U.S. Molecular Biology Enzymes, Reagents and Kits Market Size, Share, Trends, & Industry Analysis Report

By Product (Kits & Reagents and Enzymes), By Application, and By End User– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6103

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

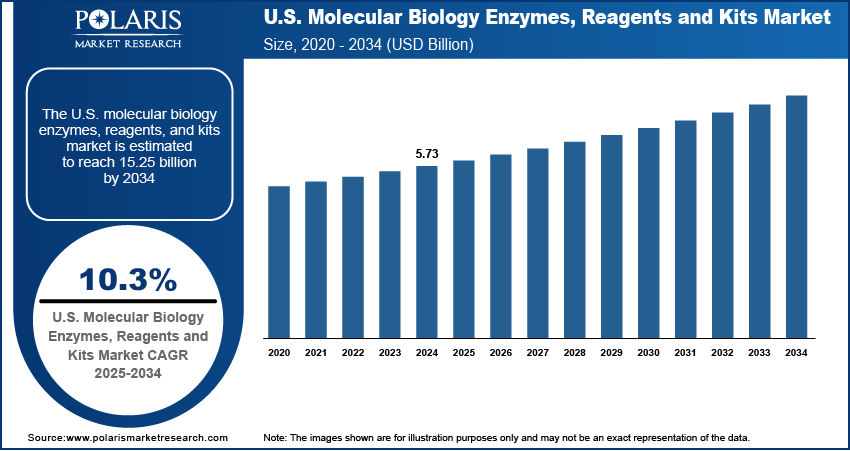

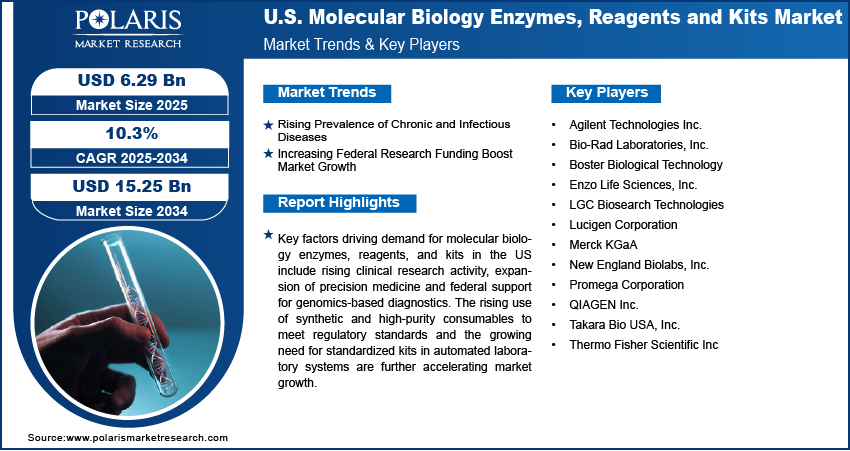

The U.S. molecular biology enzymes, reagents and kits market size was valued at USD 5.73 billion in 2024, growing at a CAGR of 10.3% during 2025–2034. Rising prevalence of chronic and infectious diseases combined with increasing federal research funding is driving demand for molecular biology enzymes, reagents, and kits used in diagnostics and life science research across the US

Key Insights

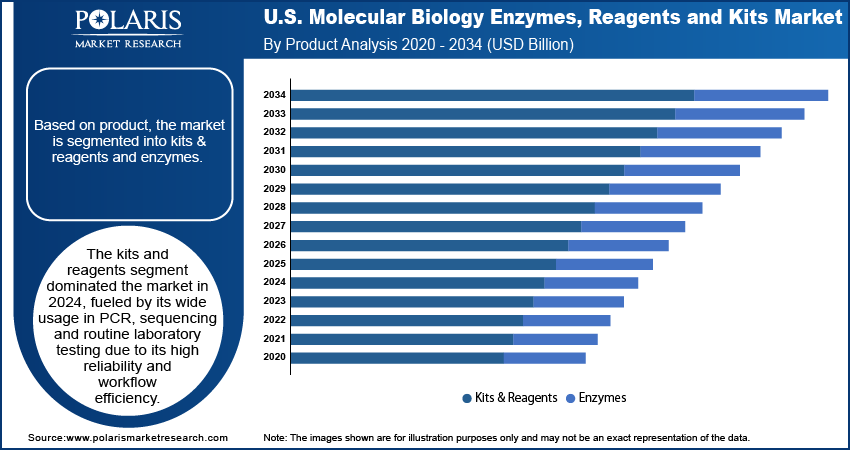

- The kits and reagents segment held the dominating market share in 2024.

