U.S. Medical Gas Application & Equipment Market Size, Share, Trends, Industry Analysis Report

By Gas Type (Medical Oxygen, Helium), By Equipment Type, By Application, By End User– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: pdf

- Report ID: PM6386

- Base Year: 2024

- Historical Data: 2020-2023

Overview

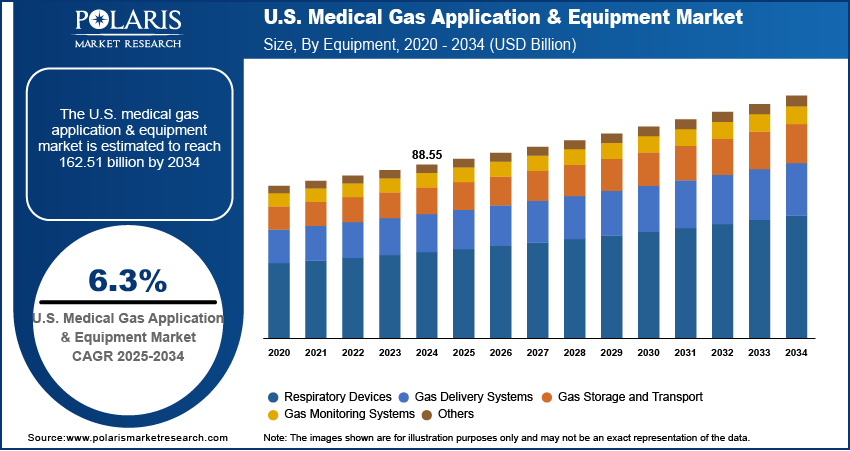

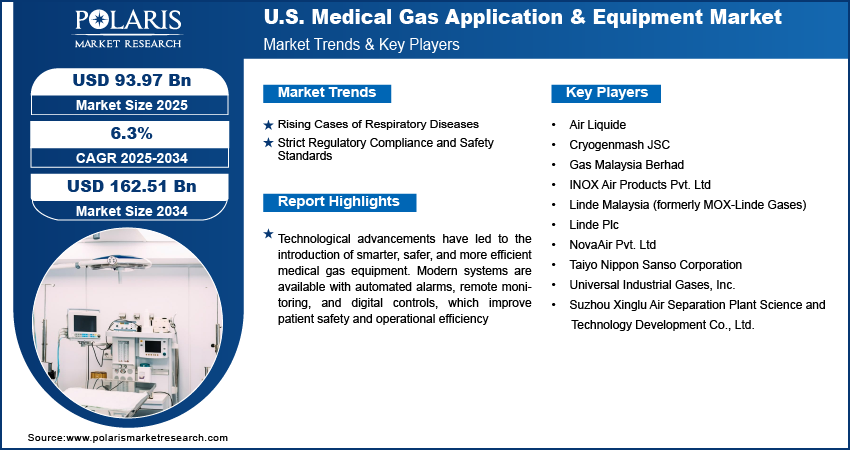

The U.S. medical gas application & equipment market size was valued at USD 88.85 billion in 2024, growing at a CAGR of 6.3% from 2025 to 2034. The market growth is driven by increasing local production and gas supply capabilities, and growing prevalence of respiratory diseases.

Key Insights

- In 2024, the medical oxygen segment dominated with the largest share driven by its critical role in treating respiratory conditions such as COPD, pneumonia, and COVID-19 complications.

- The gas delivery systems segment accounted for significant growth due to rising demand for precision, safety, and efficiency in healthcare settings.

- The pharmaceutical manufacturing & research segment is expected to experience significant growth during the forecast period, as medical gases such as nitrogen, carbon dioxide, and oxygen are vital for drug synthesis, sterilization, cryopreservation, and analytical processes in labs

- The hospitals segment dominated with the largest share in 2024. Hospitals require a steady and uninterrupted supply of medical gases with high patient volumes, frequent surgical procedures, and continuous emergency care.

Industry Dynamics

- Increasing local production and gas supply capabilities drives the demand for medical gases.

- The growing prevalence of respiratory diseases is fueling the industry growth.

- Technological advancements led to smarter, safer, and more efficient medical gas equipment.

- High implementation costs restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 88.85 billion

- 2034 Projected Market Size: USD 162.51 billion

- CAGR (2025–2034): 6.3%

Medical gas equipment refers to the devices and systems used to store, regulate, and deliver medical gases such as oxygen, nitrous oxide, and medical air in healthcare settings. This includes cylinders, flowmeters, regulators, manifolds, gas pipelines, and alarm systems. These tools ensure the safe, precise, and continuous delivery of gases for patient care, surgeries, anesthesia, and respiratory therapy.

