Thermoformed Plastics Market Share, Size, Trends, Industry Analysis Report

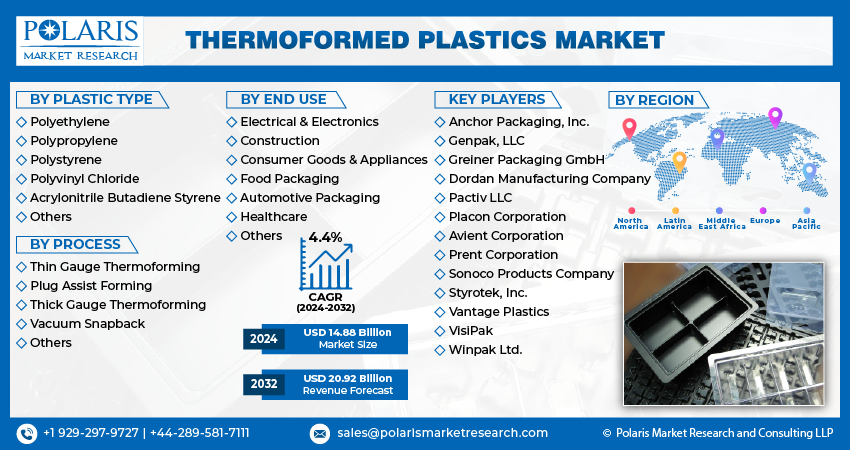

By Plastic Type (Polyethylene, Polypropylene, Polystyrene, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Others); By Process; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 117

- Format: PDF

- Report ID: PM4916

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

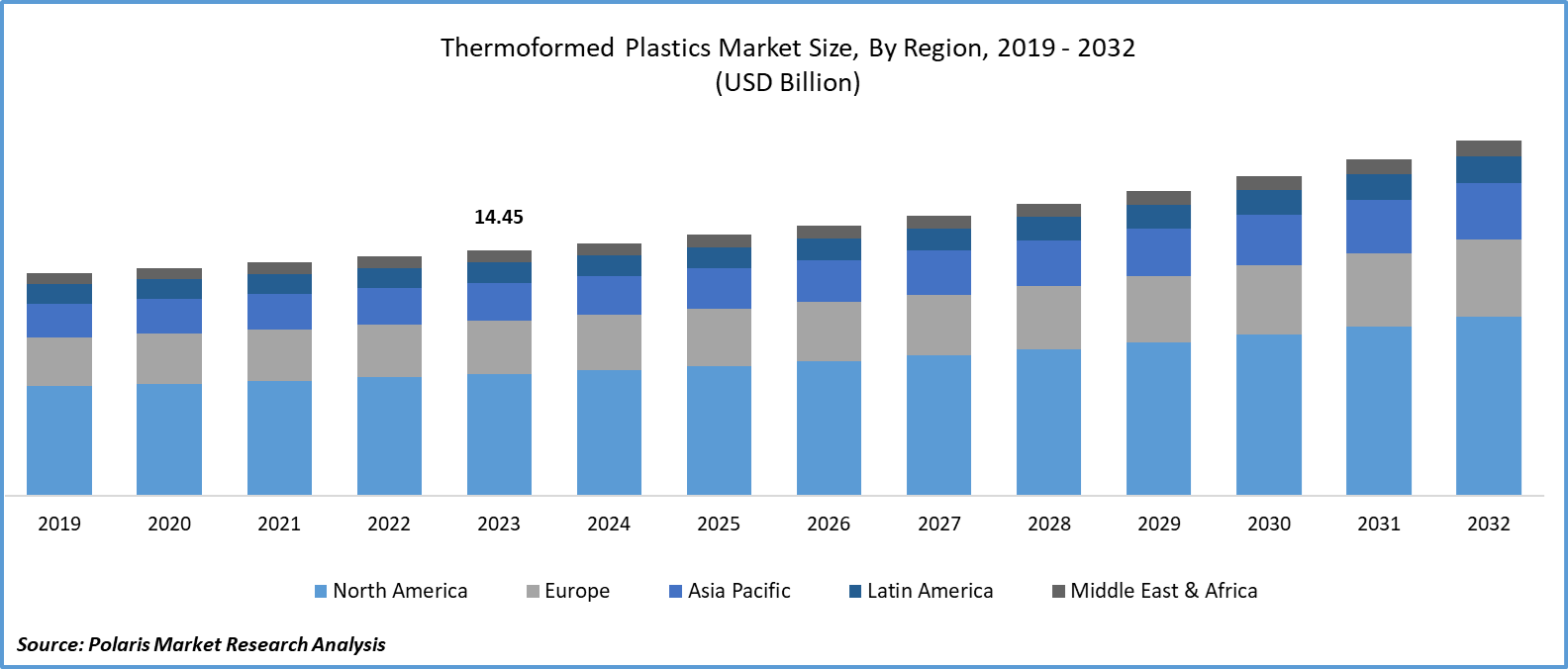

Thermoformed Plastics Market size was valued at USD 14.45 billion in 2023.

