U.S. Autonomous Underwater Vehicle Market Size, Share, Trends, & Industry Analysis Report

By Technology (Collision Avoidance, Navigation, Communication, Imagery, and Propulsion), By Type, By Shape, By Payload, By Application– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6362

- Base Year: 2024

- Historical Data: 2020-2023

Overview

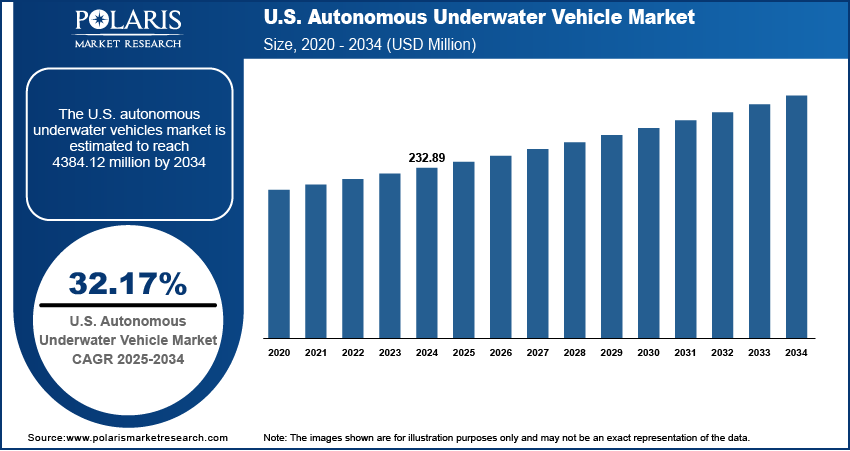

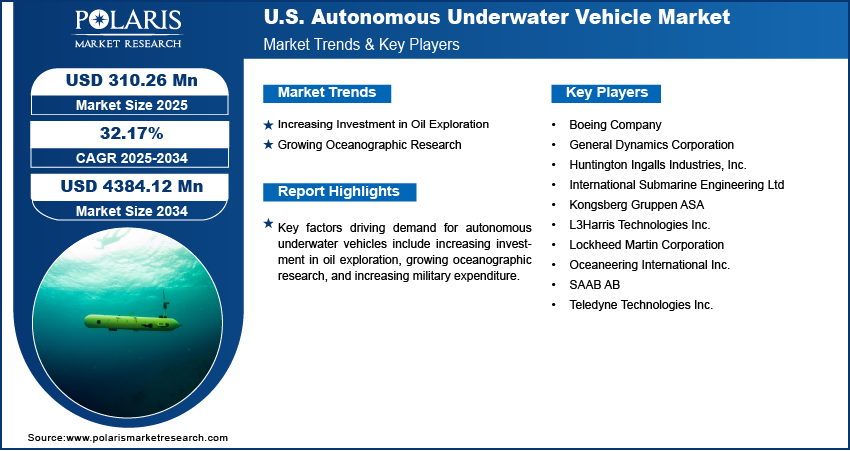

The U.S. autonomous underwater vehicle market size was valued at USD 232.89 million in 2024, growing at a CAGR of 32.17% from 2025 to 2034. Key factors driving demand for autonomous underwater vehicles include increasing investment in oil exploration, growing oceanographic research, and increasing military expenditure.

Key Insights

- The navigation segment accounted for a major revenue share in 2024 due to continuous investment by the U.S. navy in advanced navigational technologies.

