U.S. Trade Finance Market Size, Share, Trends, Industry Analysis Report

By Instrument (Letter of Credit, Supply Chain Financing, Documentary Collections, Receivables Financing/Invoice Discounting, Others), By Service Provider, By Trade, By Industry – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6416

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

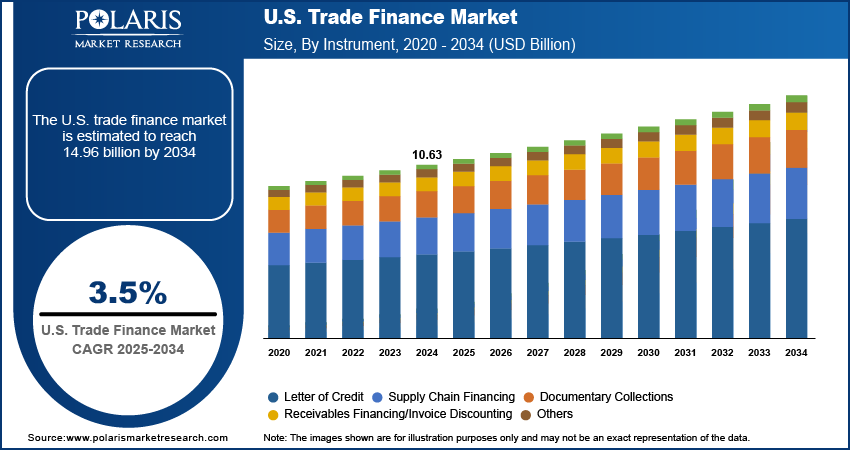

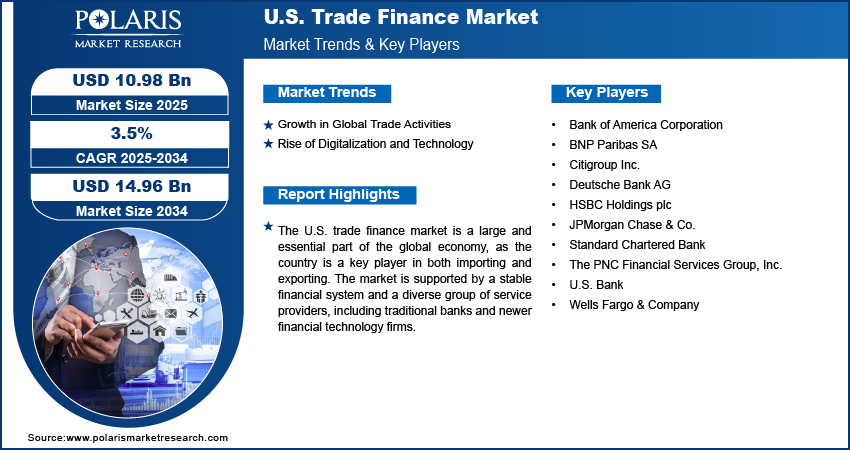

The U.S. trade finance market size was valued at USD 10.63 billion in 2024 and is anticipated to register a CAGR of 3.5% from 2025 to 2034. The U.S. trade finance industry is mainly driven by the increase in global trade activities, especially with Mexico, Canada, and China. Another key driver is the growing need for a stable flow of goods and services. A third important factor is the rise of digitalization, which is helping to improve the way these transactions are handled.

Key Insights

- By instrument, the letters of credit segment held the largest share in 2024, as it provides the highest level of security.

- By service provider, the banks segment dominated in 2024, due to their extensive global networks.

- By trade, the international trade segment holds the largest share as it has inherent complexities and risks of cross-border commerce, such as different currencies and regulations.

- By industry, the manufacturing industry holds the largest share and is driven by its reliance on intricate global supply chains.

Industry Dynamics

- The increasing globalization of economies and the growth of international trade are major drivers, as businesses need specialized financial products to handle the complexities of cross-border transactions.

