Track and Trace Solutions Market Share, Size, Trends, Industry Analysis Report

By Product (Hardware, Software); By Technology; By Application; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM1965

- Base Year: 2024

- Historical Data: 2020-2023

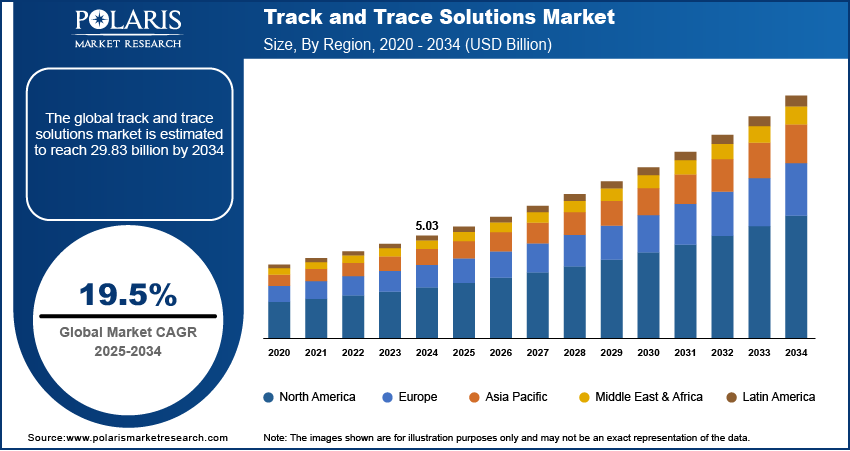

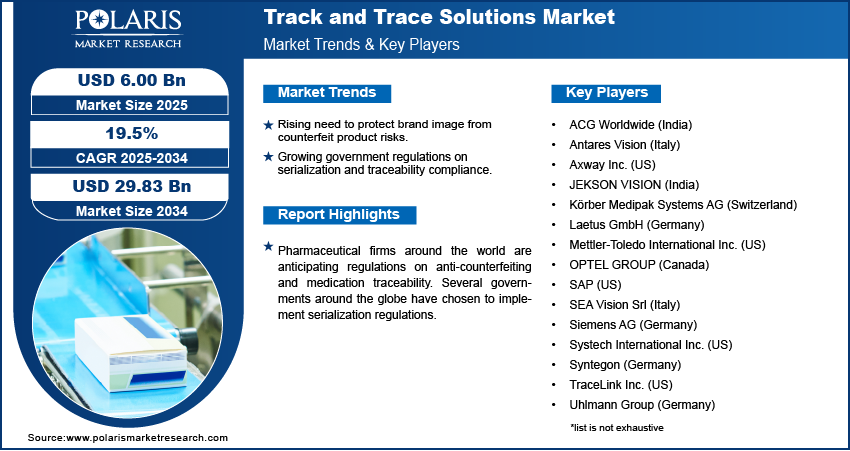

The global track and trace solutions market was valued at USD 5.03 billion in 2024 and is expected to grow at a CAGR of 19.5% during the forecast period. The favorable government intervention, strict regulations, and requirements for serialization implementation increase producers' attention on brand safety increase in the number of packaging-related product recall, and progress in the medical device industry are some of the key factors that drive the growth of track and trace solutions market.

Key Insights

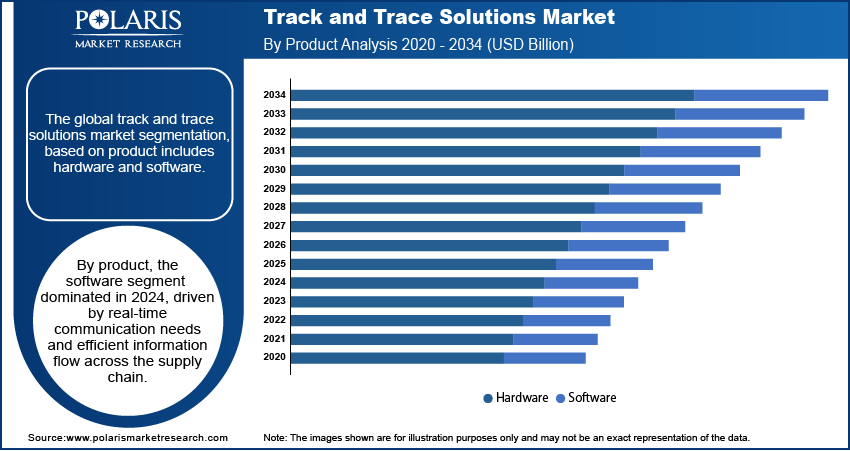

- By product, the software division held the largest share in 2024. This is mainly due to constant communication and the need for a flow of information in real time between the manufacturer and the last customer in the supply chain.

