U.S. In-Mold Electronics Market Size, Share, Trends, Industry Analysis Report

By Components (Capacitive Touch Sensing, Lighting, Others), By Technology, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6126

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

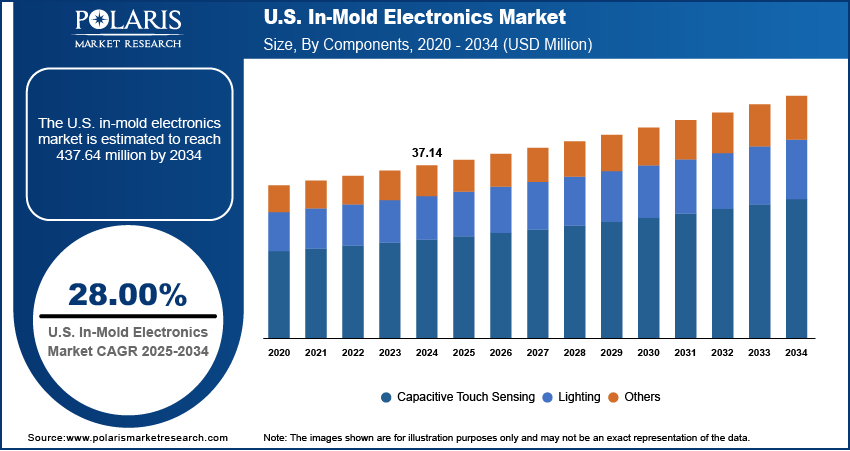

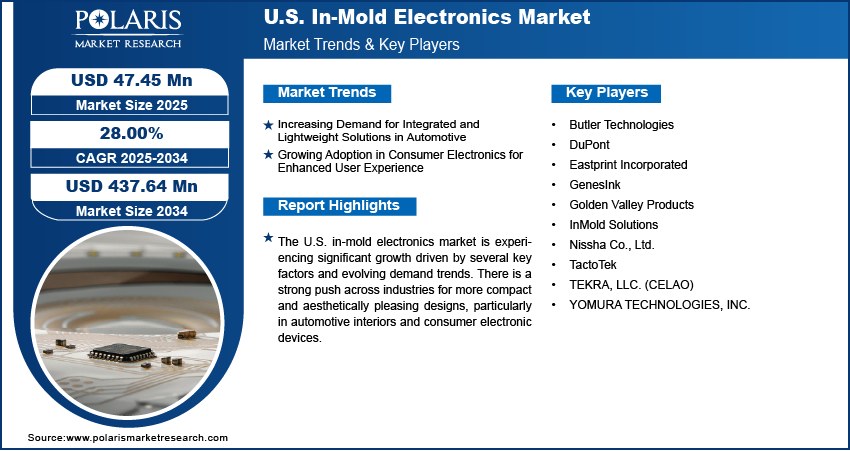

The U.S. in-mold electronics market size was valued at USD 37.14 million in 2024 and is anticipated to register a CAGR of 28.00% from 2025 to 2034. The market growth is largely driven by the increasing demand for smart surfaces in automotive interiors, as these components offer lightweight and integrated designs.

Key Insights

- By components, the capacitive touch sensing segment held the largest share in 2024. This is due to the growing demand for sleek, integrated, and interactive surfaces across a wide array of products, from automotive dashboards to consumer devices, where button-free designs are highly valued.

