U.S. Renewable Methanol Market Share, Size, Trends, Industry Analysis Report

By Feedstock (Renewable Energy, Agricultural Waste, Municipal Solid Waste, And Forestry Residues), By Application, And By End Use; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 116

- Format: PDF

- Report ID: PM4909

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

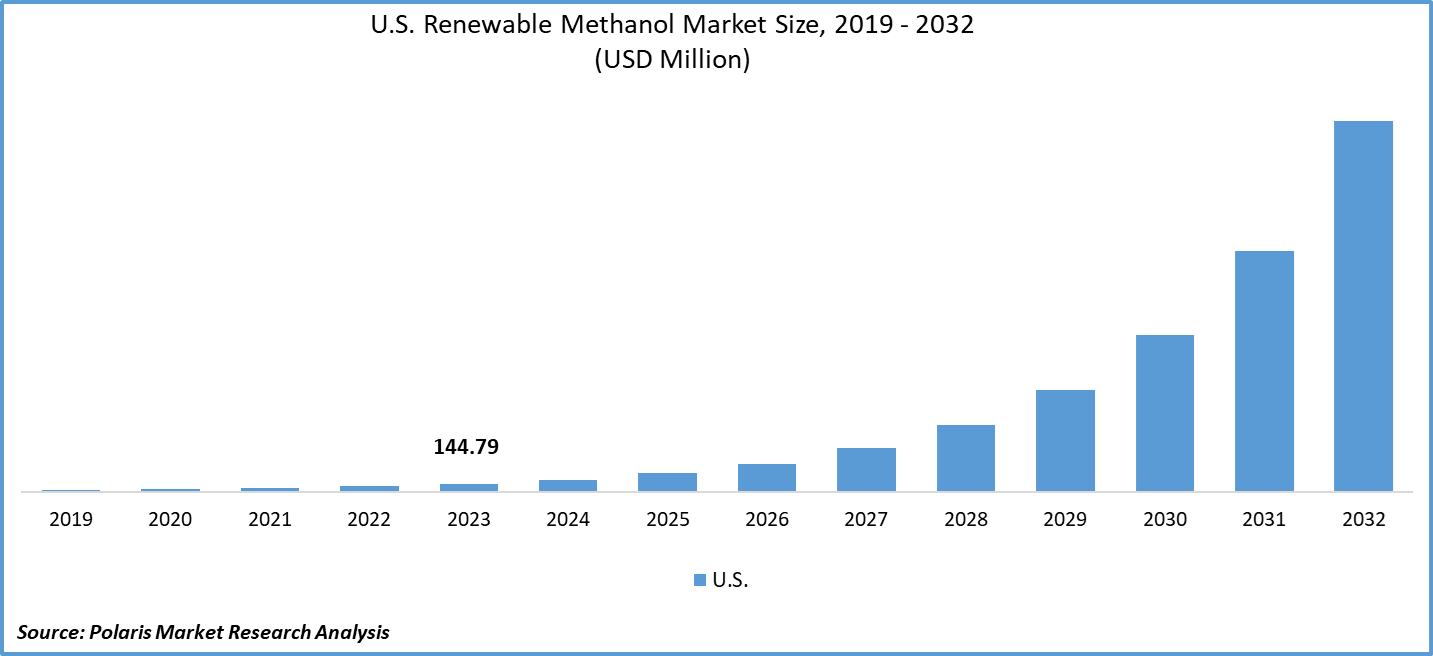

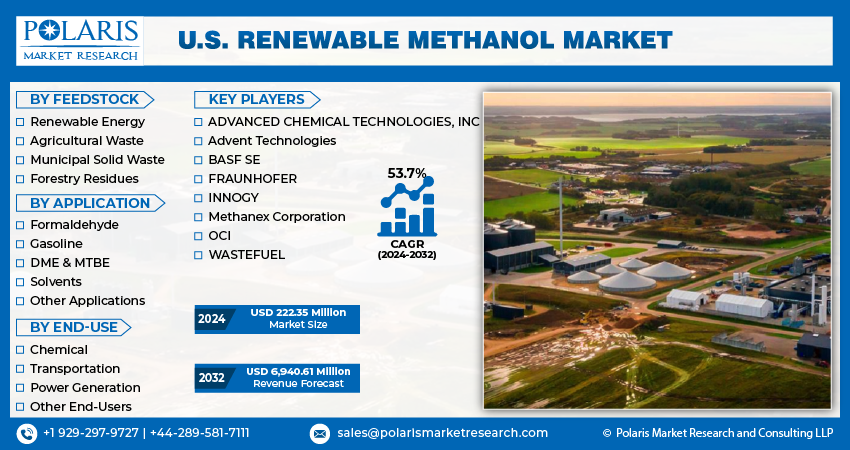

The U.S. renewable methanol market size was valued at USD 144.79 million in 2023. The market is anticipated to grow from USD 222.35 million in 2024 to USD 6,940.61 million by 2032, exhibiting a CAGR of 53.7% during the forecast period.

