Electronic Contract Manufacturing and Design Services Market Size, Share, Trends, Industry Analysis Report

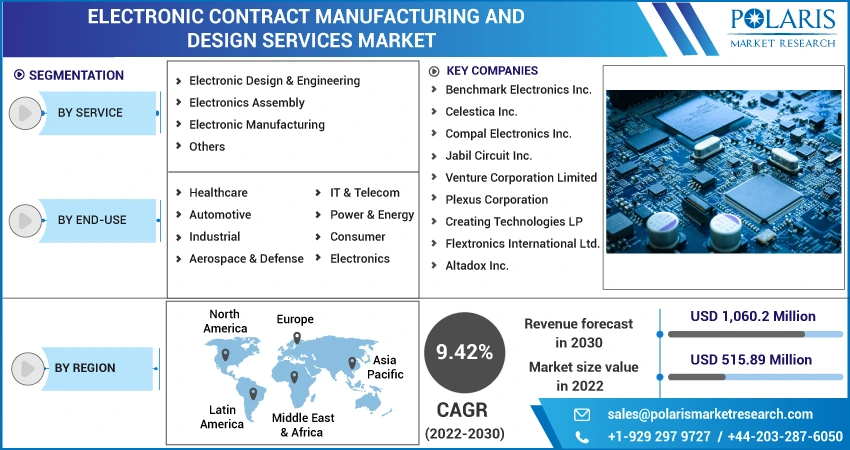

: By Service (Electronic Design & Engineering, Electronic Assembly), By End-use By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM1457

- Base Year: 2024

- Historical Data: 2020-2023

What is Electronic Contract Manufacturing and Design Services Market Size?

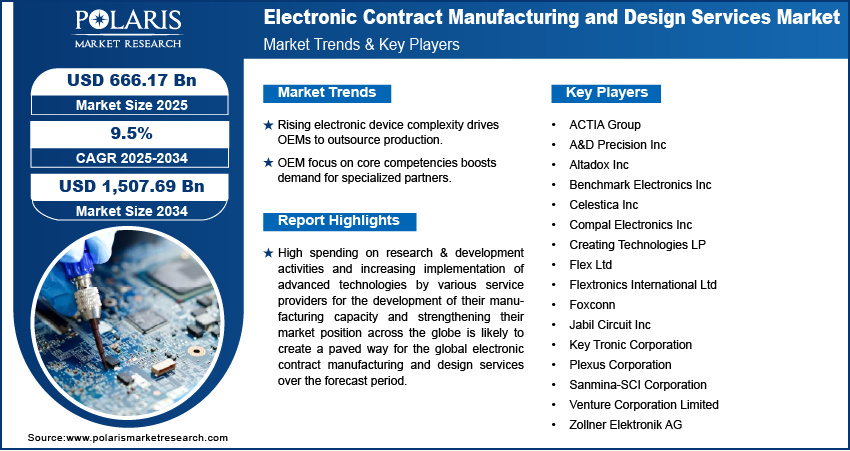

The global electronic contract manufacturing and design services market was valued at USD 609.77 billion in 2024 and is expected to grow at a CAGR of 9.5% during the forecast period. The rising demand for functionalities, including sub-assembly manufacturing, functional testing, and component assembly from several manufacturers, is driving the expansion of the global market during the forecast period. Additionally, an extensive rise in the purchasing power of consumers and their rising demand for consumer electronics are further anticipated to fuel the market growth within the coming years.

Key Insights

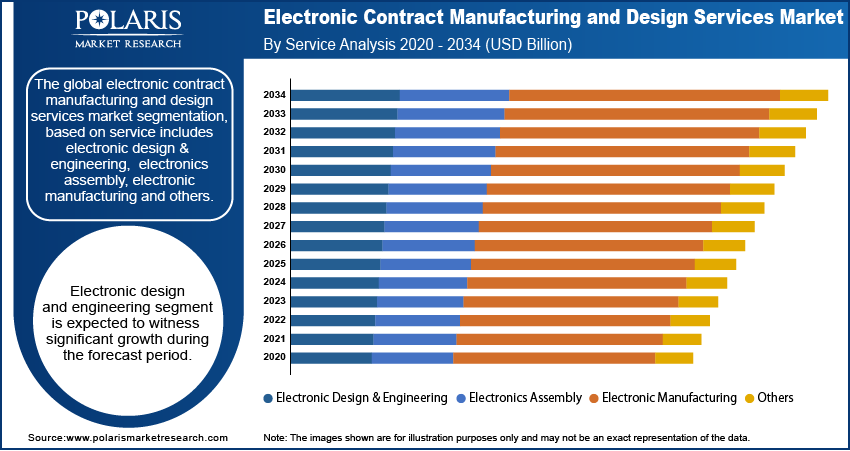

- By service, the electronic design and engineering segment is expected to witness significant growth due to the growing trend of OEMs outsourcing of complex designs of circuts and component.

