Temperature Controlled Packaging Market Share, Size, Trends, Industry Analysis Report

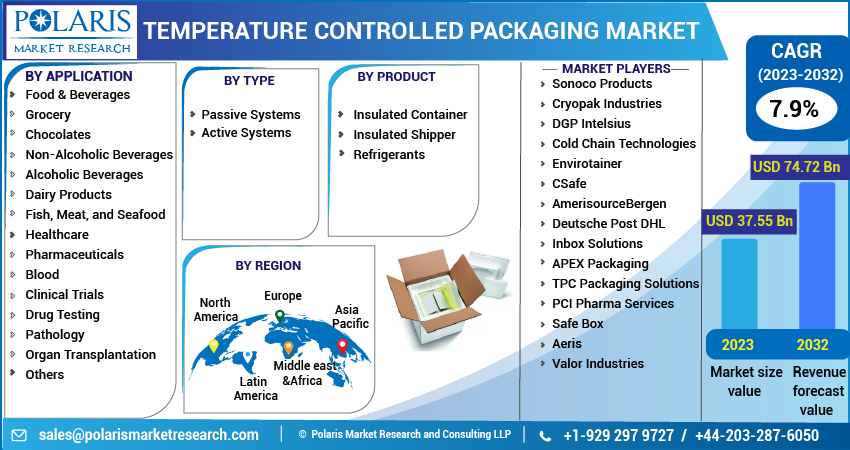

By Type, By Product (Insulated Container, Insulated Shipper, Refrigerants), By Application, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3586

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

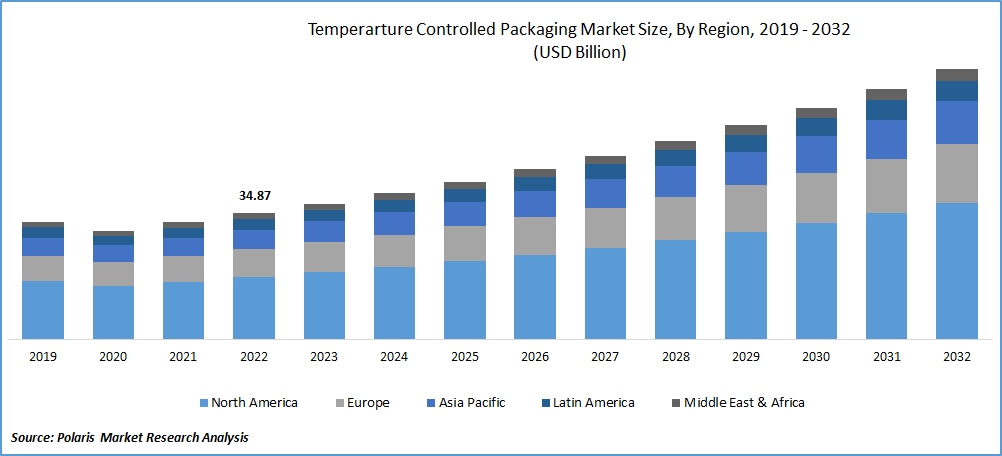

The global temperature-controlled packaging market was valued at USD 34.87 billion in 2022 and is expected to grow at a CAGR of 7.9% during the forecast period. The industry is experiencing significant growth driven by the rising demand for frozen food and biopharmaceutical products. These products, including vaccines, enzymes, and other temperature-sensitive substances, require strict temperature control throughout their production and distribution cycle. The increased demand for frozen food is fueled by changing consumer preferences, convenience, and the expansion of cold chain logistics. With the growth of e-commerce and global food trade, maintaining the integrity and quality of frozen products during transportation is crucial, driving the need for reliable temperature-controlled packaging solutions.

Know more about this report: Request a Free Sample Report

In the biopharmaceutical sector, developing and distributing vaccines, enzymes, and other sensitive biologics require stringent temperature control to preserve their efficacy and safety. The increasing focus on personalized medicine, advancements in biotechnology, and the ongoing COVID-19 pandemic have further accelerated the demand for temperature-controlled packaging solutions in the biopharmaceutical industry.

