US Integrated Bridge Systems Market Size, Share, Trend, & Industry Analysis Report

By Component (Hardware, Software, and Services), By Subsystem, By Platform, By End User – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5819

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

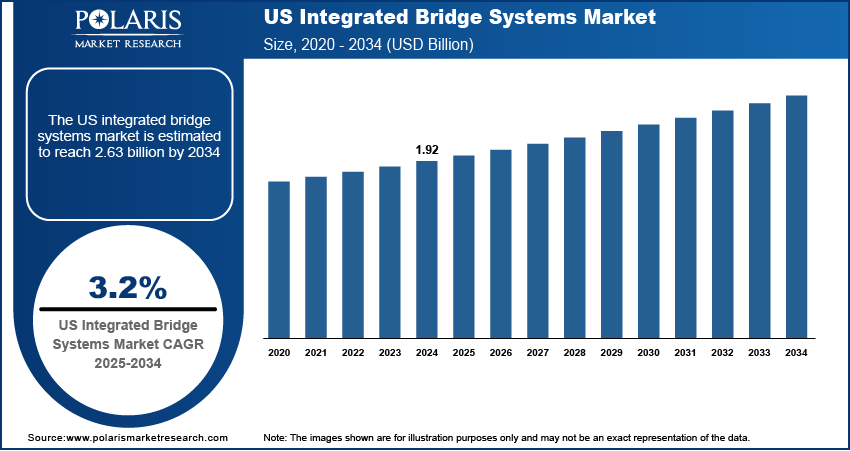

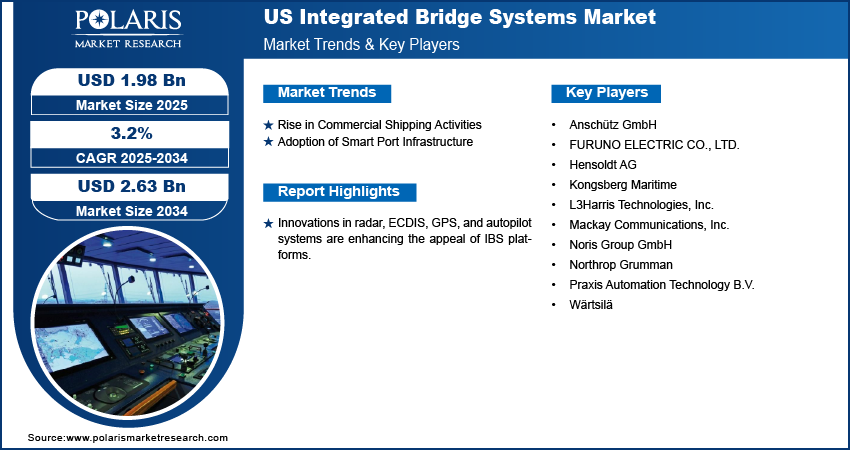

The US integrated bridge systems market size was valued at USD 1.92 billion in 2024 and is projected to register a CAGR of 3.2% during 2025–2034. The US Navy continues to invest in upgrading its naval fleet with advanced navigation and control systems. IBS solutions are crucial for enhancing mission readiness, operational safety, and automation on both new and retrofitted vessels, driving consistent demand in the defense sector.

The US integrated bridge systems market refers to the industry focused on the development, manufacturing, and deployment of integrated navigation and control systems that combine various shipboard technologies such as radar, electronic chart display, autopilot, communication, and engine monitoring into a unified interface for enhanced maritime vessel operations, safety, and efficiency. Increasing exploration in deepwater zones and remote offshore areas requires robust, reliable, and integrated navigation systems. IBS technologies support real-time monitoring, precise positioning, and safety compliance, making them essential for offshore support vessels operating under complex conditions.

