U.S. Roofing Anchor Market Size, Share, Trends, Industry Analysis Report

By Roof Type (Flat Roofs, Pitched Roofs), By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6215

- Base Year: 2024

- Historical Data: 2020-2023

Overview

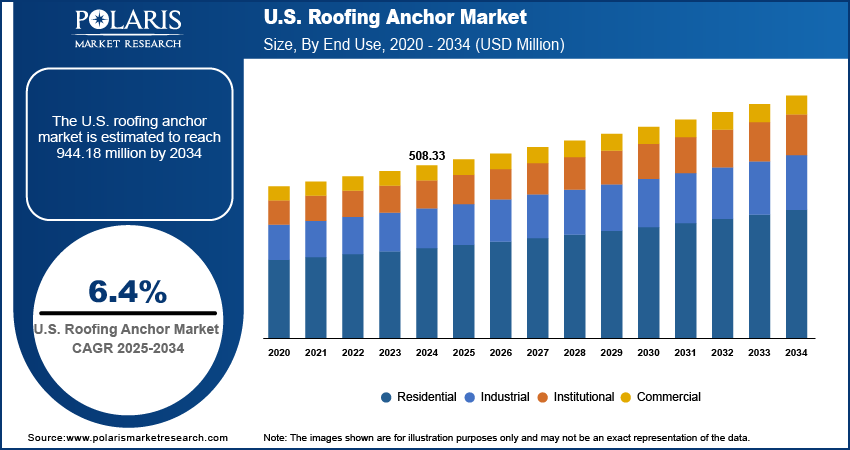

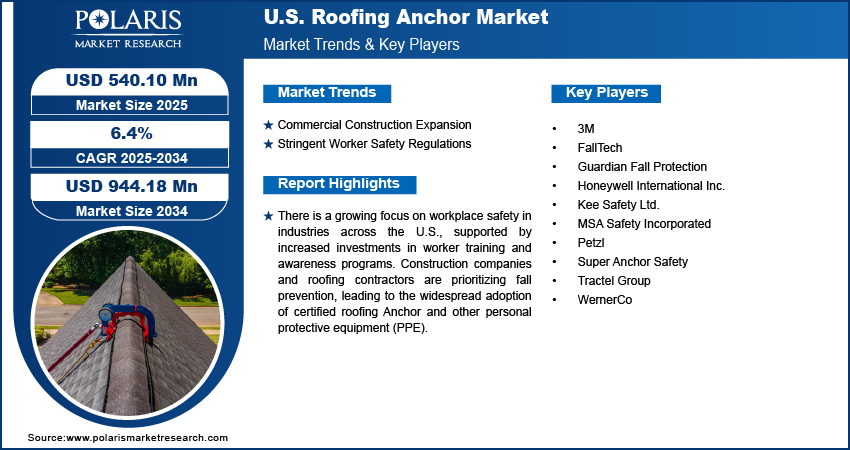

The U.S. roofing Anchor market size was valued at USD 508.33 million in 2024, growing at a CAGR of 6.4% from 2025 to 2034. The U.S. roofing anchor market is driven by stringent worker safety regulations, increasing construction and renovation activities, and rising awareness of fall protection systems. Demand is further fueled by technological advancements in anchor design and growing adoption in commercial roofing projects.

Key Insights

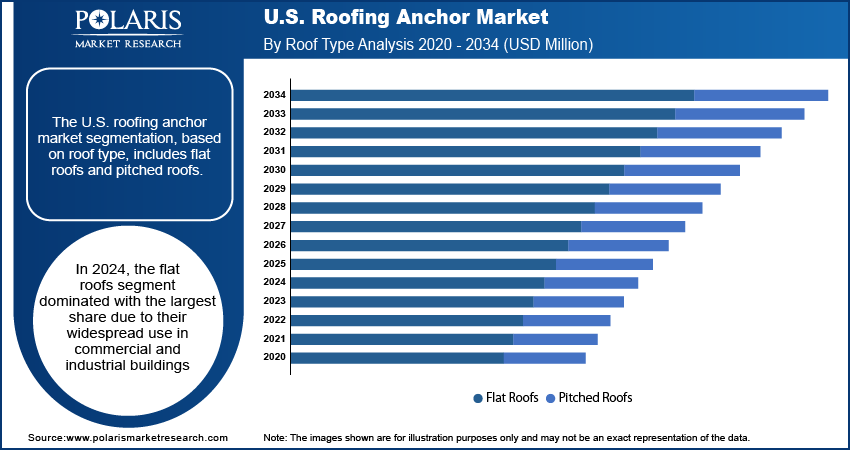

- In 2024, the flat roofs segment dominated with the largest share primarily due to their extensive application in commercial and industrial structures.