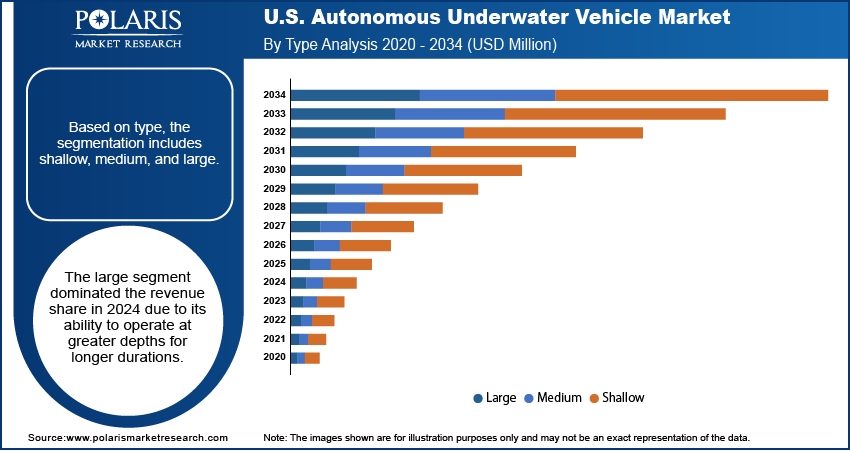

- The large segment dominated the revenue share in 2024 due to its ability to operate at greater depths.

- The torpedo segment held the largest revenue share in 2024 due to its hydrodynamic design.

- The sensors segment accounted for a major revenue share in 2024 due to their ability to study marine ecosystems.

Industry Dynamics

- The growing investment in oil exploration in the U.S. is boosting demand for autonomous underwater vehicles (AUVs) as energy companies require more efficient and cost-effective machines to survey and map the ocean floor.

- The growing oceanographic research is fueling the need for AUVs, as these vehicles can reach depths and endure conditions that limit human divers or traditional research vessels.

- Increasing need for underwater infrastructure inspection is projected to create a lucrative market opportunity.

- High development and maintenance costs are projected to hamper the demand for autonomous underwater vehicles.

AI Impact on U.S. Autonomous Underwater Vehicle Market

- AI enhances U.S. AUVs with smarter navigation and real-time decision-making, improving mission efficiency.

- Machine learning enables AUVs to adapt to dynamic underwater environments, boosting data collection accuracy.

- AI-driven automation reduces reliance on human operators, lowering operational costs and risks.

- Integration with AI accelerates data processing, enabling rapid analysis for defense, research, and energy sectors.

- Growing AI investment spurs innovation, expanding market demand, and driving competition among U.S. AUV manufacturers.

Market Statistics

- 2024 Market Size: USD 232.89 Million

- 2034 Projected Market Size: USD 4384.12 Million

- CAGR (2025-2034): 32.17%

An autonomous underwater vehicle is a self-operating, unmanned robotic system designed to navigate underwater without direct human control. Equipped with sensors, cameras, sonar systems, and navigation technologies, AUVs conduct tasks such as seabed mapping, environmental monitoring, underwater surveillance, and resource exploration. They play a critical role in scientific research, defense, offshore oil and gas industries, and search-and-rescue missions by reaching depths and terrains that are difficult or unsafe for human divers.

The U.S. Navy uses AUVs for mine detection, surveillance, and undersea warfare, strengthening national security capabilities. In the energy sector, offshore oil and gas companies deploy AUVs for pipeline inspection, subsea infrastructure monitoring, and resource exploration. Scientific institutions also utilize them for oceanographic studies, climate research, and marine biodiversity assessment. Advancements in sensor technologies, artificial intelligence, and battery life are further fueling AUV adoption in the U.S.

The demand for autonomous underwater vehicles in the U.S. is driven by the growing military expenditure. According to a report by STOCKHOLM INTERNATIONAL PEACE RESEARCH INSTITUTE, military spending by the USA rose by 5.7% in 2024. This accelerated the research and development of more sophisticated and reliable AUV models, which encouraged militaries to adopt them. Moreover, rising military expenditure is propelling defense agencies in the country to modernize their fleets with autonomous underwater vehicles to enhance their maritime surveillance and strengthen underwater warfare capabilities. Therefore, the growing military expenditure in the U.S. is fueling the demand for autonomous underwater vehicles.

