U.S. Anti-Aging Products Market Size, Share, Trends, Industry Analysis Report

By Product, By Application (Anti-Wrinkle Treatment, Anti-Pigmentation, Skin Resurfacing, and Other Applications), and By Distribution Channel– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6174

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

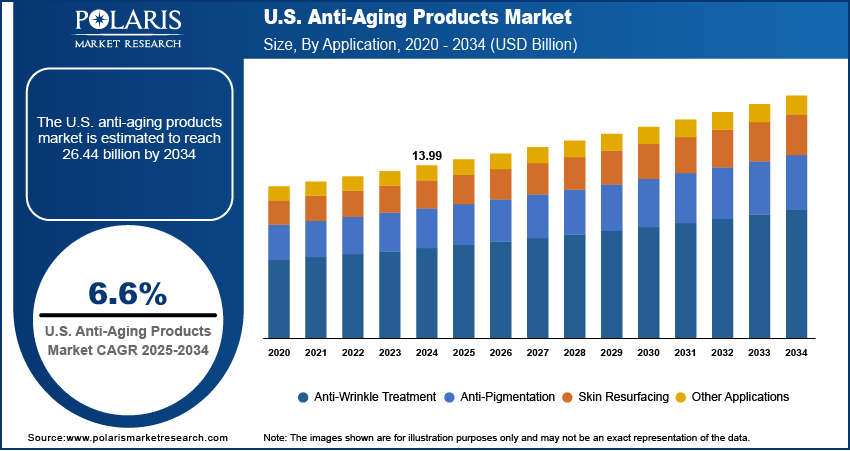

The U.S. anti-aging products market size was valued at USD 13.99 billion in 2024, growing at a CAGR of 6.6% from 2025 to 2034. Key factors driving demand for U.S. anti-aging products include rapid innovation in biotech-driven skincare products, coupled with high healthcare expenditure and increasing investment in preventive skincare.

Key Insights

- The facial serum segment dominated the market share in 2024.

- The skin resurfacing segment is projected to grow at a rapid pace in the coming years, led by increasing application of chemical peels, exfoliants, and regenerative skincare procedures for enhancing unlevel skin texture, acne spots, and aging-related dullness.

Industry Dynamics

- Increasing innovation in biotech-based skincare procedures is strengthening the U.S. market for anti-aging products. Advanced formulations involving stem cells, peptides are enhancing the performance of products and consumer trust.

- Increased healthcare spending and investment in preventive skin care are driving the market growth. U.S. consumers are increasingly spending on keeping their skin healthy and correcting age-related issues early on.

- AI-based personalized skincare product development offers promising opportunities. Intelligent algorithms and skin-analysis platforms allow for extremely tailored anti-aging programs, opening up new revenue streams for manufacturers and retailers.

- High cost of premium anti-aging products and treatments is limiting market expansion.

Market Statistics

- 2024 Market Size: USD 13.99 Billion

- 2034 Projected Market Size: USD 26.44 Billion

- CAGR (2025–2034): 6.6%

The U.S. market for anti-aging products encompasses a wide array of skincare, haircare, and dietary supplements addressing age-related issues like wrinkles, fine lines, hyperpigmentation, and skin elasticity. Growth in scientifically developed serums, retinol creams, collagen supplements, and non-invasive procedures is driving consistent expansion. Developments in active ingredient science, nanotechnology-based products, and personalized skincare are enhancing the efficacy, safety, and confidence-promoting nature of the products. The U.S. market remains at the forefront of global anti-aging innovations, delivering effective and sustainable solutions that are changing consumer desires, health-focused lifestyles, and increasing importance on holistic beauty and wellbeing.

The increasing demand for high-end skincare products is driving growth in the U.S. anti-aging products market. Rising consumer purchasing power, paired with a desire for superior and dermatologist-endorsed treatments, is fueling the high-quality creams, serums, and supplements adoption. Consumers are investing more in products that are retinol- and peptide-rich, hyaluronic acid, as well as natural extracts, in keeping with the rising trend of wellness-beauty. The premiumization trend, fueled by e-commerce growth and marketing initiatives fueled by dermatologists and influencers, is strongly driving the market growth.

The rapidly increasing population of elderly people in the U.S. is also contributing to the growth of the market. The Population Reference Bureau estimates the number of Americans 65 and above to rise from 58 million in 2022 to 82 million by 2050, which is a growth of 47%. Also, this group will make up 23% of the total U.S. In addition, this age group is projected to comprise 23% of the entire U.S. population halfway through the century, as compared to 17% in 2022. This age shift is propelling the use of anti-aging skin care and supplements. The growing requirement for healthy skin is also fueling the demand for minimizing visible indicators of aging while maintaining overall well-being. This trend represents evolving consumer interest in long-term skin care solutions.

