U.S. Nanocatalysts Market Size, Share, Trends, Industry Analysis Report

By Material (Metal-Based Nanocatalysts, Metal Oxide Nanocatalysts, Carbon-Based Nanocatalysts, Polymeric Nanocatalysts, Composite Nanocatalysts), By Application – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6384

- Base Year: 2024

- Historical Data: 2020-2023

Overview

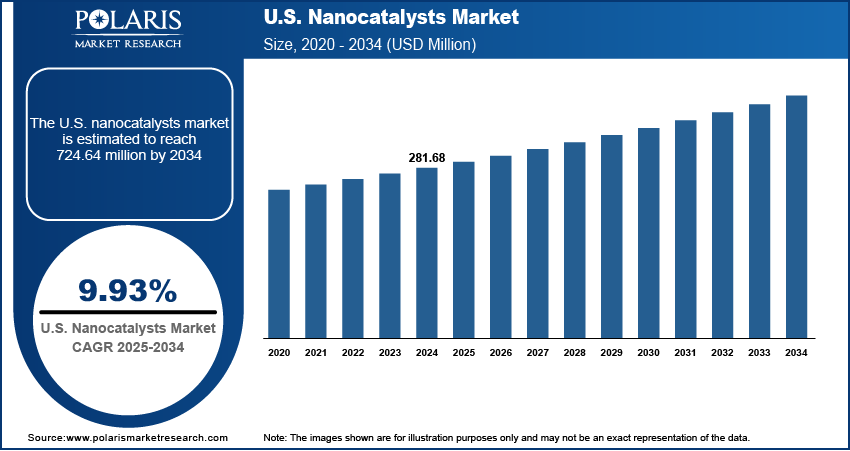

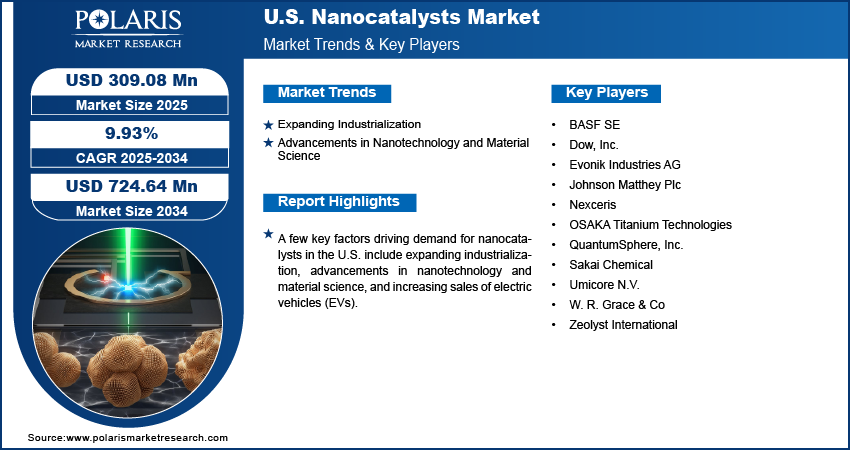

The U.S. nanocatalysts market size was valued at USD 281.68 million in 2024, growing at a CAGR of 9.93% from 2025 to 2034. Key factors driving demand for the nanocatalysts in the U.S. include expanding industrialization, advancements in nanotechnology and material science, and increasing sales of electric vehicles (EVs).

Key Insights

- The metal-based nanocatalysts segment accounted for a major revenue share in 2024 due to their growing usage in the petrochemical and energy sectors.

- The petroleum refining segment held the largest revenue share in 2024 due to refineries' reliance on nanocatalysts to enhance conversion efficiency and meet strict emission regulations.

Industry Dynamics

- Expanding industrialization is fueling the demand for nanocatalysts, as these advanced materials radically improve process efficiency in manufacturing and chemical industries.

- Advancements in nanotechnology and material science are driving the U.S. nanocatalysts market growth by developing novel nanostructures that are accelerating reaction rates and reducing energy consumption.

- The growing urbanization in the U.S. is expected to create a lucrative market opportunity during the forecast period.

- High cost and complexity of production hamper the nanocatalysts market expansion.

Artificial Intelligence (AI) in U.S. Nanocatalysts Market

- AI algorithms, particularly machine learning, analyze vast datasets to predict new nanocatalyst compositions and structures with desired properties.

- AI models optimize the complex parameters for synthesizing nanocatalysts to ensure consistent, high-quality production at scale, improving yield and reducing material waste.

- AI tools are also used to predict catalyst degradation and deactivation in industrial processes, enabling proactive maintenance schedules and maximizing operational efficiency and uptime.

