U.S. Mosquito Repellent Market Share, Size, Trends, Industry Analysis Report

By Type (Spray, Vaporizer, Cream & Oil, Coil, Other Types); By Distribution Channel; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 118

- Format: PDF

- Report ID: PM4906

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

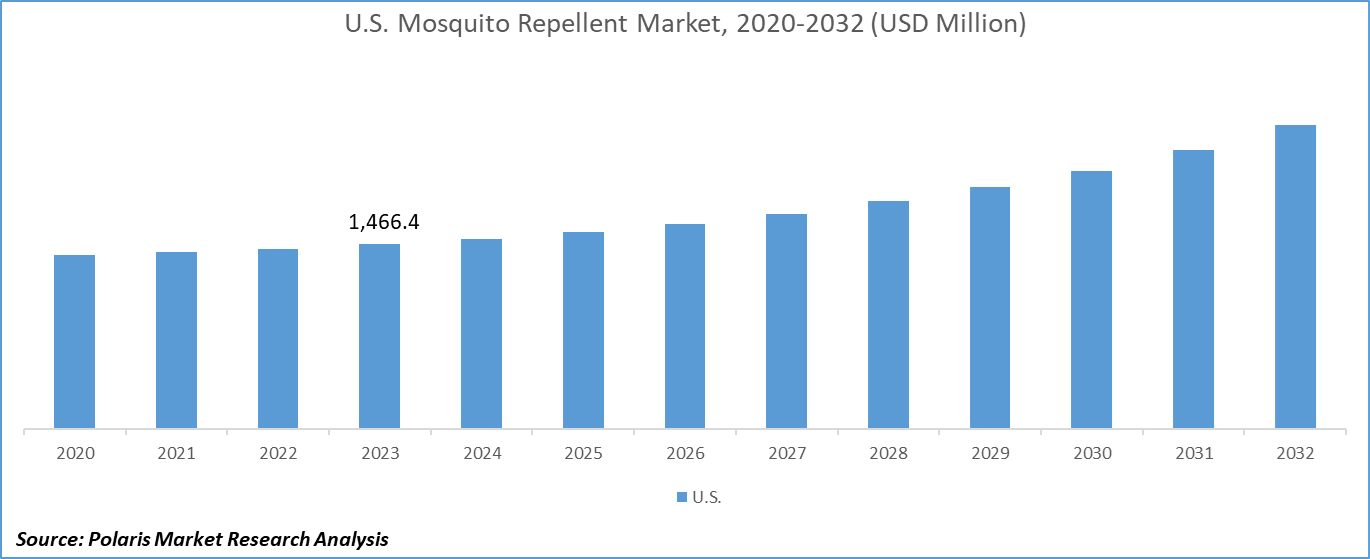

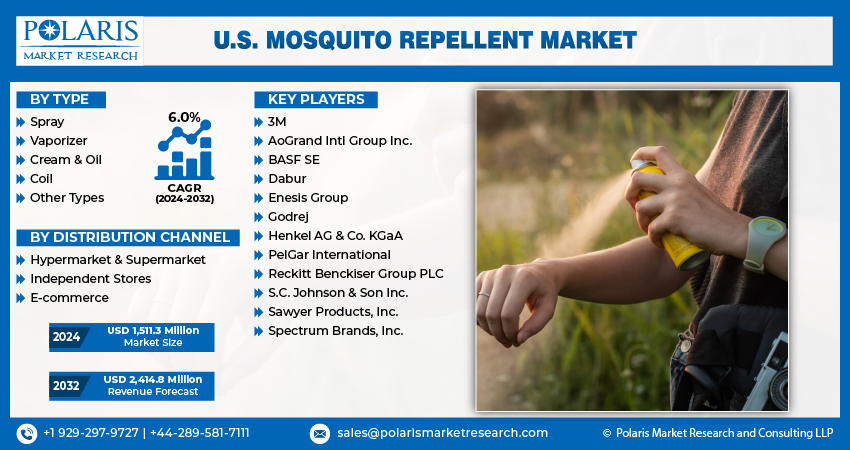

The U.S. mosquito repellent market size was valued at USD 1,466.4 million in 2023. The market is anticipated to grow from USD 1,511.3 million in 2024 to USD 2,414.8 million by 2032, exhibiting a CAGR of 6.0% during the forecast period

Industry Trends

The U.S. mosquito repellent market is expected to continue growing in the coming years, driven by factors such as rising awareness about mosquito-borne diseases, increasing outdoor recreational activities, and growing demand for natural and organic repellents.

The key trend in the market is the increasing preference for natural and organic mosquito repellents, particularly those that are DEET-free. Consumers are becoming more conscious of the potential health and environmental impacts of traditional chemical repellents. They are seeking out natural alternatives such as citronella, lemongrass, and peppermint oil-based repellents. This trend is likely to drive innovation and product development in the market, with more companies offering natural and organic mosquito repellent options. Another factor driving the U.S. mosquito repellent market is the rising incidence of mosquito-borne diseases such as West Nile virus, Zika virus, and Chikungunya. With the increasing global travel and climate change, the risk of mosquito-borne disease outbreaks is expected to continue, driving demand for effective mosquito repellents. Consumers are becoming more aware of the importance of protecting themselves from mosquito bites, and this is expected to drive sales of mosquito repellents in the country.

To Understand More About this Research: Request a Free Sample Report

Along with this, the increasing popularity of outdoor recreational activities such as camping, hiking, and backyard gatherings is also contributing to the growth of the mosquito repellent market in the U.S. Consumers are seeking effective and convenient mosquito repellent solutions that can protect their outdoor activities. This includes products such as sprays, wipes, and wearable devices that offer long-lasting protection against mosquitoes. However, one of the restraining factors in the U.S. mosquito repellent market is the availability of alternative pest control methods, such as insect traps and pest control services.

