U.S. Metal Screw Fasteners Market Size, Share, Trends, Industry Analysis Report

By Material (Stainless Steel, Carbon Steel, Others), By End Use (Automotive, Construction, Machinery & Equipment) – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6098

- Base Year: 2024

- Historical Data: 2020-2023

Overview

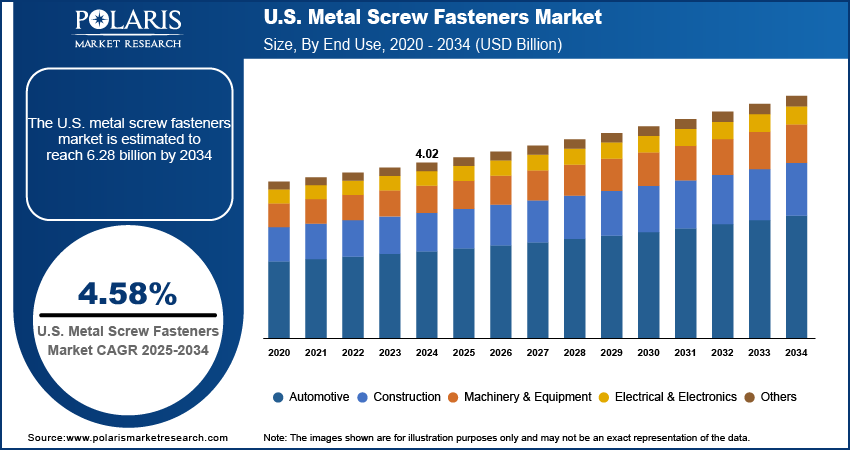

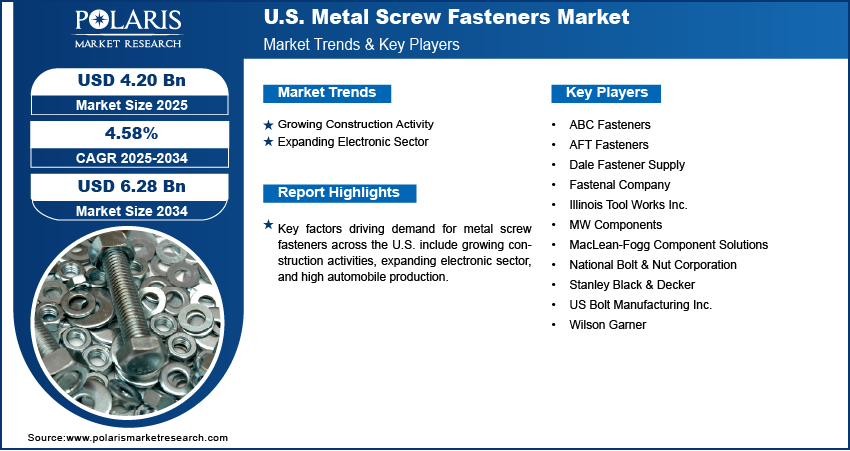

The U.S. metal screw fasteners market size was valued at USD 4.02 billion in 2024, growing at a CAGR of 4.58% from 2025 to 2034. Key factors driving demand for metal screw fasteners across the country include growing construction activities, expanding electronic sector, and the high automobile production.

Key Insights

- The stainless steel segment held the largest market share in 2024.

- The carbon steel segment is projected to grow at a robust pace in the coming years.

- In 2024, the automotive segment held 28.88% of the U.S. metal screw fasteners market.

- The construction segment is projected to hold a substantial share by 2034.

Industry Dynamics

- The growing construction activities in the U.S. drive the adoption of metal screw fasteners as builders and contractors depend on these components for framing, roofing, drywall installation, and structural connections.

- The expanding electronic sector in the U.S. propels market growth as electronic manufacturers utilize metal screw fasteners to assemble circuit boards, enclosures, heat sinks, and other internal components.

- The country's growing urbanization is expected to create a lucrative opportunity during the forecast period, putting pressure on the government and contractors to construct more commercial and residential buildings.

- Metal screw fasteners, especially those made of stainless steel or specialty alloys, are generally more expensive than alternatives such as plastic or basic carbon steel, which hinders the market revenue.

Market Statistics

- 2024 Market Size: USD 4.02 Billion

- 2034 Projected Market Size: USD 6.28 Billion

- CAGR (2025–2034): 4.58%

To Understand More About this Research: Request a Free Sample Report

Metal screw fasteners are threaded mechanical components used to securely join two or more objects. These metal screw fasteners are available in various types, including machine screws, self-tapping screws, and sheet metal screws, each designed for specific substrates and load requirements. Screws provide a stronger and often removable joint, making them ideal for assemblies requiring maintenance or disassembly. The threaded structure of a metal screw fastener offers superior grip and vibration resistance, especially when paired with washers or locking mechanisms. These fasteners are widely used in various applications, including automotive manufacturing, aerospace structures, electronic device assembly, construction frameworks, heavy machinery, and furniture fabrication.