- The rising demand for secure and flexible financing instruments, such as letters of credit and supply chain finance, is also propelling the growth. These tools help companies manage their cash flow and reduce the risks that come with international business.

- Another important factor is the growing adoption of new technologies such as blockchain and artificial intelligence, which are making trade finance more efficient, transparent, and accessible to a wider range of businesses.

Market Statistics

- 2024 Market Size: USD 10.63 billion

- 2034 Projected Market Size: USD 14.96 billion

- CAGR (2025–2034): 3.5%

Trade finance refers to the financial services that make it easier for businesses to trade goods and services across international borders. It helps importers and exporters by managing the risks associated with these transactions, ensuring that both parties receive what they need, such as timely payment for the seller and confirmed delivery for the buyer.

One of the drivers in the U.S. market is the growing trend of nearshoring, where companies move their production closer to their final consumer markets. For the U.S., this means more trade with nearby countries such as Mexico and Canada. This shift is creating a higher demand for specialized finance services that support these regional supply chains. This is a subtle but important change that is shaping the growth.

Another driver is the increase in trade between small and medium-sized businesses, which is happening because of easier access to digital platforms. These smaller companies often lack the financial resources of big corporations. They need trade finance products that are simpler to use and more affordable, which is helping to grow the overall industry. For instance, the World Trade Organization has pointed out that a significant portion of global trade is supported by trade finance, and digital apps are making these tools more accessible to smaller businesses.

Drivers and Trends

Growth in Global Trade Activities: The global economy is becoming more connected, which is a major driver for the U.S. trade finance market. As businesses continue to expand into new international markets, they face a growing need for services that help them manage the risks of cross-border trade. A few concerns in the trade include currency fluctuations, different laws in other countries, and the risk of non-payment. Trade finance products, such as letters of credit and export credit insurance, are essential for making these international transactions safe and reliable for both buyers and sellers. This increased activity directly boosts the demand for these specialized financial services.

According to the Bureau of Economic Analysis's (BEA) report, "U.S. International Trade in Goods and Services, December and Annual 2024," the U.S. reported an increase in both exports and imports for 2024. For instance, exports of goods went up by more than $38 billion to reach over $2 trillion. Similarly, imports of goods increased by more than $187 billion to reach over $3 trillion in 2024. These growing trade volumes mean that there is a higher need for financial products to support all of these transactions. This trend directly contributes to the expansion of the U.S. trade finance market.

Rise of Digitalization and Technology: The adoption of new technologies and digitalization is transforming the trade finance industry. Traditional trade finance processes are often slow and involve a lot of paperwork, which can cause delays and increase costs. Modern digital and online trading platforms and new technologies such as blockchain and artificial intelligence are helping to automate these processes, making them faster, more transparent, and more secure. This shift toward digital solutions is making trade finance more accessible to a wider range of businesses, especially smaller ones that may not have had access to these services before.

This push toward digitalization is supported by government initiatives and reports. For example, a report from the International Monetary Fund (IMF) on "Digital Payments and Finance" in 2024 highlighted how advancements in technology are making cross-border payments more efficient. These new technologies are simplifying complex transactions and lowering the costs involved, which encourages more businesses to engage in international trade. The trend of using digital tools for payments and financial management, along with trade management, is making the entire trade ecosystem more streamlined and is a key factor in driving the market growth.

Segmental Insights

Instrument Analysis

Based on instrument, the segmentation includes letter of credit, supply chain financing, documentary collections, receivables financing/invoice discounting, and others. The letter of credit segment held the largest share in 2024, as it provides a highly secure and reliable method of payment for international transactions. They are especially popular in deals where the trading partners may not know each other well or when the transaction involves a large sum of money. The bank acts as a trusted third party, guaranteeing that the seller will be paid once they meet all the specified conditions. This security greatly reduces the risk for both the importer and the exporter. As global trade continues to be a cornerstone of the US.. economy, the use of this traditional and dependable instrument remains widespread, solidifying its dominant position in the industry.

