U.S. Oral Rinse Market Size, Share, Trends, Industry Analysis Report

By Indication (Periodontitis, Mouth Ulcers, Gingivitis, Dry Mouth), By Product, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6140

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

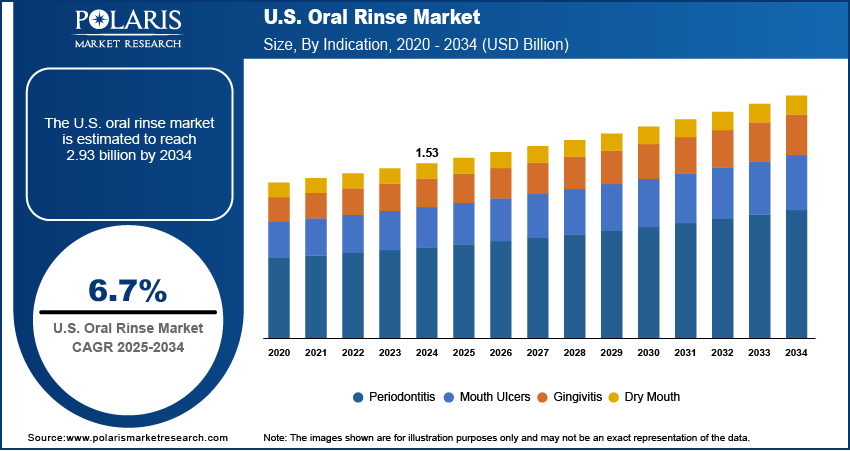

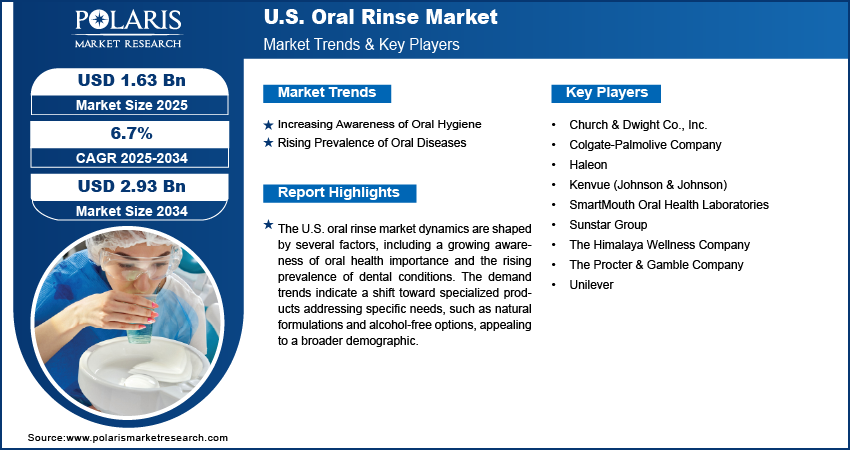

The U.S. oral rinse market size was valued at USD 1.53 billion in 2024 and is anticipated to register a CAGR of 6.7% from 2025 to 2034. The landscape is primarily driven by the increasing awareness of oral hygiene and the rising occurrence of dental issues such as plaque and bad breath. Additionally, the growing demand for preventive dental care and the availability of various product types, including alcohol-free and natural formulations, also contribute to market growth.

Key Insights

- By indication, the gingivitis segment held the largest share in 2024. This is driven by the widespread use of oral rinses as a routine part of daily hygiene to prevent and manage common gum inflammation, reflecting a broad consumer base focused on preventative oral care.

- By product, the antiseptic mouthwash products segment held the largest share in 2024. Their dominance stems from their effectiveness in controlling bacteria, reducing plaque buildup, and preventing gum disease, aligning with essential consumer needs for comprehensive oral hygiene.

- By distribution channel, the retail stores segment, including supermarkets and hypermarkets, held the largest share in 2024. This is primarily due to their extensive presence and convenience for one-stop shopping and immediate product availability during regular errands.

