Timing Devices Market Share, Size, Trends, Industry Analysis Report

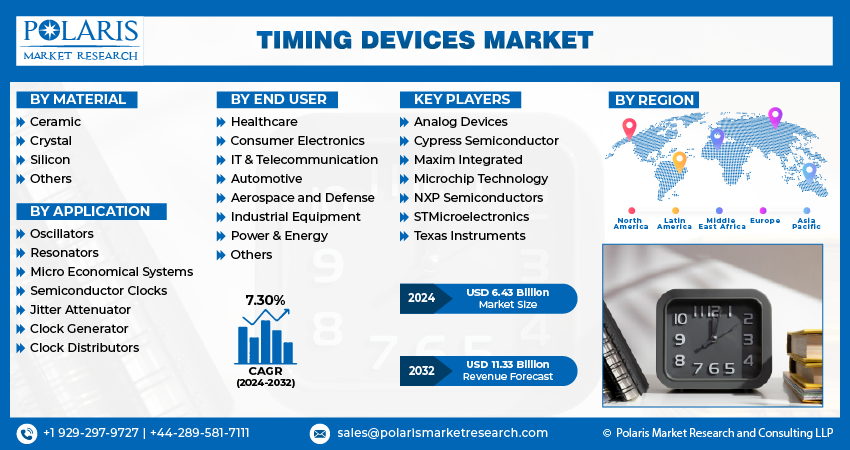

By Material (Ceramic, Crystal, Silicon, Others); By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3806

- Base Year: 2023

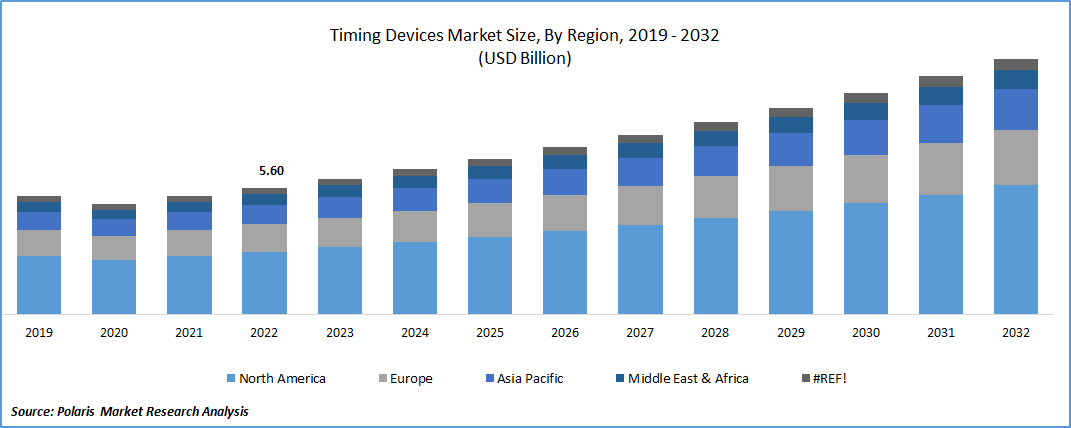

- Historical Data: 2019-2022

Report Outlook

The global timing devices market was valued at USD 6 billion in 2023 and is expected to grow at a CAGR of 7.30% during the forecast period.

Ongoing innovations in timing device technology, including the development of new materials, advanced manufacturing techniques, and novel timing architectures, drive market growth. These innovations enable the creation of timing devices with improved accuracy, stability, size, and functionality, opening new opportunities in diverse industries. The introduction of IQD's ICPT-1 chip scale atomic clock (CSAC) is driving the growth of the timing devices market.

To Understand More About this Research: Request a Free Sample Report

The ICPT-1 offers a significant advancement in timing technology, utilizing the Coherent Population Trap (CPT) method to achieve an exceptionally stable frequency. The development of new materials plays a vital role in enhancing the performance of timing devices. These advancements enable timing devices to meet the stringent requirements of various applications, such as telecommunications, aerospace, and scientific research.

Industry Dynamics

Growth Drivers

Emergence of 5G Technology

With the rise of real-time applications and systems, there is an increased need for accurate timing devices. Industries such as financial services, telecommunications, transportation, and data centers rely on precise timing to ensure smooth operations, data integrity, and synchronization across multiple devices and networks. This demand fuels the growth of timing devices in the market.

The growth of the timing devices market is primarily driven by the telecom industry, which has stringent requirements for timing and synchronization, especially with the deployment of 5G networks. In the telecom industry, achieving precise timing and synchronization is crucial to ensure efficient network operation. With the roll-out of 5G networks, the demand for synchronization has become even more critical. Reliable and accurate timing is vital for ensuring seamless communication, reducing latency, and enabling efficient data transmission. Moreover, monitoring and verification of timing performance are crucial to identify any deviations or issues that may impact network operations.

To meet these challenges, the timing devices market focuses on developing advanced solutions that provide highly accurate and reliable timing signals. These devices need to be cost-effective, scalable, and capable of meeting the stringent synchronization requirements of the telecom industry. The continuous innovation in timing technologies and synchronization techniques allows network operators to ensure optimal network performance, minimize disruptions, and deliver high-quality services to their customers.