- The pitched roof segment is expected to experience significant growth during the forecast period as their sloped design increases the risk of slips and falls, especially during activities such as inspections, shingle repairs, and solar panel installations.

- In 2024, the commercial segment dominated with the largest share, driven by the prevalence of flat roofs and stricter regulatory enforcement regarding workplace safety.

- The residential segment is expected to experience significant growth during the forecast period, driven by a rise in home renovations, rooftop solar panel installations, and the need to replace aging roofing systems.

Industry Dynamics

- Commercial construction expansion drives the adoption of roofing Anchor.

- The imposition of stringent worker safety regulations is fueling the industry growth.

- Modern roofing Anchor are more practical and affordable, thereby driving its adoption.

- High installation costs and complex roof compatibility issues restrain the industry growth.

Market Statistics

- 2024 Market Size: USD 508.33 million

- 2034 Projected Market Size: USD 944.18 million

- CAGR (2025–2034): 6.4%

Roofing Anchor are safety devices used to secure workers while performing tasks on rooftops, preventing falls and serious injuries. They serve as fixed attachment points for harnesses, lanyards, or lifelines in a fall protection system. Designed to meet safety standards, roofing Anchor can be permanent or temporary, depending on the type of roof and job requirements.

Much of the U.S. building infrastructure, particularly in older cities, is aging and in need of maintenance or retrofitting. Updated safety equipment, including Anchor, is often mandated by local building codes as roofing systems are repaired or replaced. Additionally, retrofit projects offer an opportunity to install newer, more efficient safety solutions that weren’t available during the original construction. The drive to modernize aging infrastructure, fueled by both public and private funding, fuels the demand for roofing Anchor, especially those designed for easy integration into existing structures.

There is a growing focus on employee safety in the U.S. industries, supported by increased investments in worker training and awareness programs. Construction companies and roofing contractors are prioritizing fall prevention, leading to widespread adoption of certified roofing Anchor and other personal protective equipment (PPE). Safety certifications and training programs emphasize proper use of Anchor, further expanding their use in day-to-day operations. The roofing Anchor demand benefits from greater institutional commitment to safe work practices at height as more companies aim to reduce workplace injuries and maintain strong safety records, thereby fueling the growth.

Drivers and Opportunities

Commercial Construction Expansion: The commercial construction in the U.S., including office buildings, warehouses, and retail complexes, is rising. According to the U.S. Census Bureau, in May 2025, the commercial construction spending was USD 737.7 billion. These structures often feature flat roofs, making them ideal for permanent or mobile fall protection anchor systems. Additionally, maintenance tasks such as HVAC servicing, roof cleaning, and inspections require safe rooftop access, leading to consistent demand for Anchor. In urban centers, where rooftop work is more frequent, commercial property managers are investing in safety infrastructure. This increase in commercial development drives the roofing Anchor demand across the U.S.

Stringent Worker Safety Regulations: The Occupational Safety and Health Administration (OSHA) in the U.S. enforces strict fall protection rules, especially for construction and roofing activities. These regulations require employers to implement effective fall protection systems, which include certified roofing Anchor. Non-compliance can lead to hefty penalties, legal issues, or project shutdowns, making safety equipment a must-have. The demand for certified and easy-to-install roof Anchor grows as safety standards evolve and become more rigorous. This legal pressure, combined with increased workplace safety awareness, fuels the U.S. roofing Anchor market growth.

Segmental Insights

Roof Type Analysis

The U.S. roofing Anchor market segmentation, based on roof type, includes flat roofs and pitched roofs. In 2024, the flat roofs segment dominated with the largest share due to their large use in commercial and industrial buildings. These structures require frequent rooftop maintenance for HVAC accessories, solar panels, and drainage inspections, making permanent anchor points essential for worker safety. Flat roofs offer large, accessible workspaces but increase fall risk due to their elevated, open edges. This makes reliable anchorage systems a top priority for compliance with OSHA standards. The demand for fall protection solutions on flat roofs grows as urban commercial infrastructure continues to grow, especially in large cities, thereby driving the segment growth.