The market expansion is propelled by implementing rigorous regulations governing the distribution of food and beverage products, both domestically and internationally. Notably, the U.S. Food and Drug Administration (FDA) has imposed stringent requirements on temperature-controlled packaging solutions for perishable and export-oriented food products. These regulations are designed to ensure the safety of food products and mitigate the risk of foodborne illnesses.

They aim to maintain the integrity and quality of major U.S. food exports, including soybean oil, fruits, nuts, and other perishable items. Adherence to these regulations is crucial for exporters to meet the packaging standards required for shipping their products to key trade partners such as Mexico, Canada, & Europe. The FDA's regulations mandate using temperature-controlled packaging Market solutions to safeguard the perishable nature of food products during transportation. This helps maintain the optimal temperature conditions necessary to preserve product quality and prevent spoilage.

The distribution of COVID-19 vaccines requires a specialized cold chain logistics system, with temperature-controlled packaging playing a crucial role in ensuring the integrity and effectiveness of the vaccines. A notable example is the Pfizer-BioNTech vaccine, which requires storage at extremely low temperatures of up to -70 degrees Celsius to maintain its efficacy and stability throughout warehousing and shipment processes. To meet these stringent temperature requirements, temperature-controlled packaging solutions provide the necessary insulation, temperature monitoring, and control measures. These packaging solutions help maintain the vaccines within the recommended temperature range, safeguarding their quality and effectiveness during storage and transportation.

For Specific Research Requirements, Speak With a Resaerch Analyst

Industry Dynamics

Growth Drivers

As the production and distribution of biopharmaceuticals increase, the demand for dependable temperature-controlled packaging solutions continues to surge across the country. The pharmaceutical industry's focus on ensuring product integrity and efficacy throughout the supply chain underscores the critical role of temperature-controlled packaging in preserving the quality and therapeutic value of these advanced healthcare products. The need for temperature-controlled packaging solutions arises from the pharmaceutical industry's stringent requirements for maintaining the recommended temperature range during storage and transportation.

These solutions provide the necessary insulation, temperature monitoring, and control mechanisms to ensure biopharmaceutical products remain within the specified temperature parameters. By leveraging temperature-controlled packaging solutions, pharmaceutical companies can safeguard the potency and stability of their products, mitigate the risk of temperature-induced degradation, and meet regulatory compliance standards.

Report Segmentation

The market is primarily segmented based on type, product, application, and region.

|

By Type |

By Product |

By Application |

By Region |

|

|

|

|

Know more about this report: Speak to Analyst

Passive Systems Segment Accounted for the Largest Market Share in 2022

The passive segment accounted for the largest market share in 2022. This can be attributed to passive systems' cost-effectiveness and environmentally sustainable properties compared to active systems. Passive systems provide thermal insulation and temperature stabilization to temperature-controlled packaging solutions without relying on external power or mechanical components.

Active systems witnessed a robust growth rate. This growth can be attributed to the operational systems' capability to deliver precise and accurate temperature control within the packaging by utilizing external power sources or mechanical components. In industries such as biopharmaceuticals, where maintaining the optimal temperature is crucial for product integrity, the demand for temperature-controlled packaging solutions based on active systems is particularly high. This is especially evident in the storage and transportation of biopharmaceuticals, including vaccines, which necessitate strict temperature control to preserve their efficacy and stability.

Insulated Shippers Segment Garnered Largest Share in 2022

The insulated shipper segment held the largest revenue share in 2022. The demand for insulated shippers is expected to remain robust due to the increasing need for reliable temperature-controlled packaging solutions for shipping individual or smaller quantities of products across various industries. The pharmaceutical, food, and healthcare sectors rely on insulated shippers to maintain optimal temperature conditions and preserve the quality of their valuable and sensitive shipments.