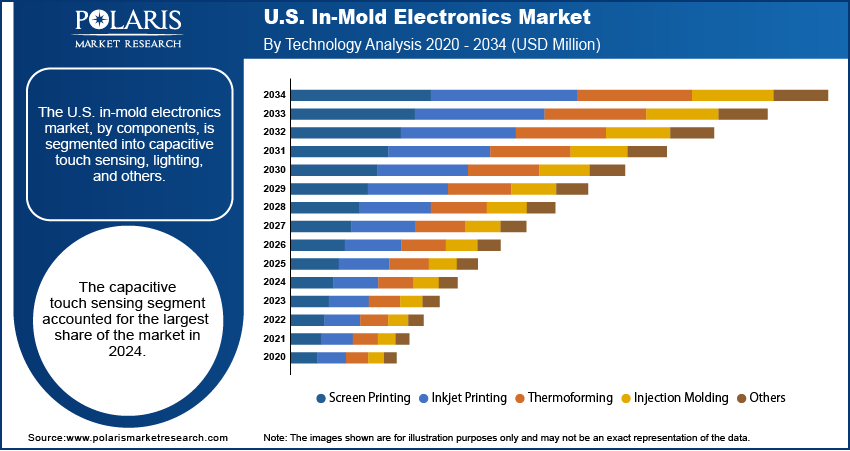

- By technology, the screen printing segment held the largest share in 2024. Its widespread adoption is attributed to its cost-effectiveness, established reliability for large-scale production, and ability to precisely deposit conductive and dielectric inks onto various substrates, making it ideal for robust IME manufacturing.

- By end use, the automotive sector held the largest share in 2024. This dominance is driven by the industry's continuous need for lightweight components to improve fuel efficiency and enhance vehicle aesthetics through integrated, functional, and sleek interior designs.

Industry Dynamics

- Industries, especially automotive and consumer electronics, increasingly seek compact and lighter components. This technology embeds electronic circuits directly into product structures, eliminating bulky wiring and external components, resulting in sleek, space-saving designs that enhance fuel efficiency and portability.

- The automotive industry is rapidly integrating this technology for advanced human-machine interfaces. It allows for touch-sensitive dashboards, integrated lighting, and control panels, replacing traditional mechanical buttons and wires.

- Consumers are looking for aesthetically pleasing and robust interfaces in devices such as smartphones, wearables, and smart home appliances. This technology enables the creation of seamless, interactive surfaces that are resistant to abrasion and moisture, offering enhanced user experience and product longevity.

- Continuous innovation in conductive inks, flexible substrates, and specialized adhesives enables the creation of more complex and reliable electronic circuits that can withstand the molding process.

Market Statistics

- 2024 Market Size: USD 37.14 million

- 2034 Projected Market Size: USD 437.64 million

- CAGR (2025–2034): 28.00%

To Understand More About this Research: Request a Free Sample Report

In-mold electronics, often called IME, is a technology that integrates electronic circuits and components directly into plastic parts during the molding process. This combines printing, thermoforming, and injection molding, including rubber molding, to create functional, lightweight, and durable electronic surfaces.

A few factors driving the industry expansion include increasing environmental regulations and the growing demand for customized electronic products. Environmental regulations are pushing manufacturers to adopt more sustainable practices, and IME offers benefits such as reduced material use and a simplified production process. The desire for personalized devices also favors IME, as it allows for unique designs and integrated functions that are difficult to achieve with traditional methods.

The increasing focus on sustainability and environmental regulations is a notable driver. Governments and consumers are putting pressure on industries to reduce their ecological footprint. For example, the U.S. Environmental Protection Agency (EPA) promotes sustainable materials management and waste reduction in the electronics manufacturing industry. IME supports these goals by reducing the number of materials used and simplifying the recycling process at the end of a product's life. This allows for fewer parts, less waste during production, and often easier disassembly for material recovery compared to complex assemblies with multiple soldered components.

Drivers and Trends

Increasing Demand for Integrated and Lightweight Solutions in Automotive: The automotive industry is continually seeking ways to enhance vehicle performance and fuel efficiency, with a significant emphasis on reducing overall vehicle weight. In-mold electronics (IME) offer a compelling solution by allowing for the integration of multiple functions, such as control panels, lighting, and sensors, directly into interior plastic components. This eliminates the need for bulky traditional wiring harnesses and mechanical switches, leading to lighter and more compact assemblies within vehicles.

IME technology brings significant aesthetic and functional improvements to automotive interiors. It enables seamless, sleek designs with fewer visible seams and buttons, creating a modern and user-friendly cabin experience. This aligns with consumer expectations for sophisticated and technologically advanced vehicles. A 2025 article titled "Frontal polymerization of thermosets to enable vacuum-formed structural electronics" published in PMC, highlights how in-mold structural electronics processes allow for rethinking the design and manufacturing of electronic products to reduce materials and costs while improving size, weight, and power (SWAP), which is especially relevant for the automotive sector. This capability to deliver lightweight, functional, and aesthetically pleasing components in the automotive sector is a key factor driving the growth of the U.S. in-mold electronics market.