The U.S. metal screw fasteners market plays a vital role in supporting the nation’s manufacturing, infrastructure, and technology sectors. In 2024, the market witnessed strong growth due to rising demand from automotive production, residential and commercial construction, and machinery manufacturing. Additionally, advancements in automation and robotics have fueled the need for high-performance, corrosion-resistant fasteners in electronic and electrical applications. In the U.S., manufacturers are increasingly focusing on producing high-grade and specialty fasteners to meet evolving technical standards, including those with anti-corrosion coatings and precision threading. The market benefits from the country’s strong industrial base, domestic steel production, and innovation in cold-forming and heat treatment technologies. Key states such as Michigan, Ohio, and Texas serve as manufacturing hubs due to their proximity to the automotive and aerospace industries. The U.S. also serves as a key exporter of specialty fasteners, especially to Canada and Mexico under USMCA agreements, further strengthening its global influence in the fastener supply chain.

The U.S. metal screw fasteners market demand is driven by the high production of automobiles. Automakers produced 12.86 million vehicles in the U.S. in 2022, according to the Department of Energy. This huge production of automobiles is propelling the need for metal screw fasteners in the country, they are used in the manufacturing of engines, chassis, body panels, interior components, and electronic systems to ensure structural stability and performance. Additionally, the rising sales of electric vehicles are driving demand for specialized metal screw fasteners that support new materials and modular designs. Therefore, the growing production of automobiles in the U.S. is propelling the demand for metal screw fasteners.

Drivers and Opportunities

Growing Construction Activity: Builders and contractors in the U.S. use metal screw fasteners for framing, roofing, drywall installation, structural connections, and to meet safety and durability standards. The rise in homebuilding, urban infrastructure upgrades, and green building initiatives is further accelerating the consumption of metal screw fasteners in the U.S. as they support faster build times, code compliance, and long-term structural integrity. Therefore, with the increasing construction activities in the U.S., the adoption of metal screw fasteners is projected to rise rapidly in the country during the forecast period.

Expanding Electronic Sector: Electronic manufacturers in the country are utilizing metal screw fasteners to assemble circuit boards, enclosures, heat sinks, and other internal components, as they ensure both mechanical stability and electrical safety. The rise of 5G infrastructure, electric vehicle electronics, and IoT devices is further fueling demand for miniaturized, high-performance fasteners as they offer strength, corrosion resistance, and compatibility with compact designs. Hence, as innovation drives continuous product development, the electronics sector consistently propels the adoption of metal screw fasteners across the U.S.

Segmental Insights

Material Analysis

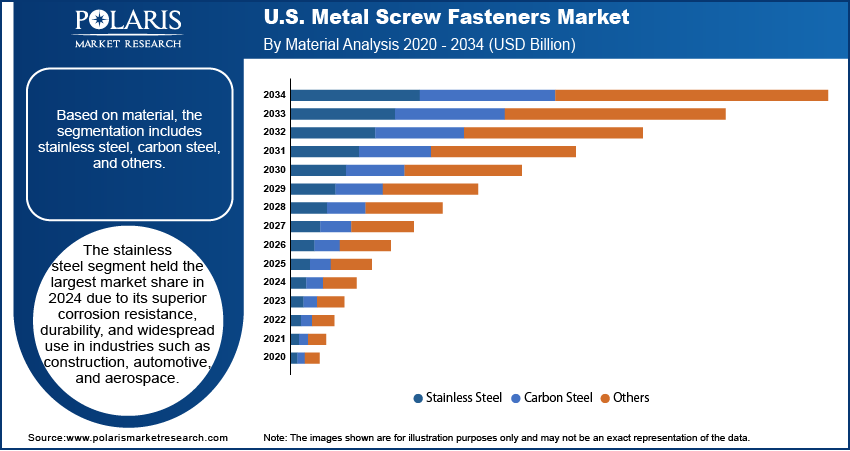

Based on material, the segmentation includes stainless steel, carbon steel, and others. The stainless steel segment held the largest market share in 2024 due to its superior corrosion resistance, durability, and widespread use in industries such as construction, automotive, and aerospace. The growing emphasis on infrastructure development and the increasing adoption of stainless steel in harsh environments, such as marine and chemical processing applications, has boosted its dominance. Additionally, stringent regulatory standards for material performance in critical sectors further reinforced the preference for stainless steel fasteners, as they offer long-term reliability and reduced maintenance costs. The rise in renewable energy projects, particularly in solar and wind installations, also contributed to the segment's growth, as these applications require materials that can withstand extreme weather conditions.

