Underwater Acoustic Communication Market Share, Size, Trends, Industry Analysis Report

By Interface Platform (Sensor Interface, Acoustic Modem); By Application; By Communication Depth, By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3086

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

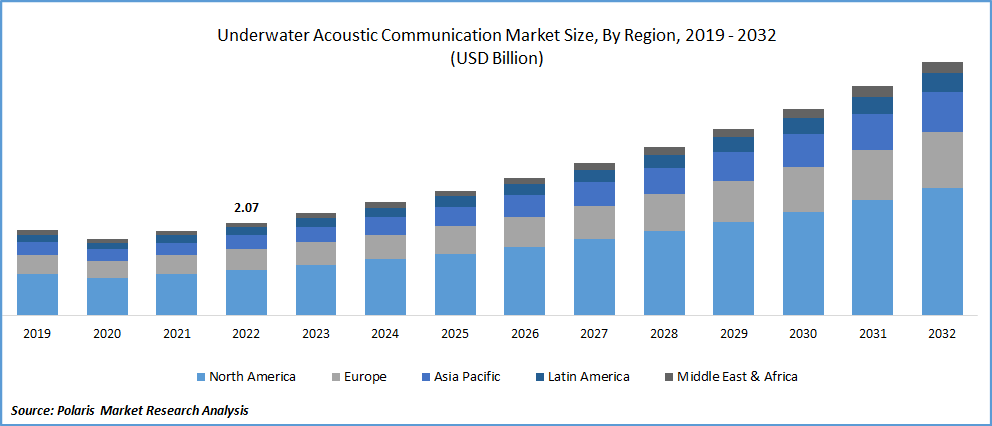

The global underwater acoustic communication market was valued at USD 2.28 billion in 2023 and is expected to grow at a CAGR of 10.6% during the forecast period. Global defense spending has increased significantly as a result of threats, contested areas, and security concerns. In addition to anti-submarine warfare, the military uses Unmanned underwater vehicles (UUVs) for mine countermeasures, rapid environmental assessment, intelligence, surveillance, and reconnaissance missions. UUVs will therefore probably be used more frequently in the upcoming years to tackle underwater security issues, leading to growth in the global market. Developing countries are likely to allocate more funds to the naval defense owing to security concerns for instance India increased the Naval defense budget due recent border disputes with China.

Know more about this report: Request for sample pages

Since World War I, underwater acoustics have been used in underwater combat. It is used to locate, track, and detect enemy targets, including submarines and surface ships. Some weapons are also fired using acoustic sensors. The sonar systems are limited by the ocean's unpredictability in space and time, which the navies of the world must be aware of at the very least in the areas where they anticipate to operate.

As a result, a complex programme of environmental research geared at sonar requirements has matched and outpaced the advancement of military systems. Recent conflicts between the countries will fuel the demand for underwater acoustic communication products in upcoming years.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with underwater acoustic communication market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Commercial uses of underwater communication systems are beneficial, especially in the oil & gas industry. These systems are employed in the exploration of the ocean's abundant immense wealth. AUVs are used to survey the seafloor before operations in the oil & gas industry. This will keep these oil and gas professionals up to date while they build their pipelines. This guarantees that their infrastructure is set up without endangering the environment.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the primary drivers of the industry's expansion is the increase in defense spending by various nations. Global defense spending has increased as a result of threats, anxiety about contested regions, and security concerns. The naval defense system predominantly uses UCS for dependable and secure communication. The military uses it to conduct underwater surveillance and to find infiltration. These factors are projected to aid in the industry's progress in the following years. UCS is beneficial for corporate operations, especially in industries like the oil and gas industry. The system is employed to look at submerged resources.

Growing importance Scientific exploration and data collection will create wide opportunities for the growth of the underwater acoustic communication market. These systems are also very helpful for science because they are utilized for underwater exploration and data gathering. It is used in oceanology, marine archaeology, and marine biology. The underwater discoveries will aid in the development of new technologies and the health sector.

A UCS helps in scientific research as well. In order to find crashed planes and investigate the causes of their crashes, autonomous underwater vehicles have also been deployed. Both the Titanic's debris and hydrothermal vents in the deep ocean have been found due to the development of communication technology. These tools locate underwater objects that aid in mapping and finding. The functions of such services fueling growth of the industry this will likely to continue throughout the forecast period.

Report Segmentation

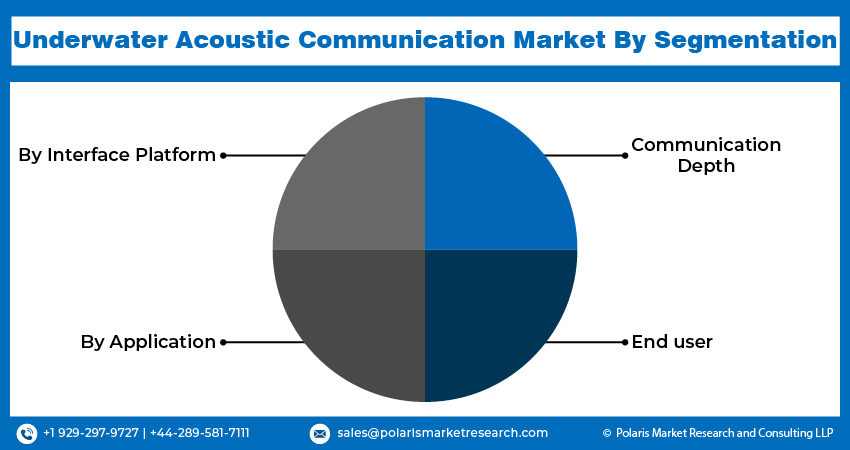

The market is primarily segmented based on interface platform, application, communication depth, end user and region.