Drivers & Opportunities

Rapid Innovation in Biotech-driven Skincare Solutions: Increasing development in biotechnology, like peptide-based and stem cell-based products, are propelling the U.S. anti-aging products market. For example, in May 2025, Beauty-Stem Biomedical introduced Miracle-48 in the U.S., a cutting-edge regenerative skincare technology that blends biotechnology with precision microsphere delivery. Its formula takes advantage of exosome-derived factors contained within 10 million microspheres and 800 million active factors per milliliter that allow for 48 rejuvenating ingredients to restore and revive the skin at a cellular level. These biotech-directed innovations emphasize the transition towards science-based, performance-driven skincare products that are driving the U.S. anti-aging products market growth.

High Healthcare Expenditure and Rising Investment in Preventive Skincare: Increasing healthcare expenditure in the U.S. is boosting consumers' interest towards preventive skincare and wellness-based routines. As per the U.S. Centers for Medicare & Medicaid Services, national healthcare spending increased 7.5% in 2023 to USD 4.9 trillion. Part of this expenditure is an expression of consumer demand for higher-end skincare, wellness products, and self-care innovations designed to cure visible signs of aging. Thus, the increasing disposable incomes combined with an active healthcare consumer base are further driving the use of premium and biotech-derived anti-aging products throughout the U.S. market.

Segmental Insights

By Product

Based on product, the U.S. anti-aging products market is divided into facial serum, moisturizers, creams & lotions, eye care products, facial cleansers & exfoliators, facial masks & peels, sunscreen & sun protection, and others. The facial serum segment held the highest share in 2024, owing to the strong consumer demand for concentrated formulations that provide focused benefits such as hydration, collagen stimulation, and wrinkle reduction. Renowned serums containing bioactive peptides, retinoids, and hyaluronic acid are highly used as they can penetrate deeper layers of the skin and give visible anti-aging effects.

Sunscreen & sun protection is expected to experience the highest growth during the forecast period, driven by rising concern for photoaging, preventive skin care, and dermatologists' emphasis on daily UV protection. Increasing demand for multi-tasking sunscreens with anti-pollution, antioxidant, and moisturizing benefits is also propelling product uptake among all age groups.

By Application

On the basis of application, the market is divided into anti-wrinkle treatment, anti-pigmentation, skin resurfacing, and other applications. The anti-wrinkle treatment application segment accounted for the largest share in 2024 due to the common adoption of retinol creams, peptide serums, and collagen-stimulating products to fight fine lines and restore the elasticity of the skin. Increasing consumer interest in wrinkle solutions that are not invasive is driving the growth of the segment.

The skin resurfacing segment is expected to expand at the highest rate through the forecast period, driven by rising uptake of chemical peels, exfoliators, and regenerative skincare products addressing uneven skin texture, acne scars, and age-defying dullness. At-home resurfacing kit advances and biotech-driven formulation are also driving segment growth in the U.S.

By Distribution Channel

Based on distribution channel, the market is segmented into supermarkets & hypermarkets, pharmacy & drugstores, specialty beauty stores, online retail, and others. The online retail segment led the U.S. market for anti-aging products in 2024, due to the explosive growth of digital retail platforms, brand-owned websites, and subscription-based beauty services. Convenience, personalized product advice, and access to a broad selection of premium brands are driving online adoption.

The specialty beauty store segment is expected to experience the highest growth over the forecast period as consumers are increasingly demanding expert guidance, experiential retail, and proximity to higher quality product offerings in specialist beauty stores. Networks of specialist retailers such as Sephora and Ulta Beauty are establishing deeper offline channels of distribution thus driving the market growth.

Key Players & Competitive Analysis

The U.S. anti-aging products market is very competitive with the top companies including Estée Lauder Companies Inc., L'Oréal USA, Inc., and Procter & Gamble Co. leading the way through innovative formulations, biotechnology use, and wider ranges of skincare products. Estée Lauder Companies Inc. keeps building its pipeline of products with peptide serums, retinol technology, and AI skincare personalization instruments, while L'Oréal USA, Inc. expands its premium and mass-market segments with clinically proven anti-aging solutions. Procter & Gamble Co. broadens its market coverage via Olay brand, emphasized on dermatologist-endorsed products for the reduction of wrinkles, hydration, and repair of skin barriers.

