U.S. Sealing Membranes Market Size, Share, Trends, Analysis Report

By Product Type (Sheet Membranes, Liquid-Applied Membranes), By End Use (Residential, Commercial, Industrial) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6401

- Base Year: 2024

- Historical Data: 2020-2023

Overview

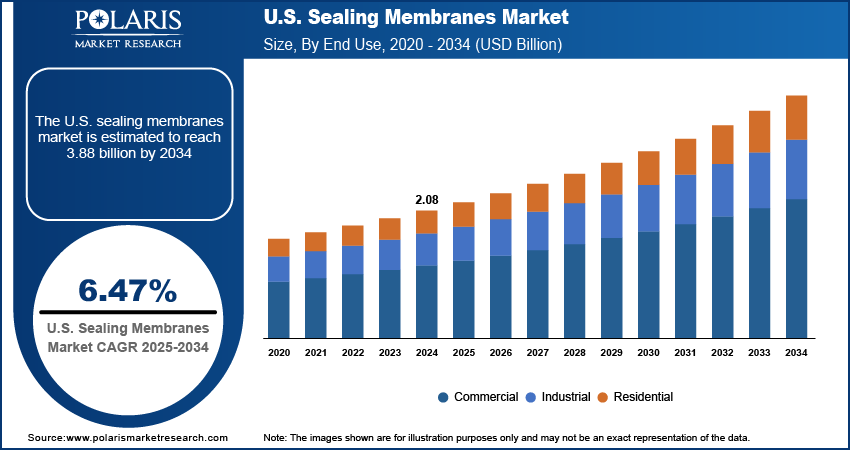

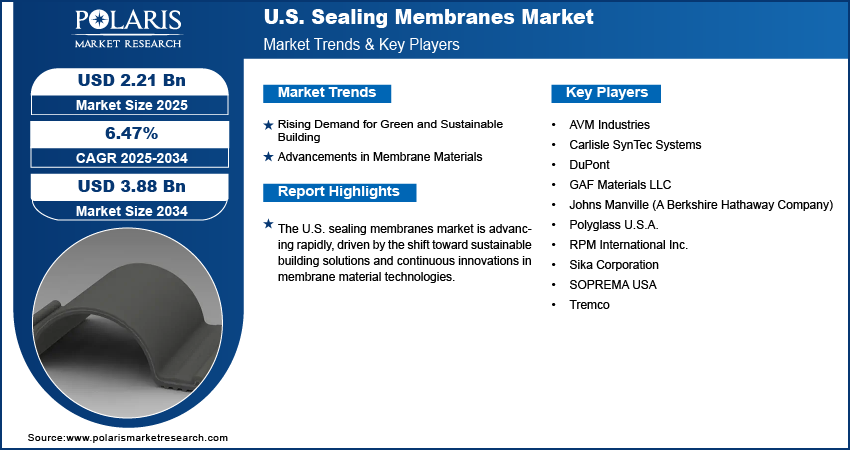

The U.S. sealing membranes market size was valued at USD 2.08 billion in 2024, growing at a CAGR of 6.47% during 2025–2034. The demand for sealing membranes is driven by robust growth in construction and renovation activity, increasing focus on indoor air quality and moisture management, rising demand for green and sustainable buildings, and advancements in membrane materials.

Key Insights

- In 2024, the liquid-applied membranes segment dominated the market, favored for their versatility, ease of application, and cost-effectiveness in new construction and repairs.

- The commercial segment is poised for significant growth, fueled by rapid urbanization, commercial real estate expansion, and increased infrastructure investment.

Industry Dynamics

- The push for green buildings boosts demand for sealing membranes. They are key component for energy efficiency, water damage prevention, and enhancing building longevity, reducing environmental impact.

- Material innovations such as self-adhesive systems and advanced polymers are driving growth. These enhancements improve durability, ease of use, and performance against environmental stressors.

- Rising raw material costs and supply chain disruptions create pricing pressure and project delays for manufacturers and contractors.

- Growing demand for green, energy-efficient buildings creates a major opportunity for high-performance, sustainable membranes that improve insulation and reduce carbon footprints.

Market Statistics

- 2024 Market Size: USD 2.08 billion

- 2034 Projected Market Size: USD 3.88 billion

- CAGR (2025–2034): 6.47%

AI Impact on U.S. Sealing Membranes Market

- AI-driven predictive maintenance enhances membrane lifespan by identifying wear and failure risks early, reducing downtime and maintenance costs in industrial applications.

- Advanced AI modeling optimizes membrane design and material selection, improving performance, durability, and energy efficiency across sectors like construction and water treatment.

- AI-powered automation streamlines manufacturing processes, increasing production efficiency, consistency, and reducing human error in sealing membrane fabrication.

- Integration of AI in quality control enables real-time defect detection and performance monitoring, ensuring higher product standards and customer satisfaction in the U.S. sealing membranes market.

