U.S. Clinical Laboratory Tests Market Size, Share, Trends, & Industry Analysis Report

By Type (Clinical Chemistry Testing, Hematology Testing), and By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6368

- Base Year: 2024

- Historical Data: 2020-2023

Overview

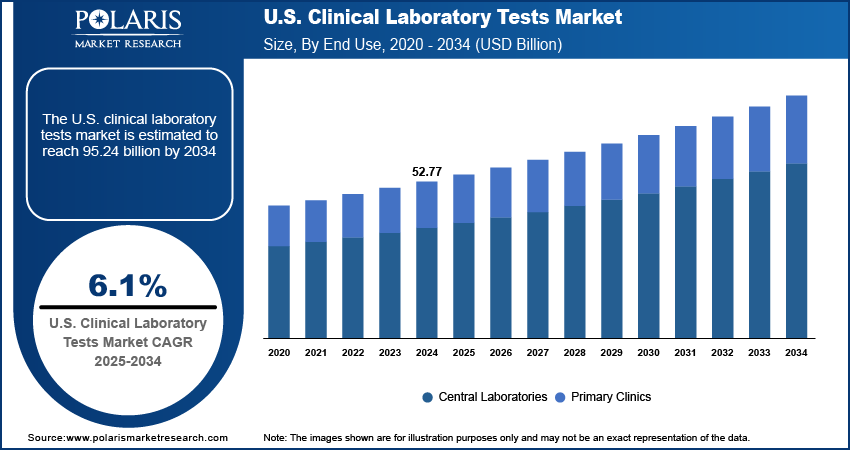

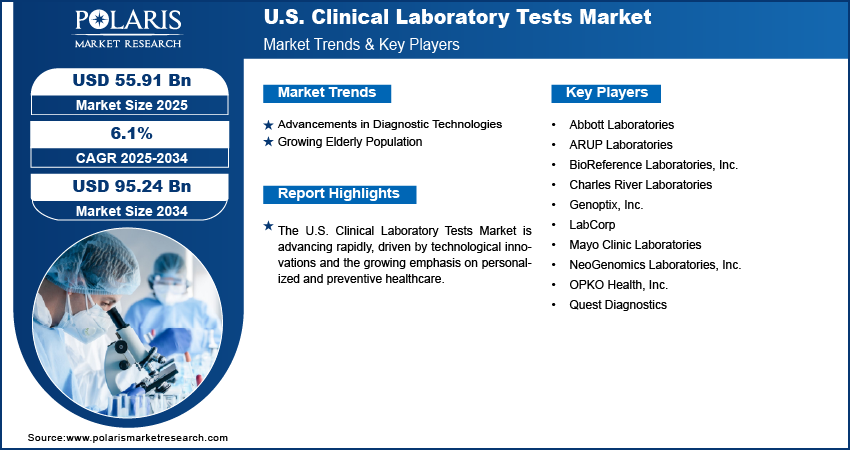

The U.S. clinical laboratory tests market size was valued at USD 52.77 billion in 2024, growing at a CAGR of 6.1% from 2025–2034. Key factors driving demand include rising chronic disease prevalence, shift towards personalized medicine, advancements in diagnostic technologies, and growing elderly population.

Key Insights

- The clinical chemistry segment dominated the revenue share in 2024 due to its central role in the delivery of healthcare in the U.S.

- The primary clinics segment is projected to grow at an 8.7% CAGR, fueled by the shift toward decentralized care and improved local diagnostic access.

Industry Dynamics

- Technological advancements such as AI and next-generation sequencing are enhancing test speed, accuracy, and efficiency, driving growth in the clinical laboratory sector.

- Expanding elderly population, which is more susceptible to chronic illness, is significantly increasing the demand for diagnostic laboratory testing.

- Rising pressure to lower healthcare costs is squeezing lab profits, making it hard to afford new, advanced testing equipment and technologies.

- The growing elderly population and rise in chronic diseases create a major opportunity to provide more essential routine and specialized diagnostic tests.

Market Statistics

- 2024 Market Size: USD 52.77 billion

- 2034 Projected Market Size: USD 95.24 billion

- CAGR (2025-2034): 6.1%

AI Impact on U.S. Clinical Laboratory Tests Market

- AI algorithms analyze complex data to detect subtle patterns, improving the precision of diagnoses in areas such as pathology and imaging interpretation.

- AI automates result analysis and optimizes laboratory workflow, significantly reducing turnaround times and increasing testing volume capacity.

- AI identifies patients at high risk for diseases by analyzing historical data, enabling preventative testing and early intervention strategies.

- AI integrates genetic, biomarker, and patient data to help tailor specific diagnostic panels and treatment plans for individual patients.

Clinical laboratory tests are diagnostic procedures conducted on blood, urine, or tissue samples to assess health conditions and play a central role in the U.S. healthcare system.

