Trade Finance Market Size, Share, Trends, Industry Analysis Report

By Instrument (Letter of Credit, Supply Chain Financing, Documentary Collections, Receivables Financing/Invoice Discounting, Others), By Service Provider, By Industry, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6415

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

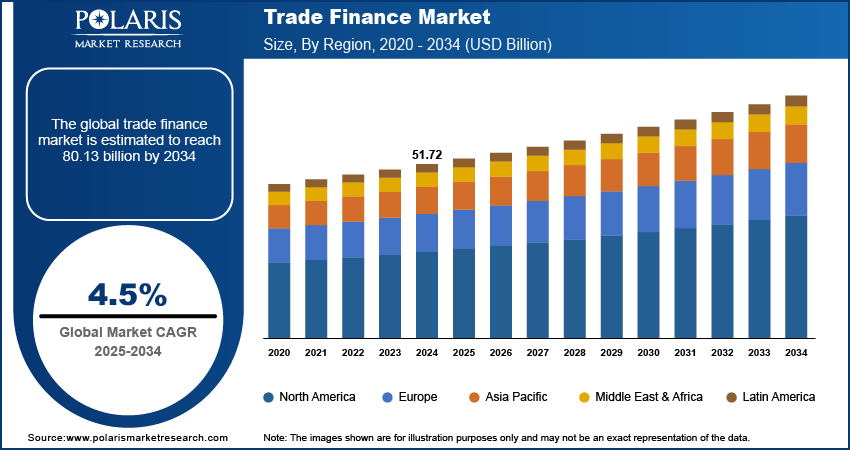

The global trade finance market size was valued at USD 51.72 billion in 2024 and is anticipated to register a CAGR of 4.5% from 2025 to 2034. The adoption of trade finance is mainly driven by the increase in global trade activities, which has led to a greater need for financial solutions to handle transactions across borders. Another key factor is the growing use of technology, such as blockchain and AI, to make trade processes more efficient and secure. Also, the rise of small and medium-sized enterprises getting into international trade has created a higher demand for accessible financing options.

Key Insights

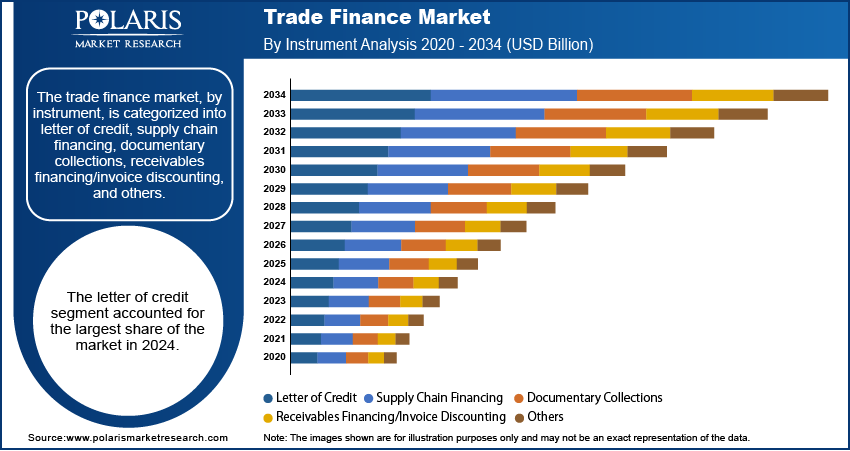

- By instrument, the letters of credit segment held the largest share in 2024, as they provide a high level of security and trust for international transactions.

- By service provider, the banks segment dominated the share due to their strong financial standing, extensive global networks.

- By trade, the international Trade segment held the largest share in 2024, because cross-border transactions involve more complex risks.

- By industry, the wholesale/retail and manufacturing industries held the largest share in 2024 due to their high volume of global trade activities.

- By region, Asia Pacific accounted for the largest share in 2024, due to its strong economic development and its crucial role in global supply chains.

Industry Dynamics

- The growth in international trade is a major driver, as more companies look to expand their business across borders. This has created a rising need for financial tools that can help manage the unique risks of cross-border transactions, such as currency fluctuations and the uncertainty of foreign buyers.

- The increasing use of technology, such as blockchain and AI, is also a key factor. These new technologies make trade processes more efficient, secure, and transparent by helping with tasks such as document verification and fraud detection, which reduces costs and risks for businesses.