The sealing membranes are protective barriers designed to prevent water, air, and vapor infiltration into building structures. The market growth is witnessing strong momentum driven by robust growth in construction and renovation activity. According to the U.S. Census Bureau, the value of construction spending in April 2025 was USD 2,152.4 billion. This rapid growth in infrastructure development worldwide is driving the demand for sealing membranes. The need for durable waterproofing and sealing solutions has become more critical as residential, commercial, and infrastructure projects continue to expand. Renovation and retrofitting efforts in older structures are further supporting demand, as builders and homeowners increasingly prioritize preventing leaks, cracks, and structural degradation. Sealing membranes, owing to their efficiency in providing long-lasting protection across foundations, walls, and roofs, are being widely adopted to enhance building performance. This trend is further reinforced by the focus on extending the service life of structures while minimizing repair costs, placing sealing membranes at the forefront of construction solutions.

A growing focus on indoor air quality and moisture management is further driving the adoption of membranes in U.S. buildings. Buildings exposed to excess moisture often face mold growth, reduced structural integrity, and compromised indoor environments that affect occupant health. Sealing membranes play an essential role in controlling vapor transmission and ensuring dry, comfortable interiors. Both residential and commercial developers are prioritizing advanced moisture control systems as awareness about healthy living spaces and energy efficiency rises. The integration of sealing membranes safeguards structural elements and also contributes to improved indoor air quality by limiting pollutants and allergens associated with damp environments. This dual benefit of health protection and structural durability continues to drive their adoption across diverse applications in the market.

Drivers & Opportunities

Rising Demand for Green and Sustainable Building: Developers and contractors increasingly adopt environmentally responsible construction practices. Sealing membranes contribute to sustainability by improving energy efficiency, reducing water damage risks, and extending the lifecycle of structures, thereby lowering the overall environmental footprint. The use of non-toxic, low-VOC, and recyclable sealing materials is gaining momentum with growing focus on LEED certification and eco-friendly building standards. According to the U.S. Green Building Council, LEED-certified projects are designed to save over 120 million metric tons of carbon dioxide CO2 emissions. These membranes align with regulatory frameworks and also meet consumer expectations for healthier and more sustainable living spaces. As a result, the preference for sealing membranes that support energy conservation and environmental responsibility is expanding their role in modern construction. Thus, the rising demand for green and sustainable buildings is driving the growth opportunities.

Advancements in Membrane Materials: Advancements in membrane materials also driving market growth in the U.S., as technological improvements enhance performance, durability, and ease of application. Innovations such as self-adhesive membranes, enhanced polymer blends, and hybrid systems are making installation more efficient while delivering superior resistance to moisture, chemicals, and temperature variations. These material improvements allow sealing membranes to serve a broader range of applications, from complex architectural designs to large-scale infrastructure projects. Additionally, the development of lighter and more flexible membranes supports faster construction timelines without compromising on strength or protection. For instance, in February 2025, Sika Corporation launched its SikaShield modified bitumen roofing line, including the new HB79 hybrid membrane, to the U.S. market. Such advancements increase the reliability of sealing solutions and also elevate their value proposition, driving greater adoption across residential, commercial, and industrial construction sectors.

Segmental Insights

By Product Analysis

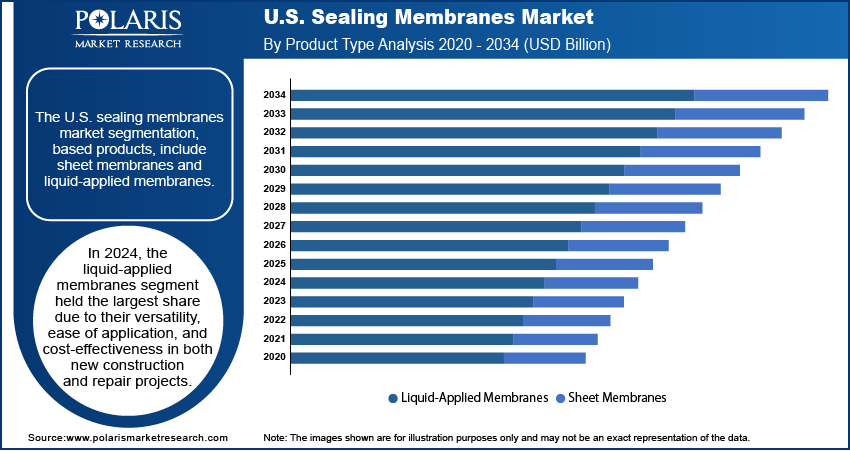

The U.S. sealing membranes market segmentation, based products, includes sheet membranes and liquid-applied membranes. In 2024, liquid-applied membranes segment held the largest share due to their versatility, ease of application, and cost-effectiveness in both new construction and repair projects. These membranes are applied seamlessly, reducing the risk of leaks or weak points that often occur at joints in traditional systems. Their adaptability to complex surface geometries makes them particularly suitable for modern architectural designs where irregular shapes are common. Additionally, the reduced installation time and lower labor requirements enhance their appeal among contractors and builders. The ability to provide durable waterproofing solutions across foundations, roofs, and balconies reinforces their dominant position in the market.