- By end-use, the IT & Telecom subsegment held the largest share in 2024 due to the rapid global proliferation and constant technological advancements of electronic devices such as smartphones, tablets, networking equipment, and computing devices.

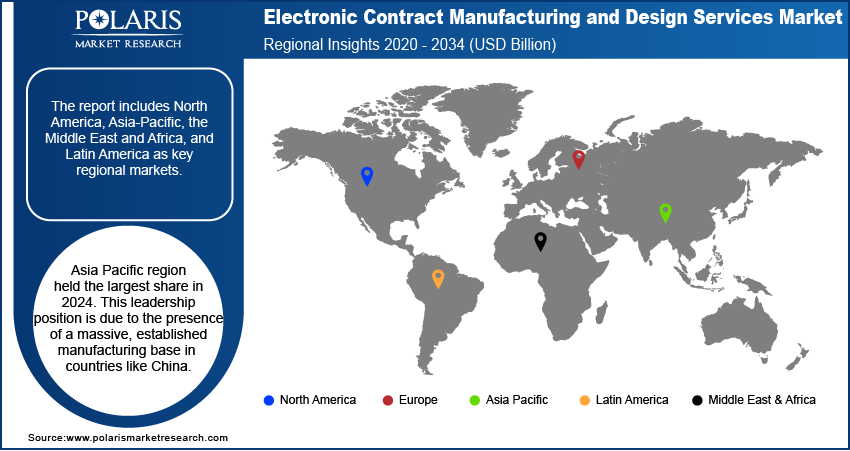

- By region, the Asia Pacific region held the largest share in 2024. This leadership position is due to the presence of a massive, established manufacturing base in countries like China.

Industry Dynamics

- The increasing complexity of electronic devices and their shorter product life cycles compel original equipment manufacturers (OEMs) to outsource.

- A significant focus on core competencies among OEMs drives the trend of delegating non-core functions, like manufacturing and supply chain management, to specialized partners.

- The rapid adoption of next-generation technologies, such as the Internet of Things (IoT), 5G connectivity, and advanced automation, creates a demand for sophisticated, high-volume production.

Market Statistics

- 2024 Market Size: USD 609.77 billion

- 2034 Projected Market Size: USD 1,507.69 billion

- CAGR (2025-2034): 9.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

High spending on research & development activities and increasing implementation of advanced technologies by various service providers for the development of their manufacturing capacity and strengthening their market position across the globe is likely to create a paved way for the global electronic contract manufacturing and design services over the forecast period. For instance, in 2021, Plexus, a leading player in the global market, launched its new manufacturing facility in Bangkok, Thailand. It was mainly aimed at increasing the production capacity of the company, with a 400,000 square feet production and warehouse area. Additionally, the rise in the demand from several end-use industries like aerospace, healthcare, information technology, telecom, defense, and automotive, coupled with the increasing number of global outsourcing activities and rapid growth in technology, is expected to create lucrative growth opportunities for the growth of the global market over the coming years at a healthy rate.

Industry Dynamics

What Factors are Driving the Industry Growth?

Improved consumer purchasing power, rising demand for consumer electronics, and highly growing internet penetration around the globe are the major factors. High adoption of smartphones and easy accessibility to fast and improved internet facilities, mainly in developed nations, including the United States, France, and Japan, have resulted in higher adoption of these smartphones in the last few years and are projected to do so in the future. According to the Pew Research Center, 91% out of all cellphone owners in U.S. has an smartphone. Moreover, Increasing focus on reducing manufacturing costs, improving consumer services, and maintaining relations with customers are a few other factors likely to drive growth. Furthermore, the presence of large market players and their growing number of innovations worldwide is further contributing to the market growth and demand.

Report Segmentation

The market is primarily segmented based on service, end-use, and region.

|

By Service |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Which Segment by Services is Expected to Witness Significant Growth During the Forecast Period?