- Another driver is the rise of small and medium-sized enterprises, or SMEs, in global trade. As these smaller companies seek to compete internationally, they often lack the capital and resources of larger corporations, creating a high demand for accessible and flexible financing solutions.

Market Statistics

- 2024 Market Size: USD 51.72 billion

- 2034 Projected Market Size: USD 80.13 billion

- CAGR (2025–2034): 4.5%

- Asia Pacific: Largest market in 2024

Trade finance is a group of financial tools and services that helps make international trade smoother for both importers and exporters. It works to reduce the risks involved in cross-border transactions, making sure that sellers get paid and buyers receive their goods. This includes applications such as managing payment and credit risks and providing access to capital, which helps businesses of all sizes participate in global trade.

The ever-changing global political landscape drive the industry growth. Various events such as new trade agreements, tariffs, or even political instability in different regions can directly affect trade flows and the need for finance. As countries form new alliances and change their trade policies, businesses must adapt, creating a need for flexible and secure financing solutions that can handle these new risks.

Another common driver is the increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors. As more consumers and governments demand environmentally friendly practices, businesses are looking for financial support to help them meet these standards. This has created a new demand for green trade finance, which provides funding for projects and transactions that meet certain environmental and social goals. For example, some government export agencies are starting to offer special loans or guarantees for companies that are involved in green technology or sustainable production. This type of support helps promote eco-friendly business practices on a global scale.

Drivers and Trends

Increased Global Trade: The overall increase in global trade activities is a major force behind trade finance. As more countries and businesses engage in cross-border commerce, there is a growing need for financial services that can manage the risks that come with these transactions. These risks include payment default, currency fluctuations, and political instability. The demand for solutions such as letters of credit, export credit, and trade loans grows as businesses seek to protect their investments and ensure smooth operations in a complex sector.

According to the World Economic Situation and Prospects 2024 report by the United Nations, global economic growth outpaced expectations in 2023. While some large economies showed strong resilience, global growth is projected to remain at 3.0% in 2024, showing a stable but slow expansion in international economic activities. This steady growth, despite existing challenges, highlights the ongoing need for trade financing to support the continuous flow of goods and services between nations. This constant activity fuels the need for trade finance services, driving the growth forward.

Technological Advancements: The rapid adoption of new technologies is a key factor changing the trade finance landscape. Old, paper-based processes were often slow, expensive, and prone to mistakes or fraud. However, the rise of technologies such as blockchain, artificial intelligence (AI), and the Internet of Things (IoT) is making trade finance faster, more secure, and more transparent. These tools help automate tasks, verify documents, and track goods in real-time, which reduces the need for manual work and lowers operational costs.

A Global Trade Update published by UN Trade and Development (UNCTAD) in December 2024 revealed that global trade is expected to reach a record $33 trillion in 2024. The report mentions that trade growth has been driven partly by new digital technologies that make things more efficient. This push for digital solutions is making the process of trade finance more attractive and accessible to a wider range of businesses, thus boosting the growth.

Segmental Insights

Instrument Analysis

Based on instrument, the segmentation includes letter of credit, supply chain financing, documentary collections, receivables financing/invoice discounting, and others. The letter of credit segment held the largest share in 2024. This is primarily because they offer a high level of security and trust between trading partners, especially when they don't know each other well. A Letter of Credit, or LC, is a guarantee from a bank that an importer's payment will be made to an exporter on time and for the correct amount. This reduces the risk of non-payment for the seller and provides assurance to the buyer that the goods will be shipped as agreed upon. Even with the emergence of newer financial tools, LCs remain a fundamental part of international trade, particularly for high-value or complex cross-border transactions, including digital transaction management. Their long-standing reliability and widespread acceptance in the global banking system ensure they continue to be the go-to choice for many businesses.

The supply chain financing segment is anticipated to register the highest growth rate during the forecast period. This segment is growing rapidly as it addresses a key challenge for businesses: working capital management. Supply Chain Financing, which includes solutions such as reverse factoring, allows suppliers to get paid early on their invoices, while their buyers can extend their payment terms. This helps both parties, as suppliers get much-needed cash flow and buyers get more time to pay. The growth of this instrument is closely tied to the rise of interconnected global supply chains and the need for businesses to optimize their cash flow. The demand for more efficient, technology-driven solutions that improve cash conversion and enhance liquidity is making Supply Chain Financing a vital and rapidly expanding part.