- By technology, barcodes held the largest share in 2024. This is because of their low prices and the ability to hold a hundred times more information than a traditional linear barcode.

- By application, the serialization subsegment held the largest share in 2024. This is because of increased attention from regulatory authorities on track and trace solutions to counteract counterfeiting.

- By end use, the pharmaceutical and biopharmaceutical sectors held the largest share in 2024. The key reason for this is the counterfeit drugs that pose a danger to patients, which need to be countered using these solutions.

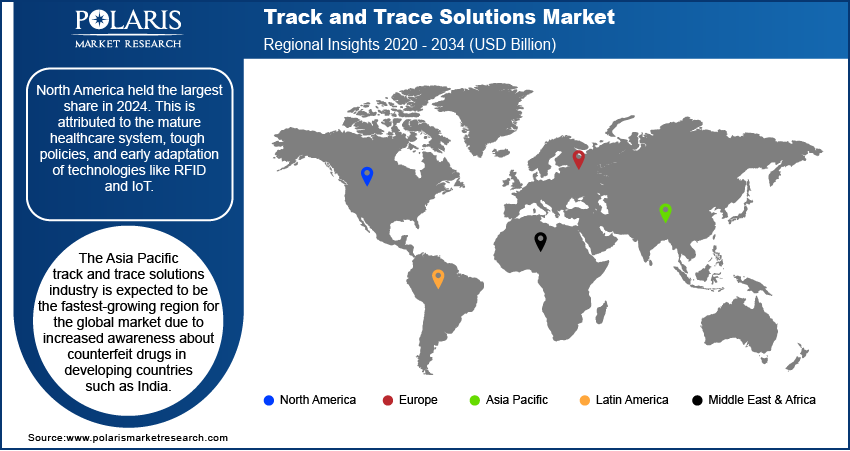

- By region, North America held the largest share in 2024. This is attributed to the mature healthcare system, tough policies, and early adaptation of technologies like RFID and IoT.

Industry Dynamics

- The increasing need to defend and protect a company's brand image against the growing risk of counterfeit products is the key driver.

- Increased government policies are another driving factor. Regulations that include serialization and traceability requirements are becoming normative.

- One of the most important factors for the growth of real-time tracking technology is the high demand for visibility across the entire supply chain. This capability helps companies manage their stocks more efficiently while improving the overall logistics of the company.

Market Statistics

- 2024 Market Size: USD 5.03 billion

- 2034 Projected Market Size: USD 29.83 billion

- CAGR (2025-2034): 19.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- AI is enabling companies in the supply chain to move from a reactionary to a more predictive strategy. AI is also able to identify potential future issues with material availability and shipping delays. This ensures that companies avoid problems by making better decisions ahead of time.

- AI recognition systems and data analysis quickly analyze images of products, logos, and package design to determine counterfeits, even at the most subtle deceptive levels.

- AI systems are modifying the operations of warehouses and inventory systems. Machine learning helps in configuring warehouses and planning the most effective movement of workers or robots to minimize the distances traveled.

Pharmaceutical firms around the world are anticipating regulations on anti-counterfeiting and medication traceability. Several governments around the globe have chosen to implement serialization regulations. The regulatory enforcement for serialization is increasing, which seems to be a significant focus area for pharmaceutical producers and supply chain partners.

Governments across the world are implementing strict rules for the serialization and aggregation of drug products. For instance, in Australia, new guidelines were issued by Therapeutic Goods Administration (TGA) on product coding in 2019 to counter the menace of counterfeit drugs in the country.

Nearly 75% of the pharmaceutical supply chain has been covered under the track and trace regulation for serialization. More than 40 countries in the world have introduced some regulations, which is expected to give a significant boost to the growth of the global market for track and trace solutions.

Industry Dynamics

Growth Drivers

The global market will be driven by increased adoption in the pharmaceutical industry for product I.D. verification, packaging, and logistics management. Stringent regulations by governments across the globe for the serialization of drugs by pharmaceutical companies and technological advancement in track and tracing systems are expected to further fuel the track and trace solutions market's growth during the forecast period.