Innovations in radar, ECDIS, GPS, and autopilot systems are enhancing the appeal of IBS platforms. The ability to consolidate and automate shipboard operations using real-time sensor data significantly improves situational awareness, reducing human error and operational risk. Additionally, agreement with US Coast Guard and IMO regulations regarding maritime safety, environmental monitoring, and navigation standards is pushing vessel owners toward integrated, automated solutions. IBS offerings help operators meet regulatory benchmarks while improving vessel efficiency.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rise in Commercial Shipping Activities

Commercial shipping operations across the US are expanding rapidly due to increased demand for containerized freight and regional maritime logistics. The US Department of Transportation noted that maritime freight value has risen over the decades, with increased ferry transport and military use of MTS facilities due to traffic congestion and growing trade. 99% of US overseas trade moves by ship, a reliable MTS is crucial for national and economic security. Waterborne cargo contributes over USD 500 billion to GDP, and generates USD 200 billion in taxes. More domestic ports are handling high cargo volumes, prompting operators to seek advanced onboard technologies to maintain efficiency and safety. Integrated bridge systems support this shift by offering centralized control, real-time monitoring, and data integration that improve navigation precision and fuel consumption. These systems play a vital role in route optimization and enable automated collision avoidance, reducing the risk of accidents in congested waterways. Regulatory pressure on emissions and safety also encourages vessel operators to adopt digital bridge solutions that ensure operational compliance while maximizing performance across diverse shipping routes. Hence, rise in commercial shipping activities boost the demand for IBS.

Adoption of Smart Port Infrastructure

Port authorities across the US are investing in smart port initiatives that rely on digital systems, automation, and real-time data exchange. The US Department of Transportation awarded USD 80 million grant to enhance supply chain resilience through real-time tracking of goods and services at the new Smart Port at Alliance Texas. These upgrades improve cargo handling efficiency, reduce port congestion, and enable seamless communication between vessels and shore facilities. To interact effectively within these smart ecosystems, ships must upgrade to advanced navigation and communication systems like integrated bridge systems. IBS solutions enhance interoperability with smart port infrastructure through features such as automated docking assistance, AIS integration, and digital charting. This alignment ensures smoother port entry and departure, enhances situational awareness, and reduces operational delays. The increasing push for smart, connected maritime infrastructure directly supports the growing demand for IBS in commercial and government fleets.

Segment Insights

Market Assessment by Component

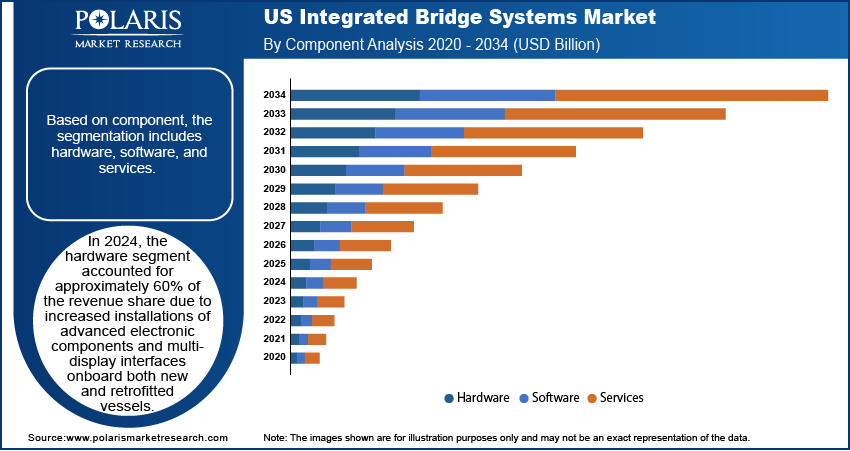

Based on component, the IBS market is segmented into hardware, software, and services. In 2024, the hardware segment accounted for approximately 60% of the revenue share due to increased installations of advanced electronic components and multi-display interfaces onboard both new and retrofitted vessels. Ship-owners are investing in radar units, ECDIS displays, gyrocompasses, autopilot systems, and sensors to enhance navigational accuracy and ensure compliance with safety mandates. Upgrading bridge hardware supports better integration across control systems and improves situational awareness, especially in high-traffic and low-visibility environments. Demand is particularly strong in defense and offshore fleets, where real-time reliability and ruggedized performance are critical operational requirements.