Report Segmentation

The market is primarily segmented based on material, application, end user, and region.

|

By Material |

By Application |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Analysis

Crystal Segment Is Expected to Witness Fastest Growth over the Forecast Period

Crystal segment is expected to have faster growth for the market. Quartz crystals offer exceptional frequency accuracy and stability, which are crucial for precise timing applications. They can maintain highly stable oscillations over extended periods, ensuring reliable and consistent timing performance. Timing devices based on quartz crystals are extensively used in a diverse range of industries and applications. They are found in consumer electronics (e.g., smartphones, tablets, wearables), communication systems, automotive electronics, industrial automation, aerospace and defense, healthcare devices, and more. The increasing demand for electronic devices and systems across these sectors drives the growth of the timing devices market.

By Application Analysis

Oscillators Segment Accounted for the Largest Market Share in 2022

Oscillators segment holds the largest market share for the market in the study period. This serves as the fundamental timing component in electronic systems. They generate clock signals or timing references that synchronize the operation of various components and ensure precise timing in applications. As electronic devices become more sophisticated and interconnected, the demand for accurate timing signals continues to grow, propelling the oscillator segment. With the proliferation of consumer electronics, communication systems, automotive electronics, industrial automation, and other sectors, the demand for timing devices, particularly oscillators, is rising. These devices require reliable and precise timing to function properly, driving the growth of the oscillator segment. The oscillator segment offers a wide range of customization options to meet specific application requirements.

By End User Analysis

Consumer Electronics Segment is Expected to Hold the Larger Revenue Share

Consumer Electronics segment is projected to witness a larger revenue share in the coming years. Consumer electronics, including smartphones, tablets, smartwatches, laptops, gaming consoles, and audio/video devices, have become an integral part of people's daily lives. The widespread adoption of these devices is a major driver for the timing devices market. Each of these devices requires precise timing and synchronization for various functions, such as data processing, communication, multimedia playback, and sensor integration. The consumer electronics industry is characterized by rapid technological advancements. There is a continuous demand for more advanced features, higher performance, and better user experiences.

Regional Insights

North America Garnered with the Larger Revenue Share in the Forecast Time Frame

North America is expected to witness a larger revenue share for the market. The strong growth in Demand (RPK) of +16.5% in North America in 2022, along with the positive outlook for air passenger demand exceeding pre-COVID levels according to the International Air Transport Association, is driving the need for timing devices in the region. With the demand for air travel in North America forecasted to surpass pre-COVID levels, there will be an increase in air traffic. This means more flights, more passengers, and a higher volume of operations that require accurate timing and synchronization.

Timing devices play a crucial role in ensuring smooth operations, coordinating flight schedules, and maintaining overall efficiency and safety. Timing devices play a crucial role in flight systems and avionics. They are used for precise timing and synchronization of various aircraft systems, including navigation systems, communication systems, flight data recorders, and cockpit instrumentation. With the increased demand for air travel, airlines and aircraft manufacturers rely on accurate timing devices to ensure the smooth operation of these critical flight systems.

Asia Pacific Expected to Register Higher Growth in the Study Period

APAC is projected to witness a higher growth rate for the market. The growing demand for consumer electronics in developing countries like India is playing a significant role in fueling the growth of the timing devices market in this region. India has witnessed a rapid increase in the adoption of consumer electronics, driven by factors such as rising disposable incomes, expanding middle-class population, technological advancements, and increasing digitalization. Consumer electronics, including smartphones, tablets, laptops, smart TVs, and wearables, have become an integral part of the daily lives of Indian consumers.

Timing devices are essential components in consumer electronics, enabling precise timekeeping, synchronization, and coordination of various functions and features. These devices ensure accurate time display, reliable operation of timers and alarms, synchronization of data transfers, and seamless integration of different electronic components within devices. As the demand for consumer electronics grows in India, manufacturers and suppliers in the region are witnessing an increased need for high-quality timing devices to meet the requirements of these devices

Key Market Players & Competitive Insights

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Analog Devices

- Cypress Semiconductor

- Maxim Integrated

- Microchip Technology

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments

Recent Developments

- In July 2023, Vanden grad, along with his friend and pitching coach Caleb Balbuena, developed an innovative electronic timing device aimed at catchers and coaches. Their company, Caught Stealing, has created the PopTime Pro100, which is being hailed as the most accurate pop and data collection device ever made for catchers.

- In April 2023, SiTime, a precision timing company, introduced 32 kHz oscillators. These oscillators are specifically designed to deliver precise timekeeping for advanced driver assistance systems (ADAS), entertainment systems, instrument clusters, and electronic control units (ECUs) in various automotive applications.

Timing Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.43 billion |

|

Revenue forecast in 2032 |

USD 11.33 billion |

|

CAGR |

7.30% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global timing devices market size is expected to reach USD 11.33 billion by 2032.

Key players in the market are Texas Instruments, Microchip Technology, NXP Semiconductors, Maxim Integrated.

North America contribute notably towards the global timing devices market.

The global timing devices market is expected to grow at a CAGR of 7.3% during the forecast period.

The timing devices market report covering key segments are material, application, end user and region.