Market Statistics

- 2024 Market Size: USD 281.68 Million

- 2034 Projected Market Size: USD 724.64 Million

- CAGR (2025–2034): 9.93%

Nanocatalysts are catalysts made at the nanoscale, typically ranging from 1 to 100 nanometers, that accelerate chemical reactions by providing a larger surface area and unique electronic properties compared to conventional catalysts. The nanoscale size of these catalysts enhances reactivity, stability, and selectivity, allowing chemical processes to occur more efficiently. They can be synthesized from metals, metal oxides, carbon-based materials, polymers, or composites, depending on the application.

Nanocatalysts are used across diverse industries to improve reaction efficiency and reduce energy consumption. In petroleum refining, they accelerate cracking and desulfurization processes, ensuring cleaner fuels. They enhance the production of polymers, fertilizers, and specialty chemicals in chemical manufacturing. The environmental sector employs nanocatalysts for wastewater treatment, air purification, and carbon capture. In the energy sector, they improve hydrogen production, fuel cell performance, and renewable energy conversion. The automotive industry uses them in catalytic converters to minimize emissions. Electronics and semiconductors also use nanocatalysts for material synthesis, while pharmaceuticals and biotechnology rely on them for drug development.

The U.S. nanocatalysts market demand is driven by the increasing sales of electric vehicles (EVs). According to the International Energy Agency, the electric car sales increased to 1.6 million in 2024 in the U.S. EVs rely on advanced battery technologies and fuel cells that require highly efficient catalysts such as nanocatalysts. Nanocatalysts enhance the performance and longevity of lithium-ion batteries used in EVs by improving electrode reactions and reducing internal resistance, which leads to faster charging and longer battery life. Therefore, as more consumers adopt EVs, manufacturers scale up production and seek ways to improve energy density, durability, and affordability, all of which depend on the unique properties of nanocatalysts.

Drivers & Opportunities

Expanding Industrialization: Expanding industrialization across sectors such as manufacturing, energy, and chemicals is fueling the demand for nanocatalysts, as these advanced materials radically improve process efficiency in these industries. Industries such as petrochemicals and energy are constantly seeking faster reaction rates, higher yields, and more sustainable operations, which is driving the demand for nanocatalysts as they provide faster reaction rates by offering an immense surface area that accelerates chemical reactions while minimizing waste. Consequently, as industries scale up production, they require increasing quantities of high-performance nanocatalysts to maintain a competitive and eco-friendly advantage.

Advancements in Nanotechnology and Material Science: Researchers are developing novel nanostructures that are accelerating reaction rates and reducing energy consumption, attracting industries such as petrochemicals and chemicals seeking efficient and sustainable solutions. The development of advanced materials enables the creation of nanocatalysts with tailored properties for applications in petroleum refining, chemical synthesis, energy conversion, and environmental remediation. This is increasing the adoption of nanocatalysts in petrochemical, energy, automotive, and other industries. Therefore, the growing advancements in nanotechnology and material science are fueling the demand for nanocatalysts in the U.S.

Segmental Insights

Material Analysis

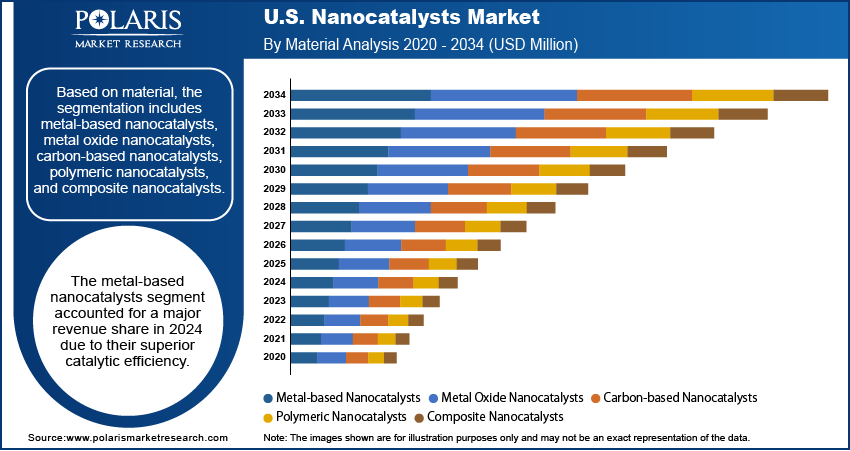

Based on material, the segmentation includes metal-based nanocatalysts, metal oxide nanocatalysts, carbon-based nanocatalysts, polymeric nanocatalysts, and composite nanocatalysts. The metal-based nanocatalysts segment accounted for a major revenue share in 2024 due to their superior catalytic efficiency. Petroleum refining, chemical manufacturing, and environmental remediation companies preferred these materials since they delivered high surface reactivity, excellent thermal stability, and consistent performance under harsh industrial conditions. Refineries used them to enhance fuel production while chemical manufacturers integrated them into large-scale synthesis processes. The ability of metal-based nanocatalysts to accelerate reactions at lower costs while maintaining durability gave them a competitive edge over other materials, contributing to their dominance across multiple industrial applications.

