Trail Camera Market Share, Size, Trends, Industry Analysis Report

By Pixel Size (Below 8 MP, 8 to 12 MP, 12 MP to 16 MP, 17 MP to 21 MP, 22 MP to 30 MP, and Above 30 MP); By Application; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3321

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

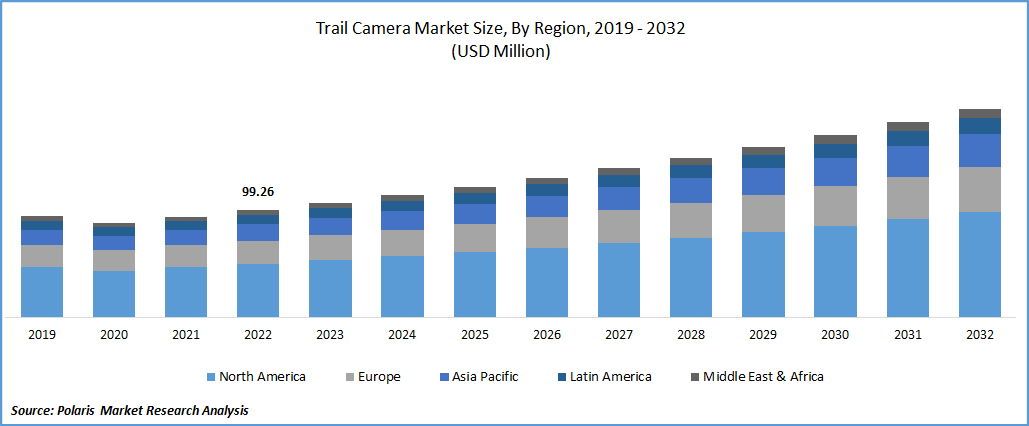

The global trail camera market was valued at USD 105.88 million in 2023 and is expected to grow at a CAGR of 6.9% during the forecast period. Growing consumer inclination towards advanced wireless functionality and durability and the introduction of a variety of new smart trail cameras by major manufacturers that include interesting qualities like night vision technology, long-life battery, long-distance detection, and fast triggering speed are primary factors influencing the global market growth. Moreover, the continuous reduction in the population of various animal species is encouraging the government, society, and organizations to pay more attention to the conservation and monitoring of animals. Thus, key market players focusing on developing innovative trail cameras to improve monitoring capabilities are also likely to create huge growth opportunities for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2022, Reolink, a leading smart security solution, announced the launch of its first trail camera KEEN Ranger PT under the new KEEN Brand. The camera can pan and tilt with a 360-degree view and allow the users to control the camera rotation through a phone app from afar. Wildlife conservation organizations, hunters, and farmers can easily get the exact picture with this rotation feature.

The research report offers a quantitative and qualitative analysis of the trail camera market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The trail cameras are now equipped with an increased flash range and high compatibility with a wide range of devices, are they are now available with protective covers that make them capable of withstanding various harsh climatic conditions. The increasing transformation of trail cameras into technologically advanced products and their growing penetration and consumer base across the globe will further stimulate the market in the forecast period.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the trail camera market. During the pandemic, many countries have imposed various restrictions on mass movements and tourism and have imposed lockdowns, due to which people were forced to stay in their homes, which has directly affected the number of outdoor enthusiasts and sporting events activities. Thus, the demand for the product has declined significantly, as wildlife and hunting photography were not allowed.

Industry Dynamics

Growth Drivers

These cameras' have high efficiency and workability, as they generate images with greater clarity and contrast and consist of two different sensors for both night and day use. Along with this, they can be placed easily in those regions where they might be readily concealed without any need to create a scent or trace, which are among the key factors expected to drive the demand and growth of the global trail camera market. Furthermore, increasing spending on wildlife research and monitoring, and surge in the product applications scope in outdoor security, and growing wildlife monitoring efforts by various organizations are also driving the market growth. Zoologists and biologists are extremely using this innovative technique in their studies owing to its several beneficial features, which have propelled the demand for trail cameras across the globe.

Report Segmentation

The market is primarily segmented based on pixel size, application, and region.

|

By Pixel Size |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

8 to 12 MP segment accounted for the largest market share in 2022

The 8 to 12 MP segment accounted for the largest market share in 2022 and is likely to retain its position over the projected period. The growth of the segment market can be mainly attributed to the introduction of various types of new models with improved technologies and better design modifications. Additionally, those cameras have gained significant traction as they can easily identify the strongest signal in the geographical area and efficiently use the network. Moreover, these camera products include various advantageous characteristics that are highly compatible with shooting high-resolution pictures, tip-lapse, and HD films with better audio. Thus, the product is very popular among travelers and people who love adventures.