Growing Adoption in Consumer Electronics for Enhanced User Experience: The consumer electronics sector is characterized by a continuous drive for innovation, miniaturization, and improved user interaction. In-mold electronics are highly beneficial in this environment as they enable the creation of thinner, lighter, and more durable devices. By embedding electronic circuits directly into the product's casing, IME technology facilitates sleek designs with integrated touch controls, flexible displays, and robust interfaces for items such as smartphones, wearables, and smart home appliances. This allows manufacturers to meet the strong consumer demand for modern, portable, and aesthetically pleasing gadgets.

IME enhances product durability by encapsulating sensitive electronic components within the molded structure, providing better resistance against dust, moisture, and physical wear. This robust integration is crucial for everyday consumer products that are frequently handled. As noted in the 2024 article "Recyclable in-mold and printed electronics with polymer separation layers" from RSC Publishing, IME devices form strong interfaces between polymers and printed metals for reliability. While the article discusses recycling challenges, it underscores the strong integration achieved, which implies enhanced durability and a reliable design for consumer products. This ability to create highly integrated, durable, and visually appealing products significantly contributes to the growth of the U.S. in-mold electronics market within consumer electronics.

Segmental Insights

Components Analysis

Based on components, the U.S. in-mold electronics market segmentation includes capacitive touch sensing, lighting, and others. The capacitive touch sensing segment held the largest share in 2024. This dominance is largely attributed to the increasing consumer and preference for intuitive, button-free interfaces in various products, including automotive dashboards, home appliances, and consumer gadgets. Capacitive touch sensing offers a sleek design, improved durability due to fewer moving parts, and enhanced aesthetic appeal, aligning well with modern product design trends. Its ability to seamlessly integrate control functions into curved or irregularly shaped surfaces, replacing traditional mechanical switches and reducing assembly complexity, further solidifies its leading position. This prevalence highlights a strong demand for advanced human-machine interfaces that are both highly functional and visually appealing, establishing capacitive touch sensing as a core element of current in-mold electronics applications.

The lighting sub-segment is anticipated to register the highest growth rate during the forecast period, fueled by the escalating demand for integrated and customizable lighting solutions, particularly in automotive interiors for ambient lighting and in consumer electronics for illuminated controls and decorative elements. As design trends favor seamless integration of functional and aesthetic features, IME enables the creation of thin, flexible, and often transparent lighting elements that can be molded directly into product surfaces. This offers advantages in terms of space-saving, weight reduction, and creative design freedom that traditional lighting solutions cannot match. The push for smart surfaces and enhanced user experience across various products positions integrated lighting as a rapidly expanding application area, driving significant future expansion in the in-mold electronics sector.

Technology Analysis

Based on technology, the U.S. in-mold electronics market segmentation includes screen printing, inkjet printing, thermoforming, injection molding, and others. The screen printing segment held the largest share in 2024, due to its established presence, cost-effectiveness, and proven reliability for large-scale production. Screen printing allows for the precise deposition of conductive inks and dielectric layers onto flexible substrates, which are then thermoformed and injection molded. Its ability to handle a wide range of materials and create uniform layers makes it a go-to choice for manufacturing components such as automotive panels, sophisticated control interfaces, and various home appliance parts. This process is often combined with plastic injection molding machines to achieve complex, high-precision parts with excellent durability and finish. The familiarity of manufacturers with this process, coupled with its suitability for high-volume applications requiring consistent quality and robust performance, reinforces its leading position in the technological landscape.

The Inkjet printing segment is anticipated to register the highest growth rate during the forecast period, driven by its inherent advantages in terms of precision, digital control, and design flexibility, which are increasingly critical for advanced IME applications. Unlike traditional methods, inkjet printing allows for direct, mask-less deposition of functional inks, enabling rapid prototyping and customization without the need for physical stencils. This capability supports the development of intricate and complex circuit designs on diverse substrates, including those with unique geometries. As industries seek more personalized and highly functional electronic components with quicker development cycles and reduced material waste, inkjet printing's ability to offer unparalleled design freedom and efficient material usage positions it as a key technology for future innovations in in-mold electronics.

