost-effective materials grows across these industries, the recycled polyolefin is becoming a feasible alternative to virgin polymers due to its performance characteristics and environmental advantages.

Increasing regulatory mandates and government policies aimed at promoting circular economy principles are acting as strong catalysts for the adoption of polyolefin. Strict waste management laws, extended producer responsibility (EPR) frameworks, and recycling targets across various regions are compelling manufacturers to incorporate recycled content in their products. These policy-driven measures encourage sustainable production practices and also create a favorable ecosystem for recyclers and converters to invest in advanced processing technologies. As a result, regulatory pressure is shaping behavior and also reinforcing the long-term viability and scalability.

Drivers and Opportunities

Advancements in Recycling Technologies: Advancements in recycling technologies are boosting growth opportunities by improving the quality, efficiency, and scalability of the recycling process. Modern techniques, such as chemical recycling, advanced sorting systems, and improved decontamination methods, are enabling the production of high-grade recycled polyolefin that closely match the properties of virgin materials. In June 2024, Braskem collaborated with TNO to develop dissolution-based recycling technology for polyolefin waste. The collaboration aims to purify plastic residues into nearly virgin-quality polymers and 100% segregated products, potentially enabling food-grade recycled materials through advanced recycling processes. These technological improvements are expanding the range of applications, particularly in high-performance sectors such as the automotive and packaging industries, where material standards are strict. The reliability and performance are increasingly meeting industrial demands as the industry continues to invest in innovation, fostering broader adoption.

Rising Consumer Demand for Sustainability and Eco-Friendly Products: Rising consumer demand for sustainability and eco-friendly products is also a critical factor boosting expansion opportunities. This shift is pushing brands to integrate recycled materials into their offerings, aligning with both consumer values and regulatory trends. The European Parliament’s April 2024 provisional rules mandate reductions in plastic packaging waste (5% by 2030 and 15% by 2040) and impose a 50% limit on the space allocated to e-commerce packaging, compelling manufacturers to minimize waste. Consumers are becoming increasingly environmentally conscious and actively seeking products that minimize their environmental impact, such as those made with recycled materials. This shift in consumer preference is encouraging brands and manufacturers to integrate polyolefin into their product lines as a visible commitment to sustainability. Consequently, consumer-driven demand is playing a pivotal role in accelerating the adoption and commercialization across diverse industries.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes low-density polyethylene (LDPE), high-density polyethylene (HDPE), polyethylene terephthalate (PET), polypropylene, and other product types. The low-density polyethylene (LDPE) segment accounted for 34.28% revenue share in 2024, primarily due to its widespread use in flexible packaging and film applications. LDPE's lightweight nature, chemical resistance, and excellent flexibility make it an ideal material for various end-use sectors, such as food packaging, agricultural films, and consumer products. Its ease of recyclability and compatibility with existing reprocessing technologies further contribute to its dominance. Moreover, the growing focus on reducing plastic waste and increasing circular usage of flexible plastics across regions such as North America and Europe has supported the high demand for recycled LDPE materials.

Source Analysis

In terms of source, the segmentation includes plastic bottles, plastic films, polymer foam, and other sources. The plastic bottles segment dominated the revenue share with 41.37% in 2024, owing to their wide availability and relatively straightforward recycling process. Plastic bottles form a substantial part of municipal plastic waste streams, particularly in urban areas of Asia Pacific and North America, as one of the most commonly discarded plastic items. Their consistent quality and high collection rates make them an attractive and cost-efficient feedstock for polyolefin recyclers. Additionally, advancements in bottle sorting and cleaning technologies have enabled more efficient material recovery, enhancing the economic viability of bottle-based recycling. This consistent supply chain and processing efficiency make plastic bottles a preferred source for producing recycled polyolefin.

Application Analysis

The segmentation, based on application, includes food packaging, construction, automotive, non-food packaging, and other applications. The automotive segment is expected to register a CAGR of 9.2% during the forecast period, driven by increasing demand for lightweight, durable, and cost-effective materials across the industry. Recycled polyolefins are gaining importance in automotive applications, including interior trims, under-the-hood components, and exterior panels, particularly in regions such as Europe and the Asia Pacific, where sustainability and emission reduction targets are being pursued more aggressively. Automakers are under increasing pressure to reduce vehicle weight to improve fuel efficiency and meet regulatory standards, leading to a greater substitution of traditional materials with recycled plastics. Additionally, the integration of these polyolefin supports these objectives and also aligns with broader environmental goals, reinforcing their growing importance in the automotive sector.

Regional Analysis

The Asia Pacific recycled polyolefin market accounted for the largest share, at 45.74%, in 2024. This dominance is primarily driven by the presence of a large manufacturing base and growing demand for cost-effective, sustainable materials. The region’s rapid industrialization, accompanied by increasing plastic consumption across sectors such as packaging, automotive, and construction, has generated a high volume of recyclable polyolefin waste. Additionally, strong governmental support for recycling infrastructure, combined with the rising awareness of environmental issues, has facilitated large-scale collection and reprocessing activities. For instance, in July 2023, India's Ministry of Environment, Forests, and Climate Change reported that, under the EPR Guidelines, registered producers, importers, and brand owners had a total EPR deficit of 3 million tonnes for plastic packaging in the 2022–23 fiscal year. Meanwhile, registered plastic waste processors generated 2.5 million tonnes in EPR certificates through recycling and processing. This ecosystem of abundant raw material supply and robust end-use demand highlights the region’s dominance.