|

By Interface Platform |

By Application |

Communication Depth |

End user |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Acoustic modem segment is expected to witness fastest growth

In 2022, acoustic modem segment is projected to garner the largest revenue share. This is primarily due to growing use of these devices in the naval defense equipment. These systems carry out command & control, remote monitoring, & submarine communication. Developed nations prioritize their naval defense forces and aggressively employ unmanned underwater vehicles for navigation and communication purposes.

Environmental monitoring segment is accounted for the largest market share in 2022

The Environmental Monitoring and Assessment Program (EMAP) of the US Environmental Protection Agency (EPA) conducts research on the underwater environment to investigate aquatic ecosystems throughout the US. The possibility of oil spills and leaks from offshore oil and gas production is a significant problem and environmental danger. Environmental monitoring is one of the key applications in underwater acoustics that enables the efficient and directivity-controlled transmission of information.

Medium water segment is expected to witness fastest growth

Medium water segment is anticipated to grow at a higher rate owing to the new demand for efficient monitoring and secure process control systems enhanced by rising environmental consciousness among the population and companies to reduce environmental impact. The Sonardyne Modem 6 Sub Mini is a small, transmission ready modem for sending data from different sensors. An omnidirectional transducer for horizontal and water communication at medium water depth is part of an acoustic modem with a 1,000 m depth rating called the type 8377-1111.

Scientific Research and Development segment is expected to witness fastest growth

Scientific research & development is likely to gain major growth owing to the competition by the market players to innovate new products in the market. The intricacy of underwater acoustic channels and the seawater environment have an impact on underwater acoustic communication. Due to the importance of underwater acoustic communication to marine survey, there is a constant need for scientific research and improvement. Diverse nations place a high value on the advancement of underwater acoustic communication technology and consistently find solutions to underwater communication issues.

North America is dominating the market in 2022

The United States uses un-manned underwater vehicles (UUVs), including anti-submarine warfare, & surveillance, in response to growing security concerns in these nations. As a result, it is anticipated that the growing use of UUVs in both the commercial and defense sectors will accelerate market growth in this region.

Government officials can monitor the environment with the aid of underwater communication devices. Checking the actions of oil and gas firms in relation to their environmental impact is possible. These technologies can be used to monitor environmental contamination and then take steps to decrease it. It is also possible to detect climate change. Furthermore, by seeing early warning indications, these systems can predict natural disasters. Thus, there is a lower chance of any disasters. This will influence the growth and expansion of market.

Asia Pacific expected to register highest growth rate over the study period. Region’s growth would be attributed to ongoing geo-political tensions between neighboring countries for coastal areas to attain control over the un-discovered fishing zones, and mineral rich areas under seas. Moreover, disputes over the sovereignty of islands by the adjacent nations also contributing to the investments in the under-water communication systems.

Competitive Insight

Some of the major players operating in the global underwater acoustic communication market include Teledyne Technologies Incorporated, KONGSBERG, Thales, L3Harris, Ultra, Sonardyne International, EvoLogics GmbH, Moog and Nortek.

Recent Developments

- In January 2023, KONGSBERG had signed a contract with Commonwealth of Australia for Naval strike missile and supporting equipment This is a crucial step in providing the Royal Australian Navy with a contemporary, reliable, and durable precision strike missile capability. The Commonwealth, Australian business, and Kongsberg Defence & Aerospace will work closely together to complete this contract.

- In January 2023, Teledyne technologies acquired chart world International limited and affiliates is a well-known supplier of affordable subscription-based hardware and software for digital marine navigation. The acquisition broadens its customer base to the commercial fleet operators while enhancing its software capabilities & its recurring revenue.

Underwater Acoustic Communication Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.52 billion |

|

Revenue forecast in 2032 |

USD 5.64 billion |

|

CAGR |

10.6% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Interface Platform, By Application, By Communication Depth, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Teledyne Technologies Incorporated, KONGSBERG, Thales, L3Harris, Ultra, Sonardyne International, EvoLogics GmbH, Moog and Nortek. |

Want to check out the acoustic communication market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

FAQ's

Key companies in underwater acoustic communication market are Teledyne Technologies Incorporated, KONGSBERG, Thales, L3Harris, Ultra, Sonardyne International, EvoLogics GmbH, Moog and Nortek.

The global underwater acoustic communication market expected to grow at a CAGR of 10.6% during the forecast period.

The underwater acoustic communication market report covering key segments are interface platform, application, communication depth, end user and region.

Key driving factors in underwater acoustic communication market growing importance Scientific exploration and data collection.

The global underwater acoustic communication market size is expected to reach USD 5.64 billion by 2032.