U.S. Rockets and Missiles Market Share, Size, Trends, Industry Analysis Report

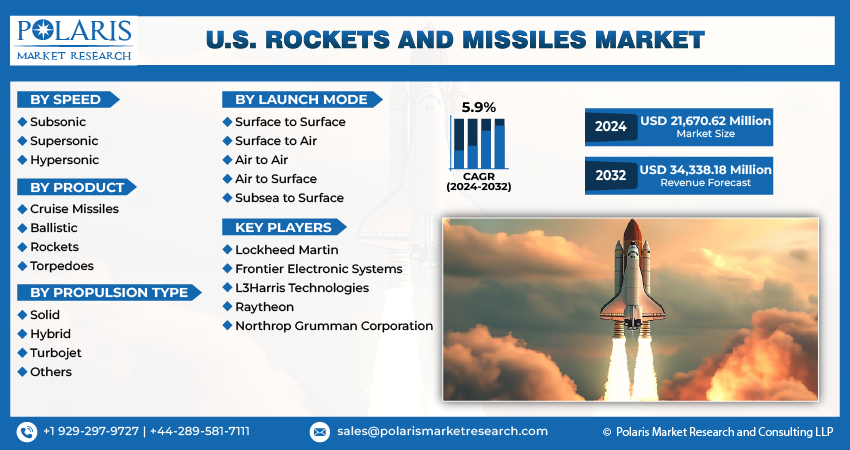

By Speed (Subsonic, Supersonic, And Hypersonic); By Product; By Propulsion Type; By Launch Mode; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4741

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

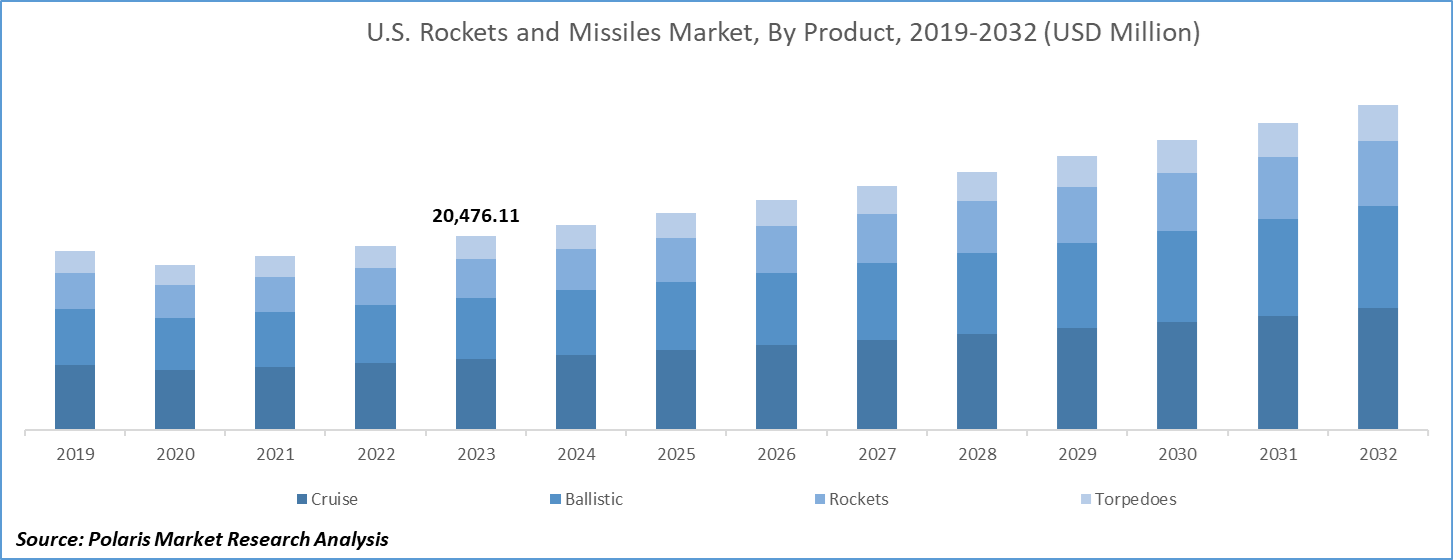

The U.S. rockets and missiles market size was valued at USD 20,476.11 million in 2023. The market is anticipated to grow from USD 21,670.62 million in 2024 to USD 34,338.18 million by 2032, exhibiting a CAGR of 5.9% during the forecast period

U.S. Rockets and Missiles Market Overview

Rockets and missiles serve as versatile weapon systems designed to neutralize various threats, including tanks, ships, aircraft, artillery, helicopters, and incoming missiles. While rockets are attached to jets for launch, missiles are self-propelled. Both are powerful tools for precision attacks in warfare, defending nations against adversaries. Beyond military use, rockets play a vital role in scientific pursuits, such as space exploration, emphasizing their broader significance in both defense and exploration.