Service Provider Analysis

Based on service provider, the segmentation includes banks, financial institutions, trading houses, and others. The banks segment held the largest share in 2024. This is mainly attributed to their extensive global networks, long-standing relationships with clients, and deep expertise in handling complex international transactions. Banks provide a wide range of trade finance products, including letters of credit, guarantees, and loans, which are essential for managing risks and ensuring smooth cross-border trade. Their large capital reserves and trusted position in the financial system make them the primary and most reliable choice for businesses of all sizes, from large corporations to small and medium-sized enterprises. Owing to their ability to offer comprehensive services and secure financial solutions, banks continue to be the main players in this segment.

The non-bank financial institutions segment is anticipated to register the highest growth rate during the forecast period. These newer players are often more agile and specialized, using advanced technology to provide innovative solutions that are tailored to specific needs. They focus on areas where banks might be slower to adapt, such as digital-first platforms, online trading platforms, quick processing of smaller transactions, and providing financing for underserved segments such as small businesses. By leveraging new technologies, these institutions can offer more efficient and accessible services. This growth is driven by a shift in customer demand for faster, more transparent, and user-friendly financing options, which these new players are well-equipped to provide. They are changing the way businesses access and use trade finance by offering flexible and modern alternatives to traditional banking.

Trade Analysis

Based on trade, the segmentation includes domestic and international. The international segment held the largest share in 2024. This is because international trade transactions are inherently more complex and riskier than domestic ones. They involve multiple parties across different countries, often with varying laws, currencies, and customs regulations. The need to manage these risks, including trade management, such as payment defaults, currency fluctuations, and political instability, makes financial solutions such as letters of credit and export credit insurance essential. The sheer volume and value of global cross-border commerce mean that international trade activities generate a much higher demand for these specialized financial services. This consistent need for secure and reliable financing to bridge the gap between importers and exporters ensures that the international segment remains dominant.

The domestic trade segment is anticipated to register the highest growth rate during the forecast period. The demand for domestic trade finance is increasing as businesses seek to streamline their internal supply chains and optimize working capital. Even within a single country, companies often face cash flow issues and need financial tools to manage the time gap between delivering goods and getting paid. The rise of small and medium-sized businesses and the growth of e-commerce within national borders have also contributed to this trend. These businesses need flexible and fast financial solutions, such as invoice discounting and receivables financing, to support their daily operations. As a result, the domestic segment is growing rapidly, driven by the need for more efficient and accessible financing options to support business-to-business transactions at a local level.

Industry Analysis

Based on industry, the segmentation includes BFSI, construction, wholesale/retail, manufacturing, automobile, shipping & logistics, and others. The wholesale/retail segment held the largest share in 2024. The manufacturing sector's large-scale production and complex supply chains, which often cross international borders, create a constant and significant demand for financing. From sourcing raw materials to shipping finished goods, every stage of the manufacturing process requires financial support to manage risks and cash flow. Similarly, the wholesale and retail industry relies heavily on trade finance to acquire large inventories of goods from suppliers, often located in different countries. The need to finance these high-volume purchases and manage payment cycles ensures that both of these industries remain the biggest users of trade finance services.

The construction industry is anticipated to register the highest growth rate during the forecast period. This growth is driven by a number of factors, including large infrastructure projects around the world and a greater need for specialized financing. Construction projects, especially those that are large and span across borders, involve complex contracts and a huge flow of materials and equipment. This creates a need for unique financing solutions that can handle the specific risks of the industry, such as long project timelines and high capital requirements. As more countries invest in infrastructure development and urbanization, the demand for trade finance tools tailored to the construction sector is increasing, making it the fastest-growing.

Regional Analysis

The Asia Pacific trade finance market accounted for the largest share in 2024. This growth is fueled by strong economic development, fast industrialization, and an increasing role in global supply chain management. The region is home to some of the world's most dynamic economies and is a major hub for both manufacturing and consumption. With a growing number of businesses, especially smaller ones, engaging in international trade, there is a large and growing need for financial tools that can manage the complexities of cross-border transactions. The region is also seeing a high rate of adoption of digital solutions, which are making trade finance more accessible and efficient for businesses across the region.

China Trade Finance Market Insights

China is a major contributor to the Asia Pacific industry. As a major global trading powerhouse, China is a dominant force in the region's trade finance landscape. The country's vast manufacturing and export sectors create an enormous volume of trade, which requires an equally large amount of financing. China is highly influenced by its government policies that support trade and its massive banking sector. The rapid digitalization of its economy and the strong push for global trade have made China a key area for the development and use of new trade finance technologies.