The sheet membranes segment is expected to grow significantly during the forecast period, supported by their high durability and consistent thickness that ensures uniform protection. These pre-fabricated membranes are favored in projects requiring precise quality standards, as they minimize the risk of inconsistent application compared to liquid-applied systems. Their strong resistance to punctures and mechanical damage makes them suitable for heavy-use surfaces, such as commercial roofs and parking decks. Moreover, technological improvements in adhesive formulations and installation techniques are enhancing ease of use, making sheet membranes more attractive for larger-scale applications. This segment is set to expand its footprint in the U.S. market with a growing focus on long-term performance and reduced maintenance costs.

By End Use Analysis

The sealing membranes market segmentation, based on end use, includes residential, commercial, and industrial. The residential sector holds the largest share in 2024 due to rising demand for durable and cost-efficient waterproofing solutions across single-family homes, apartments, and condominiums. Increasing consumer preference for high-quality building materials that extend the lifecycle of structures has further supported the adoption of waterproofing membranes in this sector. Liquid-applied membranes, in particular, are widely used in residential settings due to their ability to provide seamless protection against water intrusion in foundations, roofs, and bathrooms. Moreover, urban development and housing upgrades in metropolitan areas have contributed to steady demand. The focus on energy efficiency and structural safety in residential buildings further strengthens the sector’s dominance in the U.S. market.

The commercial segment is expected to witness significant growth during the forecast period. The growth is driven by rapid urbanization, expansion of commercial real estate, and rising investments in infrastructure projects. Office complexes, shopping centers, and hospitality facilities require robust waterproofing systems to handle high foot traffic and long-term exposure to environmental stressors. Commercial developers are increasingly adopting advanced sheet and liquid-applied membranes to ensure structural integrity and minimize maintenance costs over time. Furthermore, stricter building regulations and sustainability requirements are pushing the adoption of high-performance waterproofing solutions in this segment. Therefore, as demand for large-scale, durable, and energy-efficient structures increases, the commercial sector is projected to become a major growth contributor in the U.S. market.

Key Players & Competitive Analysis

The U.S. sealing membranes market landscape is witnessing intense competition among established players and innovative entrants. Competitive intelligence and strategy reveals that vendor strategies are increasingly focused on technological advancement, particularly in sustainable and high-performance materials, to secure revenue growth. Strategic developments include strategic investments in new production technologies and sustainable value chains to meet evolving environmental standards and latent demand. Expert's insight suggests that disruptions and trends, such as a heightened focus on resilience and green building codes, are reshaping industry ecosystems. For small and medium-sized businesses, differentiation through specialized solutions and navigating supply chain disruptions are critical for competitive positioning. Overall, growth projections remain strong, driven by robust construction activity and the need for energy-efficient building envelopes.

A few major companies operating in the U.S. sealing membranes market includes AVM Industries, Carlisle SynTec Systems, DuPont, GAF Materials LLC, Johns Manville, Polyglass U.S.A., RPM International Inc., Sika Corporation, SOPREMA USA, and Tremco.

Key Players

- AVM Industries

- Carlisle SynTec Systems (Carlisle Construction Materials)

- DuPont

- GAF Materials LLC

- Johns Manville (A Berkshire Hathaway Company)

- Polyglass U.S.A.

- RPM International Inc.

- Sika Corporation

- SOPREMA USA

- Tremco

U.S. Sealing Membranes Industry Developments

In March 2024, Polyglass U.S.A. unveiled new roofing and waterproofing membranes, including Modifleece, PolyVap SAS, and Seal the Envelope, at the IIBEC 2024 Trade Show in Phoenix. The launch showcased innovative solutions designed to improve durability and sustainability in commercial roofing.

U.S. Sealing Membranes Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Sheet Membranes

- Liquid-Applied Membranes

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

U.S. Sealing Membranes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.08 Billion |

|

Market Size in 2025 |

USD 2.21 Billion |

|

Revenue Forecast by 2034 |

USD 3.88 Billion |

|

CAGR |

6.47% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 2.08 billion in 2024 and is projected to grow to USD 3.88 billion by 2034.

The market is projected to register a CAGR of 6.47% during the forecast period.

A few of the key players in the market are AVM Industries, Carlisle SynTec Systems, DuPont, GAF Materials LLC, Johns Manville, Polyglass U.S.A., RPM International Inc., Sika Corporation, SOPREMA USA, and Tremco.

In 2024, the liquid-applied membranes segment held the largest share.

The commercial segment is expected to witness significant growth during the forecast period.