U.S. CRISPR & Cas Genes Market Size, Share, Trends, Industry Analysis Report

By Product (Kits & Enzymes, Libraries), By Service, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM6417

- Base Year: 2024

- Historical Data: 2020-2023

Overview

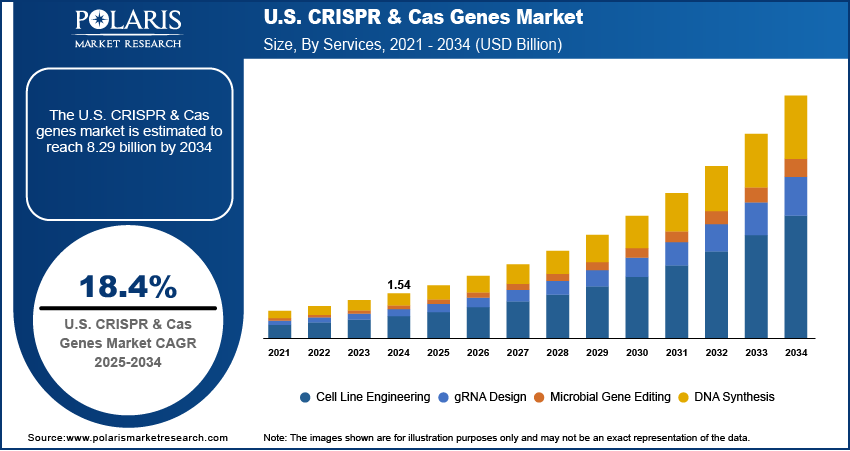

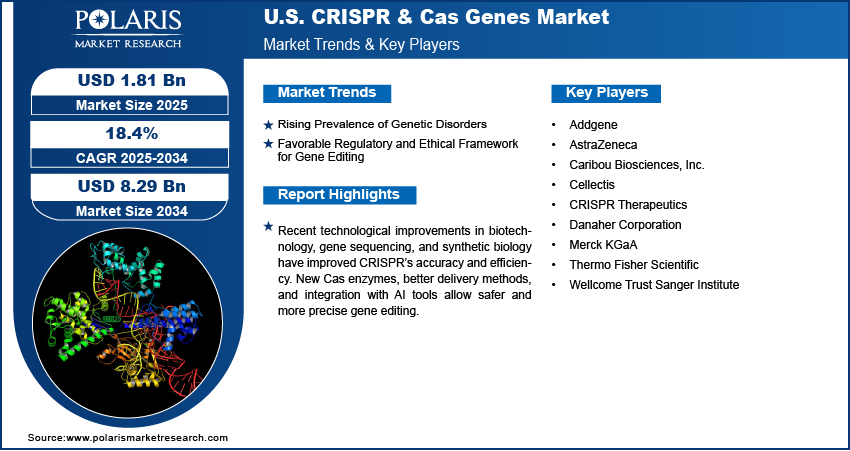

The U.S. CRISPR & Cas genes market size was valued at USD 1.54 billion in 2024, growing at a CAGR of 18.4% from 2025 to 2034. Key factors driving the growth are rising prevalence of genetic disorders, and favorable regulatory and ethical framework for gene editing.

Key Insights

- The kits and enzymes segment is anticipated to register a CAGR of 19.3% during the forecast period, driven by the extensive adoption of gene-editing tools across academic and commercial research settings.

- The microbial gene editing segment is expected to account for a substantial market share during 2025–2034, as biotechnology firms and research institutions increasingly utilize engineered microbes for applications in healthcare, agriculture, and industrial processes.

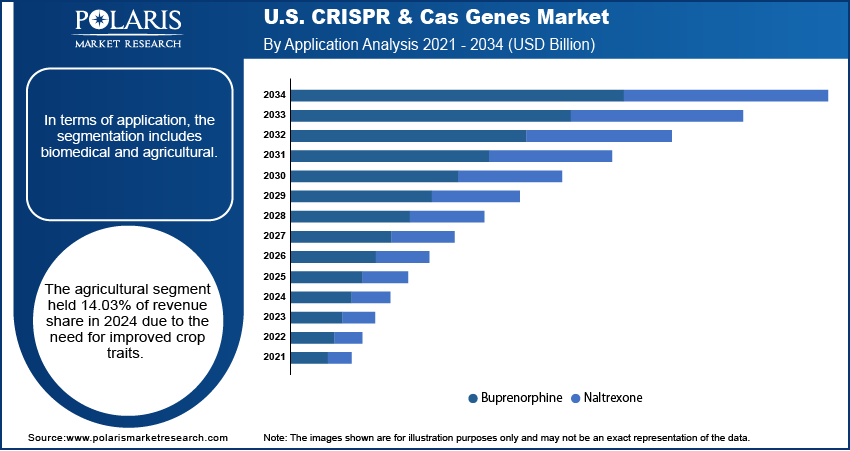

- In 2024, the agricultural application segment accounted for 14.03% of the total revenue, supported by the use of CRISPR technology to enhance crop productivity and quality.