Missiles aim to deliver payloads to designated points with the objective of destroying specified objects or targets. These sophisticated projectiles can be guided and targeted through various means, with common methods utilizing radiation such as infrared, laser beams, and radio waves. Their multifaceted role encompasses national security, scientific research, and the burgeoning commercialization of space, marked by continuous advancements and innovations steering their trajectory.

To Understand More About this Research: Request a Free Sample Report

The United States stands at the forefront of missile technology, boasting one of the world's most advanced arsenals. Deploying ballistic and cruise missiles across diverse platforms, armed with warheads tailored for a spectrum of targets and applications, the U.S. actively participates in international initiatives to curb missile proliferation.

Several factors propel the rockets and missiles market share, with growing concerns over national security, escalating geopolitical tensions, technological advancements, and increasing support for space exploration initiatives. Rising government funding further contributes to the industry's momentum. The commercial space sector, led by companies includes SpaceX, Blue Origin, and others offering launch services, injects innovation and competition into the rocket category. Reduced launch costs and enhanced space accessibility become contributor for market expansion.

The U.S. Department of Defense significantly invests in missile development, procurement, and missile defense systems. Key players in missile technology, including regional defense giants such as Lockheed Martin, Boeing, Raytheon Technologies, and Northrop Grumman, supply not only the U.S. military but also international customers. As per the U.S. Congressional Budget Office, defense spending surged from $746 billion in 2022 to a substantial $1.1 trillion in 2023. Increasing defense spending is likely to boost the growth of the market over the forecasted years.

The Departments of the Navy and the Air Force play pivotal roles in budget allocations, with notable figures highlighting expenditures on nuclear weapons ($392 billion) and missile defenses ($97 billion) between 2013 and 2022. The United States maintains leadership in space exploration, with NASA ranking among the world's prominent space agencies.

U.S. Rockets and Missiles Market Dynamics

Market Drivers

Rise in the adoption of hypersonic missile systems

The proliferation of hypersonic missile systems, capable of speeds exceeding five times the speed of sound, is reshaping the U.S. defense landscape. Nations like the US, UK, and Australia are collaborating to develop these advanced weapons, enhancing their flexibility and effectiveness over traditional ballistic missiles. Continuous research and development, including the integration of artificial intelligence by entities like NASA, are driving innovation in hypersonic technology, promising greater range and destructive capability. Concurrent advancements in propulsion, guidance, and materials further bolster the sophistication of modern missile systems. Initiatives such as Northrop Grumman's Hypersonics Capability Center demonstrate the commitment of industry leaders to push the boundaries of missile technology, ensuring sustained market growth. These developments drives the market in the U.S.

Growing space exploration

The market trend is experiencing exponential growth driven by burgeoning space exploration and commercial endeavors worldwide. Private firms like SpaceX, Blue Origin, and Virgin Galactic lead in reusable rocket development, democratizing access to space. This surge in space activities is fueled by increased investments, infrastructure enhancements, and digital technology integration. Innovative technologies such as reusable launch vehicles, CubeSats, and SmallSats are revolutionizing the space ecosystem. Private sector investments, exemplified by firms like Blue Origin and SpaceX, are injecting capital and fostering commercialization efforts. Public space agencies like NASA and ESA continue to pioneer missions, often collaborating with private entities. Next-generation systems like SpaceX's Starship and Blue Origin's New Glenn are enhancing payload capacities and launch efficiency. Overall, the convergence of public and private efforts alongside technological advancements is propelling the market industry into a new era of space exploration and utilization.

Market Restraints

Stringent regulations hinder the market growth

The rocket and missile industry faces formidable challenges due to stringent regulations and high development costs. Regulatory frameworks like the Missile Technology Control Regime (MTCR) restrict the export of advanced missile technology to curb the proliferation of weapons of mass destruction, posing barriers for market entry, especially in non-MTCR member states. National export controls add further complexity, delaying procurement and limiting market access. Enforcing these regulations can strain international relations and trigger trade disputes.

Developing advanced rocket and missile systems incurs substantial financial investments, with costs extending into billions of dollars for research, development, testing, and production. This financial burden acts as a significant barrier to entry for private companies, hindering market expansion. While manufacturers strive to incorporate new technologies, the associated costs often outweigh those of older technologies. The comprehensive development process involves significant expenses, including testing, validation, and adherence to safety standards, further challenging market expansion efforts. In summary, the interplay of stringent regulations and high development costs presents significant hurdles for the market forecast, limiting growth opportunities and innovation.