The software segment is projected to register the highest CAGR during the forecast period, supported by the growing emphasis on data-driven decision-making and automation in vessel operations. Maritime operators increasingly rely on IBS software for integrated route planning, collision avoidance algorithms, system diagnostics, and centralized control. Updates in user interface design, real-time data processing, and predictive analytics features are enabling greater system customization and efficiency. The rise of cloud-based maritime solutions and the shift toward remote fleet monitoring also contribute to software adoption. These advancements support cost-effective operations and regulatory compliance, particularly in the commercial shipping and naval modernization sectors.

Market Assessment by Subsystem

Based on subsystem, the US integrated bridge systems (IBS) market segmentation includes navigation systems, control systems, communication systems, monitoring systems, automatic identification system, and others. In 2024, the navigation systems segment held the largest market share, driven by growing demand for real-time situational data and enhanced safety protocols. Advanced navigation components such as ECDIS, GNSS simulators, digital radar integration, and AR-based overlays are being deployed extensively to support precision routing and environmental awareness. Increasing vessel automation and regulatory frameworks requiring sophisticated digital navigation capabilities are further fueling demand. Commercial and defense operators seek reliable systems to ensure safety during complex operations in congested or remote maritime zones. Enhanced navigational capabilities remain a core requirement for ship operators aiming to optimize voyage planning and minimize risks.

The automatic identification system (AIS) segment is expected to register the highest CAGR during the forecast period, driven by rising security concerns, regulatory enforcement, and traffic density in US waterways. AIS technology allows ships to transmit and receive identity, location, speed, and route information in real time, which is crucial for collision avoidance, coastal surveillance, and port traffic coordination. Federal mandates for vessel tracking and environmental compliance also encourage widespread AIS adoption across commercial and naval fleets. Technological enhancements such as satellite AIS, encrypted data channels, and integration with digital navigation interfaces are further accelerating demand across domestic and international shipping operations.

Market Evaluation by Platform

Based on platform, the segmentation includes commercial vessels, naval vessels, offshore support vessels, fishing vessels, yachts & recreational boats, and others. In 2024, the commercial vessels segment dominated the market, fueled by rising demand for efficient maritime trade and containerized cargo movement. Fleet operators are increasingly investing in modern IBS technologies to optimize fuel consumption, reduce turnaround times, and improve navigation accuracy. Regulatory mandates for emissions reduction and safety compliance have pushed cargo carriers, tankers, and RoRo vessels to adopt digital systems for better voyage planning and operational control. For instance, the California Air Resources Board (CARB) At-Berth Regulation, cargo carriers, tankers, and RoRo (Roll-on/Roll-off) vessels operating in US ports, particularly in California, have accelerated their adoption of digital systems for improved voyage planning and operational control. To meet these mandates efficiently and avoid penalties, vessel operators are increasingly relying on digital tools. The integration of radar, ECDIS, AIS, and engine monitoring tools into a centralized bridge interface provides enhanced situational awareness, which is becoming standard in modern commercial fleets.

The naval vessels segment is projected to register the highest CAGR over the forecast period, driven by defense modernization programs and the rising complexity of maritime missions. The US Navy is equipping both surface ships and submarines with advanced integrated bridge platforms to support multi-domain situational awareness, cyber-resilient control systems, and mission-specific navigation functions. These systems offer streamlined data integration from sonar, radar, and communication subsystems to enhance real-time decision-making. Increased focus on autonomy, unmanned support vessels, and fleet digitization under programs such as DMO (Distributed Maritime Operations) is accelerating the adoption of robust and secure IBS configurations.

Market Evaluation by End User

Based on end use, the segmentation includes OEM and aftermarket. In 2024, the OEM segment dominated the market, fueled by rising shipbuilding activity and integration of advanced bridge systems at the production stage. New vessels are increasingly being delivered with fully integrated digital platforms to meet safety, navigation, and communication standards. Shipyards are partnering with technology vendors to offer pre-installed IBS solutions that are optimized for vessel type and operational requirements. This trend reduces commissioning time, improves system compatibility, and ensures smoother vessel certification. High demand across both commercial and naval shipbuilding programs is sustaining strong growth in the OEM market.