The receivables financing/invoice discounting segment is anticipated to register the highest growth rate during the forecast period. This surge in popularity is mainly attributed to the need for businesses, especially smaller ones, to improve their cash flow and working capital. This type of financing allows companies to get cash by selling their invoices at a small discount to a financial institution, instead of waiting for their customers to pay. The shift toward this more flexible and accessible financing option is also fueled by the growth of digital platforms, which make the process much faster and easier. As businesses seek more agile ways to manage their finances, this segment is gaining significant traction and is set to continue its strong upward trend.

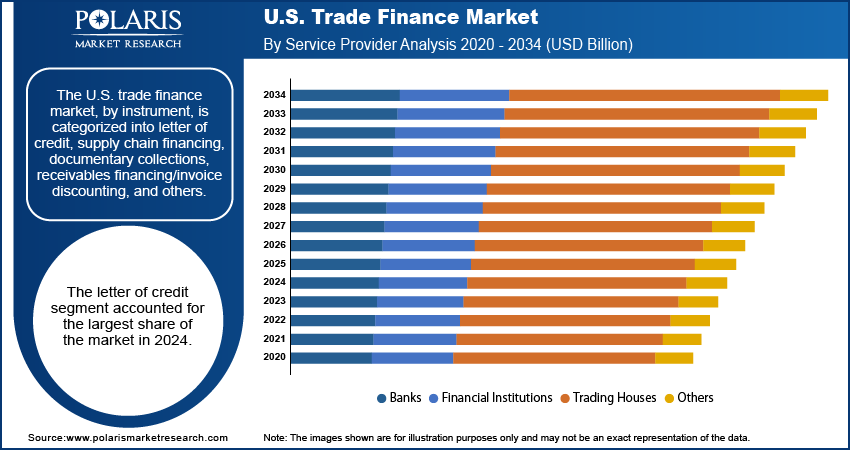

Service Provider Analysis

Based on service provider, the segmentation includes banks, financial institutions, trading houses, and others. The banks segment held the largest share in 2024. This is because banks have a long history of being involved in international trade and have extensive global networks and strong financial resources. Their established trust, comprehensive services, and ability to perform complex digital transactions management on a large scale make them the preferred choice for businesses of all sizes. They provide a wide range of services, including traditional letters of credit, documentary collections, and newer digital solutions, which strengthens their position as the main providers in the industry.

The financial institutions segment is anticipated to register the highest growth rate during the forecast period. This is attributed to their ability to be more flexible and innovative in offering specialized solutions. These institutions often focus on niche markets or specific financing needs, such as providing capital to small and medium-sized enterprises (SMEs) that may have a harder time getting services from traditional banks. Many of them are also at the forefront of adopting new financial technologies, which allows them to offer more efficient and accessible services. Their focus on digital platforms and tailored products for businesses seeking alternatives to traditional banking is a key reason for their rapid expansion.

Trade Analysis

Based on trade, the segmentation includes domestic and international. The international segment held the largest share in 2024, as cross-border trade transactions are inherently more complex and riskier than domestic ones. International trade involves different legal systems, varying customs regulations, and currency exchange risks, all of which require specialized financial tools to manage. The sheer volume of goods and services traded between the U.S. and its global partners, such as Canada, Mexico, and China, creates a massive demand for services that provide security and liquidity. This fundamental need for risk mitigation in international commerce ensures that this segment remains the most significant part of the industry.

The domestic segment is anticipated to register the highest growth rate during the forecast period. This trend is being driven by several factors, including the push for nearshoring, where companies are bringing their supply chains closer to home. This focus on local production and regional trade networks, particularly within North America, is boosting domestic business activity. Furthermore, the growth of e-commerce and digital platforms is making it easier for smaller companies to engage in domestic trade, and they need financial support to manage their cash flow and working capital. This increased focus on regional supply chains and the growing number of small businesses participating in domestic commerce are the key drivers for this segment's rapid expansion.