Industry Trend

Renewable methanol, sourced from sustainable feedstocks such as biomass, municipal waste, or captured carbon dioxide, is emerging as a promising environmentally sustainable alternative to conventional methanol production techniques reliant on fossil fuels.

The increasing focus on environmental sustainability and the urgent need to mitigate climate change are compelling industries to seek cleaner and greener alternatives to fossil fuels. Renewable methanol offers a carbon-neutral or even carbon-negative solution, as it can be produced from biomass or captured carbon dioxide, helping to reduce greenhouse gas emissions and combat climate change. Growing awareness of climate change and the need to reduce greenhouse gas emissions have spurred interest in renewable fuels like methanol. Renewable methanol, produced from sustainable feedstocks such as biomass or captured carbon dioxide, offers a carbon-neutral or even carbon-negative alternative to traditional fossil fuel-derived methanol. As policymakers and industries seek ways to decarbonize energy and transportation sectors, the demand for renewable methanol as a low-carbon fuel and chemical feedstock is expected to increase.

To Understand More About this Research: Request a Free Sample Report

In the landscape of the U.S. renewable methanol market, collaborations, contracts, and agreements are vital mechanisms employed by industry stakeholders to enhance production and facilitate the sale of renewable methanol. These collaborative efforts typically involve partnerships between renewable energy companies, technology providers, feedstock suppliers, investors, and end-users, aimed at leveraging complementary expertise, resources, and capabilities to drive market growth and innovation.

- For instance, in December 2023, Advent Technologies signed a new frame contract with Volta Energy to supply its methanol-powered fuel cell units, known as "Serene." As per the agreement, Volta Energy will integrate these fuel cell units as a new, eco-friendly power source into its product offerings.

The diversification of energy sources is a strategic priority for enhancing energy security and reducing dependence on imported fossil fuels. Renewable methanol provides a domestically sourced alternative fuel that can complement existing energy infrastructure, including transportation fuels, electricity generation, and industrial processes. As industries seek to diversify their energy sources and reduce reliance on fossil fuels, renewable methanol presents an attractive opportunity to enhance energy security and resilience.

Key Takeaway

- By Feedstock category, the renewable energy segment accounted for the largest market share in 2023.

- By end use category, the power generation segment is projected to grow at a highest CAGR during the projected period.

What are the market drivers driving the demand for the U.S. renewable methanol market?

Environmental concerns and climate change moderation drive demand to spur product demand.

Environmental concerns and the urgent need for climate change mitigation are significant factors driving the increasing demand for renewable methanol. As awareness of environmental issues continues to grow, stakeholders across various industries are seeking sustainable alternatives to conventional fossil fuels. Renewable methanol, being a carbon-neutral or even carbon-negative fuel, has emerged as a promising solution to address these concerns.

The pressing issue of climate change, exacerbated by greenhouse gas emissions from burning fossil fuels, has prompted governments, businesses, and consumers to prioritize cleaner energy sources. Renewable methanol offers a viable pathway to reduce carbon emissions while meeting energy needs. Its production from sustainable feedstocks such as biomass, municipal waste, or captured carbon dioxide allows for a significant reduction in greenhouse gas emissions compared to traditional methanol production methods reliant on fossil fuels.

Moreover, the growing momentum of international climate agreements, such as the Paris Agreement, underscores the global commitment to reducing greenhouse gas emissions and limiting global warming. Renewable methanol plays a crucial role in achieving these ambitious climate targets by providing a sustainable alternative to fossil fuels in various sectors, including transportation, industry, and power generation.

Which factor is restraining the demand for U.S. renewable methanol?

The cost-competitive with traditional fossil fuels is expected to hinder the growth of the market.

