U.S. Propylene Glycol Market Size, Share, Trends, & Industry Analysis Report

By Grade (Pharmaceutical & Food Grade, Industrial Grade), By Source, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6366

- Base Year: 2024

- Historical Data: 2020-2023

Overview

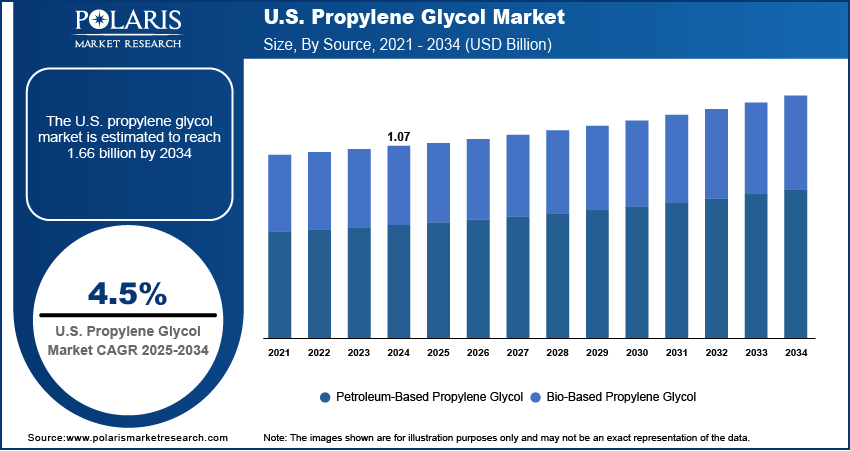

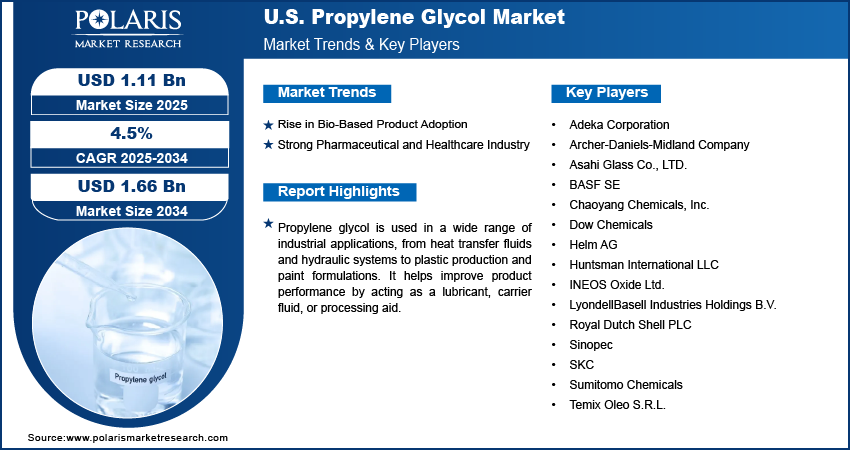

The U.S. propylene glycol market size was valued at USD 1.07 billion in 2024, growing at a CAGR of 4.5% from 2025–2034. Key factors driving demand is rise in bio-based product adoption, and strong pharmaceutical and healthcare industry.

Key Insights

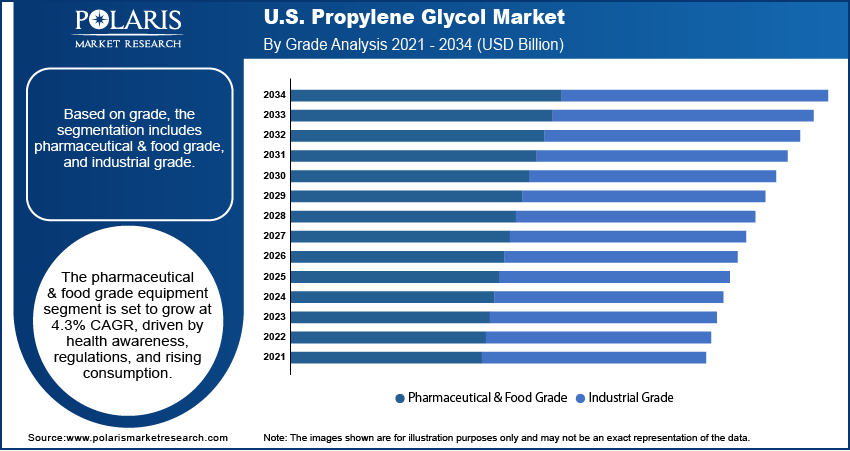

- The pharmaceutical and food grade equipment segment is projected to grow at a CAGR of 4.3% during the forecast period, supported by strict FDA regulations and a growing consumer focus on product safety and high-quality standards.

- The bio-based propylene glycol segment is expected to capture a notable market share over the coming years, driven by increasing environmental consciousness, corporate sustainability initiatives, and backing from government programs like the BioPreferred Program.