Home healthcare is rapidly growing in the U.S., leading to increased use of portable medical gas devices. Patients affected by chronic respiratory diseases prefer home-based oxygen therapy, allowing them to maintain mobility and reduce hospital visits. This shift encourages the adoption of lightweight oxygen concentrators and cylinders designed for ease of use in domestic environments. The convenience and cost-effectiveness of home care support the demand for reliable medical gas equipment outside traditional healthcare facilities, expanding the landscape for portable and user-friendly gas delivery systems, thereby fueling the growth.

Advancements in medical gas equipment technology are boosting the growth in the U.S. Innovations include smart regulators, automated gas flow control, and real-time monitoring systems that improve safety and treatment effectiveness. Improved equipment accuracy and reliability reduce gas waste and help healthcare providers optimize therapy delivery. Integration with digital health platforms enables personalized care and better patient outcomes. These technological improvements make medical gas systems more efficient and user-friendly, attracting healthcare providers to upgrade or adopt new equipment, thus expanding the industry.

Drivers & Opportunities

Rising Cases of Respiratory Diseases: The growing prevalence of respiratory illnesses such as COPD, asthma, and COVID-19 complications has significantly increased the demand for medical gases in the U.S. Oxygen therapy remains a crucial treatment for many patients suffering from these conditions. The need for reliable medical oxygen supplies and related equipment has surged as hospitals and clinics face higher patient volumes requiring respiratory support. This trend fuels the expansion of medical gas infrastructure to meet both acute and chronic respiratory care needs across healthcare facilities and home care settings, thereby driving the growth.

Strict Regulatory Compliance and Safety Standards: The U.S. healthcare industry is governed by stringent safety and quality regulations concerning medical gases and equipment. Compliance with standards ensures the safe handling, storage, and delivery of gases, which protects patients and healthcare workers. Regulatory oversight by bodies such as the FDA encourages manufacturers to innovate and maintain high product quality. Hospitals and healthcare providers prioritize certified and compliant equipment, driving demand for reliable, high-standard medical gas systems. This focus on safety strengthens market confidence and promotes continuous growth of the U.S. medical gas application & equipment market.

Segmental Insights

Gas Type Category Analysis

The U.S. medical gas application & equipment market segmentation, based on gas type, includes medical oxygen, helium, nitrous oxide, carbon dioxide, nitrogen, and others. In 2024, the medical oxygen segment dominated with the largest share driven by its critical role in treating respiratory conditions such as COPD, pneumonia, and COVID-19 complications. The demand for oxygen therapy has remained consistently high with rising hospital admissions and an aging population. Oxygen is essential in emergency care, intensive care units, and during surgeries, making it a core product in hospitals and home care. Its widespread application across all levels of care such as ambulances and post-acute settings further fuels the demand, thereby driving the segment growth.

Equipment Type Analysis

The U.S. medical gas application & equipment market segmentation, based on equipment type, includes respiratory devices, gas delivery systems, gas storage and transport, gas monitoring systems, and others. The gas delivery systems segment accounted for significant growth due to rising demand for precision, safety, and efficiency in healthcare settings. These systems include pipelines, regulators, valves, flowmeters, and outlet units that ensure safe and consistent gas supply to patients. There is a growing focus on modernizing infrastructure with advanced delivery systems as hospitals and outpatient facilities expand. Furthermore, increased investments in smart hospitals and the trend toward automation have accelerated the adoption of digitally integrated gas delivery technologies, thereby fueling the segment growth.

