U.S. Cell Culture Media & Cell Lines Market Size, Share, Trends, Industry Analysis Report

By Product (Traditional Cell Lines, Classical Media), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6142

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

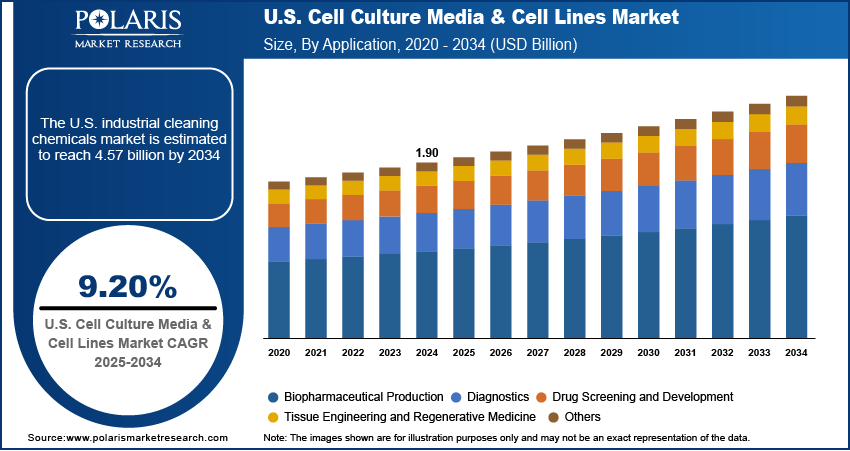

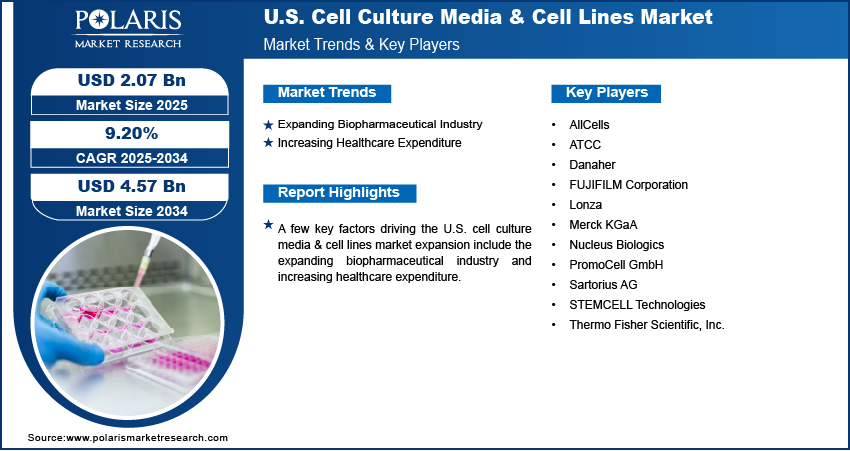

The U.S. cell culture media & cell lines market size was valued at USD 1.90 billion in 2024, growing at a CAGR of 9.20% from 2025 to 2034. Key factors driving the demand for cell culture media & cell lines in the U.S. include the expanding biopharmaceutical industry and increasing healthcare expenditure.

Key Insights

- The specialty media segment accounted for 44.12% of revenue share in 2024 due to increasing demand for advanced and customized cell culture solutions in biopharmaceutical production, regenerative medicine, and cancer research

- The tissue engineering and regenerative medicine segment is projected to register the highest CAGR in the coming years due to breakthroughs in stem cell therapies, 3D bioprinting, and organoid development.

Industry Dynamics

- The expanding biopharmaceutical industry in the U.S. is driving demand for cell culture media & cell lines by investing in advanced cell-based systems for research.

- The increasing healthcare expenditure is also fueling the market growth by promoting the establishment of advanced laboratories and biomanufacturing facilities that require high-quality cell culture media and diverse cell lines.

- The ongoing cancer research in the country is creating a lucrative market opportunity.

- The high cost and specialized expertise associated with cell culture media & cell lines hinder the market growth in the U.S.