Drivers & Opportunities/Trends

Increasing Investment in Oil Exploration: The growing investment in oil exploration in the U.S. is boosting demand for autonomous underwater vehicles (AUVs) as energy companies require more efficient and cost-effective machines to survey and map the ocean floor. AUVs equip exploration teams with advanced tools for high-resolution seabed imaging, pipeline inspection, and environmental monitoring, which are essential for identifying new oil reserves and assessing drilling sites. The push for deeper and more remote offshore exploration, especially in challenging environments such as the Arctic or ultra-deep waters, is making AUVs crucial, as they operate autonomously for extended periods and collect critical data without human intervention. Moreover, rising oil prices and the need to replace depleting reserves are encouraging companies in the U.S. to invest in advanced underwater technologies, further driving the adoption of AUVs.

Growing Oceanographic Research: Scientists and research institutions involved in oceanographic research are increasingly relying on AUVs to explore deep-sea ecosystems, monitor the impacts of climate change, and study marine biodiversity, as these vehicles can reach depths and endure conditions that limit human divers or traditional research vessels. AUVs equip researchers with advanced sensors and imaging tools, enabling them to gather high-resolution data on ocean currents, temperature, salinity, and underwater geology with greater accuracy and efficiency. The push for more comprehensive and frequent oceanographic studies, fueled by concerns over climate change, ocean acidification, and resource depletion, is further accelerating the adoption of AUVs.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes collision avoidance, navigation, communication, imagery, and propulsion. The navigation segment accounted for a major revenue share in 2024 due to continuous investment by the U.S. navy in advanced navigational technologies for deep-sea reconnaissance. Accurate navigation ensured the successful completion of seabed mapping, mine countermeasure operations, and scientific exploration, where even minor errors could compromise mission objectives. The growing use of advanced inertial navigation systems (INS), Doppler velocity logs (DVL), and acoustic positioning technologies significantly boosted demand. Oil and gas companies also adopted high-precision navigation to conduct pipeline inspections and monitor subsea infrastructure, further strengthening the segment’s dominance.

The collision avoidance segment is projected to grow at a rapid pace in the coming years, owing to the rising offshore energy activities, coupled with the growing use of autonomous vehicles for deep-sea mining and undersea cable inspections. Advances in sonar-based sensing, machine learning integration, and autonomous decision-making software make modern collision avoidance technologies more reliable and adaptive. Defense agencies are also emphasizing survivability in contested waters, pushing for vehicles equipped with robust collision avoidance systems.

Type Analysis

Based on type, the segmentation includes shallow, medium, and large. The large segment dominated the revenue share in 2024 due to its ability to operate at greater depths for longer durations. Large autonomous vehicles carried advanced payloads, including high-resolution sonars and synthetic aperture imaging systems, which enabled them to perform long-endurance operations in strategic waters. The U.S. Navy’s focus on expanding undersea dominance and strengthening maritime security drove substantial investments in large vehicles with advanced navigation, propulsion, and communication technologies. Moreover, research institutions and energy companies favored these vehicles for deep-ocean exploration and subsea infrastructure inspection, further enhancing their adoption.

Shape Analysis

In terms of shape, the segmentation includes torpedo, laminar flow body, streamlined rectangular style, and multi-hull. The torpedo segment held the largest revenue share in 2024 due to its hydrodynamic design, which enabled it to achieve higher speeds, extended ranges, and superior maneuverability in deep and shallow waters. Defense operators favored this shape for missions such as anti-submarine warfare training, mine countermeasure operations, and long-endurance reconnaissance due to its proven efficiency and reliability. Research organizations and commercial users also relied on torpedo designs for seabed mapping and environmental monitoring. The shape’s compatibility with advanced propulsion systems and diverse payloads further strengthened its adoption, making it the most widely deployed configuration across defense, scientific, and industrial applications.

Payload Analysis

Based on payload, the segmentation includes sensors, cameras, synthetic aperture sonars, echo sounders, acoustic doppler current profilers, and others. The sensors segment accounted for a major revenue share in 2024 due to their ability to study marine ecosystems and climate change. Advanced sensors, including inertial measurement units, pressure sensors, and magnetometers, enabled autonomous underwater vehicles to gather critical data in real time, ensuring accurate positioning and reliable performance in challenging underwater environments. The U.S. Navy invested heavily in sensor-integrated vehicles to improve mine detection, seabed mapping, and intelligence-gathering capabilities, while energy companies deployed them for subsea infrastructure inspection and leak detection.