End Use Analysis

Based on end use, the U.S. in-mold electronics market segmentation includes automotive, consumer electronics, home appliances, industrial equipment, and others. The automotive segment held the largest share in 2024. This segment's dominance stems from the continuous push for vehicle lightweighting to improve fuel efficiency and support the growing electric vehicle sector, where every gram saved contributes to extended range. In-mold electronics allow car manufacturers to integrate complex human-machine interfaces, control panels, and interior lighting into single, cohesive units, replacing heavier traditional wiring and mechanical switches. This reduces the overall weight of the vehicle and enables sleeker, more sophisticated cabin designs that meet consumer demand for advanced in-car technology and aesthetics. The high volume of production in the automotive sector and the increasing electronic content in modern vehicles further solidify this segment's leading position.

The consumer electronics segment is anticipated to register the highest growth rate during the forecast period. This acceleration is driven by the rapid innovation cycles and the pervasive demand for thinner, lighter, and more durable electronic gadgets. In-mold electronics enable manufacturers to create seamlessly integrated designs for products such as smartphones, wearables, tablets, and smart home devices, where integrated touch surfaces, flexible displays, and robust enclosures are highly valued. Consumers are increasingly seeking devices with minimalist designs and enhanced functionality, and IME provides a unique way to embed complex circuitry directly into the product's form. This allows for greater design freedom, improved resistance to environmental factors such as dust and moisture, and a premium user experience, making consumer electronics a vibrant and fast-growing application area for in-mold electronics technology.

Key Players and Competitive Insights

The U.S. in-mold electronics market features a dynamic competitive landscape, with several key players vying for market share through innovation in materials, manufacturing processes, and application development. These companies focus on offering integrated solutions that meet the evolving demands from industries such as automotive, consumer electronics, and home appliances. The competition is intense, driven by the need for lightweight, aesthetically pleasing, and highly functional electronic components. Companies are investing in research and development to enhance the stretchability of conductive inks, improve the durability of films, and refine the injection molding processes to enable more complex designs and reliable performance. Strategic partnerships and collaborations are also common, as firms combine expertise to accelerate product development and market penetration.

A few prominent companies in the industry include DuPont; TactoTek; Eastprint Incorporated; Nissha Co., Ltd.; Butler Technologies; Golden Valley Products; InMold Solutions; TEKRA, LLC. (CELAO); YOMURA TECHNOLOGIES, INC.; and GenesInk.

Key Players

- Butler Technologies

- DuPont

- Eastprint Incorporated

- GenesInk

- Golden Valley Products

- InMold Solutions

- Nissha Co., Ltd.

- TactoTek

- TEKRA, LLC. (a division of CELAO)

- YOMURA TECHNOLOGIES, INC.

U.S. In-Mold Electronics Industry Developments

February 2025: TactoTek announced New Albea as a licensee, expanding IMSE (In-Mold Structural Electronics) production capacity. This partnership enhances IMSE functionality through New Albea’s advanced manufacturing expertise, supporting scalable, cost-effective electronic integration in automotive, consumer electronics, and other sectors, boosting innovation in the U.S. market.

U.S. In-Mold Electronics Market Segmentation

By Components Outlook (Revenue – USD Million, 2020–2034)

- Capacitive Touch Sensing

- Lighting

- Others

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Screen Printing

- Inkjet Printing

- Thermoforming

- Injection Molding

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Automotive

- Consumer Electronics

- Home Appliances

- Industrial Equipment

- Others

U.S. In-Mold Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 37.14 million |

|

Market Size in 2025 |

USD 47.45 million |

|

Revenue Forecast by 2034 |

USD 437.64 million |

|

CAGR |

28.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 37.14 million in 2024 and is projected to grow to USD 437.64 million by 2034.

The market is projected to register a CAGR of 28.00% during the forecast period.

A few key players in the market include DuPont; TactoTek; Eastprint Incorporated; Nissha Co., Ltd.; Butler Technologies; Golden Valley Products; InMold Solutions; TEKRA, LLC. (CELAO); YOMURA TECHNOLOGIES, INC.; and GenesInk.

The capacitive touch sensing segment accounted for the largest share of the market in 2024.

The inkjet printing segment is expected to witness the fastest growth during the forecast period.