Market Statistics

- 2024 Market Size: USD 1.90 Billion

- 2034 Projected Market Size: USD 4.57 Billion

- CAGR (2025–2034): 9.20%

To Understand More About this Research: Request a Free Sample Report

The U.S. cell culture media and cell lines market focuses on nutrient-rich solutions (media) and living cells (cell lines) used for biomedical research, drug development, and biomanufacturing. Growing demand for biologics, personalized medicine, and cancer research drives the market, while advancements in 3D cell culture and stem cell technologies accelerate innovation. Key trends include the shift toward serum-free and chemically defined media to enhance reproducibility, as well as increased adoption of CRISPR-edited cell lines for precision research. Biopharmaceutical companies and academic institutions in the country are heavily investing in high-quality cell culture products to support drug discovery and regenerative medicine. Emerging opportunities lie in developing customized cell lines for targeted therapies, expanding cell-based vaccine production, and leveraging automation to streamline cell culture processes. The rise in adoption of cell and gene therapies further fuels demand, positioning the U.S. as a key country in the cell culture media & cell line industry.

Drivers & Opportunities

Expanding Biopharmaceutical Industry: Expanding biopharmaceutical industry in the U.S. is driving large-scale production of biologics such as monoclonal antibodies, vaccines, and recombinant proteins, which is propelling the demand for cell culture media and cell lines for advanced cell-based systems for research. The U.S. biopharmaceutical industry exceeded $800 billion in direct output in 2022. Additionally, the expanding biopharmaceutical industry is driving investments in personalized medicine and regenerative therapies, which fuels the market growth, as researchers rely on specialized cell lines and media formulations for the development of personalized medicine and regenerative therapies.

Increasing Healthcare Expenditure: Governments and private entities in the country allocate more funds to improve healthcare systems, which is encouraging hospitals, research institutions, and pharmaceutical companies to expand their R&D capabilities to develop new treatments for cancer, neurological disorders, and infectious diseases. This is driving demand for cell culture media and cell lines as research institutions and pharmaceutical companies rely heavily on cell-based models for accurate and reproducible results. The rise in healthcare spending is also promoting the establishment of advanced laboratories and biomanufacturing facilities that require high-quality cell culture media and diverse cell lines to support preclinical testing, vaccine development, and regenerative medicine. Health spending in the U.S. increased by 7.5% in 2023 to $4.9 trillion. Furthermore, increased investments in personalized medicine fuel the need for customized cell models and media formulations tailored to specific patient populations. Therefore, the increasing healthcare expenditure propels the U.S. cell culture media & cell lines market growth.

Segmental Insights

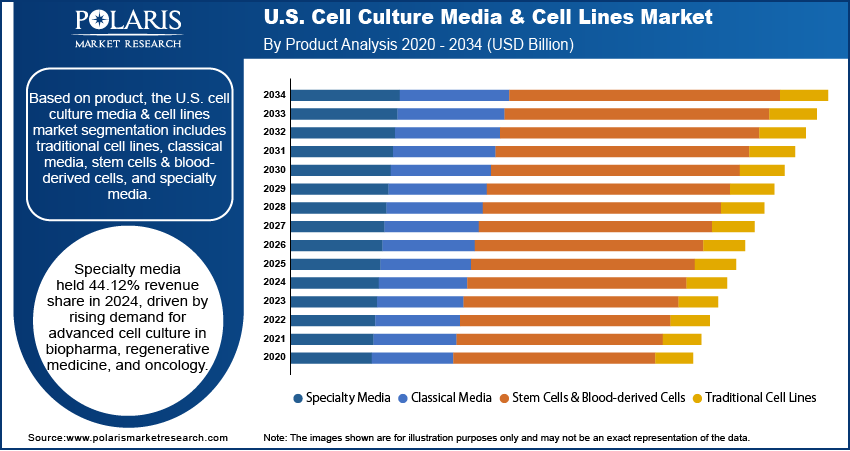

Product Analysis

Based on product, the U.S. cell culture media & cell lines market segmentation includes traditional cell lines, classical media, stem cells & blood-derived cells, and specialty media. The specialty media segment accounted for 44.12% of the market share in 2024 due to increasing demand for advanced and customized cell culture solutions in biopharmaceutical production, regenerative medicine, and cancer research. The rise in monoclonal antibody therapies, vaccines, and cell-based therapies necessitated specialty media formulations that enhance cell viability, productivity, and consistency. Pharmaceutical companies and research institutions increasingly adopted specialty media to optimize bioprocessing efficiency, reduce batch variability, and comply with stringent regulatory standards. Additionally, the growing focus on personalized medicine and the expansion of biologics manufacturing further led specialty media as the dominant segment.

