Synthetic Graphite Market Size, Share, & Trends, Analysis Report

By Product (Graphite Electrodes, Graphite Blocks and Rounds, Graphite Powder, and Others), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5769

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

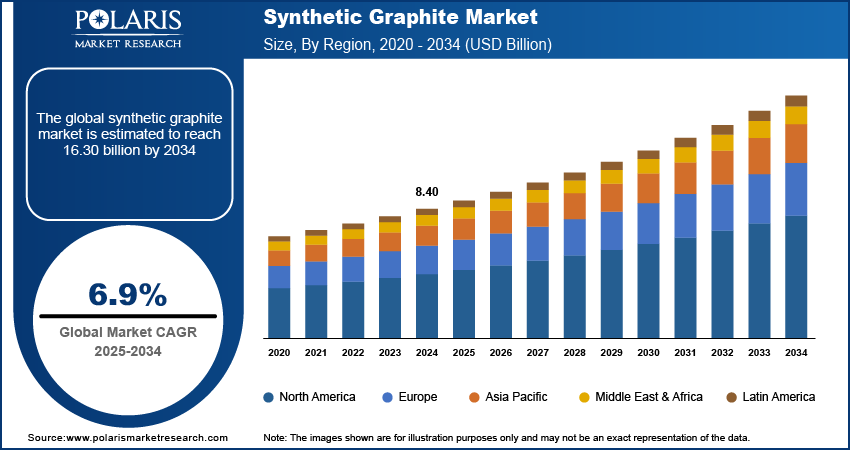

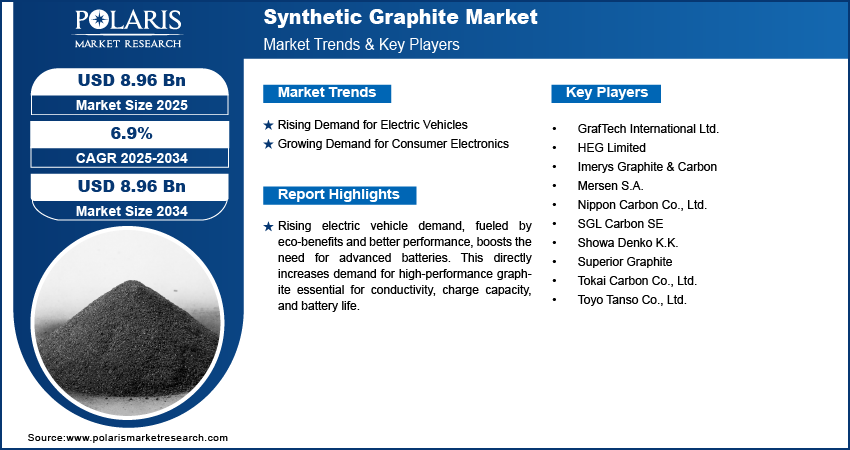

The global synthetic graphite market size was valued at USD 8.40 billion in 2024, growing at a CAGR of 6.9% during 2025–2034. The growth is driven by rising demand for electric vehicles and consumer electronics.

Synthetic graphite is a man-made form of carbon produced by heating petroleum coke or other carbon-rich materials to very high temperatures (over 2500°C) in an electric furnace. It is used in various applications such as lithium-ion batteries, electrodes, and lubricants due to its high purity, conductivity, and structural consistency.

The growing steel and metallurgy industries are propelling the demand for synthetic graphite. Synthetic graphite is widely used in the steel industry in applications such as electric arc furnaces (EAF). It is used as an electrode material because of its ability to withstand high temperatures and conduct electricity well. Additionally, the demand for steel is growing as construction and infrastructure projects are increasing worldwide. According to the United States Census Bureau, the construction spending in April 2025 was USD 2,152.4 billion. This is fueling the use of EAFs, which, in turn, increases the demand for synthetic graphite, thereby driving the growth.

Battery technology is improving due to rising demand for longer life, faster charging, and better safety. Synthetic graphite is employed in these developments as they are engineered to meet specific battery needs. Research and innovation are leading to better battery materials that improve efficiency and stability. High-performance synthetic graphite helps batteries hold a charge longer and function safely under stress. The demand for advanced forms of synthetic graphite is rising as major industries such as automotive, aerospace, and electronics are looking for advanced battery solutions, thereby driving growth.

Industry Dynamics

Rising Demand for Electric Vehicles

The demand for electric vehicles is rising across the world, driven by their environmental benefits, lower running costs, and improved performance. According to the International Energy Agency, electric car sales worldwide were 17 million in 2024 and increased by 25% from the last year. Graphite enables high conductivity, performance, and charge capacity, which contribute to factors such as driving range, charging speed, and battery lifespan in EVs. Thus, the rising demand for electric vehicles is driving the requirement for advanced battery solutions, which, in turn, is driving the demand for advanced graphite specifically for electric vehicle batteries.