The aftermarket segment is projected to experience significant growth during the forecast period, driven by retrofitting initiatives across aging fleets and the need for technology upgrades. Many vessel operators are replacing outdated navigation systems with modular IBS solutions to comply with changing regulations and reduce operational risk. Demand is especially strong for ECDIS updates, AIS enhancements, and sensor integration to improve bridge performance. Lifecycle support, remote diagnostics, and software upgrades are becoming essential service components, further supporting aftermarket expansion. Operators are also prioritizing system interoperability and long-term reliability, making aftermarket IBS adoption a cost-effective way to extend vessel utility without full-scale replacement.

Key Players and Competitive Analysis Report

The competitive landscape of the US integrated bridge systems market is shaped by a mix of strategic collaborations, technology-driven product enhancements, and targeted market penetration efforts. Industry analysis highlights a strong focus on modular system architecture and interoperability to meet evolving fleet requirements. Market expansion strategies include tailored solutions for commercial and naval platforms, along with regional service partnerships to support lifecycle management. Joint ventures between defense contractors and maritime technology firms are strengthening domestic supply chains and innovation pipelines. Mergers and acquisitions have played a critical role in consolidating expertise and expanding portfolio capabilities, particularly in navigation software and autonomous vessel controls. Post-merger integration efforts are being aligned with digital transformation goals, improving operational efficiency and client responsiveness. Strategic alliances are being formed to enhance R&D for cybersecurity, sensor fusion, and data analytics. Technology advancements in AI-powered route optimization, automated and secure communication networks are key differentiators in this dynamic and competitive US market.

List of Key Companies

- Anschütz GmbH

- FURUNO ELECTRIC CO., LTD.

- Hensoldt AG

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Mackay Communications, Inc.

- Noris Group GmbH

- Northrop Grumman

- Praxis Automation Technology B.V.

- Wärtsilä

US Integrated Bridge Systems Industry Developments

In April 2025, L3Harris Technologies signed a Memorandum of Understanding with Zamil Shipyards to enhance local maritime engineering by integrating autonomous technology into current and future vessels. This initiative aligns with Saudi Arabia’s General Authority for Military Industries’ goal of promoting localization in related industries.

US Integrated Bridge Systems Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Subsystem Outlook (Revenue USD Billion, 2020–2034)

- Navigation Systems

- Control Systems

- Communication Systems

- Monitoring Systems

- Automatic Identification System

- Others

By Platform Outlook (Revenue USD Billion, 2020–2034)

- Commercial Vessels

- Naval Vessels

- Offshore Support Vessels

- Fishing Vessels

- Yachts & Recreational Boats

- Others

By End User Outlook (Revenue USD Billion, 2020–2034)

- OEM

- Aftermarket

US Integrated Bridge Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.92 billion |

|

Market Size in 2025 |

USD 1.98 billion |

|

Revenue Forecast by 2034 |

USD 2.63 billion |

|

CAGR |

3.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The US market size was valued at USD 1.92 billion in 2024 and is projected to grow to USD 2.63 billion by 2034.

The US market is projected to register a CAGR of 3.2% during the forecast period.

A few of the key players are Northrop Grumman; L3Harris Technologies, Inc.; Anschütz GmbH; Mackay Communications, Inc.; Kongsberg Maritime; Wärtsilä; Hensoldt AG; FURUNO ELECTRIC CO., LTD.; Noris Group GmbH; and Praxis Automation Technology B.V.

In 2024, the hardware segment accounted for approximately 60% of the revenue share due to increased installations of advanced electronic components and multi-display interfaces onboard both new and retrofitted vessels.

In 2024, the navigation systems segment held the largest market share, driven by growing demand for real-time situational data and enhanced safety protocols.