- The enzymes segment is projected to grow at the fastest CAGR over the forecast period, driven by rising demand for high-performance and specialized enzymes in advanced molecular workflows.

- The US market is expanding steadily, fueled by increased investment in genomics research, growing adoption of precision medicine and rising demand for standardized molecular biology consumables across clinical and academic laboratories.

Industry Dynamics

- Rising prevalence of chronic and infectious diseases is driving the demand for molecular biology enzymes, reagents, and kits used in disease detection, monitoring, and therapeutic research.

- Increasing federal research funding is fueling large-scale academic and government-backed initiatives, thereby boosting the adoption of high-quality molecular biology consumables.

- Technological advancements in enzyme engineering and kit optimization creates opportunity for the market to enable more efficient and reliable research outcomes.

- High cost of high-purity enzymes and specialized kits is retraining the growth of the market for smaller labs and startups.

Market Statistics

- 2024 Market Size: USD 5.73 billion

- 2034 Projected Market Size: USD 15.25 billion

- CAGR (2025-2034): 10.3%

To Understand More About this Research: Request a Free Sample Report

Molecular biology enzymes, reagents, and kits are witnessing growing demand across the US due to their essential role in gene expression analysis, DNA/RNA extraction, and PCR-based diagnostics. The increasing volume of clinical research along with the adoption of precision medicine and molecular diagnostics is driving demand from academic institutions, hospital laboratories and biotechnology companies. Growing research funding from federal agencies and institutional investments is further boosting its adoption across healthcare and life sciences.

The rising federal research funding, collaborations between public and private sectors and the expanding focus on precision medicine is further fueling the demand for the market. The launch of automated platforms and high-throughput kits by domestic manufacturers is enhancing operational efficiency in laboratories. In August 2022, Thermo Fisher Scientific inaugurated a USD 180 million viral vector manufacturing facility in Massachusetts to enhance its capacity for producing advanced biologics. This strategic investment highlights rising demand within the US molecular biology enzymes, reagents, and kits industry, due to growing applications in gene therapy and biopharmaceutical research.

Key performance factors such as high purity, lot-to-lot consistency and compatibility with advanced instrumentation are driving the adoption of molecular biology enzymes, reagents, and kits across the US research and diagnostics ecosystem. There is increasing demand for ready-to-use, contamination-free consumables that support reproducibility and compliance with Good Laboratory Practice (GLP) standards. Manufacturers are investing in process standardization, enzyme engineering and cold-chain optimized packaging to meet evolving quality benchmarks. Additionally, rising national efforts to boost biodefense infrastructure and expand pathogen surveillance capabilities are creating new growth opportunities for molecular biology consumables in public health, academic and biosecurity programs.

Drivers & Opportunities

Rising Prevalence of Chronic and Infectious Diseases: The increasing number of chronic conditions such as cancer, diabetes, and cardiovascular disorders along with the rising threat of infectious diseases is driving the demand for reliable molecular biology enzymes, reagents, and kits across the US According to the American Cancer Society, more than 2 million new cancer cases are diagnosed in the US in 2024. Around 611,720 people lost their lives from cancer, which equals about 1,680 deaths each day, marking a continuous rise in cancer incidence driven by aging population and improved detection. These products are widely used in diagnostic testing and disease monitoring applications. This is due to the reliance on high-quality consumables by hospitals, public health laboratories and diagnostic centers to support accurate and fast results. This growing disease burden is creating consistent demand across clinical and research environments, boosting market expansion nationwide.