Electronic design and engineering segment is expected to witness significant growth during the forecast period. An extensively surging inclination of various types of OEMs towards outsourcing their designing requimerents coupled with the rise in the demand for electronic circuit boards because of the rising importance of these boards in various electronic devices such as mobile phones, laptops, and many others are likely to influence the growth of the segment in the coming years. In addition, various types of services provided by global contractors enable less requirement for capital and highly advanced manufacturing techniques for developing new products and devices. OEMs are rapidly outsourcing their circuit assembly requirements for electronic contract manufacturing and design services companies, which substantially help them to increase their profit margins. All these factors are likely to boost the growth of the electronic design & engineering segment over the coming years.

How IT & Telecon Segment Captured Largest Market Share in 2024?

The IT & Telecom segment captured largest market share in 2024 due to the rising investment by various market players in the research & development sector worldwide, which is creating high growth opportunities for the segment during the forecast period. Additionally, increased consumer disposable income, rising spending capacity on innovative products, and growing prevalence of smartphones and tablets with the developing internet speed and connectivity around the world is fueling the growth of the market at a significant growth rate in the coming years.

Why Asia Pacific Region Dominated in 2024?

The Asia Pacific dominated with largest share in 2024 due to the mass availability of various raw materials, low labor cost, and rapid growth in outsourcing activities are the major factors. In addition, high growth in industria the market in these countlization, rapid urbanization, and growing several end-use industries, including healthcare, automotive, and power & energy, mainly in developing nations such as India, China, and Indonesia, are also anticipated to have a positive impact onries in the near future.

What are Reasons for North America's Fastest Growth Rate?

North America is expected to witness the fastest CAGR during the forecast period as the healthcare and automotive industry are the major areas influencing the growth of the market in the region owing to the rising focus on research & development activities, a large presence of key market players, and early adoption of advanced technology with the ease of accessibility to high-speed internet connectivity.

Who are the Major Players in the Market?

The global market is fairly fragmented, with the presence of several international and local market players operating all around the world. The major key players in the global market are implementing several business strategies, including acquisition, mergers, partnerships, collaboration, and new product launches for the expansion of their geographical presence and product portfolio.

Major players in the global market are Benchmark Electronics Inc., Celestica Inc., Compal Electronics Inc., Jabil Circuit Inc., Venture Corporation Limited, Plexus Corporation, Creating Technologies LP, Flextronics International Ltd., Altadox Inc., Sanmina-SCI Corporation, Foxconn, FLEX Ltd., Key Tronic Corporation, Zollner Elektronik AG, ACTIA Group, and A&D Precision Inc.

Recent Developments

In March 2020, Samina-SCI Corporation launched its new manufacturing and supplying facility in Thailand. The new facility has complied with some new features and techniques for the convenient manufacturing process of advanced optical, radio frequency, and high-speed microelectronic products.

In November 2020, Syrma Technology, a leading provider of electronic design and manufacturing services for domestic OEMs, announced its merger with SGS Tekniks with a cash and stock deal. The main aim behind this merger was to create advanced RFID tech, power electronics, and custom magnetics for various automotive, computing, medical, power, and telecom companies.

In August 2020, Creation Technologies announced the expansion of its manufacturing facility and production capacity in Hermosillo, Mexico. The new capacity will increase the total area from 205,000 square feet to 330,000 square feet and complement the company’s existing capacity in the country.

Electronic Contract Manufacturing and Design Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 609.77 billion |

| Market size value in 2025 | USD 666.17 billion |

|

Revenue forecast in 2034 |

USD 1,507.69 billion |

|

CAGR |

9.5% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Service, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Benchmark Electronics Inc., Celestica Inc., Compal Electronics Inc., Jabil Circuit Inc., Venture Corporation Limited, Plexus Corporation, Creating Technologies LP, Flextronics International Ltd., Altadox Inc., Sanmina-SCI Corporation, Foxconn, FLEX Ltd., Key Tronic Corporation, Zollner Elektronik AG, ACTIA Group, and A&D Precision Inc. |

FAQ's

? The global market size was valued at USD 609.77 billion in 2024 and is projected to grow to USD 1,507.69 billion by 2034.

? The global market is projected to register a CAGR of 9.5% during the forecast period.

? Asia Pacific dominated the market share in 2024.

? The IT & Telecom segment accounted for the largest share of the market in 2024.