The market is anticipated to grow from USD 14.88 billion in 2024 to USD 20.92 billion by 2032, exhibiting the CAGR of 4.4% during the forecast period.

Market Introduction

The thermoformed plastics market is thriving due to its cost-effectiveness compared to alternative materials. Thermoforming, also commonly known as low volume thermoforming process offers efficient manufacturing processes, reducing production costs and cycle times. Additionally, thermoformed plastic is lightweight, lowering transportation expenses and energy consumption. Their material efficiency minimizes waste, contributing to reduced material costs and improved sustainability. These factors make thermoformed plastics highly attractive for various industries seeking cost-effective solutions. Furthermore, vacuum molding plastic formation is one of the core processes that allows in the formation of thermoformed plastics.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

For instance, in November 2023, Coveris introduced a recyclable thermoforming film packaging innovation, named MonoFlex Thermoform. This solution is crafted to function as an eco-friendly substitute, aiming to supplant conventional non-recyclable materials employed in thermoforming packaging within the food sector.

The thermoformed plastics market is experiencing growth driven by the increasing demand for food packaging. Thermoformed plastics offer excellent barrier properties, preserving food freshness by protecting against moisture and oxygen. Their customizable nature allows for innovative and appealing packaging designs, enhancing product visibility and consumer appeal. Additionally, thermoformed plastics are lightweight and cost-effective, providing efficient solutions for packaging large volumes of food products. With the rising preference for sustainable packaging materials, thermoformed plastics' recyclability and eco-friendliness further contribute to their popularity in the food industry.

To Understand More About this Research: Request a Free Sample Report

Industry Growth Drivers

Rise in Demand for Lightweight Properties is Driving Market Growth

The thermoformed plastics market is flourishing due to the lightweight properties of these materials. Thermoformed plastics offer a compelling alternative to traditional materials like glass and metal, as they are lightweight yet maintain strength and durability. This characteristic makes them highly sought-after in industries such as automotive, aerospace, and packaging, where weight reduction is crucial for efficiency and cost savings. Additionally, thermoformed plastics' lightweight nature enables easier handling, lower shipping costs, and greater design flexibility. As industry growth prioritize lightweight materials for sustainability and performance improvements, the thermoformed plastics market is expected to continue its growth trajectory.

Greater Focus on Design Flexibility is Expected to Drive Thermoformed Plastics Market Growth

Design flexibility is a primary driver fueling the industry growth of the thermoformed plastics market. Thermoforming enables the creation of intricate shapes and designs, making it ideal for diverse industries like packaging, automotive, healthcare, and consumer goods. Its ability to conform to complex geometries allows for customized solutions tailored to specific needs. Moreover, thermoformed plastics offer cost-effective production with minimal tooling investment and shorter lead times compared to traditional methods. This, combined with advancements in material technology, including enhanced properties like durability and sustainability, positions thermoformed plastics as preferred choices for market manufacturers seeking innovative and adaptable solutions to meet evolving market demands.

Industry Challenges

Environmental Concerns are Likely to Impede the Market Growth

Environmental concerns limit the growth of the thermoformed plastics market. The non-biodegradable nature of thermoformed plastics raises concerns over their contribution to plastic pollution and environmental degradation. Challenges in recycling due to complex compositions and mixed materials further extend waste management issues. With stringent regulations and increasing consumer demand for sustainability, market manufacturers are exploring alternative materials like bio-based or recycled plastics. Initiatives promoting circular economy principles aim to improve recyclability and end-of-life management.

Report Segmentation

The thermoformed plastics market analysis is primarily segmented based on plastic type, process, end use, and region.

|

By Plastic Type |

By Process |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Plastic Type Analysis

Polypropylene Segment Held a Significant Market Revenue Share in 2023

The polypropylene segment held a significant market size in 2023 due to its versatile nature, cost-effectiveness, and exceptional properties. Its versatility allows for various thermoforming processes, enabling the production of diverse products across industry dynamics. Moreover, its affordability facilitates mass production without significant cost burdens. Its excellent impact resistance ensures durability, while chemical resistance makes it suitable for packaging applications. Additionally, its recyclability supports sustainability efforts by promoting the reuse of materials. For instance, Universal Plastics Group, Inc. is providing custom thermoformed trays for industrial use in medical and scientific test equipment’s that offers better corrosion free applications.