The synthetic aperture sonars segment is expected to grow at a robust pace during the forecast period, owing to the rising need for high-resolution imaging for both defense and commercial applications. These systems provide detailed seabed maps and object classification capabilities that conventional sonar technologies cannot match, making them crucial for mine countermeasure operations, undersea reconnaissance, and environmental assessments. Offshore industries are increasingly adopting synthetic aperture sonars to support pipeline inspections, subsea construction monitoring, and resource exploration due to their ability to deliver precise images in turbid waters. Defense agencies are also prioritizing these payloads for missions in contested maritime zones where accuracy and clarity of data directly impact mission success.

Key Players & Competitive Analysis Report

The U.S. autonomous underwater vehicle (AUV) market features a competitive landscape dominated by major defense and aerospace contractors alongside specialized marine technology firms. Key players include Boeing, General Dynamics, and Lockheed Martin, which leverage their defense expertise to develop advanced AUVs for military applications. L3Harris Technologies and Teledyne Technologies contribute through the use of sophisticated sensors and integrated systems. Oceaneering International and Huntington Ingalls focus on subsea operations and naval integration, respectively. International Submarine Engineering Ltd. brings niche expertise in unmanned submersibles. Kongsberg Gruppen and SAAB AB maintain a strong presence in the U.S. market through partnerships and technology exports. Competition is driven by innovation in endurance, autonomy, and sensor capabilities, with growing demand from defense, offshore energy, and scientific research sectors shaping strategic developments across the industry.

Major companies operating in the U.S. autonomous underwater vehicle industry include Boeing Company; General Dynamics Corporation; Huntington Ingalls Industries, Inc.; International Submarine Engineering Ltd; Kongsberg Gruppen ASA; L3Harris Technologies Inc.; Lockheed Martin Corporation; Oceaneering International Inc.; SAAB AB; and Teledyne Technologies Inc.

Key Companies

- Boeing Company

- General Dynamics Corporation

- Huntington Ingalls Industries, Inc.

- International Submarine Engineering Ltd

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Oceaneering International Inc.

- SAAB AB

- Teledyne Technologies Inc.

Industry Developments

March 2022, Huntington Ingalls Industries, Inc. announced that its advanced unmanned underwater vehicle, REMUS 300, was selected as the U.S. Navy’s next-generation small UUV (SUUV) program.

U.S. Autonomous Underwater Vehicle Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Collision Avoidance

- Navigation

- Communication

- Imagery

- Propulsion

By Type Outlook (Revenue, USD Million, 2020–2034)

- Shallow

- Medium

- Large

By Shape Outlook (Revenue, USD Million, 2020–2034)

- Torpedo

- Laminar Flow Body

- Streamlined Rectangular Style

- Multi-hull

By Payload Outlook (Revenue, USD Million, 2020–2034)

- Sensors

- Cameras

- Synthetic Aperture Sonars

- Echo Sounders

- Acoustic Doppler Current Profilers

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Army & Defense

- Petroleum & Gas

- Environmental Security & Tracking

- Oceanography

- Archeology & Exploration

- Search & Rescue Activities

U.S. Autonomous Underwater Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 232.89 Million |

|

Market Size in 2025 |

USD 310.26 Million |

|

Revenue Forecast by 2034 |

USD 4384.12 Million |

|

CAGR |

32.17% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 232.89 million in 2024 and is projected to grow to USD 4384.12 million by 2034.

The market is projected to register a CAGR of 32.17% during the forecast period.

A few of the key players in the market are Boeing Company; General Dynamics Corporation; Huntington Ingalls Industries, Inc.; International Submarine Engineering Ltd; Kongsberg Gruppen ASA; L3Harris Technologies Inc.; Lockheed Martin Corporation; Oceaneering International Inc.; SAAB AB; and Teledyne Technologies Inc.

The large segment dominated the market revenue share in 2024.

The synthetic aperture sonars segment is projected to witness the fastest growth during the forecast period.