Application Analysis

In terms of application, the segmentation includes biopharmaceutical production, diagnostics, drug screening and development, tissue engineering and regenerative medicine, and other. The tissue engineering and regenerative medicine segment is projected to register the highest CAGR in the U.S. cell culture media & cell lines market in the coming years, owing to breakthroughs in stem cell therapies, 3D bioprinting, and organoid development. The rising incidence of degenerative diseases, aging populations, and the demand for alternative transplantation solutions are fueling the demand for cell culture media & cell lines in tissue engineering and regenerative medicine. Furthermore, the increasing adoption of autologous cell therapies and the commercialization of lab-grown tissues for clinical applications is expected to expand the segment’s market share during the forecast period.

Key Players and Competitive Analysis

The U.S. cell culture media and cell lines market is highly competitive, with key players such as Thermo Fisher Scientific, Merck KGaA, and Sartorius AG dominating due to their extensive product portfolios, advanced technologies, and strong distribution networks. Thermo Fisher leads with its Gibco brand, offering high-quality media and cell lines, while Merck KGaA excels in customized and specialty media solutions. STEMCELL Technologies and Lonza focus on niche segments, such as stem cell and bioprocessing applications, leveraging innovation to maintain their profitability share. Emerging competitors such as PromoCell GmbH and AllCells target research and clinical applications with specialized offerings. Additionally, ATCC remains a critical supplier of authenticated cell lines, ensuring reliability in academic and pharmaceutical research. The U.S. cell culture media and cell lines market is further influenced by strategic acquisitions and investments in cell culture technologies. Intense R&D, regulatory compliance, and the growing demand for personalized medicine and biopharmaceuticals are driving competition in the market.

A few major companies operating in the U.S. cell culture media & cell lines industry include AllCells; ATCC; Danaher; FUJIFILM Corporation; Lonza; Merck KGaA; Nucleus Biologics; PromoCell GmbH; Sartorius AG; STEMCELL Technologies; and Thermo Fisher Scientific, Inc.

Key Players

- AllCells

- ATCC

- Danaher

- FUJIFILM Corporation

- Lonza

- Merck KGaA

- Nucleus Biologics

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies

- Thermo Fisher Scientific, Inc.

U.S. Cell Culture Media & Cell Lines Industry Developments

In August 2024, Nucleus Biologics announced the launch of a novel platform, QuickStart Media, to expedite the formulation and manufacture of custom media. This platform is an addition to its comprehensive line of cell culture products and solutions.

In July 2023, Lonza launched the TheraPRO CHO Media System, a new cell culture platform that simplifies processes and optimizes productivity and protein quality when used with GS-CHO cell lines.

U.S. Cell Culture Media & Cell Lines Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Cell Lines

- Classical Media

- Stem Cells & Blood-derived Cells

- Specialty Media

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Production

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Other

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Large Biopharmaceutical Companies

- Small and Mid-sized Biotechnology Companies

- Contract Research and Manufacturing Organizations (CROs/CMOs)

- Research and Academic Institutes

- Hospitals and Diagnostic Laboratories

- Other

U.S. Cell Culture Media & Cell Lines Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.90 Billion |

|

Market Size in 2025 |

USD 2.07 Billion |

|

Revenue Forecast by 2034 |

USD 4.57 Billion |

|

CAGR |

9.20% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.90 billion in 2024 and is projected to grow to USD 4.57 billion by 2034.

The market is projected to register a CAGR of 9.20% during the forecast period.

A few of the key players in the market are AllCells; ATCC; Danaher; FUJIFILM Corporation; Lonza; Merck KGaA; Nucleus Biologics; PromoCell GmbH; Sartorius AG; STEMCELL Technologies; and Thermo Fisher Scientific, Inc.

The specialty media segment dominated the market revenue share in 2024.

The tissue engineering and regenerative medicine segment is projected to witness the fastest growth during the forecast period.