By Process Analysis

Thin Gauge Thermoforming Segment Held a Significant Market Revenue Share in 2023

The thin gauge thermoforming segment held a significant market revenue share in 2023 owing to its cost-effectiveness, versatility, and efficiency. Requiring less material than thick gauge thermoforming, it reduces material costs, making it ideal for mass production. Its versatility allows for the creation of diverse products with intricate designs and detailed features. With faster cycle times compared to thick gauge processes, thin gauge thermoforming ensures quicker turnaround and higher production rates. Moreover, it consumes less energy, contributing to cost savings and environmental sustainability. The lightweight nature of products produced through thin gauge thermoforming further enhances their appeal for industries prioritizing reduced weight and improved efficiency.

By End Use Analysis

Food Packaging Segment Held a Significant Market Revenue Share in 2023

The food packaging segment held a significant market revenue share in 2023. Thermoformed plastics are extensively utilized in food packaging due to their versatility, durability, and barrier properties against moisture and contaminants. Materials such as PET, PP, and PS are commonly employed for this purpose. These plastics can be molded into various shapes and sizes, accommodating a wide range of food products while offering transparency for product visibility. Lightweight and resistant to punctures, thermoformed plastic packaging ensures the integrity of food during handling and transportation. Customizable with branding and labeling, it enhances product presentation and communicates vital information to consumers.

Regional Insights

Asia-Pacific is Expected to Experience Growth During the Forecast Period

Asia-Pacific is expected to experience growth during the forecast period. The thermoformed plastics industry in the Asia-Pacific region is rapidly expanding due to increasing market trends such as industrialization, urbanization, and manufacturing activities across sectors such as automotive, packaging, electronics, and consumer goods. Growing disposable income and changing consumer preferences towards lightweight, durable, and cost-effective materials further drive market growth. Technological advancements enhance production efficiency, while government initiatives promote sustainability, boosting the adoption of thermoformed plastics, which are often recyclable.

In 2023, North America region accounted for a significant market share. The North American thermoformed plastics market is thriving, fueled by technological advancements, rising market demand from diverse industries, and a growing preference for sustainable packaging solutions. Thermoformed plastics find extensive use in food, pharmaceutical, and consumer goods packaging owing to their versatility and cost-effectiveness. Additionally, the industry's increasing focus on sustainability drives innovation in eco-friendly materials and processes.

Key Market Players & Competitive Insights

The thermoformed plastics market encompasses a wide range of participants, with the potential addition of new competitors set to heighten competitive pressures. Established industry leaders consistently refine their technologies, aiming to sustain a competitive edge through efficiency, dependability, and safety. These entities focus on strategic initiatives, such as forging partnerships, enhancing product offerings, and engaging in joint ventures. Their objective is to surpass industry peers, ultimately capturing a notable thermoformed plastics market share.

Some of the major players operating in the global thermoformed plastics market include:

- Anchor Packaging, Inc.

- Dordan Manufacturing Company

- Genpak, LLC

- Greiner Packaging GmbH

- Pactiv LLC

- Placon Corporation

- Avient Corporation

- Prent Corporation

- Sonoco Products Company

- Styrotek, Inc.

- Vantage Plastics

- VisiPak

- Winpak Ltd.

Recent Developments

- In November 2023, Coveris launched a new, recyclable, and flexible thermoforming film solution named Formpeel P, tailored for diverse applications within the medical packaging sector.

- In February 2023, Neste and ILLIG formed a strategic alliance to promote the adoption of eco-friendly alternatives in thermoformed plastic packaging production via demonstration projects. This collaboration leverages Neste's proficiency in delivering renewable and recycled materials for polymer manufacturing alongside ILLIG's specialization in producing thermoforming systems, aiming to develop practical sustainable practices.

- In July 2023, SABIC launched the SABIC PP compound H1090 resin and STAMAX 30YH611 resin, tailored for sheet extrusion and thermoforming applications. These products enable customers to fabricate sizable and intricate structural components efficiently.

Report Coverage

The thermoformed plastics market research report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the market research report provides market dynamics into recent developments, market trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The market dynamics provides detailed market analysis while focusing on various key aspects such as competitive industry analysis, plastic types, processes, end uses, and their futuristic growth opportunities.

Thermoformed Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.88 billion |

|

Revenue forecast in 2032 |

USD 20.92 billion |

|

CAGR |

4.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Thermoformed Plastics market size is expected to reach USD 20.92 billion by 2032

Key players in the market are Anchor Packaging, Inc., Genpak, LLC, Greiner Packaging GmbH, Pactiv LLC, Placon Corporation

Asia-Pacific contribute notably towards the global Thermoformed Plastics Market

Thermoformed Plastics Market exhibiting the CAGR of 4.4% during the forecast period.

The Thermoformed Plastics Market report covering key segments are plastic type, process, end use, and region.