The pitched roof segment is expected to experience significant growth during the forecast period as these roofs present unique safety challenges due to their slope, increasing the risk of slips and falls during various tasks such as inspections, shingle replacement, or solar panel installations. There is growing awareness around the importance of certified Anchor designed for steep-slope applications with rising home improvement activity and roofing upgrades. Additionally, regulations encouraging safer work environments have pushed contractors and homeowners to invest in anchor systems that accommodate complex roof angles without compromising structural integrity or worker safety, thereby driving the segment growth.

End Use Analysis

The U.S. roofing Anchor market segmentation, in terms of end use, includes residential, commercial, institutional, and industrial. In 2024, the commercial segment dominated with the largest share, driven by the widespread use of flat roofs and increased regulatory oversight. Commercial buildings such as office towers, schools, hospitals, and shopping malls require routine maintenance, making permanent fall protection systems a necessity. OSHA compliance is strictly enforced in these settings, compelling facility managers to install approved rooftop safety systems, including fixed or modular Anchor. Moreover, large-scale construction and retrofitting projects are common in this sector, driving demand for Anchor that meet the unique structural needs of expansive commercial rooftops, thereby driving the segment growth.

The residential segment is expected to experience significant growth during the forecast period due to increasing home renovation, solar panel installation, and aging roof replacements. Homeowners are more safety-conscious, especially with the rise of DIY projects and local contractor engagement. The demand for easy-to-install, temporary, or reusable anchor systems has grown as pitched roofs are common in homes across the U.S. States that offer tax incentives for solar installations have contributed to the need for secure anchor solutions during roof-mounted solar projects. This shift in homeowner behavior and safety awareness drives demand for Anchor across residential applications in the country.

Key Players and Competitive Analysis

The U.S. roofing anchor market is highly competitive, with key players focusing on innovation, safety compliance, and durable product design to meet OSHA standards. A few major companies such as 3M, FallTech, Guardian Fall Protection, and MSA Safety Incorporated dominate the landscape by offering a wide range of certified fall protection systems tailored for various roof types. Honeywell International Inc., WernerCo, and Kee Safety Ltd. have also strengthened their market presence through robust distribution networks and product reliability. Niche players such as Super Anchor Safety, Tractel Group, and Petzl cater to specialized applications, including residential roofing and rope-based access systems. These companies continuously invest in R&D to improve anchor compatibility with modern roofing materials such as standing seam metal and flat commercial surfaces. Strategic collaborations with contractors and safety training initiatives further enhance their market reach. As safety regulations tighten, companies are increasingly focused on offering engineered, easy-to-install, and reusable anchor systems to maintain their competitive edge.

Key Players

- 3M

- FallTech

- Guardian Fall Protection

- Honeywell International Inc.

- Kee Safety Ltd.

- MSA Safety Incorporated

- Petzl

- Super Anchor Safety

- Tractel Group

- WernerCo

U.S. Roofing Anchor Industry Developments

In May 2023, FlashCo launched its new tie-back roof Anchor, providing durable anchor points with multiple mounting options for façade access and window cleaning, while ensuring full compliance with ANSI, CSA, and OSHA standards through engineered systems and certified installation support.

U.S. Roofing Anchor Market Segmentation

By Roof Type Outlook (Revenue, USD Million, 2020–2034)

- Flat Roofs

- Pitched Roofs

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Residential

- Commercial

- Institutional

- Industrial

U.S. Roofing Anchor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 508.33 Million |

|

Market Size in 2025 |

USD 540.10 Million |

|

Revenue Forecast by 2034 |

USD 944.18 Million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 508.33 million in 2024 and is projected to grow to USD 944.18 million by 2034.

The market is projected to register a CAGR of 6.4% during the forecast period.

A few of the key players in the market are 3M, FallTech, Guardian Fall Protection, Honeywell International Inc., Kee Safety Ltd., MSA Safety Incorporated, Petzl, Super Anchor Safety, Tractel Group, and WernerCo.

The flat roof segment dominated the market share in 2024.

The residential segment is expected to witness the significant growth during the forecast period.