Growing Demand for Consumer Electronics

The consumer electronics demand is rising due to technological advancements, changing consumer preferences, and increasing disposable incomes. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022. This growth in consumer electronics propels the demand for advanced and sophisticated batteries that cater specifically to lightweight applications. Graphite is employed in this application due to its high stability and ability to store lithium ions, thereby driving their demand.

Segmental Insights

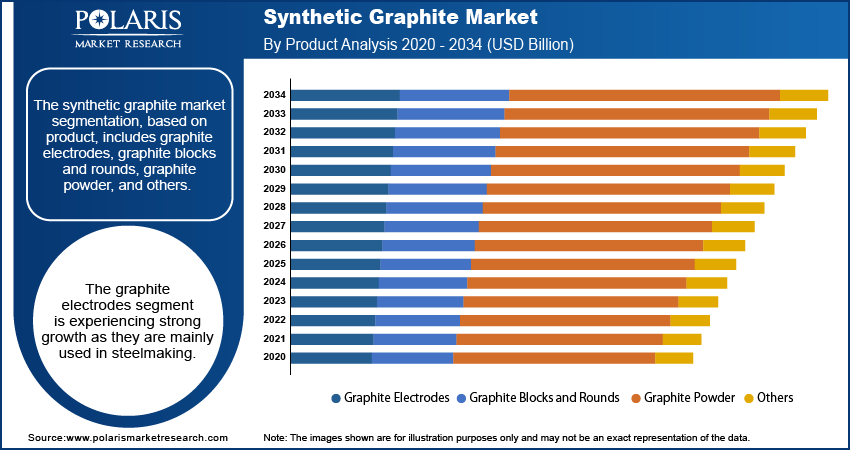

By Product Analysis

The segmentation, based on product, includes graphite electrodes, graphite blocks and rounds, graphite powder, and others. Graphite electrodes are experiencing strong growth as they are mainly used in steelmaking. The growth in steel production is driving the demand for graphite electrodes. These electrodes handle extremely high temperatures and conduct electricity efficiently, making them ideal for industrial use. Additionally, the rising construction activities worldwide are driving the demand for steel, which, in turn, is driving the adoption of synthetic graphite as graphite electrodes are essential in electric arc furnace steelmaking, thereby driving the segment growth.

The graphite powder segment is expected to witness the fastest growth during the forecast period, due to its lubricating, conductive, and heat-resistant properties. It plays an important role in lubricants, batteries, brake linings, and coatings. The growth in the manufacturing, automotive, and electronics sectors is fueling the demand for graphite powder. Additionally, the increasing use of lithium-ion batteries and electronic devices has boosted the need for high-purity graphite powder, thereby driving the segment growth.

By Application Analysis

The segmentation, based on application, includes lithium-ion batteries, foundry and metallurgy, electrical components, lubricants and greases, and others. The lithium-ion batteries segment dominated with the largest share in 2024 due to their widespread application in the consumer electronics and automotive sectors. In the automotive sector, it is used in electric car batteries due to their high energy density, which enables longer driving ranges and reduces the size of the battery pack. The rising demand for electric vehicles (EVs) and consumer electronics is driving the demand for lithium-ion batteries, thereby driving the segment growth.

The electrical component segment is expected to witness significant growth during the forecast period, as electrical components such as motor brushes, contacts, and heat-dissipation systems rely heavily on synthetic graphite for its excellent electrical and thermal conductivity. The need for materials that manage heat and power flow is increasing as electronic devices are becoming more advanced and compact. Synthetic graphite helps devices work more efficiently and last longer. The growth of smart devices and industrial automation is further fueling the demand for artificial graphite for electrical components. Additionally, the transition to smart grids and electric power systems is expected to push demand for electrical components, thereby driving the segment growth.

Regional Analysis

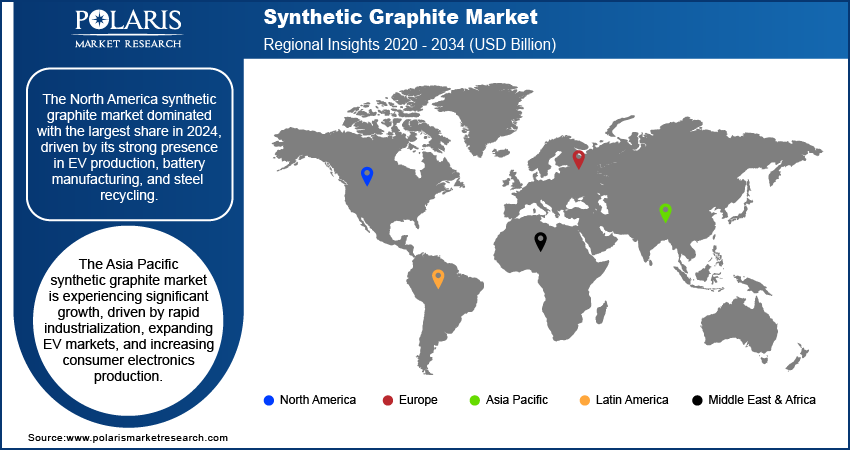

Synthetic Graphite Market in North America

The North America synthetic graphite market dominated with the largest share in 2024, driven by its strong presence in electric vehicle production, battery manufacturing, and steel recycling. The rise in clean energy projects and growing investments in advanced battery technologies are further driving the demand for artificial graphite. Additionally, North American companies focus on high-quality and sustainable materials is fueling the preference for synthetic graphite over natural alternatives. Thus, the aforementioned factors are driving the North America synthetic graphite industry.