The 17 to 21 MP segment is projected to grow at the fastest growth rate during the anticipated period, which is mainly driven by increasing consumers prevalence and seeking for cameras that are waterproof, rugged, and specially designed for outdoor uses with a variety of new features, including night vision, HD video, high-quality image, fast trigger speed, and low glow infrared.

Wildlife monitoring and research segment dominated the global market in 2022

The wildlife monitoring and research segment dominated the market with the majority of the market share in 2022 and is expected to maintain its dominance throughout the forecast period. The increasing proliferation and adoption of trail cameras, especially in developed countries like the US, Canada, Germany, and France, to get the wildlife view and study animal behavior and activities, along with the growing focus of major manufacturers on availing these cameras commercially and more affordable to customers, are key factors propelling the demand and growth of the segment market.

Moreover, trail cameras are being used for more than just nature or wildlife viewing and have become a very powerful management tool for landowners, homeowners, and land managers for security points of view and to enhance security, as these cameras are cost-effective to conventional home security cameras.

Another segment is anticipated to account for a considerable growth rate over the next coming years, on account of its widespread use in photographing trail rides and various types of races, including mountain races, due to its ability to click picture immediately and send it to a cell phone or camera very quickly. In addition, these cameras work on certain types of networks like Verizon or AT&T and utilize their wireless network to provide the best real-time access to the movements, which in turn, are likely to impact the segment growth in the forecast period positively.

Asia Pacific region is expected to witness highest growth during forecast period

The Asia Pacific region is anticipated to grow at the highest CAGR during the projected period, which is highly accelerated by a continuously increasing consumer base, rising awareness among end-users regarding the benefits and availability of these cameras, and increased adoption of the product to control the number of thefts by installing them at homes and lands. Moreover, governments in the APAC region are progressively increasing their military spending to secure their country’s border and be aware of their enemy movements, which will likely fuel the demand for the product significantly.

North American region held a significant market revenue share in 2022 and is expected to continue its position, owing to the extensively ongoing technological advancements and evolvement of trail cameras as more reliable, convenient, and adaptable products. Additionally, many consumers in the region like hunting and are more outdoor enthusiasts since they rely on these cameras for their hunting, and wildlife and nature photography are further anticipated to fuel the market's growth over the coming years. For instance, according to our findings, over 54% of Americans aged six years or more participated in at least outdoor activity in 2021, and the number of outdoor recreation participants rose by 2.2% in 2021 with 164.2 million participants.

Competitive Insight

Some of the major players operating in the global trail camera market include Browning Trail Cameras, Vista Outdoor Operations, Boly Media Communications, Covert Scouting Cameras, Easy Storage Technologies, Reconyx Inc., Good Sportsman Marketing, GSM Outdoors, Scoutguard, Moultrie, EPSCO Industries, Plano Synergy Holdings, and GG Telecom.

Recent Developments

- In July 2022, Moultrie Mobile introduced a cellular trail camera named ‘Edge.’ The newly developed camera comes with the “Auto Connect” technology, which scans & automatically connects to the network from all major U.S. telecom providers with just one sim card.

- In June 2021, Stealth Cam introduced Command Pro App, which offers seamless integration for wireless camera operation and video management. Its features include night colorization, tagging options and filters, a global gallery, high-resolution HD downloads, and many more.

Trail Camera Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 112.98 million |

|

Revenue forecast in 2032 |

USD 192.53 million |

|

CAGR |

6.9% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Pixel Size, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Browning Trail Cameras, Vista Outdoor Operations LLC, Boly Media Communications Inc., Covert Scouting Cameras Inc, Easy Storage Technologies Co. Ltd., Reconyx Inc., Good Sportsman Marketing LLC, GSM Outdoors LLC, Scoutguard, Moultrie, EPSCO Industries Inc., Plano Synergy Holdings Inc., and GG Telecom. |

We provide our clients the option to personalize the Explore the market dynamics of the 2024 trail camera market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Research Industry Reports.

FAQ's

key companies in trail camera market are Browning Trail Cameras, Vista Outdoor Operations, Boly Media Communications, Covert Scouting Cameras, Easy Storage Technologies, Reconyx Inc.

The global trail camera market expected to grow at a CAGR of 6.9% during the forecast period.

The trail camera market report covering key segments are pixel size, application, and region.

key driving factors in trail camera market are growing consumer inclination towards advanced wireless functionality.

The global trail camera market size is expected to reach USD 192.53 million by 2032.