Industry Dynamics

- Increasing consumer awareness regarding maintaining good oral hygiene significantly propels the demand for oral rinse products. Many individuals are actively seeking solutions to prevent common dental problems such as cavities, gum disease, and bad breath, recognizing the role of rinses in a complete oral care routine, which drives product adoption.

- The rising prevalence of various oral health issues, such as gingivitis, periodontitis, and halitosis, acts as a key driver for the oral rinse industry. As more people experience these conditions, they seek effective ways to manage symptoms and improve their overall oral health, leading to increased purchases of therapeutic and cosmetic rinses.

- Advancements in product formulations, including the introduction of alcohol-free options, natural ingredients, and specialized rinses for sensitive teeth or specific conditions, are fueling the adoption of these products. These innovations address diverse consumer needs and preferences, expanding the consumer base and encouraging regular use.

Market Statistics

- 2024 Market Size: USD 1.53 billion

- 2034 Projected Market Size: USD 2.93 billion

- CAGR (2025–2034): 6.7%

To Understand More About this Research: Request a Free Sample Report

The oral rinse market involves the production and sale of liquid solutions used for oral hygiene, distinct from toothpaste and floss. These solutions, including mouth fresheners, help freshen breath, reduce plaque, prevent gum disease, and provide other therapeutic or cosmetic benefits. Products range from over-the-counter options to prescription-strength formulations recommended by dental professionals.

The U.S. oral rinse market growth is driven by the increasing focus on cosmetic benefits and continuous product innovation. While general oral health and disease prevention remain primary concerns, consumers are also showing a greater interest in aesthetic enhancements, such as teeth whitening and stain removal. This growing desire for a brighter smile is leading to a demand for oral rinses that offer additional cosmetic advantages beyond basic cleaning.

Ongoing product innovation significantly contributes to the growth of this sector. Companies are consistently introducing new formulations, including alcohol-free versions, natural ingredient options, and rinses targeting specific concerns such as dry mouth or sensitivity. These innovations cater to a broader consumer base and different preferences, drawing in new users and encouraging existing ones to try specialized products. For example, the development of mouthwashes containing ingredients that help with enamel strengthening or provide advanced antimicrobial properties reflects this trend, offering more targeted solutions for various oral health needs.

Drivers and Trends

Increasing Awareness of Oral Hygiene: A significant driver for the U.S. oral rinse market expansion is the rising public awareness regarding the importance of maintaining good oral hygiene. Consumers are becoming more educated about the link between oral health and overall systemic health, leading to a proactive approach in adopting comprehensive oral care routines that often include oral rinses. This increased understanding is fueled by various public health campaigns and educational initiatives aimed at promoting preventative dental care.

According to an article published by the Centers for Disease Control and Prevention (CDC) titled "Oral Health: Preventing Cavities, Gum Disease, and More" updated in February 2023, regular oral hygiene practices, including rinsing, are crucial for preventing common oral health issues. This emphasis on preventative care encourages individuals to incorporate oral rinses into their daily routines. The growing recognition of benefits such as fresher breath, reduced plaque buildup, and stronger enamel is compelling more individuals to use these products, thereby boosting the market.

Rising Prevalence of Oral Diseases: The increasing occurrence of various oral health conditions and diseases significantly drives the demand for oral rinse products in the U.S. Conditions such as gingivitis, periodontitis, mouth ulcers and dental caries are widespread, prompting consumers to seek effective solutions for treatment and management. Oral rinses, especially those with therapeutic properties, play a crucial role in complementing brushing and flossing to combat these issues.

Data from the National Institute of Dental and Craniofacial Research (NIDCR) highlights the burden of oral diseases in the U.S. As reported in "Oral Health in America: A Report of the Surgeon General" published in 2000, and continuously referenced in subsequent NIDCR publications, dental caries and periodontal diseases remain highly prevalent, affecting a large portion of the population across all age groups. The ongoing need to address these common oral health problems directly fuels the demand for oral rinses that offer antimicrobial, anti-inflammatory, and fluoride-based benefits, thus driving the market forward.