- The contract research organizations (CROs) segment held a significant revenue share of 15.59% in 2024, as they continue to provide specialized CRISPR-related research services to pharmaceutical and biotechnology companies.

Industry Dynamics

- Rising prevalence of genetic disorders is driving the demand for this technology.

- Favorable regulatory and ethical framework for gene editing is driving the U.S. CRISPR & Cas genes market growth.

- Recent technological improvements in biotechnology, DNA sequencing, and synthetic biology have improved CRISPR’s accuracy and efficiency.

- High regulatory complexities and ethical concerns around gene editing technologies hinder the rapid adoption.

Market Statistics

- 2024 Market Size: USD 1.54 Billion

- 2034 Projected Market Size: USD 8.29 Billion

- CAGR (2025–2034): 18.4%

AI Impact on U.S. CRISPR & Cas Genes Market

- AI accelerates gene-editing research by rapidly analyzing large genomic datasets, enabling the identification of precise target sites for CRISPR & Cas gene modifications.

- Integration of AI allows predictive modeling to optimize enzyme design and reaction conditions, improving efficiency and accuracy in gene-editing experiments.

- AI-powered analytics help researchers understand complex biological pathways and off-target effects, enhancing safety and effectiveness of CRISPR-based therapies.

- AI automates data processing and workflow management in laboratories, reducing experimental errors, lowering costs, and speeding up the development of gene-editing products.

CRISPR-Cas genes refer to a natural bacterial defense system used for gene editing. The CRISPR sequences guide the Cas enzyme to specific DNA locations to make precise cuts. This technology enables targeted modification of genes for research and therapeutic purposes.

The U.S. government and private sector are investing heavily in genomics and biotechnology. Funding from agencies such as the National Institutes of Health (NIH) supports advanced gene-editing research using CRISPR-Cas technologies. These investments accelerate innovations in disease modeling, functional genomics, and therapeutic development. Additionally, biotech companies in the U.S. are raising significant capital through IPOs and venture funding, further fueling research and commercialization. This strong financial backing makes the U.S. a global leader in CRISPR applications, from basic research to potential clinical therapies, creating consistent demand and opportunity for expansion.

The U.S.-based biotech and pharmaceutical companies are rapidly expanding their pipelines of CRISPR-based therapeutics targeting genetic diseases such as sickle cell anemia, Leber congenital amaurosis, and beta-thalassemia. Companies such as CRISPR Therapeutics, Editas Medicine, and Intellia Therapeutics are conducting advanced-stage clinical trials in collaboration with larger pharmaceutical partners. These efforts reflect growing confidence in the safety and efficacy of CRISPR-Cas9 technology for in vivo and ex vivo therapies. Investor interest and regulatory focus are increasing as clinical data continue to show promise, thereby fueling the growth.

Drivers & Opportunities

Rising Prevalence of Genetic Disorders: The rising incidence of genetic and rare diseases in the U.S. is driving the demand for precise and effective gene-editing therapies. Conditions such as Duchenne muscular dystrophy, cystic fibrosis, and hereditary blindness have limited treatment options, making CRISPR a highly attractive approach. According to the Cystic Fibrosis Foundation, 40,000 children and adults are suffering from cystic fibrosis in the country. The urgency to find permanent cures rather than lifelong treatments is pushing researchers and clinicians to explore CRISPR-based solutions. Additionally, the U.S. has robust rare disease advocacy networks and patient registries that support clinical trial recruitment and data sharing, helping to fast-track therapeutic development and market growth.

Favorable Regulatory and Ethical Framework for Gene Editing: The U.S. Food and Drug Administration (FDA) and National Institutes of Health (NIH) provide structured and transparent regulatory pathways for gene-editing therapies, which support innovation while ensuring patient safety. Although regulatory oversight is stringent, it is also adaptive, allowing fast-track designations and accelerated approvals for promising therapies, especially in rare diseases. Ethical guidelines and Institutional Review Boards (IRBs) further ensure responsible use of CRISPR technologies. This regulatory balance allows researchers and companies to move from lab to clinic with confidence, thereby fueling the adoption.

Segmental Insights

Product Analysis

Based on product, the segmentation includes kits & enzymes, libraries, design tool, antibodies, and other products. The kits & enzymes segment is projected to register a CAGR of 19.3% over the forecast period due to the widespread use of gene-editing tools in academic and commercial research. Researchers and biotech firms rely on ready-to-use kits for accurate, fast, and reproducible gene-editing experiments. These kits streamline complex processes, saving time and reducing technical errors. The growing focus on functional genomics, drug discovery, and precision medicine is fueling the adoption of CRISPR reagents. Additionally, advancements in enzyme engineering are improving specificity and efficiency, making kits even more effective for diverse applications, thus driving growth in the segment.