Increasing Federal Research Funding: Rising federal investments in life sciences research are accelerating the adoption of molecular biology enzymes, reagents, and kits across academic and public research institutions. Rising government funding through agencies such as the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC) is helping to accelerate genomics, molecular diagnostics and disease surveillance programs in the country. This growing financial support is allowing laboratories to access advanced consumables that offer high purity and reproducibility. In addition, the increasing funding is fueling innovation and strengthening domestic supply capacity for molecular research and biotechnology development in the U.S.

Segmental Insights

Product Analysis

Based on product, the segmentation includes kits & reagents, and enzymes. The kits & reagents segment dominated the market in 2024, driven by strong demand for ready-to-use solutions that simplify workflow processes in research and diagnostics. These products are widely used in digital PCR, qPCR, sequencing, and cloning applications due to their consistency, reliability and compatibility with automation systems. In March 2025, Bio-Techne’s Asuragen brand introduced a new molecular biology kit that simplifies the detection of complex carrier screening genes using long-read sequencing. The kit combines long-range PCR and nanopore technology into a single workflow, helping laboratories reduce testing steps. Growing adoption of high-throughput technologies in academic, clinical and industrial laboratories is further boosting demand for standardized kits. Additionally, rising product launches with enhanced formulation and contamination control features are accelerating segment growth across routine testing and advanced molecular biology workflows in the U.S.

The enzymes segment is expected to grow at the fastest rate during the forecast period. This is due to increasing use of specialty enzymes in genomic research, synthetic biology and advanced diagnostics. For instance, in September 2024, TriLink BioTechnologies partnered with Alphazyme to launch CleanScribe RNA Polymerase, a new enzyme developed for high-yield and high-purity in vitro transcription. This launch expands their molecular biology consumables range and supports growing demand for specialized reagents used in mRNA synthesis and gene expression studies. Also, growing demand for high-fidelity, thermostable and reverse transcriptase enzymes is rising across research institutes and biotechnology companies, which in turn fuels the enzymes segment’s growth in the coming years. In addition, increasing innovations in enzyme engineering and custom formulations for multiplex assays are expanding the application scope of this segment. Furthermore, rising interest in precision medicine and molecular diagnostics is fueling the need for reliable enzyme systems with high purity and performance.

Application Analysis

By application, the segmentation includes sequencing, cloning, polymerase chain reaction (PCR), restriction digestion, synthetic biology, epigenetics, and other application. The polymerase chain reaction (PCR) segment dominated the market in 2024, due to its widespread use in clinical diagnostics, gene expression studies and infectious disease detection. These tests are commonly used across hospitals, research laboratories and public health agencies for their speed, sensitivity and accuracy. The segment is further driven by high demand for qPCR and RT-PCR kits for pathogen surveillance and cancer diagnostics. Moreover, the rising advancements in reagent formulations and thermal cycler compatibility are enhancing assay performance, thus boosting the growth of the PCR segment till 2034.

The sequencing segment is projected to grow at the fastest pace through 2034. This is owing to the rising adoption of next-generation sequencing (NGS) technologies in clinical research, drug development, and genetic screening. Increasing demand for personalized medicine and genomics-based diagnostics is driving the use of specialized enzymes and reagents required for library preparation and data accuracy. In addition, the rising government funding for large-scale genomic initiatives and increasing partnerships between biotech firms and research institutes is projected to witness highest CAGR growth during forecast period.

End User Analysis

Based on end user channel, the segmentation includes academic and research institutes, pharmaceutical and biotechnology companies, hospitals and diagnostic laboratories, contract research organizations (CROs), forensic laboratories, food and agriculture research centers, and environmental testing labs. The pharmaceutical and biotechnology companies segment accounted for the highest market share in 2024, due to increasing R&D spending in drug discovery, clinical trials and biologics development. These companies use molecular biology consumables in cell line development, assay design, and biomarker validation to support consistent demand across R&D workflows. In addition, the rising demand for GMP-grade reagents, expansion of biomanufacturing facilities and partnerships with diagnostic firms is driving the demand for the molecular biology consumables in pharmaceutical and biotechnology companies.