Segmental Insights

Indication Analysis

Based on indication, the U.S. oral rinse market segmentation includes periodontitis, mouth ulcers, gingivitis, and dry mouth. The gingivitis segment held the largest share in 2024. Consumers widely use oral rinses as an essential part of their daily routine to prevent and manage common gum inflammation and to ensure overall mouth cleanliness. This dominance stems from the high prevalence of gum-related issues among the adult population, where oral rinses act as an accessible and effective adjunct to brushing and flossing. Many therapeutic oral rinses are specifically formulated to target the bacteria and plaque that cause gingivitis, making them a go-to solution for individuals seeking to improve their gum health and prevent more severe periodontal diseases. The broad consumer base engaged in preventative oral care further solidifies this segment's leading position, with a wide array of products available for general oral hygiene.

The dry mouth (xerostomia) segment is anticipated to register the highest growth rate during the forecast period. The condition, characterized by insufficient saliva production, can lead to various oral health problems, including discomfort, difficulty speaking or swallowing, and an increased risk of cavities and infections. The rising awareness of dry mouth as a significant health concern, coupled with an aging population and an increase in medications that list dry mouth as a side effect, is driving the demand for specialized oral rinses designed to alleviate its symptoms. These products often contain moisturizing agents and ingredients that help stimulate saliva flow, providing much-needed relief and improving the quality of life for affected individuals. The growing recognition and diagnosis of dry mouth and dry mouth relief products contribute to the rapid expansion of this niche but increasingly important segment.

Product Analysis

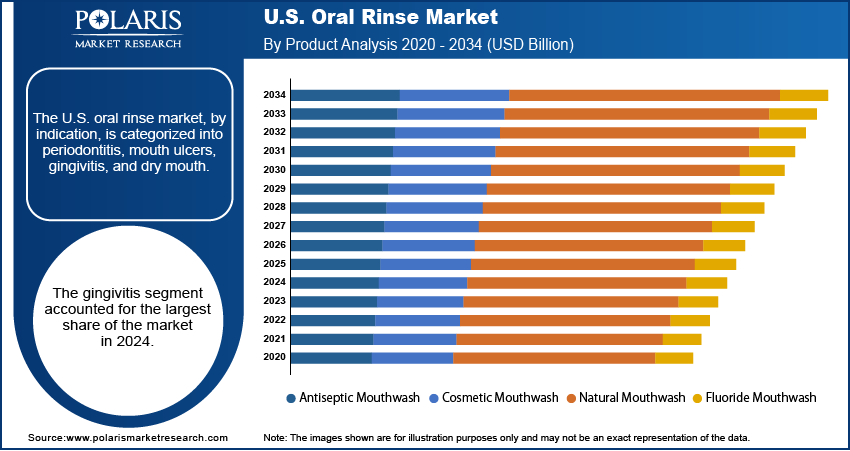

Based on product, the U.S. oral rinse segmentation includes antiseptic mouthwash, cosmetic mouthwash, natural mouthwash, and fluoride mouthwash. The antiseptic mouthwash segment held the largest share in 2024, primarily due to their effectiveness in controlling bacteria, reducing plaque buildup, and preventing gum disease, which aligns with consumers' core needs for comprehensive oral hygiene. Antiseptic rinses, often containing active ingredients that target germs, are widely recommended by dental professionals for their therapeutic benefits and are a common staple in many households for daily oral care routines. Their long-standing presence and proven efficacy in addressing common oral health concerns, such as gingivitis and bad breath, contribute significantly to their broad appeal and continued market leadership. The widespread availability and strong brand recognition of these products also play a crucial role in maintaining their commanding position in the overall product landscape.