According to WHO, 10% of medical products sold in developing and underdeveloped countries are counterfeit drugs that are substandard in nature. Even developed markets such as the U.S. are facing a similar problem.

In the U.S., over 3.2 million antiviral products, testing kits, and other COVID-19 related products were seized, in 2020, as they are either mislabeled or prohibited for sale in the country. Hence there will be an increased focus to adopt track and trace solutions for COVID-19 related products.

The emergence of new technology such as RFID is expected to increase track and trace systems adoption. Radio-frequency identification (RFID) is expected to enhance security and product handling and reduce time and labor in product handling.

Many new developments are taking place in the market owing to its increased demand. For instance, RFID-tag-equipped labels prefilled syringes and vials were introduced by Fresenius Kabi that will improve the workflow of inventory management in the operating rooms. Zebra Technologies Corp launched zebra MotionWorks Proximity in June 2020. The system will be useful in alerting and contact trace as the system is incorporated with proximity sensing.

What is the impact of blockchain technology on the track and trace solutions market?

Blockchain technology significantly impacts the track and trace solutions industry. Blockchain-integrated track and trace solutions can be used across various industries to enhance security, transparency, and efficiency. The solutions address challenges related to product monitoring across their lifecycle. Industries seek to enhance supply chain integrity and meet evolving consumer and regulatory demands. Thus, the adoption of blockchain-enabled track and trace solutions would grow in the coming years. With this adoption, key players providing track and trace solutions are collaborating and partnering with blockchain vendors to integrate the technology in their solutions seamlessly. This helps them stay ahead in the competition and expand their business. The following table provide comprehensive information on companies/platforms that combine blockchain and track & trace solutions, with their key differentiators.

|

Company/Platform |

Region/Country |

Key Focus Area |

Key Differentiators |

|

Wholechain |

USA |

Blockchain-based traceability platform for supply chains |

|

|

OpenSC |

Australia |

Transparency in food/commodity supply chain |

|

|

Fujitsu Track & Trust (DLT) |

Japan/Global |

Blockchain technology for traceability in supply chain operations |

|

|

Oracle Blockchain (Track & Trace app) |

USA/Global |

Integration of enterprise blockchain solution and supply chain apps |

|

|

Acviss/Origin |

India/Global |

Computer vision + blockchain end-to-end product traceability |

|

|

Aura Blockchain Consortium |

Switzerland/Global |

Digital product passports for luxury goods |

|

|

Everledger |

UK/Global |

Asset provenance tracking |

|

Blockchain providers and industry players are focusing on innovating track and track solutions. This factor is expected to propel the adoption of blockchain-based track and track solutions during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of product, technology, application, end-use, and region.

|

By Product |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The software segment dominated the market for track and trace solutions and generated the highest revenue in 2024, owing to the increasing acceptance in healthcare companies such as biopharmaceutical, pharmaceutical, and medical device companies.

These software solutions are being used to handle production facilities, case and bundle monitoring, product lines, and warehousing and shipping in real-time. The companies producing this software are investing in research and development for new product innovation, which is expected to drive market growth for track and trace solutions.

The hardware solutions market segment of the track and trace solutions industry is expected to have a high growth rate during the forecast period. The market’s largest revenue share was held by the printing and marking solutions segment. This system is critical in the manufacturing and supply chain to ensure product consistency and integrity.

Rising serialization demand and the need to attain regulatory compliance are driving the market growth. Furthermore, advancements in coding technologies like laser marking systems, Thermal Transfer Overprinting (TTO), and Large Character Marking (LCM) are expected to drive market growth for track and trace solutions.

Insight by Technology

The barcodes segment generated the highest revenue in 2024. The 2D barcode is the largest category of barcode technology and is predicted to remain the same during the analysis duration. The surge of 2D barcodes in pharma and biopharma product packaging significantly contributes to the increased market share. Furthermore, the greater data storage ability of 2D barcodes over linear barcodes, and their increased popularity in the market for track and trace solutions, drive the demand for 2D barcode-based solutions.

The introduction of barcode technology in the healthcare industry was prompted by government legislation and a rise in the sale of counterfeit drugs. The Directorate General of Foreign Trade announced the implementation of such a system for the pharmaceutical products exported from India. As a result, the market for barcode-based technology of track and trace solutions has increased and is anticipated to stay strong over the forecast period.