While renewable methanol presents environmental advantages, its cost competitiveness compared to traditional fossil fuels poses a challenge. Production expenses, especially from innovative feedstock’s or advanced conversion methods, often exceed those of conventional fossil-derived methanol. Moreover, the unpredictability of fossil fuel prices and regulatory landscapes can impact the economic feasibility of renewable methanol ventures, constraining market demand. Achieving widespread adoption necessitates addressing these barriers through technological innovation, regulatory stability, and financial incentives to bolster the attractiveness of renewable methanol as a sustainable energy solution.

Report Segmentation

The market is primarily segmented based on feedstock, application, and end use.

|

By Feedstock |

By Application |

By End-Use |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Feedstock Insights

Based on a feedstock analysis, the market is segmented into renewable energy, agricultural waste, municipal solid waste, forestry residues. Renewable energy held the largest market in 2023. Renewable energy sources such as biomass, municipal waste, and captured carbon dioxide serve as primary feedstocks for renewable methanol production. These feedstocks are abundantly available and offer a sustainable alternative to fossil fuels, making them a preferred choice for renewable methanol producers. Renewable energy sources are inherently cleaner and more sustainable than fossil fuels, offering significant environmental benefits. Production of renewable methanol from renewable energy sources results in lower greenhouse gas emissions, reduced air pollution, and minimized environmental impact compared to traditional fossil-derived methanol production methods.

By End Use Insights

Based on the end-use analysis, the market has been segmented on the basis of chemicals, transportation, power generation, and other end-users. The power generation segment is expected to be the fastest-growing CAGR during the forecast period. The global shift towards renewable energy sources for power generation is driving the demand for renewable methanol as a clean energy carrier. Renewable methanol can be used as a sustainable fuel for power generation in various applications, including electricity production in thermal power plants and fuel cells. As governments and utilities prioritize renewable energy deployment to meet climate targets and reduce carbon emissions, the demand for renewable methanol in the power generation sector is expected to increase significantly. Renewable methanol can be produced from renewable energy sources such as biomass, wind, solar, and hydroelectric power through electrolysis or thermochemical processes. The synergy between renewable energy systems and renewable methanol production facilitates the integration of renewable methanol into the power generation sector, driving market growth.

Competitive Landscape

In the competitive landscape of the U.S. renewable methanol market, several key players are vying for market share and driving innovation in production, distribution, and utilization. Established renewable energy companies, chemical manufacturers, and technology providers are leading the charge in developing renewable methanol production facilities and deploying advanced conversion technologies. Additionally, startups and emerging players are entering the market with novel approaches to feedstock sourcing, process optimization, and market positioning. Collaboration and strategic partnerships between industry stakeholders are prevalent, aiming to leverage complementary expertise and resources to enhance production efficiency and market competitiveness.

Some of the major players operating in the market include:

- ADVANCED CHEMICAL TECHNOLOGIES, INC

- Advent Technologies

- BASF SE

- FRAUNHOFER

- INNOGY

- Methanex Corporation

- OCI

- WASTEFUEL

Recent Developments

· In September 2023, Advent Technologies revealed its latest line of Serene Power Systems, which are designed to incorporate a compact battery along with a small fuel cell configuration. The fuel cell can be operated with methanol or eMethanol, which makes this system much more efficient for various technical applications.

· In August 2023, PacBio and GeneDx have initiated a research partnership with the University of Washington to investigate the efficacy of long-read whole genome sequencing in neonatal care, aiming to enhance diagnostic yield.

· In March 2022, Maersk signed an agreement with WasteFuel to procure green methanol at a large scale. According to the agreement, Maersk intends to purchase more than 30,000 tons per year of WasteFuel's green methanol to fuel its vessels.

Report Coverage

The U.S. renewable methanol market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, feedstock, application, and end use, and their futuristic growth opportunities.

U.S. Renewable Methanol Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 222.35 Million |

|

Revenue forecast in 2032 |

USD 6,940.61 Million |

|

CAGR |

53.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Feedstock, By Application, And By End Use |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in U.S. Renewable Methanol Market are ADVANCED CHEMICAL TECHNOLOGIES, INC, Advent Technologies, BASF SE

The U.S. renewable methanol market exhibiting a CAGR of 53.7% during the forecast period.

The U.S. Renewable Methanol Market report covering key segments are feedstock, application, and end use.

key driving factors in U.S. Renewable Methanol Market are increasing consumer awareness and demand

U.S. Renewable Methanol Market Size Worth $6,940.61 Million By 2032