The natural mouthwash segment is anticipated to register the highest growth during the forecast period, driven by a strong consumer shift toward products with fewer synthetic chemicals and a preference for natural or organic ingredients. As consumers become more health-conscious and seek transparency in product formulations, natural mouthwashes, which often feature ingredients such as essential oils, aloe vera, and herbal extracts, are gaining significant traction. These products are perceived as gentler and more environmentally friendly alternatives, appealing to a demographic that prioritizes wellness and sustainability in their personal care choices. The increasing demand for alcohol-free options also contributes to the expansion of the natural segment, as many natural formulations inherently avoid harsh alcohols.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes retail stores, pharmacies, and online stores. The retail stores segment held the largest share in 2024. This segment's dominance is largely attributed to the broad reach and accessibility of these physical stores, which offer consumers the convenience of purchasing a wide array of daily necessities, including oral care items, during a single shopping trip. The ability for consumers to visually inspect products, compare various brands directly, and benefit from immediate product availability significantly contributes to the high sales volumes observed in these traditional retail channels. This established buying behavior and the pervasive presence of such stores ensure their continued leadership in the oral rinse distribution landscape.

The online stores segment is anticipated to register the highest growth during the forecast period. This rapid expansion is a direct result of the evolving consumer preference for digital shopping, which offers unmatched convenience, a wider selection of products, and often more competitive pricing compared to physical stores. Consumers increasingly utilize online platforms to research products, read reviews, and take advantage of subscription services and exclusive online discounts, which enhance the overall purchasing experience. The growing comfort with e-commerce, along with the ease of home delivery, has significantly propelled this segment forward, indicating its substantial potential for continued expansion in the coming years.

Key Players and Competitive Insights

The U.S. oral rinse market features a highly competitive landscape dominated by several global consumer goods and pharmaceutical giants. A few major players such as The Procter & Gamble Company, Colgate-Palmolive Company, Kenvue (Johnson & Johnson), Haleon, Unilever, and Church & Dwight Co., Inc. are key contenders. These companies continuously strive to innovate their product offerings, expand their distribution networks, and engage in extensive marketing and promotional activities to capture and maintain their share in this dynamic sector. The competition is intense, driven by product differentiation, brand loyalty, and strategic pricing.

A few prominent companies in the industry include Church & Dwight Co., Inc.; Colgate-Palmolive Company; Haleon; Kenvue (Johnson & Johnson); SmartMouth Oral Health Laboratories; Sunstar Group; The Himalaya Wellness Company; The Procter & Gamble Company; and Unilever.

Key Players

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Haleon

- Kenvue (Johnson & Johnson)

- SmartMouth Oral Health Laboratories

- Sunstar Group

- The Himalaya Wellness Company

- The Procter & Gamble Company

- Unilever

U.S. Oral Rinse Industry Development

June 2023: Procter & Gamble (P&G) launched a new concentrated mouthwash in the U.S. under its Crest Scope brand, called Crest Scope Squeez Mouthwash.

U.S. Oral Rinse Market Segmentation

By Indication Outlook (Revenue – USD Billion, 2020–2034)

- Periodontitis

- Mouth Ulcers

- Gingivitis

- Dry Mouth

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Antiseptic Mouthwash

- Cosmetic Mouthwash

- Natural Mouthwash

- Fluoride Mouthwash

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Retail Stores

- Pharmacies

- Online Stores

U.S. Oral Rinse Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.53 billion |

|

Market Size in 2025 |

USD 1.63 billion |

|

Revenue Forecast by 2034 |

USD 2.93 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.53 billion in 2024 and is projected to grow to USD 2.93 billion by 2034.

The market is projected to register a CAGR of 6.7% during the forecast period.

A few key players in the market include Church & Dwight Co., Inc.; Colgate-Palmolive Company; Haleon; Kenvue (Johnson & Johnson); SmartMouth Oral Health Laboratories; Sunstar Group; The Himalaya Wellness Company; The Procter & Gamble Company; and Unilever.

The gingivitis segment accounted for the largest share of the market in 2024.

The natural mouthwash segment is expected to witness the fastest growth during the forecast period.