Synthetic Graphite Market in US

The US synthetic graphite market is expected to witness significant growth during the forecast period, due to rising investments in electric vehicles, battery energy storage systems, and high-tech manufacturing. Major battery producers and carmakers are expanding operations, which is boosting the demand for synthetic graphite in lithium-ion batteries. Additionally, government incentives promoting clean energy and local production are accelerating domestic graphite sourcing. The steel industry’s reliance on electric arc furnaces, which use synthetic graphite electrodes, further contributes to the industry growth.

Synthetic Graphite Market in Asia Pacific

The Asia Pacific synthetic graphite market is projected to witness substantial growth, driven by rapid industrialization, expanding EV demand, and increasing consumer electronics production. Countries such as China, Japan, South Korea, and India are investing in clean energy and battery technology. The need for synthetic graphite is rising as the demand for lithium-ion batteries is growing. Additionally, the region has a strong manufacturing base and lower production costs, attracting global companies to set up operations, thereby driving the growth in the region.

Synthetic Graphite Market in China

The China synthetic graphite market is expected to experience significant growth during the forecast period, as China is the world’s largest manufacturer of electric vehicles and batteries, both of which rely heavily on synthetic graphite. The government’s focus on renewable energy and self-reliance in critical materials has led to major investments in domestic graphite production facilities. Additionally, China has a growing steel industry, due to which the demand for synthetic graphite is rising in the country.

Key Players & Competitive Analysis Report

The market is highly competitive, dominated by key global players focused on expanding capacity, innovating products, and securing long-term supply contracts. Companies such as GrafTech International Ltd. and SGL Carbon SE leverage vertical integration and advanced manufacturing to maintain strong positions. Tokai Carbon Co., Ltd.; Nippon Carbon; and Showa Denko K.K. benefit from robust R&D capabilities and diversified portfolios across battery and industrial applications. European leaders such as Mersen S.A. and Imerys Graphite & Carbon emphasize sustainability and serve growing EV and energy storage markets. Indian manufacturers HEG Limited and Toyo Tanso are gaining global traction through cost competitiveness and strategic expansions. Superior Graphite, with a strong US presence, targets high-growth sectors such as lithium-ion batteries. As EV adoption surges and battery technologies advance, players are forming alliances, investing in localized production, and enhancing material performance to secure long-term relevance in the evolving synthetic graphite landscape.

Key Players

- GrafTech International Ltd.

- HEG Limited

- Imerys Graphite & Carbon

- Mersen S.A.

- Nippon Carbon Co., Ltd.

- SGL Carbon SE

- Showa Denko K.K.

- Superior Graphite

- Tokai Carbon Co., Ltd.

- Toyo Tanso Co., Ltd.

Industry Developments

In April 2025, Shanshan launched a fast-charging synthetic graphite for Li-ion batteries, enhanced with OCSiAl’s single wall carbon nanotubes, improving conductivity and thermal management. The product entered the consumer electronics market, with EV sector expansion planned, marking a major advancement in battery performance technology.

In January 2025, General Motors signed a multi-billion-dollar agreement with Norway-based Vianode to supply synthetic graphite for EV batteries through 2033. Vianode committed to large-scale North American production by 2027, supporting Ultium Cells and enhancing GM’s local battery supply chain.

Synthetic Graphite Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Graphite Electrodes

- Graphite Blocks and Rounds

- Graphite Powder

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Lithium-Ion Batteries

- Foundry and Metallurgy

- Electrical Components

- Lubricants and Greases

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Synthetic Graphite Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.40 Billion |

|

Market Size Value in 2025 |

USD 8.96 Billion |

|

Revenue Forecast by 2034 |

USD 16.30 Billion |

|

CAGR |

6.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.40 billion in 2024 and is projected to grow to USD 16.30 billion by 2034.

The global market is projected to register a CAGR of 6.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are GrafTech International Ltd.; HEG Limited; Imerys Graphite & Carbon; Mersen S.A.; Nippon Carbon Co., Ltd.; SGL Carbon SE; Showa Denko K.K.; Superior Graphite; Tokai Carbon Co., Ltd.; and Toyo Tanso Co., Ltd.

The lithium-ion battery segment dominated the market share in 2024.

The graphite electrode segment is expected to witness the significant growth during the forecast period.