The academic and research institutes segment is projected to grow at the fastest pace during the forecast period. This segment due to rapidly increasing federal funding and the presence of leading universities and medical research centers across the US These institutions rely on molecular biology enzymes, reagents, and kits for basic research, genetic engineering and disease mechanism studies. Moreover, growing demand for reproducible and validated reagents is high due to strict publication and quality requirements, which ensures reliability in experimental outcomes and compliance with research standards. In addition, this segment is witnessing high adoption due to increasing collaborations with pharmaceutical companies and government agencies to enable broader access to high-performance consumables in molecular biology research and experimental workflows.

Key Players & Competitive Analysis Report

The US molecular biology enzymes, reagents and kits industry is moderately consolidated, with competition centered around product reliability, purity and regulatory compliance. Key players are focusing on enzyme engineering, contamination-free kit formulations and automation compatibility to enhance research accuracy and workflow efficiency. Rising strategic priorities include expanding production capacity, improving cold-chain logistics and developing GMP-grade consumables to meet clinical and research standards. Leading companies are investing in domestic manufacturing and supply chain resilience to ensure uninterrupted delivery across academic, pharmaceutical and diagnostic sectors in response to evolving market and regulatory requirements.

Key companies in the US molecular biology enzymes, reagents and kits industry include Thermo Fisher Scientific Inc., Merck KGaA, New England Biolabs, Inc., Agilent Technologies Inc., Promega Corporation, Takara Bio USA, Inc., QIAGEN Inc., Bio-Rad Laboratories, Inc., Enzo Life Sciences, Inc., Lucigen Corporation, Boster Biological Technology, and LGC Biosearch Technologies.

Key Players

- Agilent Technologie s Inc.

- Bio-Rad Laboratories, Inc.

- Boster Biological Technology

- Enzo Life Sciences, Inc.

- LGC Biosearch Technologies

- Lucigen Corporation

- Merck KGaA

- New England Biolabs, Inc.

- Promega Corporation

- QIAGEN Inc.

- Takara Bio USA, Inc.

- Thermo Fisher Scientific Inc.

Industry Developments

July 2025: Promega partnered with Addgene to launch a curated collection of plasmids, aimed at pushing life science research and molecular biology innovation. This collaboration boosts ongoing efforts within the US molecular biology enzymes, reagents, and kits market to expand access to high-quality genetic tools and streamline research workflows across academic and commercial laboratories.

November 2024: Takara Bio launched a high-throughput, cost-effective qPCR system designed to accelerate clinical research and improve assay efficiency. This launch supports the US molecular biology enzymes, reagents, and kits market by addressing growing demand for scalable and validated tools in genomics, diagnostics and translational research.

U.S. Molecular Biology Enzymes, Reagents and Kits Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Kits & Reagents

- Enzymes

- Polymerases

- Ligases

- Restriction Endonucleases

- Reverse Transcriptase

- Phosphatases

- Proteases and Proteinases

- Other Enzymes

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Sequencing

- Cloning

- Polymerase Chain Reaction (PCR)

- Restriction Digestion

- Synthetic Biology

- Epigenetics

- Other Application

By End User Channel Outlook (Revenue, USD Billion, 2020–2034)

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Forensic Laboratories

- Food and Agriculture Research Centers

- Environmental Testing Labs

U.S. Molecular Biology Enzymes, Reagents and Kits Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.73 Billion |

|

Market Size in 2025 |

USD 6.29 Billion |

|

Revenue Forecast by 2034 |

USD 15.25 Billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 5.73 billion in 2024 and is projected to grow to USD 15.25 billion by 2034.

The US market is projected to register a CAGR of 10.3% during the forecast period.

A few of the key players in the market are Thermo Fisher Scientific Inc., Merck KGaA, New England Biolabs, Inc., Agilent Technologies Inc., Promega Corporation, Takara Bio USA, Inc., QIAGEN Inc., Bio-Rad Laboratories, Inc., Enzo Life Sciences, Inc., Lucigen Corporation, Boster Biological Technology, and LGC Biosearch Technologies.

The kits and reagents segment dominated the market share in 2024, due to strong demand for ready-to-use solutions across diagnostic, academic and pharmaceutical research applications.

The academic and research institutes segment is projected to grow at the fastest pace, driven by rising federal funding, strong institutional research output, and demand for validated reagents across US universities and research centers.