China Recycled Polyolefin Market Insights

China held the largest share in Asia Pacific in 2024, due to its extensive manufacturing sector and high plastic consumption across industrial and consumer markets. The country's large-scale plastic waste generation, combined with government-backed recycling initiatives, supports a strong domestic supply of recyclable polyolefins. Additionally, the presence of numerous processing facilities and favorable regulatory developments has positioned China as a central hub for production and utilization.

North America Recycled Polyolefin Market Trends

The market in North America is projected to grow significantly during the forecast period, driven by the increasing adoption of circular economy initiatives and a growing focus on sustainable manufacturing practices. Major industries in the region are actively transitioning toward using recycled content in response to evolving environmental regulations and consumer expectations. In June 2024, Trex recycled over 320 million pounds of waste polyethylene (PE) film and is expanding efforts to repurpose harder-to-recycle materials. Since its founding, Trex has diverted more than 5 billion pounds of PE waste, solidifying its position as one of North America’s largest recyclers of PE film, bags, and packaging. The availability of advanced recycling technologies and well-structured waste management systems further supports the efficient recovery and utilization of polyolefin materials. Moreover, corporate sustainability goals and public-private collaborations are reinforcing investment in closed-loop systems, driving the growth across diverse applications.

U.S. Recycled Polyolefin Market Overview

The market in the U.S. is expanding due to a growing focus on sustainability across major industries and increasing consumer demand for eco-conscious products. Businesses are progressively adopting recycled polyolefin to meet internal sustainability goals and comply with emerging environmental standards. Furthermore, investments in advanced recycling technologies and the development of closed-loop supply chains are enhancing the commercial feasibility of recycled plastics in major applications.

Europe Recycled Polyolefin Market Outlook

Europe is projected to hold a substantial share by 2034, driven by the region’s strict environmental policies and progressive approach to plastics recycling. Europe has established ambitious targets under its circular economy agenda, leading to increased demand for high-quality recycled materials in industries such as automotive, construction, and consumer goods. The widespread adoption of extended producer responsibility schemes and industry-led sustainability initiatives is accelerating the integration into product manufacturing. Europe remains a pivotal market for driving circular solutions within the global polyolefin value chain, owing to its mature recycling infrastructure and ongoing technological innovation.

UK Recycled Polyolefin Market Analysis

The UK market growth is driven by strict environmental regulations and national commitments to reducing plastic waste through circular economy practices. The push for integrating recycled content in product manufacturing, particularly in the packaging and automotive sectors, is accelerating demand for these polyolefins. Government incentives, coupled with the rising collaboration and innovation in plastic reprocessing, are reinforcing the UK's position for sustainable material adoption.

Key Players and Competitive Analysis

The recycled polyolefin industry is witnessing intense competition, driven by sustainable value chains, strategic investments, and emerging technologies. In developed markets, major players dominate through expansion opportunities in high-demand sectors such as packaging and automotive. Meanwhile, emerging markets are gaining traction due to economic and geopolitical shifts, with governments enforcing stricter recycling mandates. Competitive intelligence reveals that small and medium-sized businesses are leveraging technological advancements in chemical recycling to capture latent demand. Disruptions and trends, such as circular economy policies and corporate sustainability goals, further fuel revenue growth. Companies are also focusing on region-wise market size to optimize future development strategies, particularly in regions with high volumes of plastic waste. Vendor strategies are increasingly prioritizing the supply chain disruptions, while expert insights highlight growth projections in high-growth markets, such as electric vehicle components. Pricing insights suggest that competitive positioning will rely on cost-efficient recycling methods and business transformation toward greener alternatives.

A few major companies operating in the industry include Borealis GMBH, Dow, ExxonMobil, GCR, INEOS AG, MBA Polymers Inc., LyondellBasell Industries Holdings B.V., Omya International AG, Pashupati Group, and SABIC.

Key Players

- Borealis GMBH

- Dow

- ExxonMobil

- GCR

- INEOS AG

- LyondellBasell Industries Holdings B.V.

- MBA Polymers Inc.

- Omya International AG

- Pashupati Group

- SABIC

Industry Developments

- May 2025: Borealis and Borouge showcased their joint polyethylene and polypropylene pipe solutions portfolio, featuring over 15 pipe and fitting samples. The display highlighted durable infrastructure solutions for sewage, drinking water, gas, and industrial applications, leveraging Borstar technology for performance and sustainability.

- March 2025: Axens and SOREMA collaborated to offer integrated plastic waste recycling solutions, combining Axens' chemical recycling technologies (TAC, Rewind) with SOREMA's mechanical treatment expertise. The collaboration aims to optimize feedstock preparation and enhance recycled plastic output for applications such as food-grade packaging.

Recycled Polyolefin Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene

- Other Product Types

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Other Sources

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food Packaging

- Construction

- Automotive

- Non-food Packaging

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Recycled Polyolefin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 60.32 Billion |

|

Market Size in 2025 |

USD 65.52 Billion |

|

Revenue Forecast by 2034 |

USD 140.09 Billion |

|

CAGR |

8.81% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 60.32 billion in 2024 and is projected to grow to USD 140.09 billion by 2034.

The global market is projected to register a CAGR of 8.81% during the forecast period.

Asia Pacific dominated the market in 2024, holding a 45.74% share of the global market in 2024.

A few of the key players in the market are Borealis GMBH, Dow, ExxonMobil, GCR, INEOS AG, MBA Polymers Inc., LyondellBasell Industries Holdings B.V., Omya International AG, Pashupati Group, and SABIC.

The low-density polyethylene (LDPE) segment accounted for 34.28% revenue share in 2024.

The automotive segment is expected to register a CAGR of 9.2% during the forecast period.