North America Trade Finance Market Trends

North America is a major player on a global scale. The region's well-developed financial infrastructure, with a strong presence of large international banks and fintech innovators, creates a dynamic environment. The market is supported by significant cross-border trade, particularly with major partners such as Canada and Mexico, as well as an increasing focus on digital trade solutions. Businesses in this region are actively seeking ways to streamline their financial operations, making a wide variety of trade finance products highly sought after.

U.S. Trade Finance Market Outlook

In North America, the U.S. is the largest contributor to the trade finance market. The country’s diverse economy and large volume of international trade activities, especially with major global partners, are key drivers. The U.S. is characterized by a high degree of technological adoption, with companies increasingly using digital platforms to manage trade and supply chain finance. This shift toward more efficient and transparent systems helps businesses navigate the complexities of global commerce and manage risks effectively. The U.S. remains a leader in both the volume of trade and the innovation of financial solutions.

Europe Trade Finance Market Assessment

Europe is a significant market for trade finance, driven by its complex network of international trade and its emphasis on financial stability. The region's trade finance landscape is shaped by a high volume of intra-European trade, as well as extensive trade relationships with other major global partners. The European Union's single and common trade policies simplify some cross-border transactions. However, businesses still rely on trade finance to manage risks related to different currencies, legal systems, and economic conditions. The landscape is mature, with a strong presence of traditional banks, but it is also seeing growing interest in new, technologically advanced solutions to enhance efficiency and security.

A major contributor to the European landscape is the Germany trade finance market. Germany's economy is highly focused on exports, particularly in manufacturing and engineering. This strong export orientation creates a constant demand for a wide range of trade finance services to support its global business activities. German companies, including its large number of small and medium-sized enterprises, are very active in international trade, making the country a key hub for financial products such as export credit insurance and guarantees. The sector in Germany is supported by a stable banking sector and a reputation for reliable business practices, which further fuels the need for trusted trade finance solutions.

Key Players and Competitive Insights

The competitive landscape of the trade finance market is made up of a mix of established global banks and newer, more specialized financial companies. While large banks such as HSBC, Citi, and JP Morgan have a dominant position due to their vast resources and worldwide networks, other players are also gaining ground. The market is also seeing more involvement from regional banks, financial technology startups, and even trading houses. This mix of competitors creates a dynamic environment where traditional players are modernizing their services, and newer companies are bringing innovative, technology-driven solutions to the table.

A few prominent companies in the industry include Bank of America Corporation, Citi, Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Standard Chartered PLC, BNP Paribas SA, UBS Group AG., Wells Fargo & Company, The Toronto-Dominion Bank, and DBS Bank Ltd.

Key Players

- Bank of America Corporation

- BNP Paribas SA

- Citi

- DBS Bank Ltd.

- Deutsche Bank AG

- HSBC Holdings PLC

- JPMorgan Chase & Co.

- Standard Chartered PLC

- The Toronto-Dominion Bank

- UBS Group AG

- Wells Fargo & Company

Trade Finance Industry Developments

August 2025: Citi announced the continuation of its global rollout and enhancements to the CitiDirect Commercial Banking Platform.

January 2024: The Bank of America announced an expansion of its Digital Deals Platform. This platform, which is part of its CashPro Trade product, helps businesses manage their trade finance transactions more efficiently, from start to finish.

Trade Finance Market Segmentation

By Instrument Outlook (Revenue – USD Billion, 2020–2034)

- Letter of Credit

- Supply Chain Financing

- Documentary Collections

- Receivables Financing/Invoice Discounting

- Others

By Service Provider Outlook (Revenue – USD Billion, 2020–2034)

- Banks

- Financial Institutions

- Trading Houses

- Others

By Trade Outlook (Revenue – USD Billion, 2020–2034)

- Domestic

- International

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Construction

- Wholesale/Retail

- Manufacturing

- Automobile

- Shipping & Logistics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Trade Finance Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 51.72 billion |

|

Market Size in 2025 |

USD 53.92 billion |

|

Revenue Forecast by 2034 |

USD 80.13 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 51.72 billion in 2024 and is projected to grow to USD 80.13 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Bank of America Corporation, Citi, Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Standard Chartered PLC, BNP Paribas SA, UBS Group AG., Wells Fargo & Company, The Toronto-Dominion Bank, and DBS Bank Ltd.

The letter of credit segment accounted for the largest share of the market in 2024.

The financial institutions segment is expected to witness the fastest growth during the forecast period.