The industry is seeing firm uptake of biotech-led and multifeatured products that tackle wrinkles, pigmentation, and skin elasticity, driven by rising consumer need for prevention-focused skincare and science-backed outcomes. Players are spending big on biotechnology collaborations, exosome and peptide science, and precision delivery technologies to drive efficacy and differentiation. Strategic partnerships with dermatologists, biotech companies, and digital beauty platforms are driving consumer interaction and product uptake among various demographics. Ongoing R&D in regenerative skincare, microbiome-inspired formulations, and clean-label active ingredients are defining the future of U.S. anti-aging treatments.

Prominent companies operating in the U.S. anti-aging products market include AMOREPACIFIC US, Inc., Avon Products, Inc., Beiersdorf Inc., Coty Inc., Estée Lauder Companies Inc., GAR Laboratories, Inc., Johnson & Johnson Services, Inc., L'Oréal USA, Inc., Mary Kay Inc., Oriflame Holdings, Inc., PMD Beauty (Age Sciences Inc.), Procter & Gamble Co., Revlon Consumer Products Corporation, Shiseido Americas Corporation, and Unilever United States, Inc.

Key Players

- AMOREPACIFIC US, INC.

- Avon Products, Inc.

- Beiersdorf Inc.

- Coty Inc.

- Estée Lauder Companies Inc.

- GAR Laboratories, Inc.

- Johnson & Johnson Services, Inc.

- L'Oréal USA, Inc.

- Mary Kay Inc.

- Oriflame Holdings, Inc.

- PMD Beauty (Age Sciences Inc.)

- Procter & Gamble Co.

- Revlon Consumer Products Corporation

- Shiseido Americas Corporation

- Unilever United States, Inc.

U.S. Anti-Aging Products Industry Developments

In February 2025, Estée Lauder Companies (ELC) partnered with Serpin Pharma to develop new skincare ingredients targeting longevity. Serpin Pharma is known for its expertise in anti-inflammatory research, in Serine Protease Inhibitors, a group of proteins that support the repair of inflamed cells.

U.S. Anti-Aging Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Facial Serum

- Moisturizer, Creams, & Lotions

- Eye Care Products

- Facial Cleanser & Exfoliators

- Facial Masks & Peels

- Sunscreen & Sun Protection

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Anti-Wrinkle Treatment

- Anti-Pigmentation

- Skin Resurfacing

- Other Applications

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets & Hypermarkets

- Pharmacy & Drugstores

- Specialty Beauty Stores

- Online Retail

- Others

U.S. Anti-Aging Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 13.99 Billion |

|

Market Size in 2025 |

USD 14.89 Billion |

|

Revenue Forecast by 2034 |

USD 26.44 Billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |

FAQ's

The market size was valued at USD 13.99 billion in 2024 and is projected to grow to USD 26.44 billion by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period.

A few of the key players in the market are AMOREPACIFIC US, INC.; Avon Company; Beiersdorf Inc.; Coty Inc.; Estée Lauder Inc.; GAR Laboratories; Johnson & Johnson; L'Oréal Paris; Procter & Gamble; and Unilever.

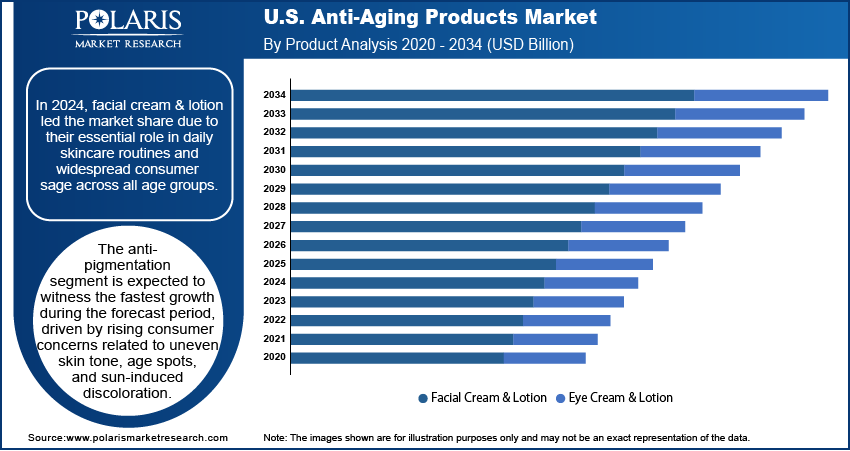

The facial cream & lotion segment accounted for the largest revenue share in 2024.

The anti-pigmentation segment is expected to witness fastest growth during the forecast period.