- In 2024, the automotive sector accounted for 26.88% of total market revenue, as the U.S. remains one of the largest and most established automotive markets, with strong demand for propylene glycol-based antifreeze, coolants, and brake fluids.

- The pharmaceutical segment held a significant 9.86% revenue share in 2024, fueled by the country’s robust R&D ecosystem, advanced production capabilities, and stringent regulatory oversight, ensuring consistent demand for pharmaceutical-grade glycol.

Industry Dynamics

- Rise in bio-based product adoption are driving the demand for bio-based propylene glycol.

- Strong pharmaceutical and healthcare industry is driving the U.S. propylene glycol market

- The growth in construction, manufacturing, and electronics sectors fuels the need for industrial-grade propylene glycol.

- Strict environmental regulations and health concerns related to excessive consumption or exposure to synthetic propylene glycol limits the growth.

Market Statistics

- 2024 Market Size: USD 1.07 Billion

- 2034 Projected Market Size: USD 1.66 Billion

- CAGR (2025-2034): 4.5%

AI Impact on the Industry

- AI enhances production efficiency by optimizing chemical reaction parameters and real-time process control, leading to higher yield and reduced energy consumption in propylene glycol manufacturing.

- AI-powered supply chain analytics improve demand forecasting, inventory management, and logistics planning, enabling more resilient and cost-effective distribution of propylene glycol across industries.

- AI-driven quality control systems use machine learning and computer vision to detect impurities and ensure consistent purity levels, especially critical in pharmaceutical and food-grade propylene glycol.

- Predictive maintenance powered by AI helps monitor equipment used in glycol production, reducing unplanned downtime, lowering maintenance costs, and extending asset life.

- AI-supported market analysis tools assist manufacturers in identifying emerging trends, regulatory shifts, and consumer demand patterns, enabling faster, data-driven strategic decisions.

Propylene Glycol is a colorless, odorless, and slightly viscous liquid used as a solvent, humectant, and preservative in various industries. It is commonly found in food, pharmaceuticals, cosmetics, and industrial applications like antifreeze and de-icing solutions. Produced from petroleum or bio-based sources, it is generally recognized as safe (GRAS) when used appropriately.

The U.S. is a major consumer of packaged and processed food, which heavily relies on food-grade propylene glycol as a stabilizer, humectant, and preservative. The popularity of convenience foods, frozen meals, and ready-to-drink beverages continues to grow, especially among urban consumers and younger demographics. The food industry’s push for shelf stability, texture enhancement, and moisture control supports rising use of glycol-based additives. Additionally, the U.S. regulatory environment allows its use in food applications under controlled limits, further promoting growth.

The U.S. has a well-established automotive manufacturing and aftermarket service industry, which drives strong demand for propylene glycol in coolants and antifreeze formulations. Cold weather conditions across many states make glycol-based antifreeze essential for vehicle maintenance. Additionally, the growing adoption of electric vehicles is increasing the need for thermal management systems, where propylene glycol plays a vital role. The aftermarket further contributes significantly, as millions of vehicles require regular maintenance. The demand of high-performance glycol fluids is rising as automotive technology evolves and EV adoption rises, thereby driving the growth.

Drivers & Opportunities

Rise in Bio-Based Product Adoption: Environmental sustainability is becoming a priority for both consumers and manufacturers in the U.S., boosting demand for bio-based propylene glycol made from renewable resources like corn or soy. Government initiatives such as the U.S. BioPreferred Program and corporate ESG commitments are encouraging companies to reduce carbon footprints and transition to greener chemical alternatives. Bio-based glycol offers similar performance with lower environmental impact, making it increasingly attractive for use in pharmaceuticals, food, personal care products, and industrial applications. The demand for renewable propylene glycol rises as eco-conscious consumer behavior grows, thereby driving the growth.

Strong Pharmaceutical and Healthcare Industry: The U.S. has one of the largest and most advanced pharmaceutical industries in the world, which is driving demand for pharmaceutical-grade propylene glycol. It is widely used as a solvent in drug formulations such as syrups, injectables, and topical applications. The need for medications rises with a growing elderly population, increasing prevalence of chronic diseases, and high healthcare spending. Additionally, the U.S. FDA’s strict regulations ensure consistent quality standards, further supporting demand for safe and approved ingredients like propylene glycol across pharmaceutical and healthcare applications, thereby fueling the growth.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes pharmaceutical & food grade, and industrial grade. Pharmaceutical & food grade equipment segment is projected to grow at a CAGR of 4.3% over the forecast period due to stringent FDA regulations and increasing consumer emphasis on product safety and quality. It is widely used as an excipient in pharmaceuticals and as a food additive in processed foods and beverages. The growing prevalence of chronic conditions, aging population, and high healthcare spending are boosting pharmaceutical production. Simultaneously, the popularity of convenience foods and beverages is fueling demand for food-grade glycol. The U.S.’s strong focus on compliance and quality assurance makes high-purity propylene glycol a vital component in both industries.