Industry Analysis

Based on industry, the segmentation includes BFSI, construction, wholesale/retail, manufacturing, automobile, shipping & logistics, and others. The manufacturing segment held the largest share in 2024. This is mainly because the manufacturing sector relies heavily on complex global supply chains, requiring the import of raw materials and the export of finished goods. These cross-border transactions involve significant value and often require a range of financial tools, such as letters of credit and documentary collections, to manage risks and ensure smooth operations. The scale and consistent nature of these international deals make manufacturing a key driver of demand for trade finance services.

The wholesale/retail industry is anticipated to register the highest growth rate during the forecast period. This is attributed to the rapid expansion of e-commerce, which has made it easier for businesses of all sizes to engage in international trade. As online retailers and wholesalers increasingly source products from overseas or sell to customers in other countries, they need efficient and flexible trade finance solutions to manage inventory and payments. This growth is also fueled by the rise of supply chain financing, supply chain management, and invoice discounting, which are well-suited to the fast-paced, high-volume nature of the wholesale and retail sectors, helping them to manage cash flow and support their growing trade activities.

Key Players and Competitive Insights

The U.S. trade finance market is very competitive, with major players including JPMorgan Chase & Co., HSBC Holdings plc, Wells Fargo & Company, Citigroup Inc., and Bank of America Corporation. The competitive landscape is dominated by large, global banks that leverage their extensive networks and wide range of services to maintain their market leadership. These banks are focusing on digitalization and technology to improve their offerings and keep up with new market trends.

A few prominent companies in the U.S. trade finance market include BNP Paribas SA, HSBC Holdings plc, JPMorgan Chase & Co., Deutsche Bank AG, Wells Fargo & Company, Citigroup Inc., Bank of America Corporation, and Standard Chartered Bank.

Key Players

- Bank of America Corporation

- BNP Paribas SA

- Citigroup Inc.

- Deutsche Bank AG

- HSBC Holdings plc

- JPMorgan Chase & Co.

- Standard Chartered Bank

- The PNC Financial Services Group, Inc.

- U.S. Bank

- Wells Fargo & Company

U.S. Trade Finance Industry Developments

August 2025: Wells Fargo & Company announced it was expanding its strategic partnership with Google Cloud to use AI tools across its banking operations.

July 2025: JPMORGAN CHASE & Co. launched a new supply chain finance solution in collaboration with Oracle. This new offering aims to provide businesses with a more seamless and integrated way to manage their working capital and improve cash flow.

U.S. Trade Finance Market Segmentation

By Instrument Outlook (Revenue – USD Billion, 2020–2034)

- Letter of Credit

- Supply Chain Financing

- Documentary Collections

- Receivables Financing/Invoice Discounting

- Others

By Service Provider Outlook (Revenue – USD Billion, 2020–2034)

- Banks

- Financial Institutions

- Trading Houses

- Others

By Trade Outlook (Revenue – USD Billion, 2020–2034)

- Domestic

- International

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Construction

- Wholesale/Retail

- Manufacturing

- Automobile

- Shipping & Logistics

- Others

U.S. Trade Finance Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.63 billion |

|

Market Size in 2025 |

USD 10.98 billion |

|

Revenue Forecast by 2034 |

USD 14.96 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 10.63 billion in 2024 and is projected to grow to USD 14.96 billion by 2034.

The market is projected to register a CAGR of 3.5% during the forecast period.

A few key players in the market include BNP Paribas SA, HSBC Holdings plc, JPMorgan Chase & Co., Deutsche Bank AG, Wells Fargo & Company, Citigroup Inc., Bank of America Corporation, and Standard Chartered Bank.

The letter of credit segment accounted for the largest share of the market in 2024.

The financial institutions segment is expected to witness the fastest growth during the forecast period.