Key Takeaways

- By type category, the cream & oil segment accounted for the largest U.S. mosquito repellent market share in 2023

- By distribution channel category, the e-commerce segment is expected to grow with a significant CAGR over the U.S. mosquito repellent market forecast period

What are the market drivers driving the demand for the market?

Technological advancements and innovations in repellent formulations drive the U.S. mosquito repellent market.

The manufacturers are introducing novel formulations that offer enhanced efficacy, convenience, and safety with ongoing research and development. These advancements include the development of long-lasting formulations that provide extended protection against mosquitoes, as well as microencapsulated products that release repellent ingredients over time, ensuring prolonged effectiveness.

Also, the integration of natural and eco-friendly ingredients in repellent formulations caters to the growing consumer preference for sustainable and non-toxic solutions. Advancements in delivery systems, such as sprays, lotions, and wearable devices, offer consumers a wide range of options to suit their preferences and lifestyles. Overall, these technological innovations drive market growth by addressing evolving consumer needs and preferences while providing effective solutions for mosquito protection.

Which factor is restraining the demand for the market?

Regulatory considerations and compliance challenges affects the U.S. mosquito repellent market growth.

The manufacturers are facing hurdles in product development, registration, and marketing due to stringent regulations governing the safety and efficacy of repellent products. Compliance with regulatory standards requires extensive testing and documentation, adding to product development costs and timelines. Varying regulatory frameworks across the U.S. necessitate navigating a complex landscape of requirements, further complicating market entry and expansion. Thus, failure to meet regulatory standards results in product recalls, fines, and damage to brand reputation. These challenges hinder innovation and market access for manufacturers, constraining the growth potential of the mosquito repellent market in the United States.

Report Segmentation

The market is primarily segmented based on type and distribution channel.

|

By Type |

By Distribution Channel |

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Type Insights

Based on type category analysis, the market has been segmented on the basis of spray, vaporizer, cream & oil, coil, and other types. The cream & oil segment has emerged as the largest shareholding segment in the U.S. market since creams and oils offer a convenient and easy-to-use application method, allowing consumers to apply the repellent directly to their skin, providing immediate protection against mosquito bites.

Also, many cream and oil formulations contain active ingredients such as DEET or picaridin, which are highly effective at repelling mosquitoes for extended periods, appealing to consumers seeking reliable protection. With the growing preference for natural and organic products, manufacturers have developed cream and oil repellents using plant-based ingredients like citronella, eucalyptus, or lemongrass, catering to health-conscious consumers. The versatility of cream and oil formulations, offering protection for both outdoor and indoor activities, further contributes to their popularity, making them the preferred choice for a wide range of consumers in the U.S. market.

By Distribution Channel Insights

Based on distribution channel category analysis, the market has been segmented on the basis of hypermarket & supermarket, independent stores, and e-commerce. The e-commerce segment is anticipated to experience significant growth over the forecast period in the market due to the increasing prevalence of online shopping platforms, which provide consumers with convenient access to a wide range of mosquito-repellent products from the comfort of their homes, eliminating the need for physical store visits.

Also, e-commerce platforms offer greater product visibility and accessibility, allowing consumers to compare prices, read reviews, and make informed purchasing decisions easily. Online purchasing of mosquito repellents offers several benefits, including doorstep delivery and multiple payment options, which significantly augment the overall appeal of this mode of purchase. With the ongoing trend of digitalization and the growing preference for online shopping, the e-commerce segment is poised to capitalize on these factors, driving significant growth in the U.S. mosquito repellent market over the forecast period.

Competitive Landscape

The U.S. market is characterized by intense rivalry among key players competing for market share and consumer loyalty. Established companies dominate the market with their wide range of repellent products and extensive distribution networks. These industry giants leverage their brand recognition, product innovation capabilities, and marketing strategies to maintain their competitive edge. Also, the market has the presence of several local players and niche manufacturers offering specialized repellent solutions tailored to specific consumer needs and preferences.

Some of the major players operating in the U.S. market include:

- 3M

- AoGrand Intl Group Inc.

- BASF SE

- Dabur

- Enesis Group

- Godrej

- Henkel AG & Co. KGaA

- PelGar International

- Reckitt Benckiser Group PLC

- S.C. Johnson & Son Inc.

- Sawyer Products, Inc.

- Spectrum Brands, Inc.

Recent Developments

- In February 2022, Terminix, a pest control company, has successfully acquired Mr. Mister Mosquito Control, a provider of mosquito control services in 33 cities across North Georgia.

Report Coverage

The U.S. mosquito repellent market research report provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, distribution channel, and futuristic growth opportunities.

U.S. Mosquito Repellent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,511.3 million |

|

Revenue Forecast in 2032 |

USD 2,414.8 million |

|

CAGR |

6.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2020 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Distribution Channel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in U.S. Mosquito Repellent Market are 3M, AoGrand Intl Group Inc., BASF SE, Dabur, Enesis Group, Godrej, Henkel AG & Co. KGaA, PelGar International, Reckitt Benckiser Group PLC

The U.S. mosquito repellent market exhibiting a CAGR of 6.0% during the forecast period

The U.S. Mosquito Repellent Market report covering key segments are type and distribution channel.

key driving factors in U.S. Mosquito Repellent Market are technological advancements and innovations in repellent formulations

The U.S. mosquito repellent market size is expected to reach USD 2,414.8 Million by 2032