Service Analysis

Based on service, the segmentation includes cell line engineering, gRNA design, microbial gene editing, DNA synthesis. The microbial gene editing segment is expected to witness a significant share over the forecast period as biotech companies and research institutions are exploring the potential of engineered microbes for applications in healthcare, agriculture, and industrial biotechnology. CRISPR allows for precise manipulation of microbial genomes to improve the production of biofuels, enzymes, and therapeutic proteins. This segment is driven by increasing interest in sustainable solutions and the development of next-generation probiotics, antimicrobials, and biosensors. Companies are outsourcing microbial editing tasks to specialized service providers to reduce costs and accelerate R&D timelines. The growing commercial interest in synthetic biology is further boosting demand for microbial gene-editing services.

Application Analysis

In terms of application, the segmentation includes biomedical, agricultural. The agricultural segment held 14.03% of revenue share in 2024 as CRISPR technology is used to improve crop quality and productivity. Gene editing helps develop crops with improved resistance to pests, diseases, and environmental stress, which supports food security and farming efficiency. In the U.S., favorable regulatory policies for CRISPR-edited crops have encouraged research and commercial development in this area. Agricultural biotechnology companies are using CRISPR to shorten breeding cycles and improve traits such as shelf life and nutritional value. The increasing demand for high-yield and climate-resilient crops drives the use of CRISPR in agricultural applications.

End Use Analysis

In terms of end use, the segmentation includes biotechnology & pharmaceutical companies, academics & government research institutes, and contract research organizations (CROs). The contract research organizations (CROs) segment held a significant revenue share in 2024, holding 15.59% as they are focused on offering specialized research services to pharmaceutical and biotechnology companies. Many organizations prefer to outsource CRISPR-related projects to CROs to reduce operational costs and save time. CROs provide support in areas such as cell line development, gene editing validation, and preclinical studies. The growing complexity of CRISPR-based research has increased the need for expert services that CROs are well-equipped to provide, thereby fueling the segment growth.

Key Players & Competitive Analysis

The U.S. CRISPR & Cas genes market features a competitive landscape with a mix of established biotechnology firms, pharmaceutical companies, and research institutions. Thermo Fisher Scientific and Merck KGaA are leading suppliers of CRISPR tools, kits, and reagents, serving both research and clinical sectors. CRISPR Therapeutics, Caribou Biosciences, and Cellectis are at the forefront of developing CRISPR-based therapeutics, focusing on gene-editing treatments for genetic diseases and cancer. AstraZeneca is investing in CRISPR for drug discovery and target validation. Danaher Corporation supports the market through its subsidiaries offering advanced gene-editing tools. Addgene plays a key role as a nonprofit plasmid repository, supporting academic research. Meanwhile, the Wellcome Trust Sanger Institute contributes significantly to foundational research and innovation. The competitive environment is shaped by strategic collaborations, licensing agreements, and ongoing clinical advancements, with companies aiming to gain leadership in both therapeutic applications and CRISPR technology development.

Key Players

- Addgene

- AstraZeneca

- Caribou Biosciences, Inc.

- Cellectis

- CRISPR Therapeutics

- Danaher Corporation

- Merck KGaA

- Thermo Fisher Scientific

- Wellcome Trust Sanger Institute

U.S. CRISPR & Cas Genes Industry Developments

In May 2025, Biomay AG launched its FDA-grade CRISPR/Cas9 nuclease for off-the-shelf purchase, expanding its product portfolio. The company, an FDA-approved GMP manufacturer, provided high-quality Cas9 nuclease to support scalable and compliant gene-editing applications globally.

U.S. CRISPR & Cas Genes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Kits & Enzymes

- Vector-Based Cas

- DNA-Free Cas

- Libraries

- Design Tool

- Antibodies

- Other Products

By Service Outlook (Revenue, USD Billion, 2021–2034)

- Cell Line Engineering

- gRNA Design

- Microbial Gene Editing

- DNA Synthesis

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Biomedical

- Agricultural

By End Use Outlook (Revenue, USD Billion, 2021–2034)

- Biotechnology & Pharmaceutical Companies

- Academics & Government Research Institutes

- Contract Research Organizations (CROs)

U.S. CRISPR & Cas Genes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.54 Billion |

|

Market Size in 2025 |

USD 1.81 Billion |

|

Revenue Forecast by 2034 |

USD 8.29 Billion |

|

CAGR |

18.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.54 billion in 2024 and is projected to grow to USD 8.29 billion by 2034.

The market is projected to register a CAGR of 18.4% during the forecast period.

A few of the key players in the market are Addgene, AstraZeneca, Caribou Biosciences, Inc., Cellectis, CRISPR Therapeutics, Danaher Corporation, Merck KGaA, Thermo Fisher Scientific, and Wellcome Trust Sanger Institute.

The enzyme and kits segment dominated the market revenue share in 2024.

The agriculture segment is projected to witness the fastest growth during the forecast period.