Source Analysis

Based on source, the segmentation includes petroleum-based propylene glycol, and bio-based propylene glycol. Bio-based propylene glycol segment is expected to witness a significant share over the forecast period driven by rising environmental awareness, corporate sustainability goals, and support from government initiatives like the BioPreferred Program. Consumers are demanding eco-friendly, non-toxic ingredients in personal care, food, and pharmaceutical products. In response, manufacturers are investing in bio-based production processes using renewable feedstocks such as corn and soy. The demand for sustainable alternatives to petroleum-based glycol is growing as large companies shift toward greener supply chains and carbon reduction strategies. This transition is further fueled by regulatory incentives and consumer preference for clean-label products, thereby fueling the growth.

End User Analysis

In terms of end user, the segmentation includes food and beverage, automotive, personal care and cosmetics, chemical, pharmaceutical, construction, and others. The automotive held 26.88% of revenue share in 2024 as the U.S. has one of the largest and most mature automotive industries in the world, which significantly drives demand for propylene glycol in antifreeze, coolants, and brake fluids. Cold climates in northern states require glycol-based products for winter vehicle protection. Additionally, the rapid growth of the electric vehicle industry is increasing the need for advanced thermal management systems. Strong vehicle ownership, a large aftermarket sector, and strict performance standards make glycol-based fluids critical in both passenger and commercial vehicles, thereby fueling the segment growth.

The pharmaceutical segment held significant revenue share in 2024, holding 9.86% driven by large R&D investment, advanced manufacturing capabilities, and strong regulatory oversight. Propylene glycol is a major ingredient in various drug formulations, acting as a solvent, stabilizer, and carrier for active pharmaceutical ingredients. The need for pharmaceutical-grade glycol is consistently rising with the growing demand for over-the-counter medications, injectables, and topical products. The industry’s emphasis on quality, safety, and compliance with FDA standards ensures ongoing usage. Additionally, the country’s high healthcare expenditure and continuous innovation in drug development further drive demand in this segment.

Key Players & Competitive Analysis

The U.S. propylene glycol market is highly competitive, featuring a mix of global chemical giants and regional players with strong manufacturing and distribution networks. Key companies such as Dow Chemicals, Huntsman International LLC, and LyondellBasell Industries play a dominant role, benefiting from their large-scale production capabilities, integrated supply chains, and well-established customer bases. These firms are focusing on innovations in bio-based propylene glycol and process efficiency to align with increasing demand for sustainable solutions. International players like BASF SE, INEOS Oxide Ltd., and Royal Dutch Shell PLC also maintain a strong presence through U.S.-based subsidiaries and strategic partnerships. Additionally, companies like ADM are gaining traction by offering renewable, corn-based alternatives, catering to the growing clean-label and green chemistry trends. Competitive strategies include capacity expansion, R&D investment, and adherence to strict FDA and EPA standards. The focus on product purity, environmental compliance, and customization for end-user industries continues to shape the market landscape.

Key Players

- Adeka Corporation

- Archer-Daniels-Midland Company

- Asahi Glass Co., LTD.

- BASF SE

- Dow Chemicals

- Helm AG

- Huntsman International LLC

- INEOS Oxide Ltd.

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell PLC

- Sinopec

- SKC

- Sumitomo Chemicals

- Temix Oleo S.R.L.

Industry Developments

March 2024, Dow launched two sustainable propylene glycol solutions Propylene Glycol CIR and REN in North America, using bio-circular and circular feedstocks. These ISCC PLUS-certified products support various industries with high-performance, environmentally friendly alternatives, reinforcing Dow’s commitment to sustainable innovation.

U.S. Propylene Glycol Market Segmentation

By Grade Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Pharmaceutical & Food Grade

- Industrial Grade

By Source Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Petroleum-Based Propylene Glycol

- Bio-Based Propylene Glycol

By End User Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Food and Beverage

- Automotive

- Personal Care and Cosmetics

- Chemical

- Pharmaceutical

- Construction

- Others

U.S. Propylene Glycol Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.07 Billion |

|

Market Size in 2025 |

USD 1.11 Billion |

|

Revenue Forecast by 2034 |

USD 1.66 Billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.07 billion in 2024 and is projected to grow to USD 1.66 billion by 2034.

The market is projected to register a CAGR of 4.5% during the forecast period.

A few of the key players in the market are Adeka Corporation; Archer-Daniels-Midland Company; Asahi Glass Co., LTD.; BASF SE; Chaoyang Chemicals, Inc.; Dow Chemicals; Helm AG; Huntsman International LLC; INEOS Oxide Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; Sinopec; SKC; Sumitomo Chemicals; Temix Oleo S.R.L.

The pharmaceutical and food grade segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.