The U.S. clinical laboratory tests market is driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, which necessitate continuous monitoring and timely intervention. The demand for accurate and efficient testing services has increased, ensuring better disease management and improved patient outcomes as the burden of these long-term illnesses grows. A February 2024 Centers for Disease Control and Prevention report estimated that 42% of Americans have multiple chronic conditions. These conditions drive approximately 90% of the nation's USD 4.1 trillion in annual healthcare expenditures, highlighting their substantial impact on the system. In particular, the U.S. healthcare framework highlights early detection and regular monitoring of chronic conditions, which has further strengthened the reliance on laboratory diagnostics. This consistent demand highlights the critical importance of clinical tests in reducing healthcare costs by preventing disease progression through timely intervention.

The U.S. clinical laboratory tests market is further driven by a growing emphasis on personalized medicine, which focuses on customizing treatment strategies for individual patients based on their genetic, biochemical, and molecular profiles. Laboratory tests are essential for this approach by providing detailed insights into biomarkers, genetic variations, and disease predispositions. In the U.S., where healthcare innovation and precision-based care are advancing rapidly, personalized testing enables clinicians to make more informed therapeutic decisions and improve treatment efficacy. This trend has fueled the adoption of advanced diagnostic techniques, maintaining the role of laboratories as an important enabler of precision healthcare. As a result, clinical laboratory tests are supporting routine diagnostics and also transforming into tools that drive individualized treatment pathways across diverse therapeutic areas.

Drivers & Opportunities

Advancements in Diagnostic Technologies: Advancements in diagnostic technologies are fueling the growth of the U.S. clinical laboratory tests market by improving the speed, accuracy, and range of testing. Innovations such as molecular diagnostics, high-throughput sequencing, and automation allow laboratories to process a large volume of samples more efficiently while providing precise results. For instance, in February 2024, Complete Genomics and seqWell collaborated to expand library preparation solutions, making seqWell products compatible with complete genomics sequencing platforms to enable faster, higher-throughput workflows suited for synthetic biology, genomic screening, and environmental surveillance. These advancements are particularly essential in supporting early detection of complex diseases, guiding treatment decisions, and monitoring therapeutic effectiveness. In the U.S., where healthcare systems prioritize both quality and efficiency, technological progress has improved access to advanced testing options, making them an essential part of clinical workflows. This continuous innovation strengthens diagnostic capabilities and also increases the overall reliance on laboratory tests in patient care.

Growing Elderly Population: The growing elderly population in the U.S. is boosting the demand for clinical laboratory tests, as aging individuals are more sensitive to chronic conditions, infections, and degenerative diseases. A June 2025 Census government report stated that the U.S. population aged 65 and older grew to 61.2 million in 2024, representing 18% of the total population. Older adults typically require regular health monitoring and frequent diagnostic evaluations to manage comorbidities and maintain quality of life. Clinical tests provide critical insights into disease progression, medication effectiveness, and overall health status, making them indispensable in geriatric care. Moreover, the healthcare system faces rising demand for wide diagnostic services to support preventive and personalized approaches, as the proportion of elderly individuals steadily increases. This demographic shift has thus boosted the role of laboratory testing as an essential part of effective healthcare delivery for the aging U.S. population.