Report Segmentation

The market is primarily segmented based on speed, product, propulsion type, and launch mode.

|

By Speed |

By Product |

By Propulsion Type |

By Launch Mode |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

U.S. Rockets and Missiles Market Segmental Analysis

By Speed Analysis

- The hypersonic segment is projected to grow at the fastest CAGR during the U.S. market forecast period. Hypersonic rockets and missiles are designed with propulsion systems enabling them to achieve speeds of Mach 5 or higher, which is five times the speed of sound. These precision-guided weapons pose significant challenges for countermeasures due to their exceptional speed, and while they are currently in the developmental phase, they are anticipated to become operational in the near future.

- A distinctive feature of hypersonic missiles is their reliance on aerodynamic control surfaces, such as tail fins or wings to glide and maneuver such as an aircraft, as opposed to using pushers as a spacecraft. The necessity of air for these control surfaces implies that a hypersonic missile must operate within the atmosphere to execute maneuvers. Initially, a hypersonic cruise missile is accelerated to high speeds by a rocket booster, followed by the utilization of a supersonic combustion ramjet (scramjet) to maintain speed throughout its flight.

- The supersonic segment led the industry market with over 34.01% revenue share in 2023 and is anticipated to retain its position throughout the market forecast period. Supersonic aircraft and missiles achieve speeds surpassing the sound barrier, typically ranging from Mach 1 to Mach 5 (five times the speed of sound). In comparison to subsonic counterparts, supersonic missiles cover greater distances in less time, reducing susceptibility to interception and allowing for quicker responses in time-sensitive scenarios.

- The heightened kinetic energy of supersonic missiles enhances their penetration capabilities, making them advantageous for targeting heavily fortified or hardened structures such as bunkers or underground facilities. Generally, supersonic missiles boast longer effective ranges compared to subsonic ones, enabling strikes against distant targets and expanding operational capabilities.

By Product Analysis

- The Cruise Missiles segment accounted for the largest market share in 2023. Cruise missiles are specifically engineered to deliver a sizable warhead with high precision over extensive distances. Modern iterations of cruise missiles exhibit the capability to travel at varying speeds, ranging from high subsonic and supersonic to hypersonic speeds. These self-navigating projectiles operate on a non-ballistic trajectory, flying at extremely low altitudes.

- A cruise missile's flight characteristics depend on its speed, with subsonic variants flying at low altitudes, typically less than 100 meters, and hypersonic versions covering altitudes from 30 km to 40 km. Hypersonic cruise missiles employ a rocket booster for initial acceleration to near-hypersonic speeds and then sustain and accelerate their flight using a supersonic combustion ramjet (scramjet) operating above Mach 4.

Competitive Landscape

The U.S. Rockets and Missiles Market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant U.S. Rockets and Missiles Market share.

Some of the major players operating in the U.S. market include:

- Lockheed Martin

- Frontier Electronic Systems

- L3Harris Technologies

- Raytheon

- Northrop Grumman Corporation

Recent Developments

- In January 2024, Northrop Grumman-built GEM 63XL solid rocket boosters provide to help successfully launch the inaugural flight of United Launch Alliance’s Vulcan Centaur Rocket.

- In October 2023, L3Harris Technologies, Leidos, and MAG Aerospace have joined forces for the U.S. Army's High Accuracy Detection and Exploitation System (HADES) program. The collaborative effort aims to provide a fleet of aerial intelligence, surveillance, and reconnaissance (ISR) aircraft for the swift collection of operational intelligence against the nation's most advanced adversaries.

- In December 2023, Raytheon has concluded another successful live-fire demonstration of the advanced 360-degree Lower Tier Air and Missile Defense Sensor, referred to as LTAMDS. In partnership with the U.S. Army, this test event involved the launch of a tactical ballistic missile surrogate, following a trajectory representative of a credible threat.

Report Coverage

The market report emphasizes key regions across the globe to understand the product for users better. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, industry, and their futuristic growth opportunities.

U.S. Rockets and Missiles Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21,670.62 million |

|

Revenue Forecast in 2032 |

USD 34,338.18 million |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. Rockets and Missiles Market report covering key segments are speed, product, propulsion type, and launch mode.

U.S. Rockets and Missiles Size Worth $34,338.18 Million By 2032

U.S. Rockets and Missiles Market exhibiting a CAGR of 5.9% during the forecast period

key driving factors in U.S. Rockets and Missiles Market are Rise in the adoption of hypersonic missile systems