The carbon steel segment is projected to grow at a robust pace in the coming years, owing to its cost-effectiveness, high tensile strength, and versatility across a broad range of industrial applications. The expanding automotive and manufacturing sectors, which prioritize affordability without compromising structural integrity, are projected to fuel demand for carbon steel fasteners. Additionally, advancements in coating technologies, such as zinc and galvanized finishes, are enhancing the corrosion resistance of carbon steel, making it a more practical option for outdoor and high-moisture environments.

End Use Analysis

In terms of end use, the segmentation includes automotive, construction, machinery & equipment, electrical & electronics, and others. The automotive segment held 28.88% of the U.S. metal screw fasteners market share in 2024 due to the strong presence of established vehicle manufacturers and rising consumer demand for both internal combustion engine (ICE) and electric vehicles. Automakers relied heavily on screw fasteners for assembling body panels, powertrain components, interiors, and electrical systems, where precision, vibration resistance, and high-strength joining are critical. The shift toward lightweight materials and modular vehicle platforms further increased the need for specialized fasteners that provide durability without adding excessive weight. Additionally, regulatory pressure to meet fuel efficiency standards and emission targets encouraged OEMs to adopt high-performance fastening solutions, boosting demand across the automotive supply chain.

The construction segment is projected to hold a substantial share in 2034 due to rising infrastructure spending, growth in residential and commercial building projects, and increased renovation activity across urban centers. Builders prefer metal screw fasteners for their versatility, quick installation, and load-bearing capabilities in structural applications such as framing, decking, roofing, and drywall. Moreover, innovations in fastener design and materials, including coated screws for corrosion resistance and self-tapping variants for faster assembly, are enabling contractors to work more efficiently while ensuring long-term structural integrity.

Key Players and Competitive Analysis

The U.S. metal screw fasteners market is highly competitive, characterized by the presence of established manufacturers, distributors, and niche players that cater to diverse industrial sectors, including automotive, aerospace, construction, and machinery. Major companies such as Fastenal Company and Illinois Tool Works Inc. (ITW) dominate the market through extensive distribution networks, strong brand recognition, and a wide product portfolio. Fastenal, one of the largest fastener distributors in North America, leverages its vast supply chain and e-commerce platform to serve both large industrial clients and small businesses efficiently. Meanwhile, ITW’s engineered fastening division provides specialized solutions, reinforcing its position in high-performance sectors, such as automotive assembly.

Price competition remains intense, with some companies outsourcing production to low-cost regions to maintain profitability. However, firms emphasizing domestic manufacturing, such as Wilson Garner, differentiate themselves by promoting "Made in the USA" quality and faster delivery.

A few major companies operating in the U.S. metal screw fasteners industry include ABC Fasteners, AFT Fasteners, Dale Fastener Supply, Fastenal Company, Illinois Tool Works Inc., MW Components, National Bolt & Nut Corporation, Stanley Black & Decker, US Bolt Manufacturing Inc., and Wilson Garner.

Key Players

- ABC Fasteners

- AFT Fasteners

- Dale Fastener Supply

- Fastenal Company

- Illinois Tool Works Inc.

- MW Components

- MacLean-Fogg Component Solutions

- National Bolt & Nut Corporation

- Stanley Black & Decker

- US Bolt Manufacturing Inc.

- Wilson Garner

Industry Developments

February 2022: MacLean-Fogg Component Solutions (MFCS), a supplier of original equipment automotive components, announced the launch of the Threadstrong Line of Made-In-USA aftermarket wheel fasteners.

U.S. Metal Screw Fasteners Market Segmentation

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Stainless Steel

- Carbon Steel

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Construction

- Machinery & Equipment

- Electrical & Electronics

- Others

U.S. Metal Screw Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.02 Billion |

|

Market Size in 2025 |

USD 4.20 Billion |

|

Revenue Forecast by 2034 |

USD 6.28 Billion |

|

CAGR |

4.58% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.02 billion in 2024 and is projected to grow to USD 6.28 billion by 2034.

The market is projected to register a CAGR of 4.58% during the forecast period.

A few of the key players in the market are ABC Fasteners, AFT Fasteners, Dale Fastener Supply, Fastenal Company, Illinois Tool Works Inc., MW Components, National Bolt & Nut Corporation, Stanley Black & Decker, US Bolt Manufacturing Inc., and Wilson Garner.

The stainless steel segment dominated the market share in 2024.

The construction segment is expected to witness the fastest growth during the forecast period.