Segmental Insights

Type Analysis

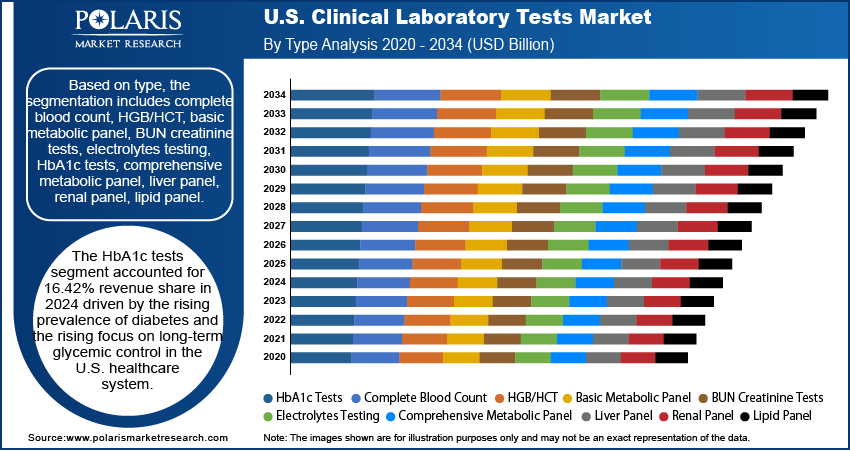

Based on type, the segmentation includes clinical chemistry testing, hematology testing, immunology & serology testing, molecular diagnostics, and others. The clinical chemistry segment dominated the revenue share in 2024 due to its central role in the delivery of healthcare in the U.S. The widespread occurrence of chronic diseases such as diabetes, cardiovascular disease, and kidney disease creates a need for ongoing biochemical monitoring and, therefore, continuous high-volume testing. This segment is also integrated into routine preventive care paradigms and annual wellness visits, becoming a standard of care as it is promoted widely and reimbursed by both public and private insurers. Moreover, the substantial level of automation and standardization of testing in large laboratory networks promotes efficiency and cost-effective delivery of results, which can be provided at a speed that aligns with the structure of the U.S. healthcare system. These tests are foundational in diagnosing and making treatment decisions. Thus, the combination of clinical necessity, preventive mandates, and scalable infrastructure supports the segment's dominant position.

End Use Analysis

In terms of application, the segmentation includes central laboratories, primary clinics. The primary clinics segment is expected to witness robust growth with 8.7% CAGR during the forecast period driven by the increasing shift towards decentralized healthcare delivery and greater accessibility of diagnostic services at the community level. In the U.S., primary clinics often serve as the first point of contact for patients, making them essential in facilitating routine testing, early disease detection, and preventive care. The expansion of point-of-care testing and integration of advanced diagnostic tools into primary care environments has further strengthened their role in delivering timely results and reducing reliance on centralized laboratories. This growing preference for localized and patient-centric care is fueling demand for laboratory tests within primary clinics, positioning them as a critical growth avenue in the U.S. Clinical Laboratory Tests Market.

Key Players & Competitive Analysis Report

The U.S. clinical laboratory testing sector is distinguished by intense competition among large players such as Quest Diagnostics and LabCorp, alongside specialized and regional laboratories. Competitive intelligence and strategy focus on technological advancement in automation, AI, and genomics to improve efficiency and diagnostic accuracy. A major revenue growth opportunity lies in capitalizing on the aging population and rising chronic disease prevalence, which drive latent demand and opportunities for routine and specialized testing. Labs are forming strategic investments and partnerships with tech firms, enhancing capabilities from sample collection to data analytics to secure a sustainable value chain. Industry trends show a strong shift towards personalized medicine and decentralized point-of-care testing, creating new emerging market segments. Success requires future development strategies that prioritize scalability, innovation, and navigating complex regulatory landscapes. Future growth projections will be shaped by economic and geopolitical changes affecting supply chains and reimbursement policies.

Major companies operating in the U.S. clinical laboratory tests industry include Abbott Laboratories; ARUP Laboratories; BioReference Laboratories, Inc.; Charles River Laboratories; Genoptix, Inc.; LabCorp; Mayo Clinic Laboratories; NeoGenomics Laboratories, Inc.; OPKO Health, Inc.; and Quest Diagnostics.

Key Players

- Abbott Laboratories

- ARUP Laboratories

- BioReference Laboratories, Inc.

- Charles River Laboratories

- Genoptix, Inc.

- LabCorp

- Mayo Clinic Laboratories

- NeoGenomics Laboratories, Inc.

- OPKO Health, Inc.

- Quest Diagnostics

Industry Developments

- April 2025: Quest Diagnostics launched a blood test combining AB 42/40 and p-tau217 biomarkers to help confirm amyloid pathology in Alzheimer's patients with MCI or dementia. It uses mass spectrometry and immunoassay techniques.

- June 2024: PHASE Scientific Americas launched two at-home collection kits, the INDICAID health Diabetes HbA1c Kit and Heart Health Lipid Panel Kit, allowing individuals to monitor average blood sugar and cholesterol/triglyceride markers using self-collected samples analyzed by certified laboratories.

U.S. Clinical Laboratory Tests Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Chemistry Testing

- Routine Chemistry Testing

- Specialized Chemistry Testing

- Hematology Testing

- Immunology & Serology Testing

- Molecular Diagnostics

- Infectious Disease Testing

- Genetic Testing

- Molecular Microbiology

- Transplant Diagnostics

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Central Laboratories

- Primary Clinics

U.S. Clinical Laboratory Tests Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 52.77 Billion |

|

Market Size in 2025 |

USD 55.91 Billion |

|

Revenue Forecast by 2034 |

USD 95.24 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 52.77 billion in 2024 and is projected to grow to USD 95.24 billion by 2034.

The market is projected to register a CAGR of 6.1% during the forecast period.

A few of the key players in the market are Abbott Laboratories; ARUP Laboratories; BioReference Laboratories, Inc.; Charles River Laboratories; Genoptix, Inc.; LabCorp; Mayo Clinic Laboratories; NeoGenomics Laboratories, Inc.; OPKO Health, Inc.; and Quest Diagnostics.

The clinical chemistry segment dominated the revenue share in 2024.

The primary clinics segment is expected to witness robust growth with 8.7% CAGR during the forecast period.