Insight by Application

The serialization solutions segment dominated the market and generated the highest revenue in 2024, owing to the growing attention of regulatory authorities on the incorporation of track and trace solutions. The federal government, state governments, and the healthcare sector are all taking steps to reduce product trafficking and drug counterfeiting.

Furthermore, manufacturers' increased emphasis on brand protection and patient safety is anticipated to accelerate the market segment's growth in track and trace solutions during the forecast period.

Manufacturers are facing difficulties as serialization requirements become more complex and diverse, particularly in the pharmaceutical industry. Manufacturers find it challenging to incorporate serialization in track and trace due to the differences in regulations and standards across nations and the management of large, consolidated datasets. The rising rate of counterfeiting of pharmaceutical products and other health products fuels the acceptance of serialization in the supply chain.

Geographic Overview

North America is expected to be the biggest region for track and trace solutions during the forecast period due to the increased adoption of advanced results such as RFID and stringent regulatory guidelines in countries like the U.S.

The FDA recalled the CapsoCam Plus video capsule system due to the device mislabeling. Such stringent measures have resulted in the increased use of track and trace solutions in the region. In addition, the region's demand is projected to be driven by the presence of highly established healthcare infrastructure and acceptance of this technology in the U.S.

The Asia Pacific track and trace solutions industry is expected to be the fastest-growing region for the global market due to increased awareness about counterfeit drugs in developing countries such as India. Countries such as China and India have many pharmaceutical industries that will help adopt the technology in the region.

Competitive Insight

The key companies in the market for track and trace solutions are introducing new products frequently to meet the needs of the pharmaceutical industry. The companies are also investing heavily to develop new advanced solutions. They are looking to penetrate the developing markets with huge revenue potential in the coming years as many emerging economies have implemented strict guidelines on medical products.

Some of the major players operating in the market for track and trace solutions include OPTEL GROUP, Mettler-Toledo International Inc., Systech International Inc., TraceLink Inc., Antares Vision, SAP, Xyntek Inc., SEA Vision Srl, Syntegon, Körber Medipak Systems AG, Siemens AG, Uhlmann Group, JEKSON VISION, Videojet Technologies, Inc., Zebra Technologies Corporation, Axway Inc., ACG Worldwide, Laetus GmbH, and WIPOTEC-OCS.

Industry Development

February 2024: TrinaTracker introduced an upgraded version of its Vanguard 1P Smart Tracking Solution, incorporating advanced hardware improvements and a refined Smart Control System.

March 2024: Systech, a digital traceability leader under Markem-Imaje and Dover, completed the acquisition of Germany-based Pharmacontrol Electronic GmbH (PCE).

Track And Trace Solutions Market Research Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.03 billion |

| Market size value in 2025 | USD 6.00 billion |

|

Revenue forecast in 2034 |

USD 29.83 billion |

|

CAGR |

19.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Technology, By Application, By End-use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

OPTEL GROUP (Canada), Mettler-Toledo International Inc. (US), Systech International Inc. (US), TraceLink Inc. (US), Antares Vision (Italy), SAP (US), Xyntek Inc. (US), SEA Vision Srl (Italy), Syntegon (Germany), Körber Medipak Systems AG (Switzerland), Siemens AG (Germany), Uhlmann Group (Germany), JEKSON VISION (India), Videojet Technologies, Inc. (US), Zebra Technologies Corporation (US), Axway Inc. (US), ACG Worldwide (India), Laetus GmbH (Germany), and WIPOTEC-OCS (Germany). |

Want to check out the track and trace solutions market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

FAQ's

• The track and trace solutions market size was valued at USD 5.03 billion in 2024 and is projected to grow to USD 29.83 billion by 2034.

• The track and trace solutions market is projected to register a CAGR of 19.5% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are PTEL GROUP, Mettler-Toledo International Inc., Systech International Inc., TraceLink Inc., Antares Vision, SAP, Xyntek Inc., SEA Vision Srl, Syntegon, Körber Medipak Systems AG, Siemens AG, Uhlmann Group, JEKSON VISION, Videojet Technologies, Inc., Zebra Technologies Corporation, Axway Inc., ACG Worldwide, Laetus GmbH, and WIPOTEC-OCS.

• The pharmaceutical and biopharmaceutical segment dominated the market revenue share in 2024.

• The barcodes segment held the largest market share in 2024.