The metal oxide nanocatalysts segment is projected to grow at a robust pace in the coming years, owing to the rising industrial focus on sustainability and green chemistry solutions. Metal oxide nanocatalysts enable efficient pollutant degradation, hydrogen production, and photocatalytic reactions, which align with clean energy and environmental protection goals in the country. The government’s push for renewable energy adoption and stricter emission control regulations is also fueling demand for metal oxide variants.

Application Analysis

In terms of application, the segmentation includes petroleum refining, chemicals, environmental, energy & fuel cells, automotive, electronics & semiconductor, food & beverage, and pharmaceuticals & biotechnology. The petroleum refining segment held the largest revenue share in 2024 due to refineries' reliance on nanocatalysts to improve fuel quality, enhance conversion efficiency, and meet strict emission regulations. Petrochemical refineries used nanocatalysts to break down heavy hydrocarbons into lighter fractions such as gasoline, diesel, and jet fuel, which directly supported the nation’s energy demand. The industry favored nanocatalysts due to their ability to lower reaction temperatures and increase process efficiency, which reduced operating costs while boosting output. Growing energy consumption, coupled with the need to produce cleaner fuels, further strengthened the dominance of the segment across the refining landscape.

The environmental segment is expected to grow at a rapid pace during the forecast period, owing to industries prioritizing sustainable practices and regulatory bodies enforcing stringent pollution control standards. Industries are increasingly adopting nanocatalysts for applications such as water purification, wastewater treatment, and catalytic converters, which help reduce greenhouse gas emissions and degrade harmful pollutants. The push toward carbon neutrality and federal initiatives that support green technologies is further fueling the need for nanocatalysts across multiple industries.

Key Players & Competitive Analysis

The U.S. nanocatalysts market is a dynamic and highly competitive landscape, characterized by intense R&D and strategic specialization. Established chemical giants such as BASF SE and Dow, Inc. are leveraging their vast production scale to dominate the market. They are challenged by technology-focused firms such as Nexceris and QuantumSphere, Inc., which pioneer novel materials for emerging applications in energy storage and green hydrogen. Simultaneously, specialty chemical companies such as W. R. Grace & Co. and Johnson Matthey Plc hold significant shares in refining and petrochemical catalysts, competing on performance and longevity. Companies are developing more efficient, selective, and cost-effective nanocatalysts to meet stringent environmental regulations.

A few major companies operating in the U.S. nanocatalysts market include BASF SE; Dow, Inc.; Evonik Industries AG; Johnson Matthey Plc; Nexceris; OSAKA Titanium Technologies; QuantumSphere, Inc.; Sakai Chemical; Umicore N.V.; W. R. Grace & Co.; and Zeolyst International.

Key Companies

- BASF SE

- Dow, Inc.

- Evonik Industries AG

- Johnson Matthey Plc

- Nexceris

- OSAKA Titanium Technologies

- QuantumSphere, Inc.

- Sakai Chemical

- Umicore N.V.

- W. R. Grace & Co

- Zeolyst International

U.S. Nanocatalysts Industry Developments

In December 2024, BASF officially opened its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany.

U.S. Nanocatalysts Market Segmentation

By Material Outlook (Revenue, USD Million, 2020–2034)

- Metal-Based Nanocatalysts

- Metal Oxide Nanocatalysts

- Carbon-Based Nanocatalysts

- Polymeric Nanocatalysts

- Composite Nanocatalysts

By Application Outlook (Revenue, USD Million, 2020–2034)

- Petroleum Refining

- Chemicals

- Environmental

- Energy & Fuel Cells

- Automotive

- Electronics & Semiconductor

- Food & Beverage

- Pharmaceuticals & Biotechnology

U.S. Nanocatalysts Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 281.68 Million |

|

Market Size in 2025 |

USD 309.08 Million |

|

Revenue Forecast by 2034 |

USD 724.64 Million |

|

CAGR |

9.93% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 281.68 million in 2024 and is projected to grow to USD 724.64 million by 2034.

The market is projected to register a CAGR of 9.93% during the forecast period.

A few of the key players in the market are BASF SE; Dow, Inc.; Evonik Industries AG; Johnson Matthey Plc; Nexceris; OSAKA Titanium Technologies; QuantumSphere, Inc.; Sakai Chemical; Umicore N.V.; W. R. Grace & Co.; and Zeolyst International.

The metal-based nanocatalysts segment dominated the market share in 2024.

The environmental segment is expected to witness the fastest growth during the forecast period.