The insulated containers segment witnessed steady growth. The increased demand for insulated containers can be attributed to their ability to offer a temperature-controlled environment, protect the contents from temperature fluctuations, and ensure product stability and safety during transportation. These factors drive the growth of the insulated container segment as industries seek reliable solutions to export their bulk products without compromising quality.

The food & beverage industry relies on insulated containers to export frozen foods, ensuring they remain frozen and retain freshness during transit. Similarly, the healthcare industry extensively employs insulated containers to ship temperature-sensitive drugs and pharmaceuticals. These containers provide a controlled environment that safeguards the potency and effectiveness of these products.

APAC Region Dominated the Global Market in 2022

APAC region witnessed steady growth due to a surge in cross-border trade of temperature-sensitive agricultural products. Implementing efficient packaging solutions enables exporters to meet quality standards and maintain the market competitiveness of their products in international markets. As the international trade of these temperature-sensitive agricultural products continues to expand, there is a growing need for efficient temperature-controlled packaging solutions. These solutions ensure that the products remain within the required temperature range throughout the cross-border journey, safeguarding their quality and preserving market value.

North America dominated the market. This can be primarily attributed to the region's robust healthcare sector, which generates substantial demand for temperature-controlled packaging solutions. These solutions play a critical role in the shipment and storage of temperature-sensitive drugs, vaccines, biologics, and medical devices, ensuring their integrity and efficacy.

Furthermore, the growing trend of online grocery shopping and food delivery in the region has amplified the need for reliable temperature-controlled packaging. To guarantee that perishable products such as groceries, meal kits, and prepared foods reach consumers in optimal condition, it is crucial to maintain the appropriate temperatures throughout the delivery process. Insulated shippers and containers are essential in preserving these perishable items' freshness, quality, and safety during transportation.

The Middle East & Africa region is experiencing growth fueled by various factors, including the growing demand for organic food products and the increasing popularity of frozen meals. These factors have created a need for effective temperature-controlled packaging solutions in the region. One significant driver of this demand is the rising preference for organic food products. Consumers increasingly seek organic options due to their perceived health benefits and environmental considerations. Temperature-controlled packaging solutions are crucial to ensure the freshness and integrity of organic products. These solutions help maintain the desired temperature throughout the supply chain, safeguarding organic food items' quality and nutritional value.

Competitive Insight

Some of the major players operating in the global market include Sonoco Products, Cryopak Industries, DGP Intelsius, Cold Chain Technologies, Envirotainer, CSafe, AmerisourceBergen, Deutsche Post DHL, Inbox Solutions, APEX Packaging, TPC Packaging Solutions, PCI Pharma Services, Safe Box, Aeris, and Valor Industries.

Recent Developments

- In January 2023, Cold Chain Technologies recently introduced CCT Therashield, a new product lineup addition. It is a reusable thermal packaging solution specifically designed for the healthcare industry. This innovative packaging solution addresses the increasing demand for sustainable and cost-effective temperature-controlled packaging in the healthcare sector.

Temperature Controlled Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 37.55 billion |

|

Revenue forecast in 2032 |

USD 74.72 billion |

|

CAGR |

7.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Sonoco Products, Cryopak Industries, DGP Intelsius, Cold Chain Technologies, Envirotainer, CSafe, AmerisourceBergen, Deutsche Post DHL, Inbox Solutions, APEX Packaging, TPC Packaging Solutions, PCI Pharma Services, Safe Box, Aeris, and Valor Industries |

FAQ's

key companies in Temperature Controlled Packaging Market are Sonoco Products, Cryopak Industries, DGP Intelsius, Cold Chain Technologies, Envirotainer.

The global temperature-controlled packaging market expected to grow at a CAGR of 7.9% during the forecast period.

The Temperature Controlled Packaging Market report covering key are type, product, application, and region.

key driving factors in Temperature Controlled Packaging Market are Rising demand for dependable temperature-controlled packaging solutions..

The global temperature-controlled packaging market size is expected to reach USD 74.72 billion by 2032.