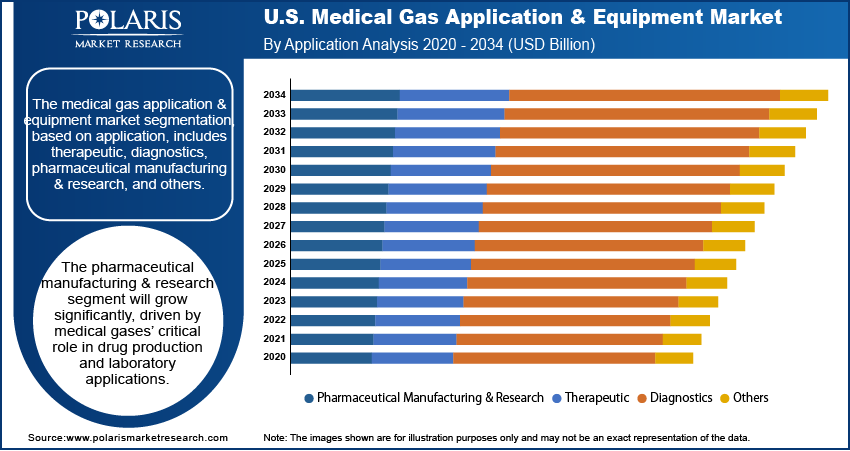

Application Analysis

The U.S. medical gas application & equipment market segmentation, based on application, includes therapeutic, diagnostic, pharmaceutical manufacturing & research, and others. The pharmaceutical manufacturing & research segment is expected to experience significant growth as medical gases such as nitrogen, carbon dioxide, and oxygen are vital for drug synthesis, sterilization, cryopreservation, and analytical processes in labs. The expansion of U.S. pharmaceutical R&D activities, especially with growing investment in biologics, vaccines, and advanced therapies, has increased demand for high-purity medical gases and related equipment. Moreover, the U.S. is a global leader in pharma innovation further driving the growth in the segment.

End User Analysis

The U.S. medical gas application & equipment market segmentation, based on end user, includes hospitals, clinics, ambulatory surgical centers, home healthcare, academic & research institutions, pharmaceutical & biotechnology companies, and others. The hospitals segment dominated with the largest share as hospitals require a steady and uninterrupted supply of medical gases with high patient volumes, frequent surgical procedures, and continuous emergency care. From intensive care units to surgical theatres, these facilities rely on medical air, oxygen, nitrous oxide, and vacuum systems for daily operations. Additionally, the shift toward specialized care units and the growing number of private hospitals across the U.S. have further increased infrastructure demand, thereby driving the growth.

Key Players and Competitive Analysis

The U.S. medical gas application & equipment market is highly competitive, led by multinational corporations and supported by domestic specialists offering both industrial-scale supply and localized service. Air Liquide and Linde Plc dominate the space through extensive infrastructure, offering a broad range of gases and integrated systems for hospitals, home care, and research facilities. Universal Industrial Gases, Inc. plays a key role in supplying on-site gas generation systems, helping healthcare providers ensure continuity and cost-efficiency. INOX Air Products and Taiyo Nippon Sanso Corporation are expanding their footprint through strategic partnerships and advanced production technologies. NovaAir Pvt. Ltd. and Cryogenmash JSC bring niche expertise in cryogenic systems and specialty gases, while Suzhou Xinglu supplies modular air separation units suited for smaller facilities. Meanwhile, Gas Malaysia Berhad and Linde Malaysia have limited direct presence but maintain relevance through cross-border collaborations and technology transfer. The market thrives on innovation, regulatory compliance, and strong logistical networks.

Key Players

- Air Liquide

- Cryogenmash JSC

- Gas Malaysia Berhad

- INOX Air Products Pvt. Ltd

- Linde Malaysia (formerly MOX-Linde Gases)

- Linde Plc

- NovaAir Pvt. Ltd

- Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd.

- Taiyo Nippon Sanso Corporation

- Universal Industrial Gases, Inc.

U.S. Medical Gas Application & Equipment Industry Developments

In May 2023, Luxfer Gas Cylinders introduced the G-Stor Go H2 Type 4 hydrogen cylinder, designed for high-pressure storage up to 350 bar. The lightweight, low-permeation solution targeted fuel cell transit, heavy-duty transport, and bulk hydrogen applications across U.S. markets.

U.S. Medical Gas Application & Equipment Market Segmentation

By Gas Type Outlook (Revenue, USD Billion, 2020–2034)

- Medical Oxygen

- Helium

- Nitrous Oxide

- Carbon Dioxide

- Nitrogen

- Others

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory Devices

- Gas Delivery Systems

- Gas Storage and Transport

- Gas Monitoring Systems

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Therapeutic

- Diagnostics

- Pharmaceutical Manufacturing & Research

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Healthcare

- Academic & Research Institutions

- Pharmaceutical & Biotechnology Companies

- Others

U.S. Medical Gas Application & Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 88.55 Billion |

|

Market Size in 2025 |

USD 93.97 Billion |

|

Revenue Forecast by 2034 |

USD 162.51 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 88.85 billion in 2024 and is projected to grow to USD 162.51 billion by 2034.

The U.S. market is projected to register a CAGR of 6.3% during the forecast period.

A few of the key players in the market are Air Liquide, Cryogenmash JSC, Gas Malaysia Berhad, INOX Air Products Pvt. Ltd, Linde Malaysia (formerly MOX-Linde Gases), Linde Plc, NovaAir Pvt. Ltd, Suzhou Xinglu Air Separation Plant Science and Technology Development Co., Ltd., Taiyo Nippon Sanso Corporation, and Universal Industrial Gases, Inc.

The medical oxygen segment dominated the market share in 2024.

The pharmaceutical manufacturing & research segment is expected to witness the significant growth during the forecast period.